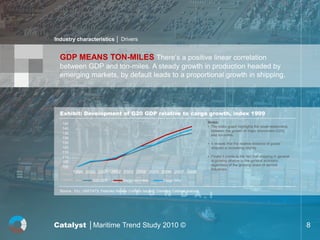

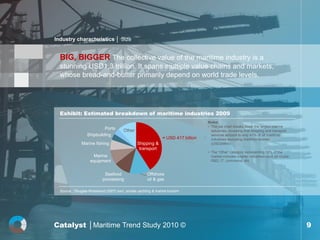

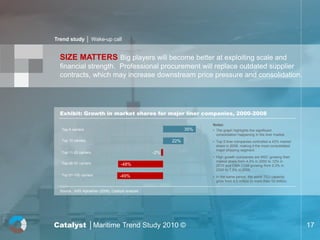

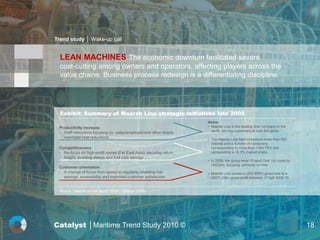

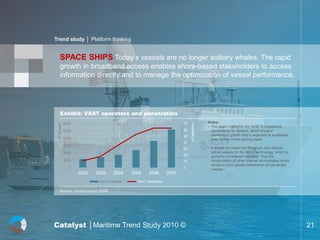

The document discusses key trends in the maritime industries. It notes that the industries faced a tough period with overcapacity and declining freight rates, leading companies to focus on core business and cost cutting. This included outsourcing non-core functions to reduce overhead. Larger companies were better able to leverage scale through professional procurement. The downturn also accelerated digitalization trends, with functions like chartering and operations increasingly taking place online through digital platforms. This opens opportunities for new business models based on digital information and assets. Overall, the trends highlighted the benefits of scale, cost leadership through outsourcing and digitalization.