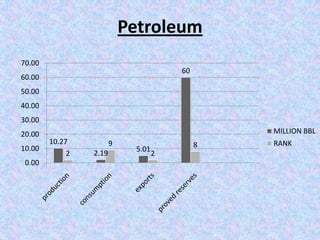

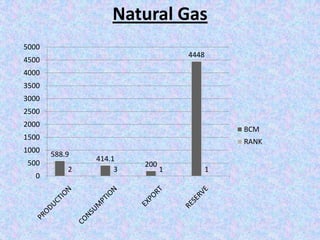

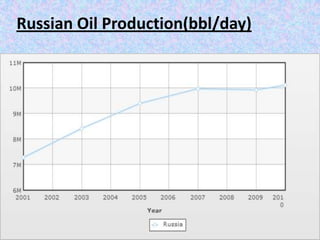

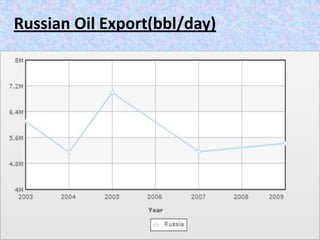

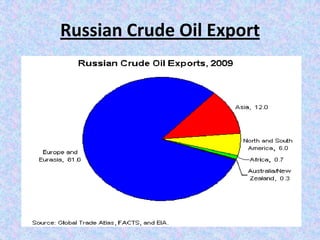

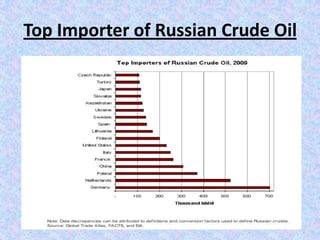

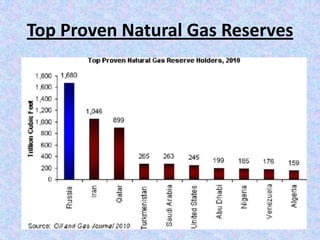

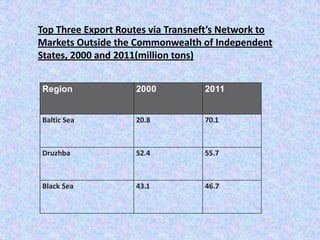

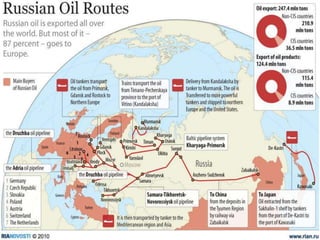

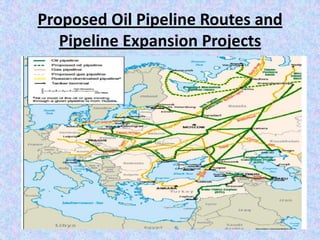

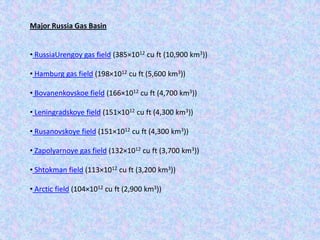

Russia is a major exporter of crude oil and natural gas. The top three routes for Russian crude oil exports via pipeline are to the Baltic Sea, through the Druzhba pipeline, and to the Black Sea. Proposed new pipelines include Nord Stream to Europe, South Stream to Europe through the Black Sea, and the ESPO pipeline to export oil to Asia Pacific markets like China. Major gas basins in Russia that feed exports include the Urengoy, Hamburg, and Bovanenkovskoe fields.