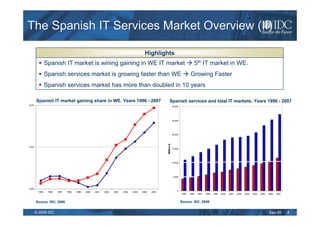

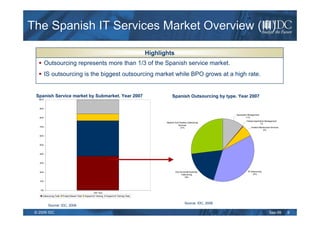

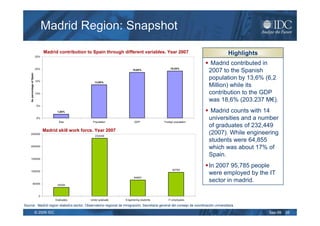

Madrid is a top location for IT sourcing due to its skilled workforce, competitive costs, and industry experience. IDC analyzed Madrid and found it has over 232,000 university graduates, many with engineering degrees. Madrid contributes 39% of Spain's IT market and over half of large company IT spending. Its workforce is experienced in key industries like telecom. Madrid offers the right skills at a competitive price while remaining culturally close to Europe.