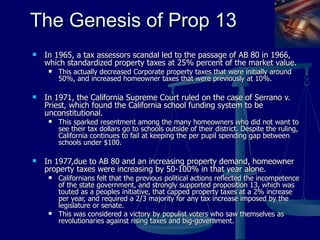

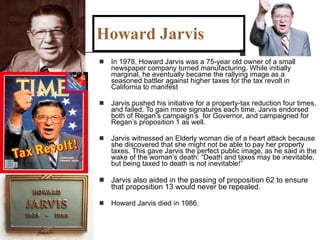

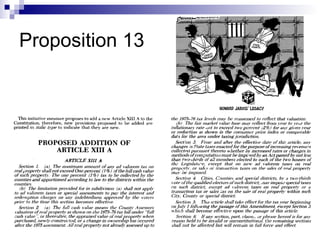

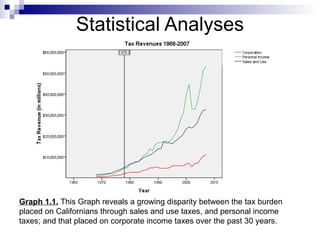

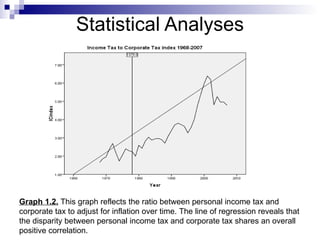

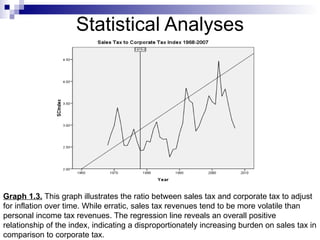

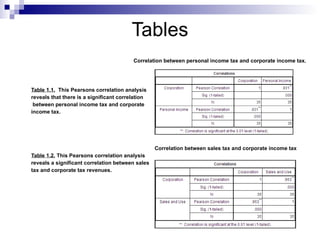

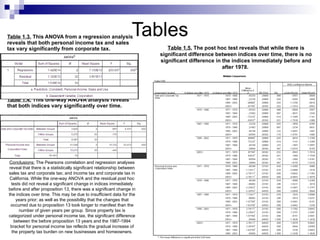

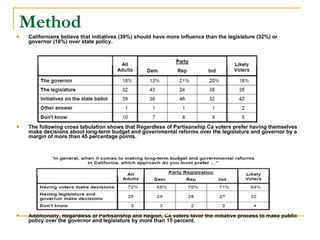

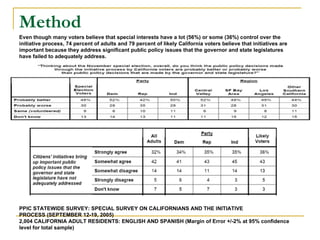

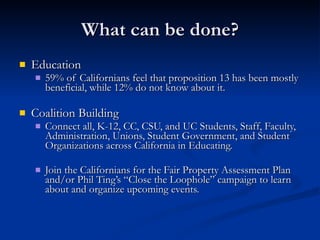

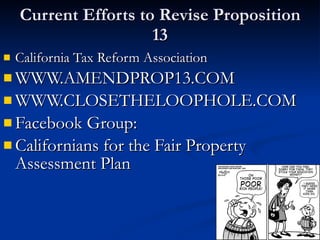

The document outlines a proposal to amend Proposition 13 in California, presenting a fair property assessment plan that distinguishes between commercial and residential property taxation to address inequities created by the original proposition. It discusses the historical context, consequences, and statistical analyses showing disparities in tax burdens post-Proposition 13. The plan aims to generate significant revenue by taxing commercial properties at full cash value while preserving residential tax structures, promoting land use efficiency, and engaging citizens in the legislative process.