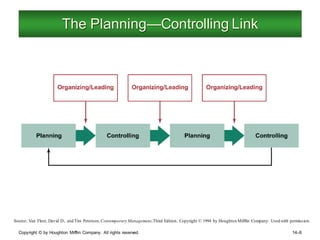

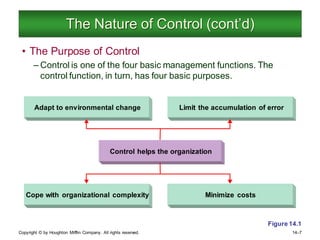

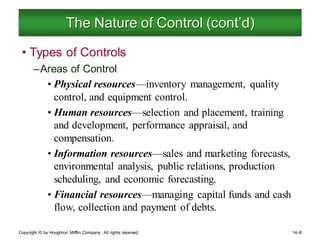

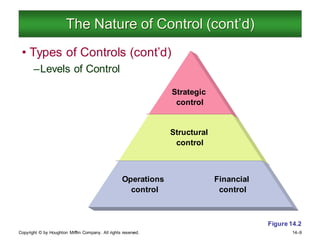

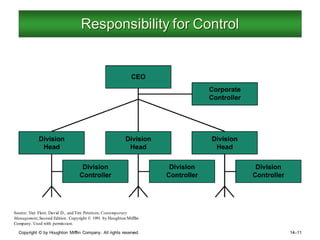

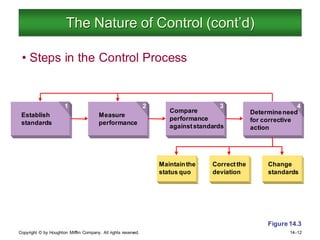

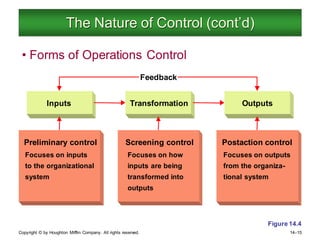

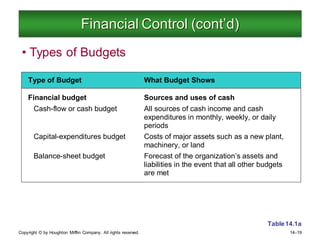

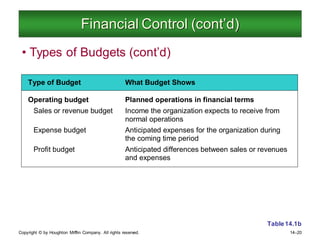

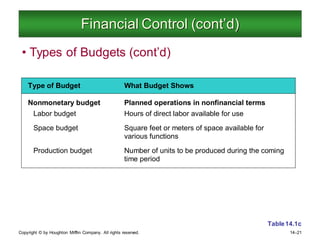

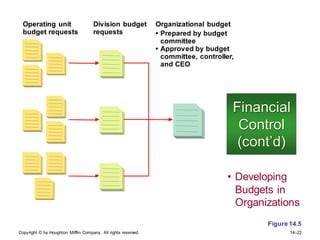

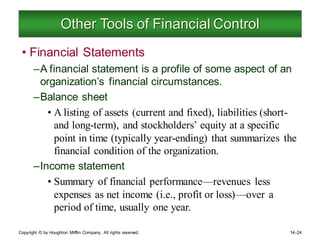

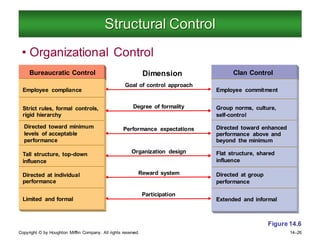

This chapter discusses the concept of control in management. It defines control as regulating organizational activities to keep performance within acceptable limits. The chapter outlines the purpose of control, different types of control (operations, financial, structural, strategic), and the steps in the control process (establish standards, measure performance, compare to standards, determine need for corrective action). It also discusses tools for financial control like budgets and financial statements, as well as challenges in implementing effective control systems and overcoming resistance to control.