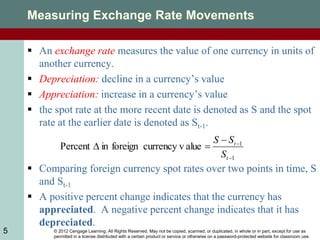

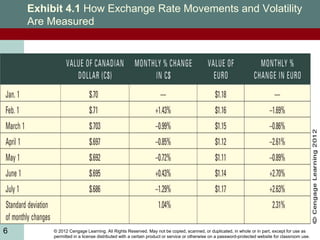

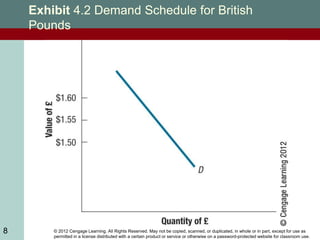

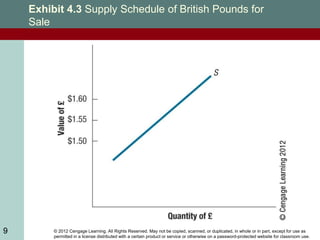

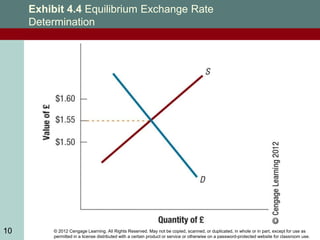

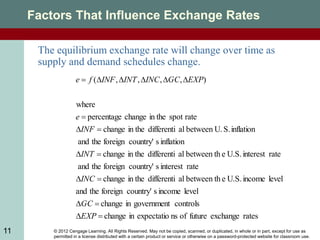

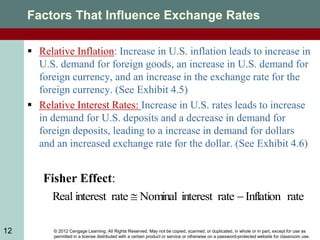

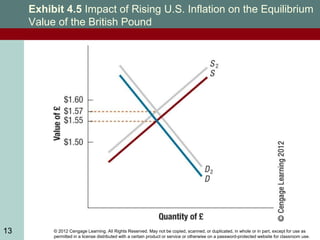

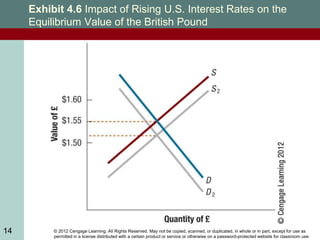

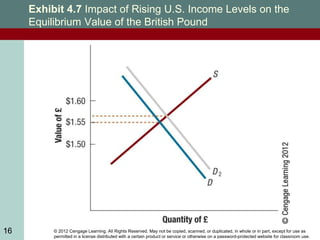

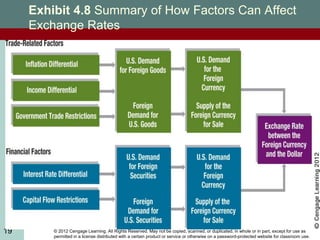

The document discusses exchange rate determination and factors that influence exchange rates. It begins by explaining how exchange rate movements are measured and how the equilibrium exchange rate is determined by the interaction of supply and demand. Key factors that can cause fluctuations in exchange rates are then examined, such as relative inflation, interest rates, income levels, and expectations of future economic conditions between countries. Speculators seek to capitalize on anticipated exchange rate movements through currency speculation.