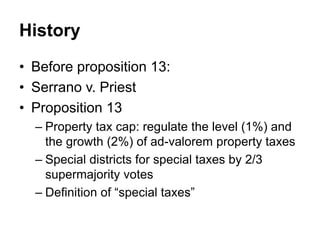

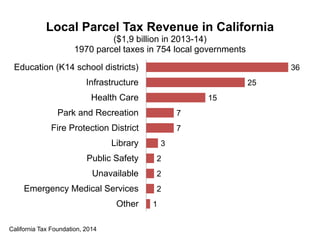

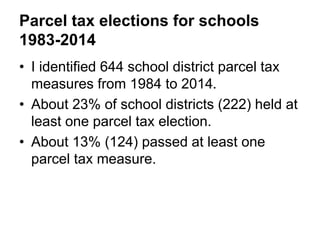

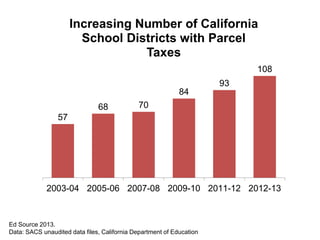

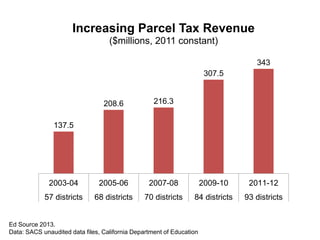

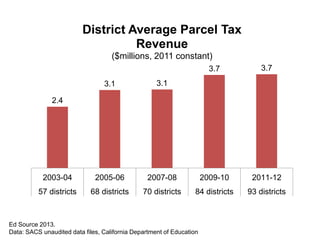

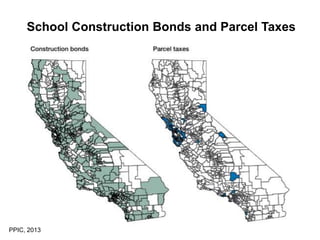

This document summarizes a study on the political economy of parcel taxes adopted by California school districts. It finds that parcel taxes have increased as a way for districts to supplement school funding after property tax limits were passed. Between 1983-2014, about 13% of districts passed a parcel tax. The number of districts and revenue from parcel taxes has risen steadily since 2003. Previous studies have looked at factors like costs of schooling and political ideology but not the redistributive effects. This study aims to fill that gap using a political economic perspective and matching method to compare parcel tax measures to school construction bond measures.