TAX ACCOUNTING

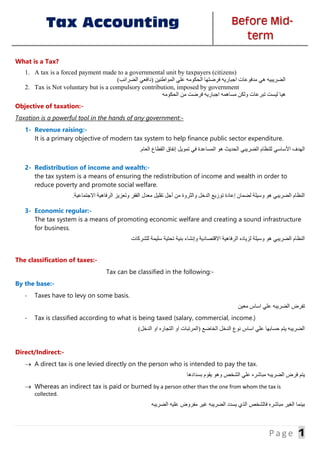

- 1. Tax Accounting Before Mid- term P a g e 1 What is a Tax? 1. A tax is a forced payment made to a governmental unit by taxpayers (citizens) )الضرائب (دافعي المواطنين علي الحكومه فرضتها اجباريه مدفوعات هي الضريبيه 2. Tax is Not voluntary but is a compulsory contribution, imposed by government الحكومه من فرضت اجباريه مساهمه ولكن تبرعات ليست هيا Objective of taxation:- Taxation is a powerful tool in the hands of any government:- 1- Revenue raising:- It is a primary objective of modern tax system to help finance public sector expenditure. .العام القطاع إنفاق تمويل في المساعدة هو الحديث الضريبي للنظام األساسي الهدف 2- Redistribution of income and wealth:- the tax system is a means of ensuring the redistribution of income and wealth in order to reduce poverty and promote social welfare. .االجتماعية الرفاهية وتعزيز الفقر معدل تقليل أجل من والثروة الدخل توزيع إعادة لضمان وسيلة هو الضريبي النظام 3- Economic regular:- The tax system is a means of promoting economic welfare and creating a sound infrastructure for business. للشركات سليمة تحتية بنية وإنشاء االقتصادية الرفاهية لزياده وسيلة هو الضريبي النظام The classification of taxes:- Tax can be classified in the following:- By the base:- - Taxes have to levy on some basis. معين اساس علي الضريبه تفرض - Tax is classified according to what is being taxed (salary, commercial, income.) )الدخل او التجاره او (المرتبات الخاضع الدخل نوع اساس علي حسابها يتم الضريبه Direct/Indirect:- → A direct tax is one levied directly on the person who is intended to pay the tax. بسدادها يقوم وهو الشخص علي مباشره الضريبه فرض يتم → Whereas an indirect tax is paid or burned by a person other than the one from whom the tax is collected. الضريبه عليه مفروض غير الضريبه يسدد الذي فالشخص مباشره الغير بينما

- 2. Tax Accounting Before Mid- term P a g e 2 Taxation in Egypt:- Egypt introduced its first modern tax law in 1939 which imposed taxes:- a. On business and labor gain (law No. 14 for 1939) b. An Agriculture land (law no. 113 of 1939). Egyptian tax system:- The current structure of the Egyptian tax system includes both direct and indirect taxes as follows:- The nature of income tax law no. 91 of 2005:- 1- Drawback of previous income tax (law no. 157 of 1981) ضريبة تعديل رقم (قانون السابقة الدخل 157 لسنة 1981 ) 2- The philosophy of the new tax law no. 91 of 2005. .رقم الجديد الضرائب قانون فلسفة 91 لعام 2005 . 3- The Ingredients of Tax Law No. 91 Of 2005 الضرائب قانون مكونات 4- The Mechanisms of Income Tax Law No 91 Of 2005 الدخل ضريبه حساب طريقه 5- The Features of Income Tax Law no. 91 of 2005 الدخل ضرائب قانون خصائص 6- Overview of Income Tax Law No. 91 Of 2005 And Its Amendments. وتطوراته الضرائب قانون علي عامه نظره

- 3. Tax Accounting Before Mid- term P a g e 3 Drawbacks of the previous tax law:- 1- More than 250,000 tax cases still need to be resolved by the civil courts with tax payers, unwilling to deal directly with the tax administration. من أكثر هناك تزال ال 250.000 ، الضرائب دافعي مع المدنية المحاكم قبل من تسوية إلى بحاجة ضريبية قضية مباشرة التعامل في راغبين غير .الضرائب مصلحه مع 2- More than 19 billion pound of taxes that are officially due remain uncollected, عن يزيد ما 19 .تحصيلها يتم لم ًارسمي المستحقة الضرائب من جنيه مليار 3- There is widespread mistrust between lawyers and tax administrations. .الضرائب ومديرين المحامين بين الثقة انعدام انتشار 4- Inspire of the exemption that have been granted by the tax law and investment law, foreign investment in Egypt is declining and taxation in Egypt is considered to be a major obstacle to the country's development plan. عقبة مصر في الضرائب وتعتبر ، التراجع في آخذ مصر في األجنبي االستثمار فإن ، االستثمار وقانون الضرائب قانون منحه الذي اإلعفاء .البالد في التنمية خطة أمام رئيسية 5- Widespread tax evasion has become generally officially acknowledged. أصب .عام بشكل ًايرسم به اًفمعتر الضريبي التهرب انتشار ح Therefore, Income Tax Law no 91 0f 2005 was issued to replace the Tax Law no. 157 of 1981 The philosophy of the new tax law no. 91 of 2005:- Law no. 91 of 2005 is built on three dimension philosophy:- 1- Encouraging investment by private sector. .الخاص القطاع قبل من االستثمار تشجيع 2- Achieving fairness in tax burden among the different groups of taxpayers. .الضرائب دافعي فئات مختلف بين الضريبي العبء في العدالة تحقيق 3- Generating adequate financial resources for public spending on social programs such as education and health. .والصحة كالتعليم االجتماعية البرامج على العام لإلنفاق كافية مالية موارد تحقيق

- 4. Tax Accounting Before Mid- term P a g e 4 The ingredient of tax law no. 91 of 2005:- In order to achieve the goals of law 91, it has drawn on the following ingredients:- 1- Easiness and clarity of the legislation to be understood and easily applied by both taxpayers and tax administration. .الضرائب مصلحه الضرائب دافعي قبل من وتطبيقها فهمها يسهل بحيث القوانين ووضوح سهولة 2- Building of trust between the taxpayer and tax administration:- it is the essential for encouraging taxpayer to fairly report their income, leading to smooth the tax collecting process. الضرائب دافعي بين الثقة بناء الضرائب ومصلحه : - على الضرائب دافعي تشجيع الضروري من إلى يؤدي مما ، عادل بشكل دخلهم عن اإلبالغ .الضرائب تحصيل عملية تسهيل 3- Developing and advancement of tax administration by using information technology in registration and payment by taxpayers, leading to make collecting taxes more efficient for both taxpayers and tax administration. زيادة إلى يؤدي مما ، الضرائب دافعي قبل من والدفع التسجيل في المعلومات تكنولوجيا استخدام خالل من وتقدمها الضرائب مصلحه تطوير .الضرائب وإدارة الضرائب دافعي من لكل الضرائب تحصيل كفاءة 4- Making balance between finance the public programs and encouraging new investment this can be done by providing exemption for new projects in the beginning of their business and hence subject them to higher tax rate in long run after becoming successful اال وتشجيع العامة البرامج تمويل بين التوازن تحقيق ذلك وبعد أعمالها بداية في الجديدة للمشاريع إعفاء توفير خالل من وذلك الجديد ستثمار .أعلى ضريبي لمعدل إخضاعها 5- Fairness of tax burden. The meaning of tax burden is a portion of income which the taxpayer sacrificed to support the public spending. Taxpayer has high income has to pay more tax than taxpayer has low income