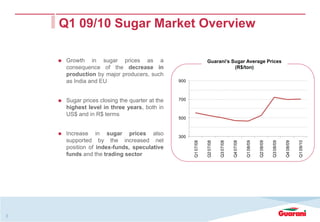

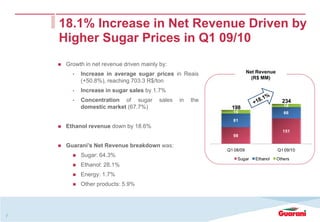

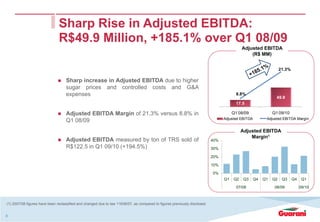

1) Açúcar Guarani reported strong financial results for Q1 2009/2010, with an 18.1% increase in net revenue driven by higher sugar prices in Reais and a 185.1% increase in adjusted EBITDA to R$49.9 million.

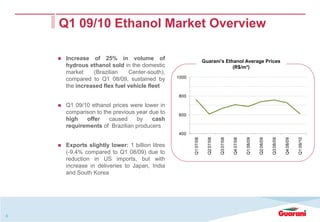

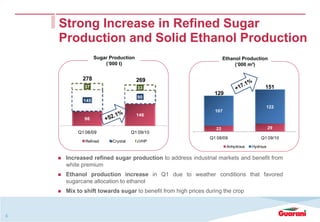

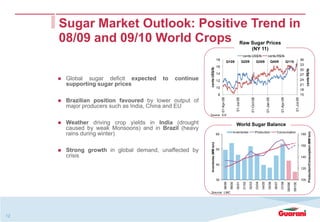

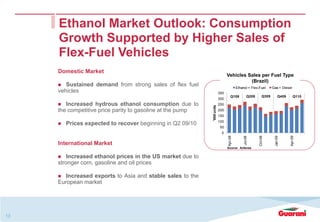

2) Sugar production and sales increased compared to the previous year, with a focus on the domestic market, while ethanol production was up but revenue decreased.

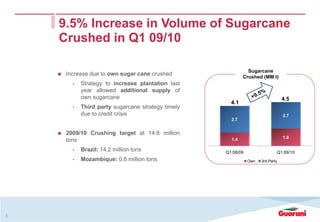

3) Sugarcane crushing was up 9.5% due to increased own cane supply and a stable contribution from third parties.