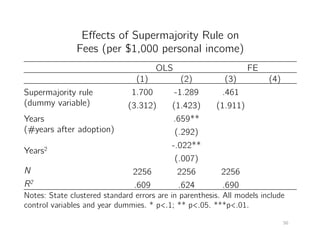

1) The document discusses a study analyzing the fiscal effects of constitutional supermajority requirements for raising taxes in U.S. states.

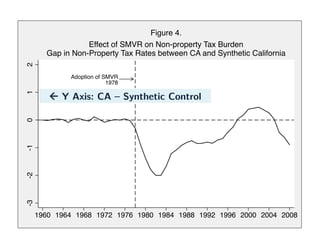

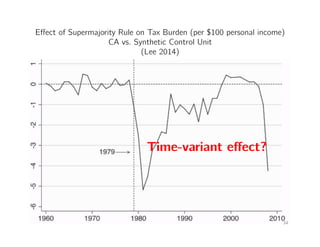

2) Using a synthetic control method, the study finds that California's non-property tax burden was $1.44 lower per $100 of personal income annually after adopting a 2/3 supermajority requirement in 1978, on average from 1979 to 2008.

3) Placebo tests indicate this effect is unique to California and not seen in other states, supporting a causal impact of the supermajority requirement on reducing taxes.

![“[Legislators] have been too quick, in

the past, to try to solve our budget

problems by automatically looking at

tax increases” (Tom Cross (R) of

Illinois )"](https://image.slidesharecdn.com/2015cgu-210302194742/85/2015-CGU-4-320.jpg)