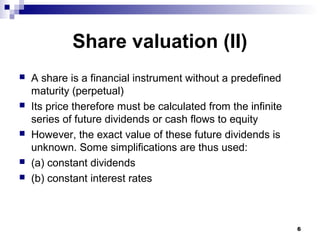

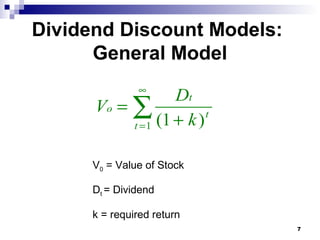

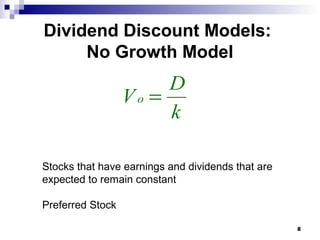

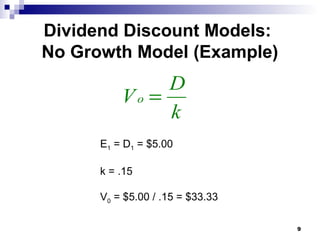

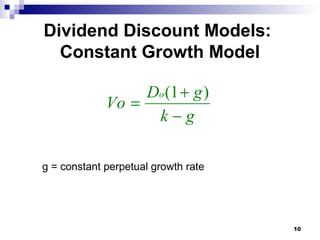

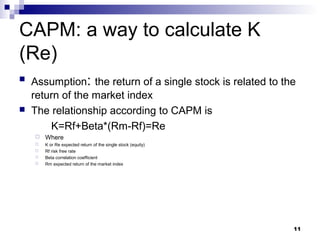

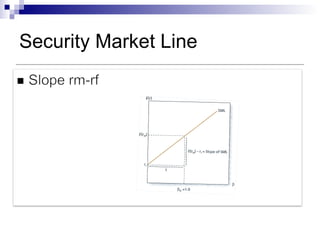

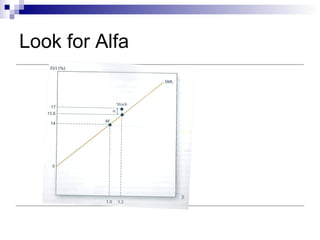

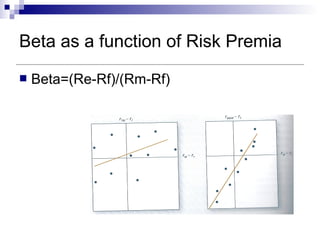

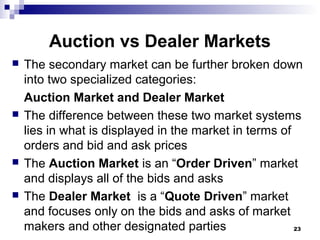

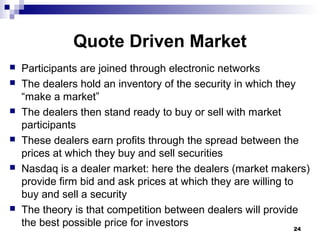

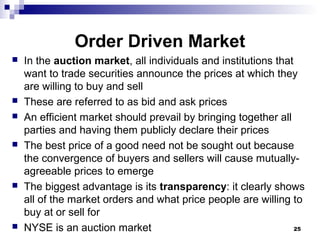

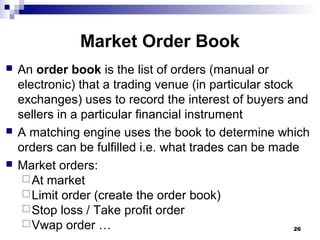

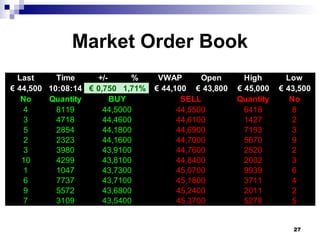

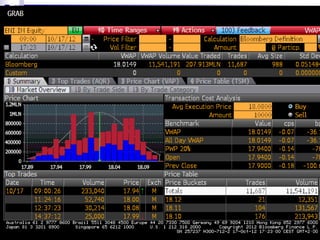

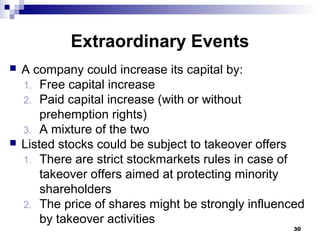

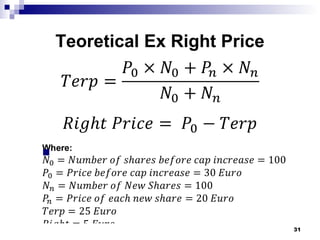

This document discusses various topics related to pricing shares and stock markets. It begins by defining stocks/shares and describing their nominal, book, and market values. It then distinguishes between ordinary shares and preferred shares, noting their different risk profiles and dividend payment priorities. Various models for valuing shares are presented, including dividend discount models assuming no growth, constant growth, and the capital asset pricing model (CAPM) for calculating the required rate of return. The primary and secondary stock markets are defined, with the primary market involving a company's initial public offering of shares and the secondary market comprising subsequent trading on exchanges. Finally, extraordinary corporate events like capital increases and takeovers are briefly covered.