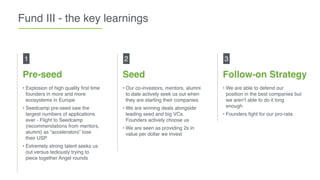

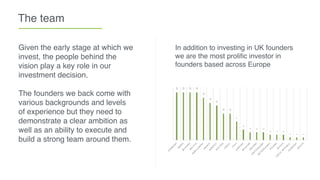

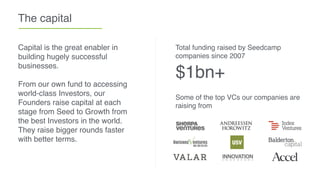

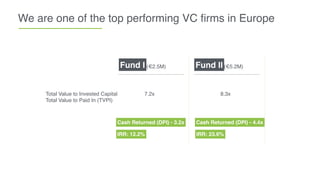

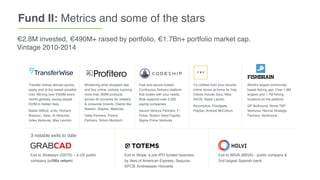

Seedcamp, established in 2007, is a European seed fund focused on investing in early-stage technology companies to foster global competition. With a target of raising a £50 million fund to support pre-seed and seed investments, Seedcamp aims to leverage its expansive network and expertise to scale ambitious startups. Over its tenure, Seedcamp has invested in over 240 companies, creating significant company value while refining its strategies based on past learnings from its funds.