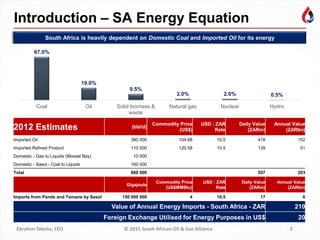

The document discusses South Africa's oil and gas industry, highlighting its dependency on crude oil imports, particularly from OPEC countries like Saudi Arabia and Nigeria. It notes the country's refining capacity and the challenges posed by new fuel standards and increased tariffs on pipelines, which could raise operational costs for refiners. Additionally, the document touches on the potential for offshore exploration in East Africa and infrastructure investment needs in the sector, emphasizing the importance of supportive policies and streamlined regulations.