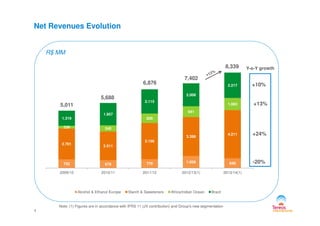

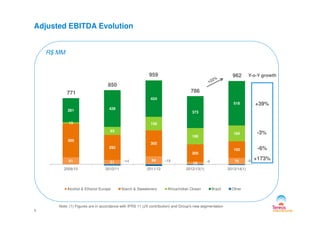

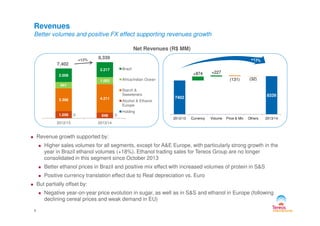

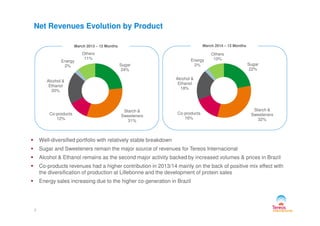

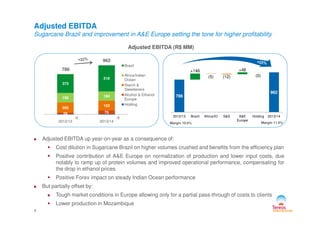

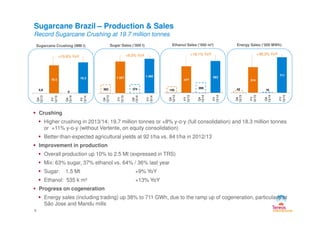

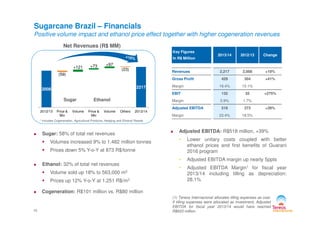

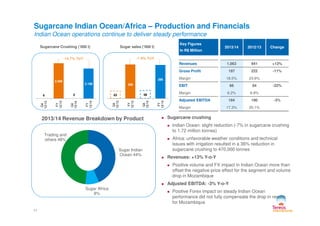

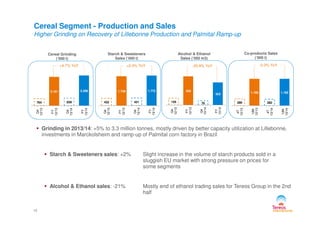

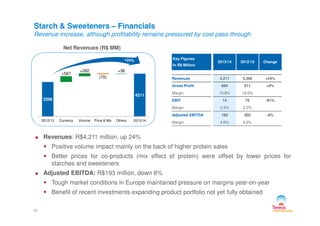

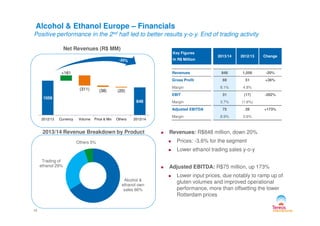

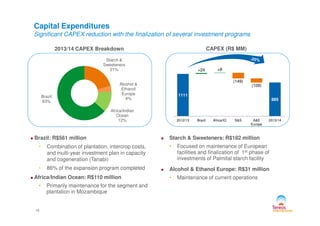

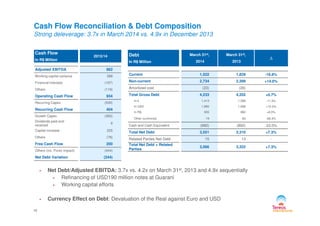

Tereos Internacional reported on its 2013/14 fiscal year results. Key points included record sugarcane crushing in Brazil of 19.7 million tonnes, driven by strong yields and benefiting operational performance. Cereal grinding was up 5% due to better capacity utilization. Revenues increased 24% for the Starch & Sweeteners segment however profitability remained pressured. Overall, revenues grew 10% to R$8.3 billion while adjusted EBITDA rose 39% to R$962 million, supported by Brazil operational improvements and better performance in Alcohol & Ethanol Europe.