Embed presentation

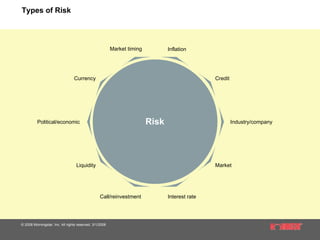

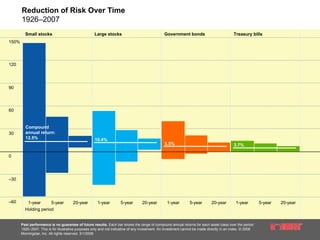

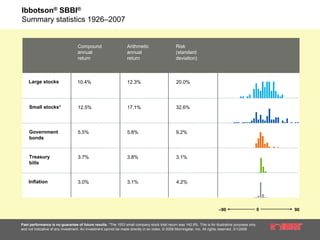

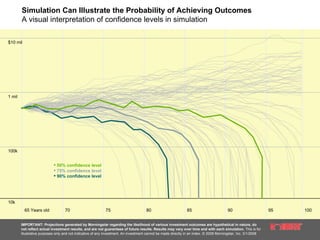

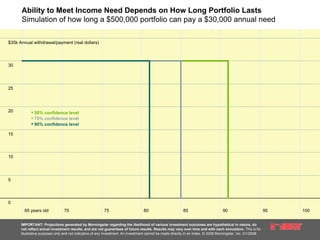

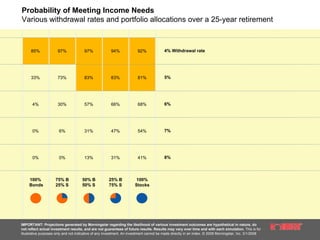

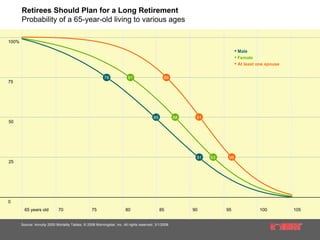

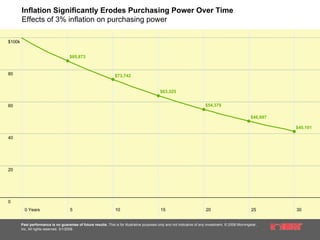

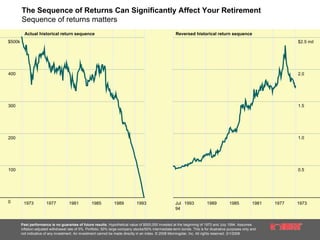

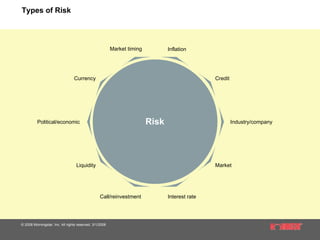

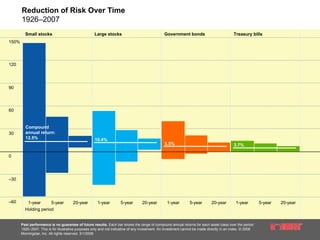

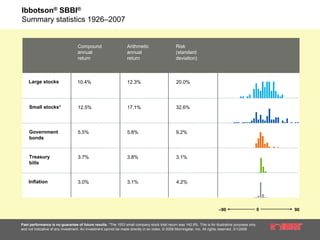

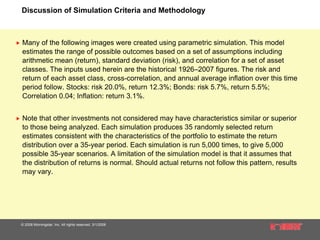

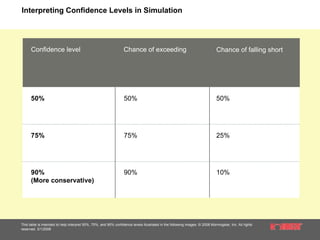

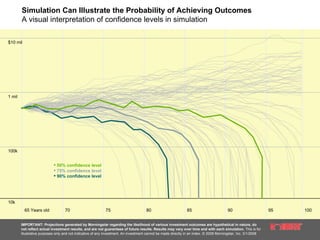

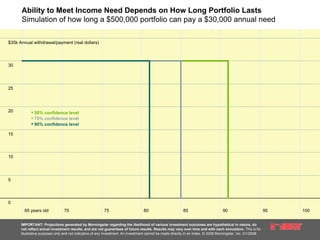

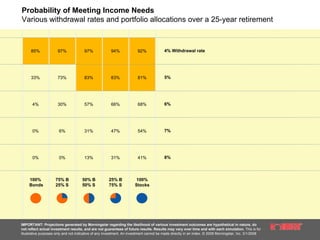

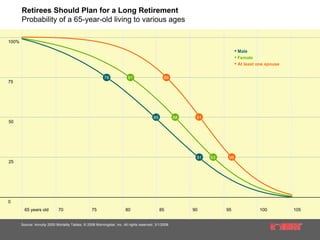

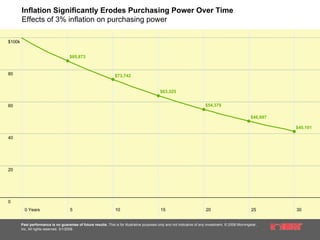

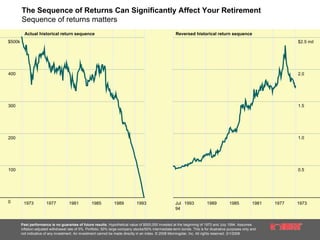

The document discusses various risks in retirement planning such as longevity risk, market volatility, inflation, and sequencing of returns. It provides simulations showing the probability of different portfolio allocations meeting income needs over a 25-year retirement and the likelihood of funds lasting to different ages. The key risks retirees face include running out of money, healthcare costs, and inflation eroding purchasing power. Managing these risks requires intelligent diversification among stocks, bonds, and funds.