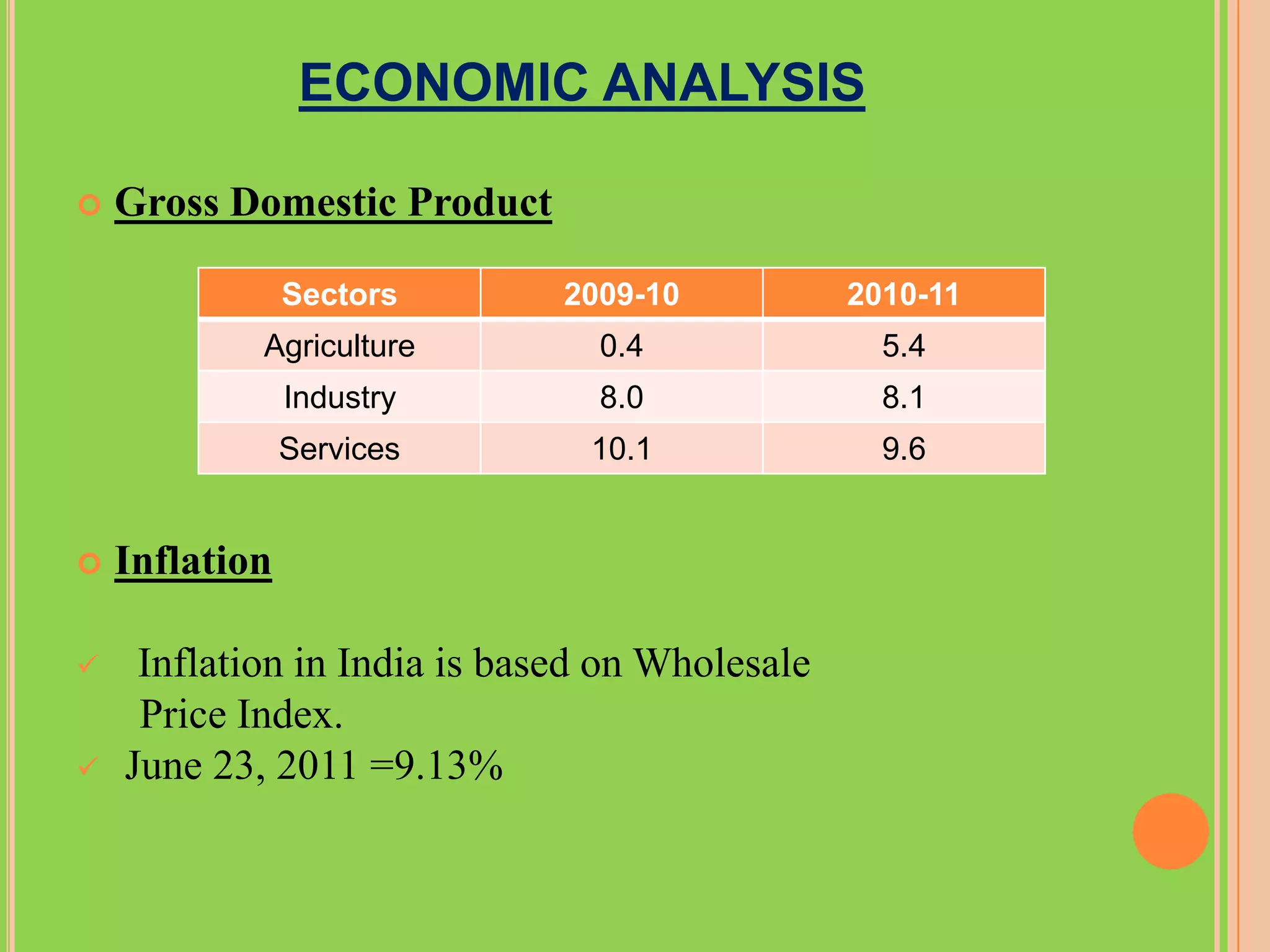

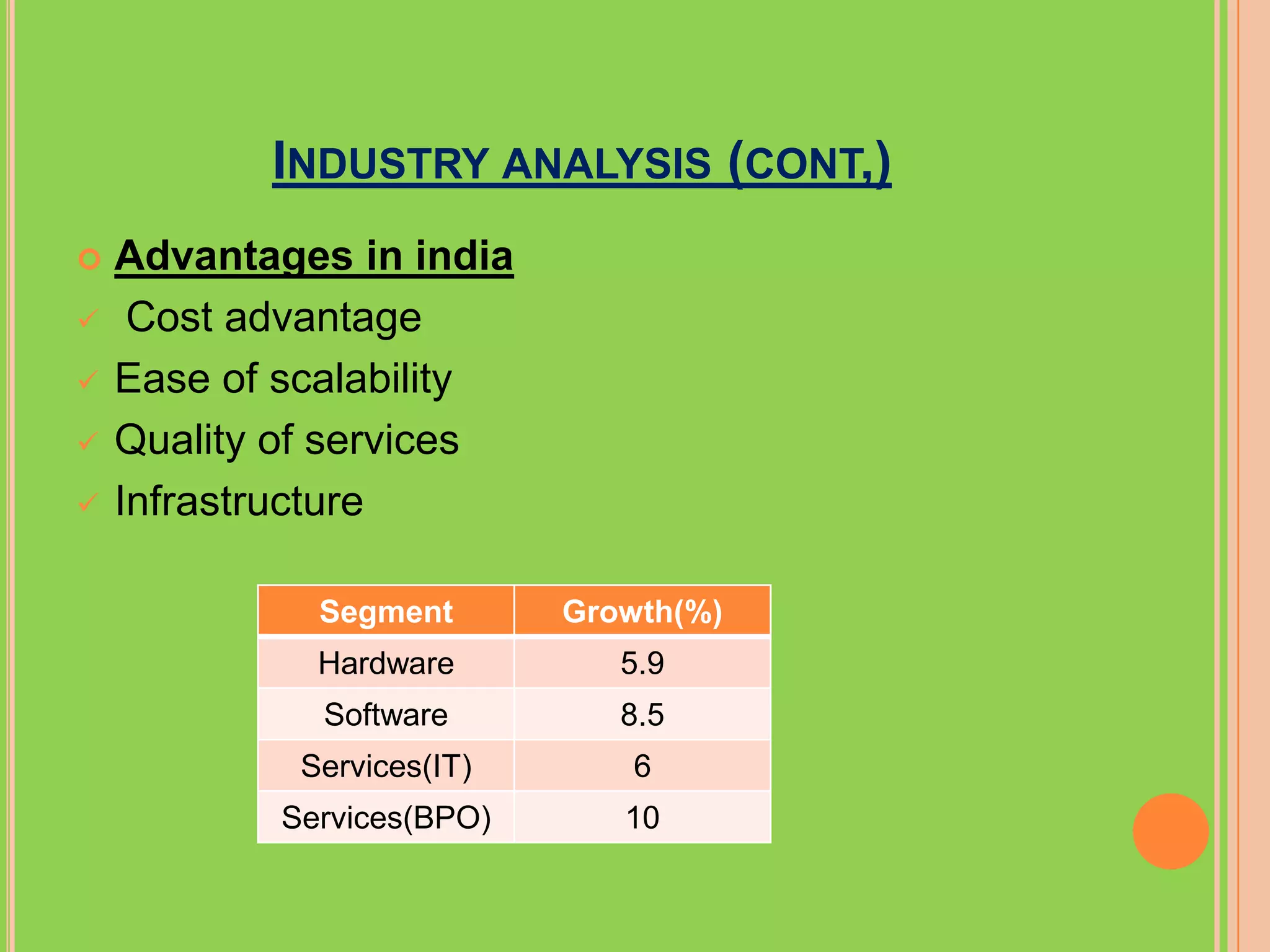

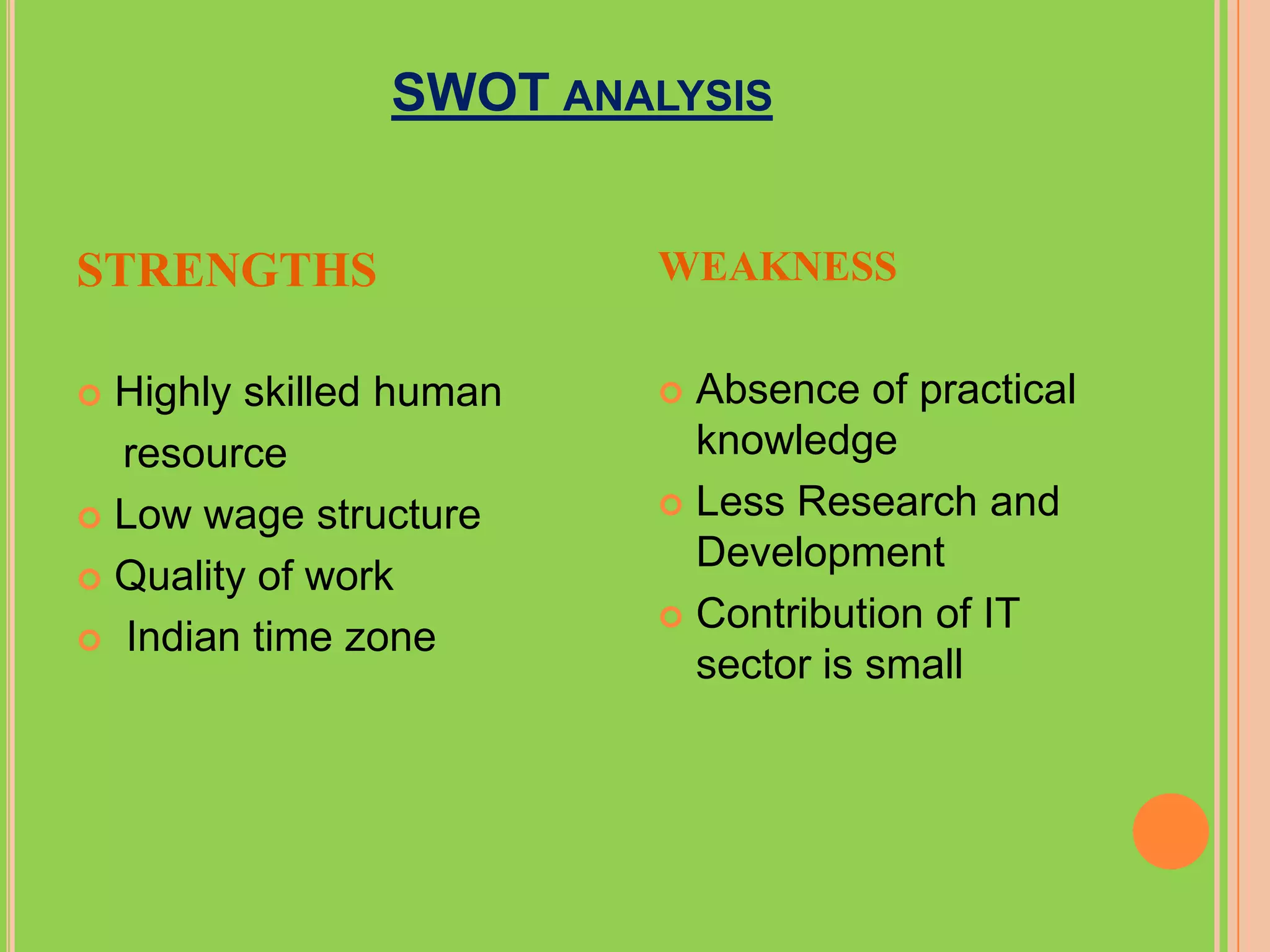

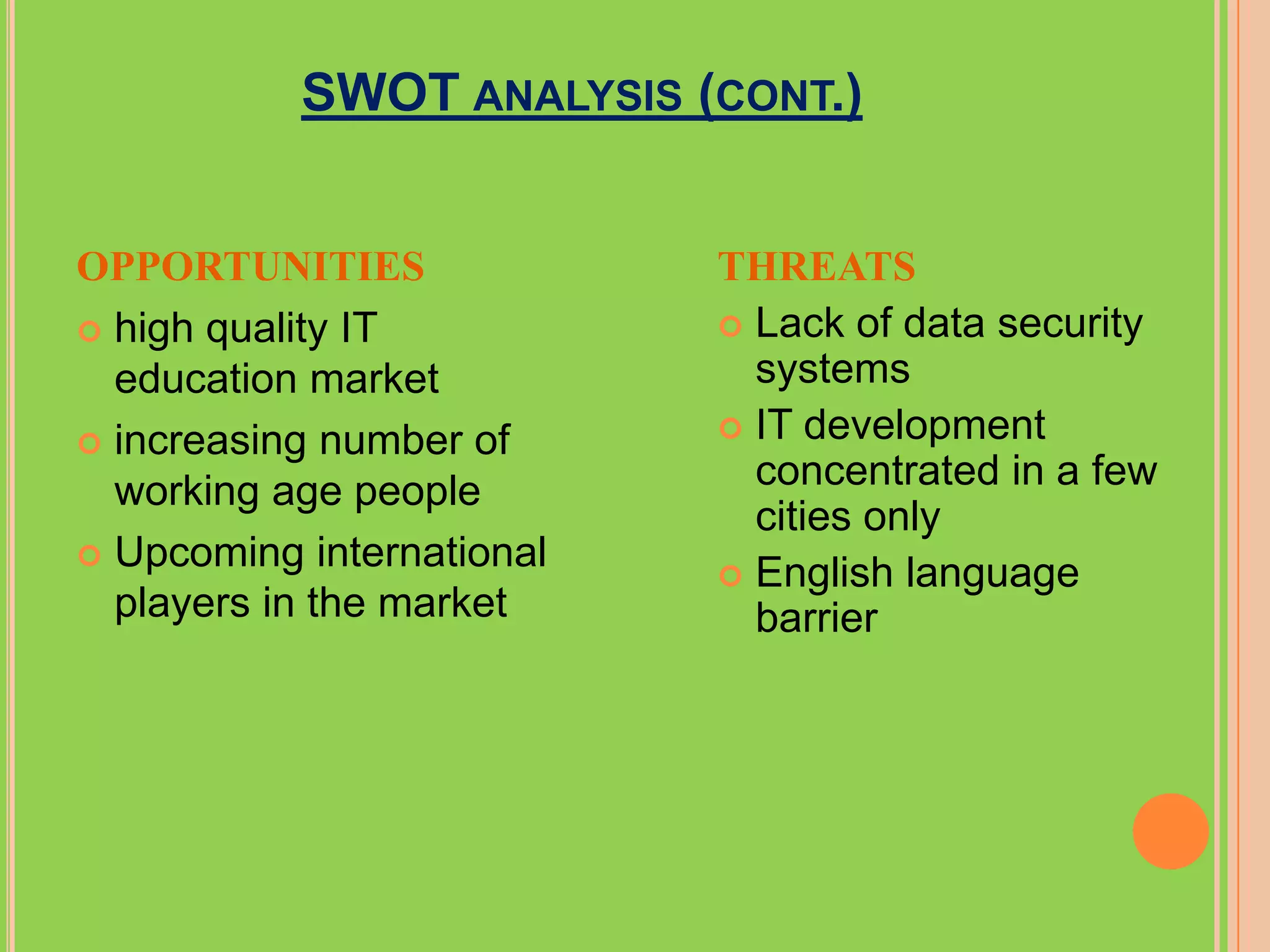

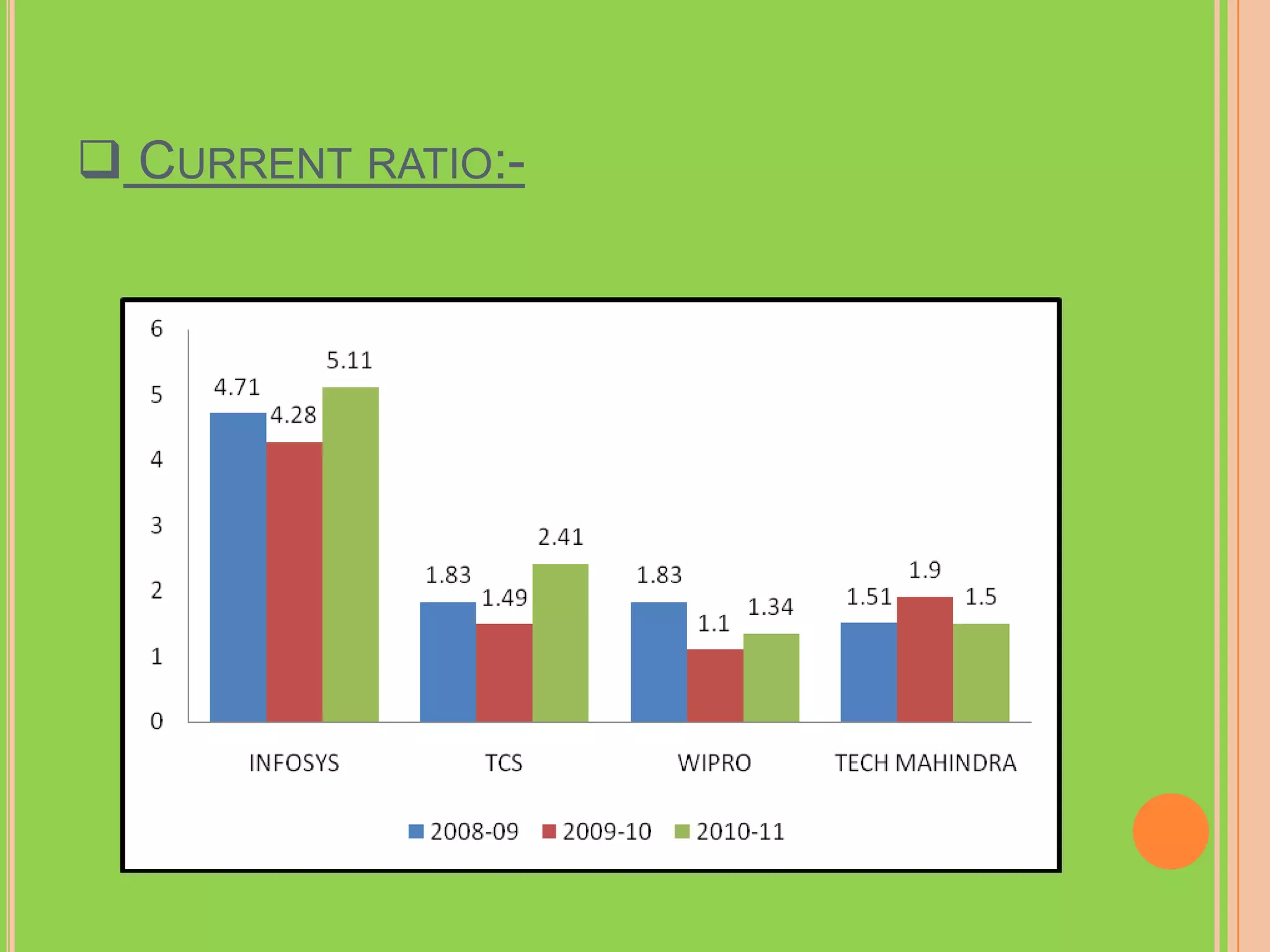

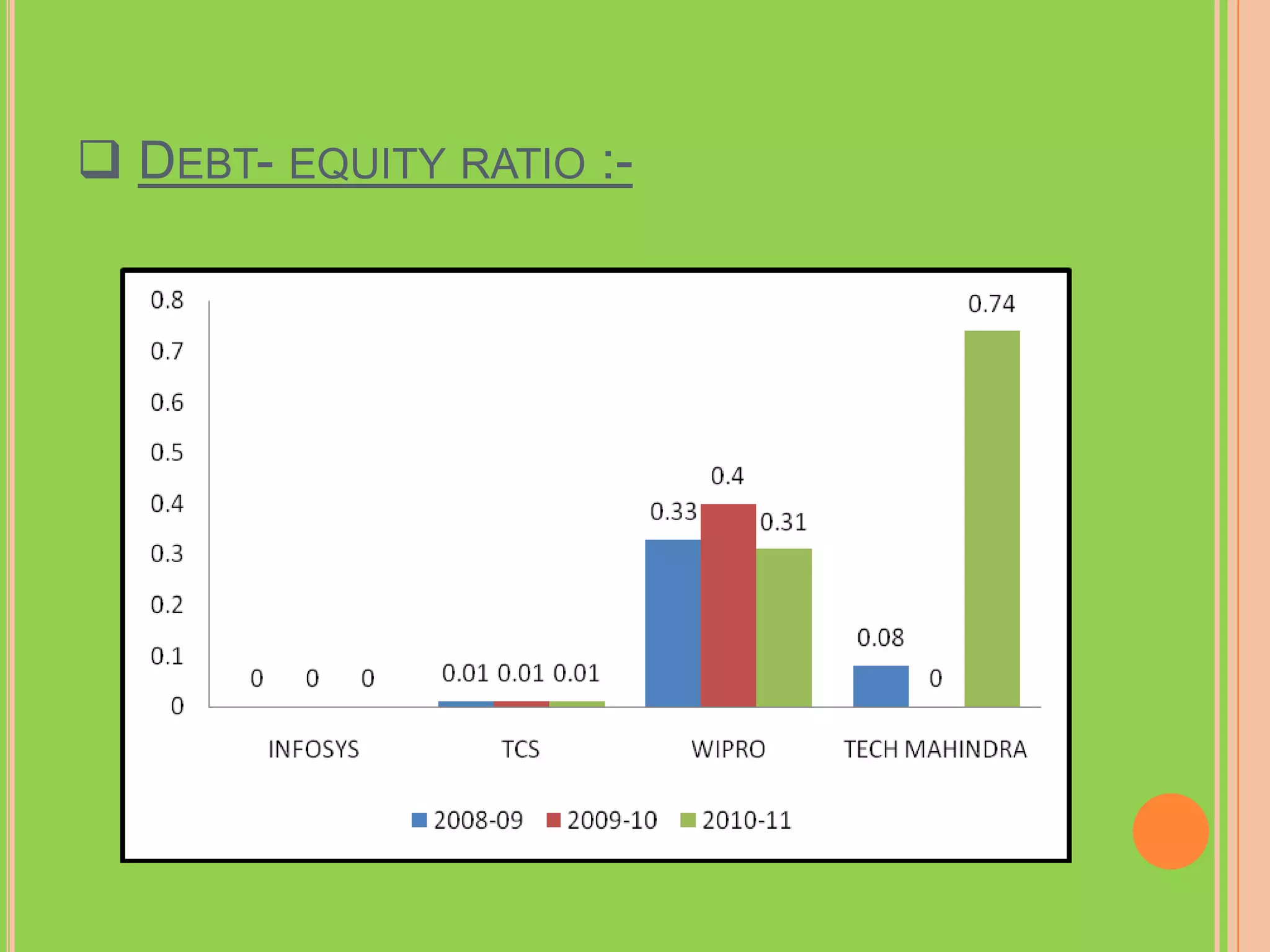

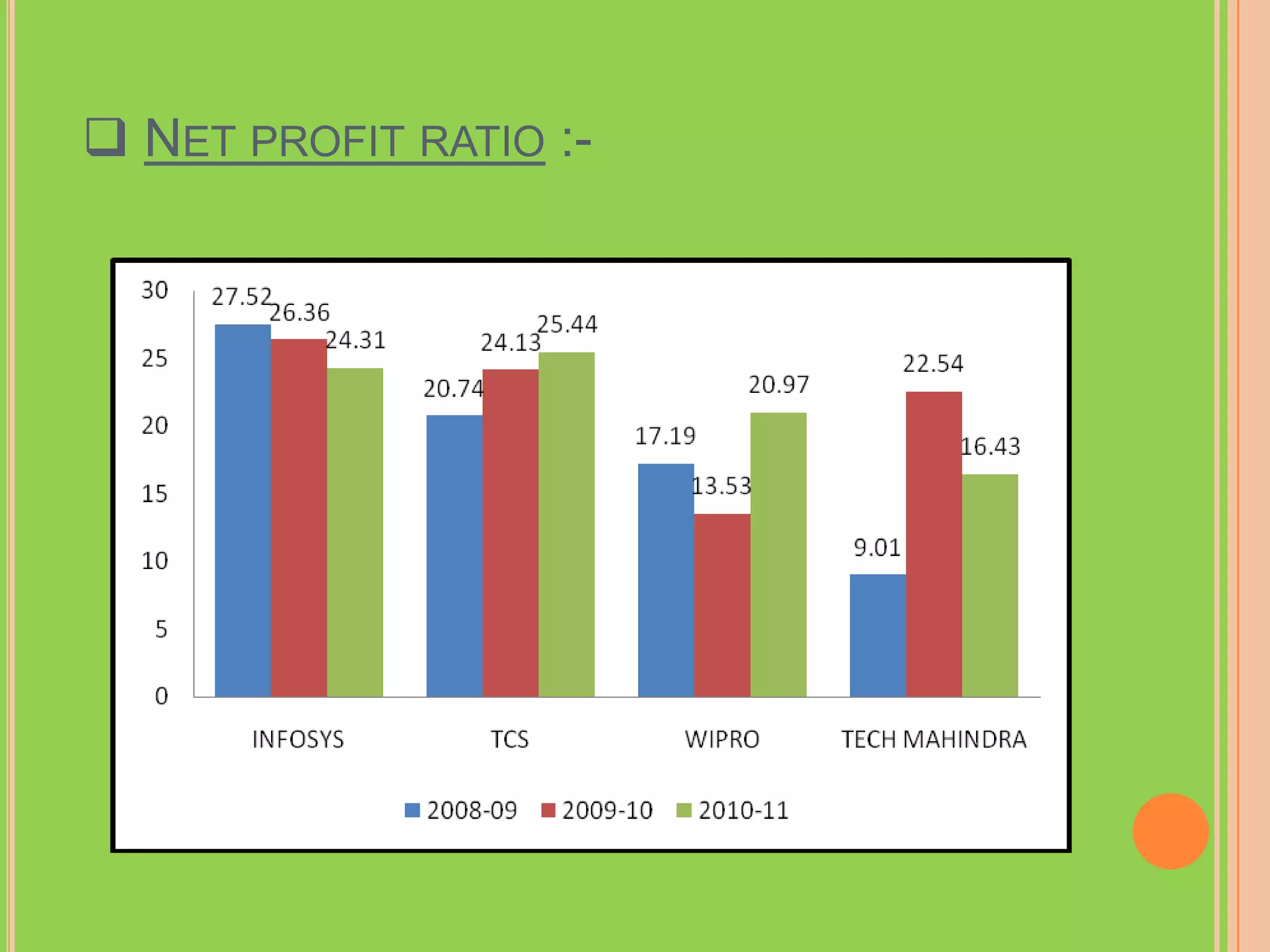

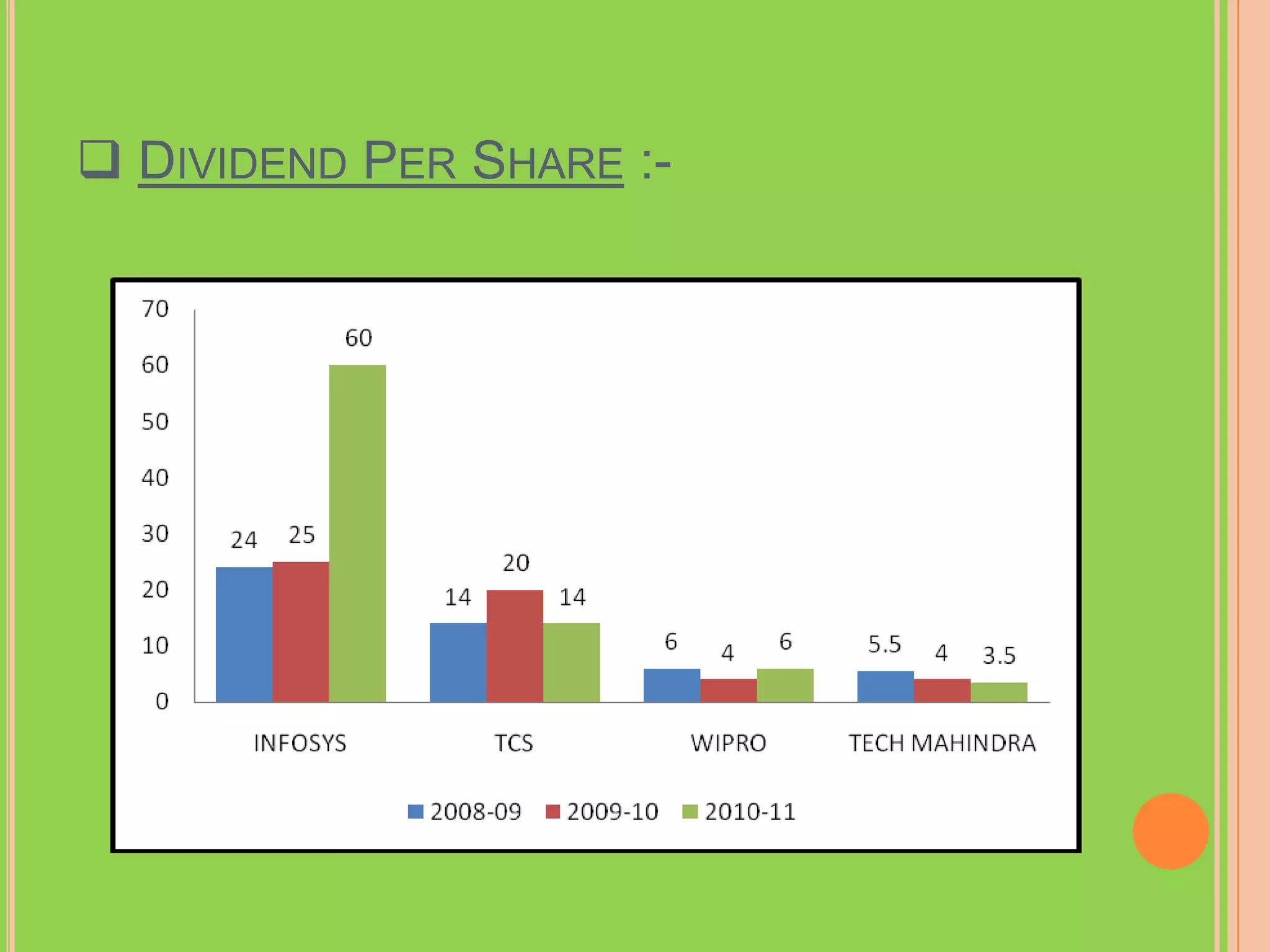

This document summarizes a research paper on fundamental analysis of IT sector companies in India. It discusses the objectives to analyze company positions and identify the best performing IT companies. It covers topics such as the IT industry overview, economic analysis, industry analysis using SWOT, research methodology including ratio analysis. The findings suggest Infosys is the top ranked company based on financial ratios. The conclusion recommends investing in Infosys while advising to sell shares of weaker performer Wipro.