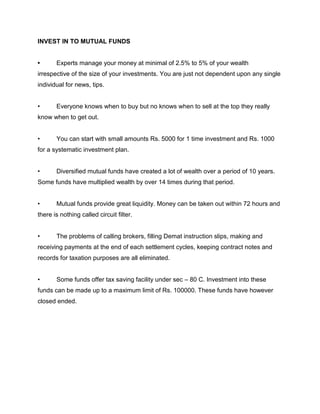

The document is a comprehensive project report submitted to Shweta Patel on the topic of customer perception towards SBI Mutual Fund. It was submitted by Vishal S. Shah as part of the requirements for an MBA degree from the Late Smt. Shardaben Ghanshyambhai Patel Institute of Management. The report includes an introduction to mutual funds and SBI Mutual Fund, a literature review, research methodology, and plans to study customer perception through surveys in Baroda to understand their views on risk and returns of investing in SBI mutual funds.

![A

COMPREHENSIVE PROJECT REPORT

ON

“CUSTOMER PERCEPTION TOWARDS SBI MUTUAL FUND”

Submitted to:

SHWETA PATEL

Late Smt. Shardaben Ghanshyambhai Patel Institute of Management

IN PARTIAL FULFILLMENT OF THE

REQUIREMENT OF THE AWARD FOR THE DEGREE OF

MASTER OF BUSINESS ASMINISTRATION

In

Gujarat Technological University

UNDER THE GUIDANCE OF

Faculty Guide:

SHWETA PATEL

Submitted by

VISHAL S. SHAH

[Batch : 2011-13, Enrollment No.:117330592034]

MBA SEMESTER III/IV

Late Smt. Shardaben Ghanshyambhai Patel Institute of Management

MBA PROGRAMME

Affiliated to Gujarat Technological University

Ahmedabad

Month, Year](https://image.slidesharecdn.com/117330592034sbi-121016081842-phpapp01/75/117330592034-sbi-1-2048.jpg)