Report

Share

Recommended

Recommended

Writekraft Research & Publication LLP.

We are one of the leading PhD assistance company that deals in helping PhD scholars in their Thesis, Research paper writing and publication work. We are providing custom PhD Thesis written for you exactly the way you want along with a Turnitin plagiarism report.

For more Information Contact us@ admin@writekraft.com

Or Call us @ 7753818181, 9838033084

www.writekraft.com

Working capital management of automobiles industry in haryana [www.writekraft...

Working capital management of automobiles industry in haryana [www.writekraft...WriteKraft Dissertations

Accounts receivables management 1 copy - copy

Accounts receivables management 1 copy - copyShifas ibrahim MBA student @ ILAHIA SCHOOL OF MANAGEMENT STUDIES

More Related Content

What's hot

Writekraft Research & Publication LLP.

We are one of the leading PhD assistance company that deals in helping PhD scholars in their Thesis, Research paper writing and publication work. We are providing custom PhD Thesis written for you exactly the way you want along with a Turnitin plagiarism report.

For more Information Contact us@ admin@writekraft.com

Or Call us @ 7753818181, 9838033084

www.writekraft.com

Working capital management of automobiles industry in haryana [www.writekraft...

Working capital management of automobiles industry in haryana [www.writekraft...WriteKraft Dissertations

Accounts receivables management 1 copy - copy

Accounts receivables management 1 copy - copyShifas ibrahim MBA student @ ILAHIA SCHOOL OF MANAGEMENT STUDIES

What's hot (20)

Working capital management of automobiles industry in haryana [www.writekraft...

Working capital management of automobiles industry in haryana [www.writekraft...

summer internship report on digital banking (Punjab & Sind Bank)

summer internship report on digital banking (Punjab & Sind Bank)

Idiro Analytics - What is Rotational Churn and how can we tackle it?

Idiro Analytics - What is Rotational Churn and how can we tackle it?

0601091 merchandise planning for reliance industries

0601091 merchandise planning for reliance industries

E-commerce Challenges & Opportunities - A Seminar Presentation

E-commerce Challenges & Opportunities - A Seminar Presentation

Similar to Practice test 1 acct 201

Similar to Practice test 1 acct 201 (20)

Intermediate Accounting I Final Exam Booklet Replacement.docx

Intermediate Accounting I Final Exam Booklet Replacement.docx

Due Tues., May 2- 7 questions Big Time Picture Frames h.docx

Due Tues., May 2- 7 questions Big Time Picture Frames h.docx

FE - 8Test Bank for Financial Accounting Tools for Business Dec.docx

FE - 8Test Bank for Financial Accounting Tools for Business Dec.docx

Problem 1 (10 Points)Jackson Browne Corporation is authorized to.docx

Problem 1 (10 Points)Jackson Browne Corporation is authorized to.docx

Exercises1. Classification of activitiesClassify each of the.docx

Exercises1. Classification of activitiesClassify each of the.docx

AACC 206 Week Assignment Please complete the following 5 e.docx

AACC 206 Week Assignment Please complete the following 5 e.docx

Week Two Exercise AssignmentRevenue and Expenses1. Recognition.docx

Week Two Exercise AssignmentRevenue and Expenses1. Recognition.docx

The following information is for Henenlotter Inc. for the year end.docx

The following information is for Henenlotter Inc. for the year end.docx

Quiz –PART I — MULTIPLE CHOICE Instructions De.docx

Quiz –PART I — MULTIPLE CHOICE Instructions De.docx

1) Questions & Your AnswersYour Answer1.(Multiple Choice)Purch.docx

1) Questions & Your AnswersYour Answer1.(Multiple Choice)Purch.docx

1.Isaac Inc. began operations in January 2013. For certain of it.docx

1.Isaac Inc. began operations in January 2013. For certain of it.docx

Accounting 97061 paper 1 multiple choice may june session 2002

Accounting 97061 paper 1 multiple choice may june session 2002

ACC205 Discussion QuestionsAccounting Equation As you hav.docx

ACC205 Discussion QuestionsAccounting Equation As you hav.docx

Part I. Comprehensive problems. Place answers below each questio.docx

Part I. Comprehensive problems. Place answers below each questio.docx

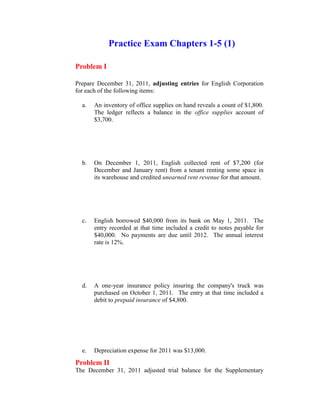

Practice test 1 acct 201

- 1. Practice Exam Chapters 1-5 (1)<br />Problem I<br />Prepare December 31, 2011, adjusting entries for English Corporation for each of the following items:<br />a.An inventory of office supplies on hand reveals a count of $1,800. The ledger reflects a balance in the office supplies account of $3,700.<br />b.On December 1, 2011, English collected rent of $7,200 (for December and January rent) from a tenant renting some space in its warehouse and credited unearned rent revenue for that amount.<br />c.English borrowed $40,000 from its bank on May 1, 2011. The entry recorded at that time included a credit to notes payable for $40,000. No payments are due until 2012. The annual interest rate is 12%.<br />d.A one-year insurance policy insuring the company's truck was purchased on October 1, 2011. The entry at that time included a debit to prepaid insurance of $4,800.<br />e.Depreciation expense for 2011 was $13,000.<br />Problem II<br />The December 31, 2011 adjusted trial balance for the Supplementary Corporation is presented below.<br />Account TitleDebitsCreditsCash 21,000Accounts receivable 300,000Allowance for uncollectible accounts 20,000Prepaid rent expense 10,000Inventory 50,000Equipment 600,000Accumulated depreciation - equip250,000Accounts payable 40,000Note payable (due in six months) 60,000Salaries payable 8,000Interest payable 2,000Capital stock 400,000Retained earnings 100,000Sales revenue 800,000Cost of goods sold 480,000Salaries expense 120,000Rent expense 30,000Depreciation expense 60,000Interest expense 4,000Bad debt expense 5,000________ Totals 1,680,000 1,680,000<br />Required:<br />Prepare the necessary closing entries at December 31, 2011.<br />Problem III<br />The Kerr-Graham Corporation had two operating divisions, one manufacturing cooking utensils and the other herb gardens. Both divisions qualified as separate components of the entity. On September 15, 2011, the company adopted a plan to sell the assets of the herb garden division. The actual sale was made on December 8, 2011, at a price of $1.8 million. The book value of the division’s asset was $3 million, resulting in a before-tax loss of $1.2 million on the sale.<br />The division incurred before-tax operating losses of $300,000 from the beginning of the year to September 15, and $90,000 from September 16 through December 8. The income tax rate is 40%. Kerr-Graham’s after-tax income from its continuing operations is $1,050,000.<br />Required:<br />Prepare Kerr-Graham’s income statement for 2011 beginning with “income from continuing operations.” Include appropriate EPS disclosures assuming that 100,000 shares of common stock were outstanding throughout the year. Show calculations.<br />Problem IV<br />In 2011, McArthur-Douglas contracted to build an airplane for $12,000,000. Data relating to the contract are as follows:<br />($ in thousands)<br /> 20112012<br />Costs incurred during the year $2,000$6,000<br />Estimated costs to complete as of year-end 6,000 - <br />Billings during the year 6,000 6,000<br />Cash collections during the year5,0007,000<br />Required:<br />Determine the gross profit that McArthur-Douglas should recognize in both 2011 and 2012 using the percentage-of-completion method. Show calculations.<br />Problem V<br />On July 1, 2011, Barnes Manufacturing Company sold inventory to SuperRite, Inc. for $400,000. Terms of the sale called for a down payment of $80,000 and two annual installments of $160,000 due on each July 1, beginning July 1, 2012. Each installment also will include interest on the unpaid balance applying an appropriate interest rate. The inventory cost Barnes $320,000. <br />Required:<br />Compute the amount of gross profit to be recognized from the installment sale in 2011, 2012, and 2013 using the installment sales method. Show calculations.<br />Multiple Choice<br />Enter the letter corresponding to the response which best completes each of the following statements or questions.<br /> 1.Financial statements generally include all but which of the following:<br />a.income statement.<br />b.balance sheet.<br />c.federal income tax return.<br />d.statement of cash flows.<br /> a 2.The primary objective of financial reporting is to provide information:<br />a.useful in making decisions.<br />b.about a firm's economic resources and obligations.<br />c.about a firm's product lines.<br />d.about a firm's financing and investing activities.<br /> c 3.The two fundamental decision-specific qualities that make accounting information useful are:<br />a.verifiability and timeliness.<br />b.predictive value and feedback value.<br />c.relevance and faithful representation.<br />d.cost effectiveness and materiality.<br /> c 4.Which of the following characteristics does not describe a liability?<br />a.result of a past transaction.<br />b.probable.<br />c.present obligation.<br />d.must be legally enforceable.<br /> a 5.The underlying assumption that presumes a company will continue indefinitely is:<br />a.going concern.<br />b.periodicity.<br />c.economic entity.<br />d.monetary unit.<br /> c 6.In general, revenue is recognized when the earnings process is virtually complete and:<br />a.production is completed.<br />b.a purchase order is received.<br />c.cash is collected.<br />d.collection of the sales price is reasonably assured.<br /> 7.A transaction that is unusual, but not infrequent, should be reported separately as a(an)<br />a.Extraordinary item, net of applicable income taxes.<br />b.Extraordinary item, but not net of applicable income taxes.<br />c.Component of income from continuing operations, net of <br />applicable income taxes.<br />d.Component of income from continuing operations, but not net of applicable income taxes.<br /> a 8.A gain or loss should be reported in an income statement as an extraordinary item (net of tax) if it is due to a transaction considered:<br />a.to favorably affect taxes<br />b.extraordinarily large in amount<br />c.expected to materially impact the financial condition of the company<br />d.unusual in nature and infrequent in occurrence<br />The following data for the Robinson Companies, Inc. apply to questions 9 and 10:<br />Income statement:2011<br />Sales$2,500,000<br />Cost of goods sold1,300,000<br />Net income200,000<br />Balance sheets:20112010<br />Accounts receivable$ 300,000$ 200,000<br />Total assets2,000,0001,800,000<br />Total shareholders' equity900,000700,000<br /> 9.The accounts receivable turnover for 2011 is:<br />a.4.33<br />b.8.33<br />c. 5.2<br />10.0<br /> 10.The return on shareholders' equity for 2011 is:<br />a.20%<br />b.25%<br />c.22.22%<br />d.8%<br />