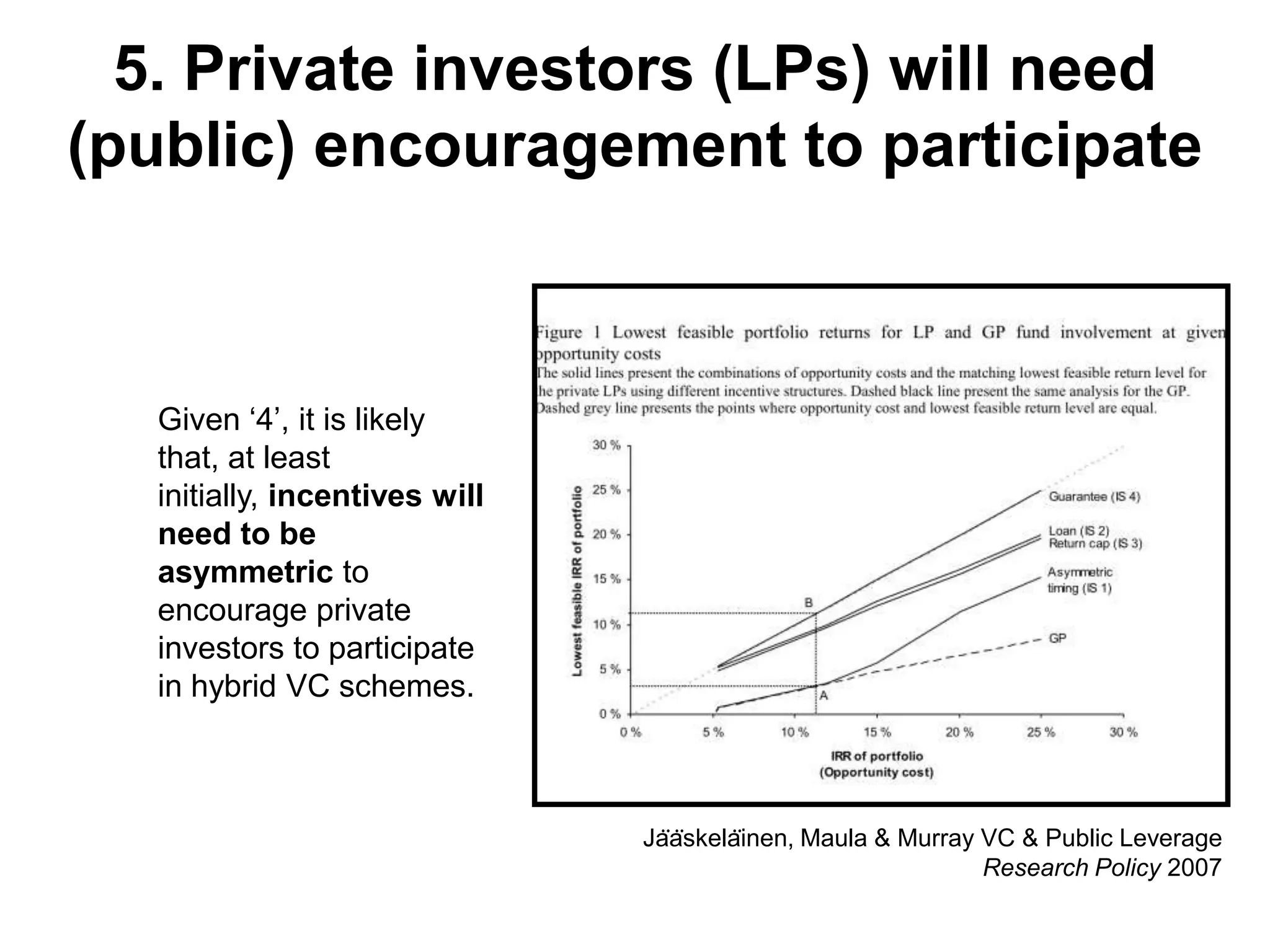

The document discusses challenges with public/private venture capital programs within entrepreneurial ecosystems. It notes that while an entrepreneurial ecosystem perspective is useful, it also increases complexity and requires integrated policy approaches. It then provides observations on venture capital programs, including that governments need to build expertise to design effective programs, that experienced investment managers are critical, and that programs need sufficient scale. It also notes that both public and private interests must be balanced for the programs to be sustainable and achieve their objectives.