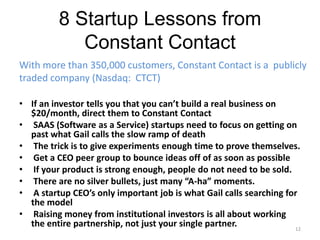

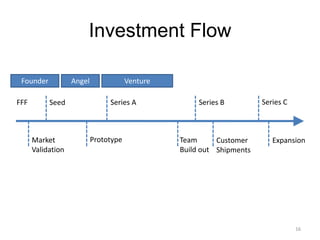

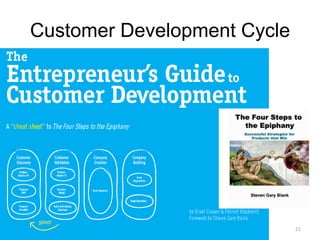

This document provides information and advice about obtaining venture capital investment in Silicon Valley. It discusses questions venture capitalists will ask founders, such as whether they have a great management team, a product addressing a big profitable market, and a clear exit strategy. It also covers topics like the customer development cycle, building a lean startup, and how the venture capital world is changing with more angels and super angels funding earlier stages. References are provided for learning more about startups that have been funded and trends in startup funding.