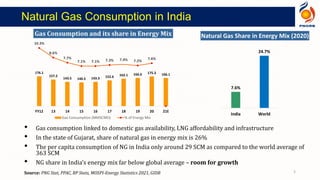

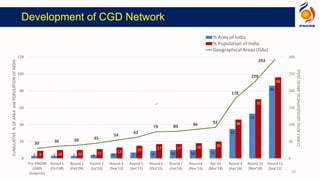

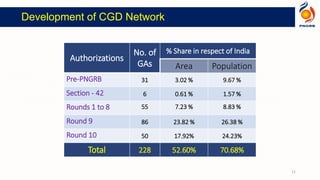

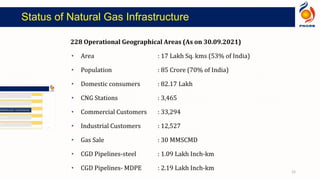

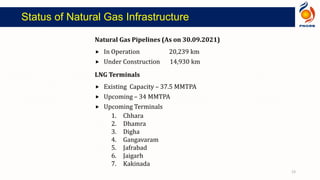

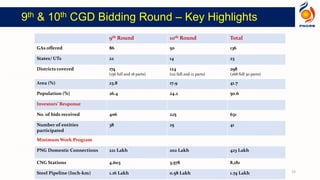

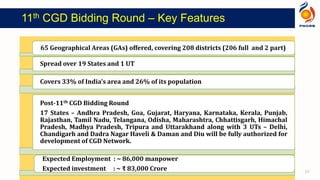

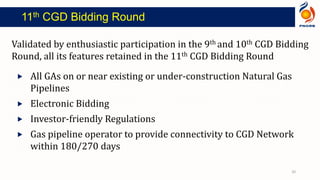

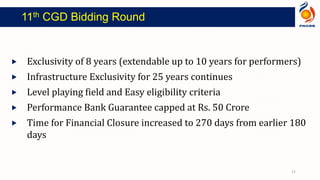

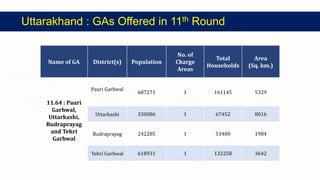

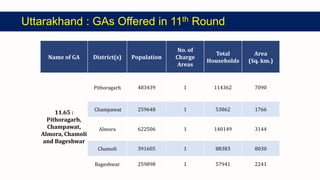

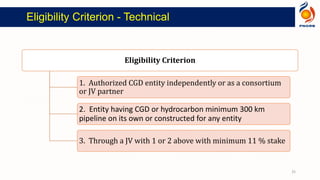

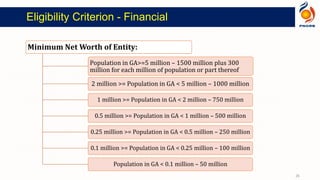

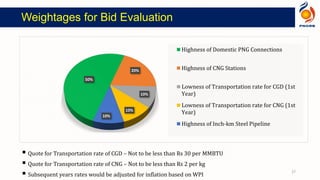

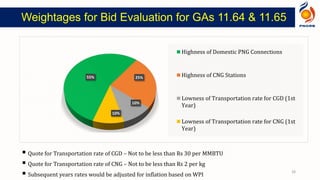

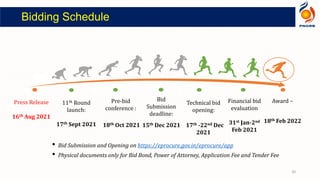

The document discusses India's 11th City Gas Distribution bidding round. It provides context on natural gas usage in India, previous bidding rounds, and details of the 11th round. 65 geographical areas across 19 states and 1 union territory will be bid out, covering 33% of India's area and 26% of its population. The bidding is scheduled to take place between October 2021 to February 2022.