Bs complete fy 2016 17

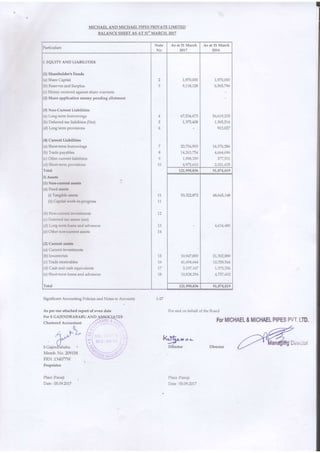

- 1. MICHAEL AND MICHAEL PIPES PRIVATE LIMITED BALANCE SHEET AS AT 31'' MARCH,2017 K,!$a-r.- Note 2017 2016 I. EQUITY AND LIAAILITIES (1) Shar€holde!'s Funds (a) Share Capital (b) Resenes and Surplus (c)Money received against share wanants (2) Share application money pending allotment (3) Non-Curent Liabilities (a) Long-tern borowings (b) Deferred tax liabiliiies (Net) (d) Long term provisions (4) Current Liabilities (a) Sholt-ierm bonowings (b) Trade payables (c) Other current liabilities (d) Shortrem provisions Total II.Assets (1) Non-currert assetE (a) Fixed assets (i) Tangible assets (ii) Capital work-in-progress (b) Non-cun ent inveshnenis (c) Deferred tax assets (net) (d) Long term loans and advances (e) Other non-current assets (2) Cunent assets (a) Current investmenbs (b) Inveniories (c)Trade receivables (d) Cash and cash equivalents (e) ShoFterm loans and advances Total 2 3 5 6 7 8 10 11 1',I 72 13 14 15 76 17 t8 1,970,OOO 9,114,124 67,534,673 1,375,408 20,754,903 f1,263,754 1,998,359 4,975,610 L97A,AA0 6,565,796 56,619,235 1,36151,1 913,O27 16,376,586 4,664,696 2,421,635 121,990,436 9'1,074,079 53,322,872 10,9q,459 41,694,641 5,197,167 70,828,294 48,645,148 1,634,480 21342,889 10,358,5.14 1,375,356 4,757,602 721,990,836 91,074,019 Significant Accounting Policies and Notes to Accounls 1-27 For and on behalfof the Boarcl .nl r' J^ (l s Cajend'Ebabu ' For MICHAEL E MICHAEL PIPES PVT. tTD. Direcior Dlrector Me b. No. 209158 FRN ;134077W Piace :Panaji Date | 05.09.2017 Place:Panaji Date r05.09.2017

- 2. MICHAEL AND MICHAEL PIPES PRIVATE LIMITED STATEMENT OF PROFIT AND LOSS STATEMENT FOR THE YEAR ENDED 31S' MARCH, 2017 Particulars Note No As at 31 March 2017 As at 31 March 2016 [. Revenue from operations lL Other Income IIL Total Revenue (I +II) IV. Expenses: Changes in inventodes of finished goods, work-in-progress and Stock-in-Trade Cost of matedals consumed Operating Expenses Employee benefit expense Other expenses Financial costs Depreciation and amortization expense Total Expenses V. Profit before tax VI. Tax expense: (1) Current tax (2) Deferled tar ; (3) Short/ (Excess) Plovision for Earlier years VII. Profit/(Loss) for the period (XI + XfV) VIIL Eaming per equity share: (1) Basic 20 2L 22 2i 24 26 27 (m-IV) L70987567 4401447 1753890'14 10,290,755 64,745,057 58,541.,462 1,945,848 18,685,377 6,576,091. 6,449,287 23,808,014 7,142,231 24,950,245 (r8,732,921) 72,1.86,350 'r7,220,365 1,658,480 3,543,689 3,502,929 4,9'9,435 "167,233,877 24,298,326 8,'r55,137 2,519,937.39 989s 1.24,223 344,001 0 5,625,305 285.55 783,695 L32 Significant Accounting Policies and Notes to Accounts A6 per our attached report of even date Fol S GAIENDRABABU AND ASSOCIATES Chaf€red Accountant L-27 Ior and on behalf of the Boald t{o$,-'* fJlrectot ljllecrof For MICHAEL & MICHAEL PIPES PW [TD. t€r L {-- ( S GajeMrababu Memb. No. 209158 FRN :134077W Proprietor Place : Panaji Da'te r05.09.2017 Place : Panaji Date :05.09.20U Managing Dlrcctor

- 3. MICHAEL AND MICHAEL PIPES PRIVATE LIMITED CASH FLOW STATEMENT FOR THE YEAR ENDED 31ST MARCH 2017 Particulals Year Ended 31,03.20U Year End€d 31.03,2016 A- Cash Flow ftom opelatine activities : Net Profit/(Loss) before tax & exceptional items Adiusted for : Depreciation lnterest lnco e Interest Expenses & other finance cost Operating profif before workint capital chant€s Adiusted for : Trade & Other Receivable lnventories Short Term Provisions Other current liabilities Trade & Otlrcr Payables Cash generated fronr operation Tax Paid Net Cash from Operating activities B, Cash FIow from Investment Aclivilies: Net Purchase ofFixed Assets & Capital Advances Interest Received long term Loans & Advances sho tern Loans & Advances Net Cash used in Invesfing Activities C. Cash Flow from Finanaing Activities: Long Term Borrowings(net) Short Teim Borrowings(net) Long term provision Interest Expe$es & other finance cost Net Cash used in Financing Activities Net lncrease/(Decrease) in Cash & Cash Equivalent (A+B+C) Cash & Bank Balances at the beginnine of the Period I Cash and cash equivalents Short term bank deposits Total Cash & Bank Balances at fhe beginling of pedod Cash & Bank Balances at the End of the Peliod : Cash and cash equivalents Short tern bank deposits Total Cash & Bank Balances at the End oI period (11,127 ,010.7'l) 269,515.00 4,634,480.00 9,143,664.71) (15,366,680.42) (1,725,637.49) (38,s34,533. ls,366,680.42) (31,336,100.00) 10,355,030.00 2,953,975 .39 1,420,828.00 9,599,058.00 12803,958.37 (18,654,950.51) 731,077.00 'L641,7 45.80 (32,42'r,949.00) 7,484.40 (4,394,471.40) 6,449,286.8't (269,515.00) 245,176.28 1,130,180.00 't57,099.00 5,040068.00 8,155,137.19 20,911,000.00 ,047 ,208 6 13,903,791.39 _____):::::::::_ 11,383,854.00 7.804,637 .14 3,821,870.72 r,375,15628 4,919,435 .04 (2484.00) 929.00 651,918.80 9,066,798.80 't,521,824.66 10,588,619.46 10,915,438.00 4,378,3'7.00 913,026.86) 16,576,091.00) 28,351,382.28 20,508.29 (3,502,929.00) 76 10,464,426,30 24,868,961.57 (3,201,'t4s.62) 1.375,356.28 5,'r97 ,167 .40 5,'197,'167.00 4,576,501 .94 245,776.28 1,130,180.00 4,576,50'1.90 4,576,501.90 1,375,356.28 1,375,356.2ti ;-;;;-;;r--5,197 ,167 .00 Fur.tlLl un Lrehalf of the Board .4 !. 'L,/{l S Gajendrab't u Menrb. No. 209158 FRN:134077W Proprietor Place:Panaji Date : 05.09.20U l-ya-*- Place:Panaii Date:05.09.2017 ''ti Director I

- 4. NOTES TO ACCOUNTS FORMING INTEGRAL PART OF FINANCIAL STATEMENTS NOTE: 1 SIGNIFICANT ACCOUNTING POLICIES a) Basis for preparation of financial statement The accompanying financial statements have been prepared in accordance with generally accepted accounting principles in India under dre historical cost convention on accrual basis of accounting. These financial statements have been prepared to comply in all material aspects with the Accounting Standards notified under section 133 of the Companies Act, 2013 ("the Act") read with rule 7 of the Companies (Accounts) Rules 2014 and in accordance with accounting principles generally accepted in India. This responsibility includes the design, implementation and maintenance of internal control relevant to the preparation and presentation of the financial statements that give a true and fair view and are free from material misstatement, whether due to fraud or error. b) Method Accounting The Company follows the milrcantile system of accounting c) Revenue recomition of Income & Expenditure i) Revenue from sale of products is recognized on transfer of ali significant risk and rewards of ownership of product on to customer, which is generally on dispatch of goods. Sales are stated net of returns and discount during the year excluding Value Added Tax. Revenue from Contracts is accounted on the basis of RA bills raised by the Company. ii) Purchases are recognized when ownership of goods is transferred and inclusive of all statutory levies but excluding excise duty & VAT credit iiD Interest income is recognized on time proportion basis iv) All items of Income & Expenses are accounted on accrual basis VAT Credit i) Raw Material, Stores & Spares and Capital Goods are accounted inclusive of Input VAT in case of Local Purchases ii) Sales are accounted inclusive of Output VAT Fixed Assets Fixed Assets are shown at the cost of acquisition less depreciation and impairment loss, if any. The cost of fixed assets includes installation/initial start-up expenses including interest on borrowings attdbutable to acquisition of fixed assets up to the date of commercial production and incidental expenses incurred up to that date, and other identifiable direct expenses. Depreciation d)

- 5. In respect of fixed assets acquired during the year, Calculation of deprecation is done based on the method provided in companies' act L956. The Company provides pro-rata depreciation from the date on which asset is acquired / put to use. In respect of assets sold, pro-rata depreciation is provided up to the date on which the asset is sold. Investments Investments are "NIL" as on 31.03.2017 Inventories 1) Raw Materials are valued at lower of cost or Replacement Cost. Cost is weighted average cost and compdses of all expenditure including taxes incurred in bringing the inventories to the present condition and location inclusive of VAT. 2) The Unbilled amount on Account of Contracts is shown under Revenue Work in Progress. 3) Finished goods are valued at cost or net realizable value whichever is less and cost consists of Raw material cost and conversion cost incurred in bringing the inventories to the present condition and location. 4) Stores and Spares are valued at lower of cost or net realizable value. lt includes vat credit. Borrowing Cost Borrowing cost attdbutable to the acquisition of assets is capitalized as part of the cost of respective assets up to the date when such assets is ready for its intended use. Other borrowing costs are charged to the Profit & Loss Account. Taxation i) Current Tax is determined as the amount of tax payable in respect of taxable income for the period. ii) Deferred tax is recognized subject to the consideration of prudence in respect of deferred tax liability/assets on timing differences, being the differences between taxable income and accounting income that originates in one period and capable of reversal in one or more subsequent periods subject to tax holiday. Impairment of Assets Impa ment is ascertained at each balance sheet date in respect of Cash Generating Units. An impairment loss is recognized whenever the carrying amount of an asset exceeds its recoverable amount. The recoverable amount is the greater of the net selling price and value in use. in assessing value in use, the estimated future cash flows are discounted to their present value based on an appropriate discount factor. Provisions Contingent Liabilities and Contingent Assets A provision is made based on a reliable estimate when it is probable that an out flow of resources embodying economic benefits will be requireil to settle an obligation. Contingent liabilities, if mateial, are disclosed by way ol notes to accounts. Contingent assets are not recognized or' disclosed in financial statements. h) i) k) ffi

- 6. MICHAEL AND MICHAEL PIPES PRIVATE LIMITED Notes to Accounts are integrated par t of finanancial statements Particulars t:T;t Rupee6 As at 37-s2076 Rupees 1 Significant Accounting Pollcies Equity Share Capital Authorieed 20000 shares of ?100 each Issue4 Subscrib€d & Paid up 19700 Equity Shares of t 100 each At tlrc beginning of tlte period lssued dlring the period Outstanding at t]rc end of the pedod ' Reservee and Surplus Surplus in Ptofit and Loss A,/c Resewes & Surplus: Capital Reseree Balance as per last financial statements Add: Profit for the Yeaf l€ss : Appropriations Clo6ing Balance NON CURRENT LIABILITIES LONG TEdM BORROWINGS SECURED VUAYA BANK TERM LOAN GIDC Kotak Mahlndra Vehicle Loan HDFC Bank Loan Against Depo6it 2,000,000,00 1,970,000,00 2000,000.00 1,970,000.00 1,970,000.00 1,970,000.00 a) Reconciliation of number of s outstanding at the beginnidg aDd at the end of the Reporting Pedod 31.03.2017 31.03.2016 Eouity shares 79700 0 19,700 79,700 79,700 b) Terrns/ Rights Attached to equify s The company has one cla8s of equity s having a pat value of Rs. 100 per . Each holder of equity s is entided to one vote per . The company declares and pays divdend in Indiar Rupees. The dividend ProPosed by the Board of Dilecto! is subject to the approval of the holders in the ensuing Armual General Meeting. In the event of Liquidation of the company, the holder6 of equity s will be entitled to receive remaining assets of the company, aJter dishibution of all preferential amounts. The distribution will be in proportion to the number of equity s held by the holders 6,565,795 6,382,073.00 2,ss2333 't,346,129.01.) 9,118,123.26 5,035,943.99 13,381,531.00 74,702,588.00 ,f,r,,fr tuk, 75,667,676.00

- 7. UNSECURED From Dfuectors, Friends & relatives 38,485,526.00 35,181,322.00 67,534,673.00 56,679,235.00 DEFERRED TAX LIABILITY Defeffed Tax Liability Defered Tax Assets Deferred Tax Assets (Net) LONG TERM PROVISIONS Provision for Employee Bene6ts Provision for lncooe Tax 1,375,408.42 1,365,514.00 1.,375,408.42 1,365,514.00 913,026.86 9'17,026.86 CURRENT LIABILITY 7 SHORT TERM BORROI,!'ING SECURED Cash Credit Facility from banls Sedfted against Wpothecntiotr of all ctu-rellt assets nfid cllarge aoer fxed assets. ; TRADE PAYABLE Trade payable- Due to Micro,Snall & Mediun Enterpdses Trade Payables-Others OTHER CURRENT LIABILITIES Repayment of Term Loan Kotak Mahindra Bank Repayment of Term Loan HDIC Bark Repaynent of Term Loan PNB Anount due to employees Others Current Advance From Customers SHORT-TERM PROVISIONS Provision Ior Expenses Others 20,754,903.00 76,376,586.00 20,754,903.00 1.6,376,586.00 1.4,263,754.00 4,664,696.40 74,263,754.00 4,664,696.40 600,000.00 473,000.00 9 ,359.00 577,531..00 1,99&359.00 577,531.00 4,975,6'10.39 2,42'r ,635 .00 4,975,6'IA 39 2,421 ,635 .00 12 NON CURRENT INVESTMENTS MVRIPPL &MMPPL Conso*ium Advance Non Tmd€ Investments a) Unqloted shares b) Investmenf in Mutual Fund NON CURRENT ASSETS a#

- 8. LONG TERM LOANS AND ADVANCES Deposits Margin Money MVRIPL & MMPPL Consortium Retention IRCON OTHER NON CURRENT ASSETS GIDC toward$ honda land Security Deposits Deposits Govemment Authodties (SaleE Tax Deposit) CURRENT ASSETS INVENTORIES Raw Material Revenue Work In Progiess Finished Goods TRADE RECEIVABLES UNSECURED : Over Six Montl$ -Good Other Debts - Good Doubtful Le6si Provision for Doubtful Debts Debls DIE ffon cotnDa,ties h der lhe sa rc rna neetne|t Debts Due froln directors or other offrcers of the colnvahu CASH AND CASH EOUIVALENTS Cash in hand and as Imprest Balances with banks : in Curent Accourts in Dividend Accounts in Deposit Accounts SHORT TERM LOANS AND ADVANCES Duties & Taxes Advance given to Suppliers Prepaid Expenses Balance with Govemment Authorities Other Loans & Advances Acctued interest OTHER CURRENT ASSEiS 515,658.00 579,932.00 2500,000.00 12850,000.00 2,932,201 .00 2,872,957 .00 1,089,309.00 3,545,771.00 4,634,480 .40 10,942859.00 2't,302,889.00 1,150,885.00 3,71't,462.40 40,543,759.00 6,647,082,00 4'!,694,644.00 70,358,544.00 41,694,644.00 10,358,544.00 157,099.00 225,478.00 4,814,590.00 245,176.28 816,878.00 313,302.00 5,7y7,767 .00 7,375,356.28 4,934,577 .00 459,000.00 z242sA.00 3,043,508.00 '148,625.00 168,539.00 4,554,465.00 34s98.00 70,828,294.00 4,757 ,602.00

- 9. Advances to Creditors for Expenses Notes To Accounts Particulars REVENUE FROM OPERATIONS Sales of Products Sale oI Services Oiher Operating Revenue Less : Excise Duby Net Sales 21 OTHER INCOME Tlansportation Charges ( Own Vehicle) Discount Interest Miscellaneous Income HiIe Charges Received 2't,582,082.00 14,577,448.00 149,40s,485.00 9,290,966.00 '170,987,567.00 23,848,014.40 ---1?6,r8?,so.oo 23,8oeo14D 3,'t95,666.40 920,475.40 269,515.00 15,791.00 827,169.40 7,484.40 ?92,638.00 14,940.00 4,401,447.00 1,142,231. .00 : CHANGES IN INVENTORIES OF FINISHED GOODS WORK. IN-PROGRESS AND STOCK-IN-TRADE Stock at close - Process & By Ptoduct Stock at close - Finished Stock at conmencement - Process Stock atcommencement - Finished (Increase) / Decrease in Stocks COST OF MATERIAL CONSUMED Opening Stock Add : Raw Material Purchased Less : Closing Stock Raw Material Consumpation OPERATING EXPENSES Contract WI,P Contlact Charges Siie Expenses Consumables Puchases Freight & Coolie Elechicity Charges Cenerator Running & Maintenance Machinery Repairs & Maintenance Factory Repairs & Maintenance 2,872,956.04 24,722,956.00 't,990,034.62 (10,290,7ss.00) (18,732,921,.38 579,932.40 38,750.00 6,1,680,783.00'12,727,532.40 515,658.00 s79,932.00 64,745,057.00 12186,350.00 64,745,057.00 !2186350.00 2s00,000.00 2,932,2U.04 12850,000.00 2,872,956.40 10,432,201 .04 12850,000.00 20,722,956.00 1 ,990,A34.62 17 ,507 ,573.00 1,304,529.00 2,365,409 ,00 376,034.00 7,347 ,990.04 99,510.00 '1,440,937.00 10,953,173.00 8,015.00 31,499.00 55,940.00 423,405.00 4,930.00 60,611.00 2,443,521 .00

- 10. Wages Testing Chatges Site Rent Other Factory Expenses EMPLOYEE BENEFITS EXPENSES Salary Wages Bonus etc Staff Welfare Expenses OTHER EXPENSES Audito$ Remuneration - As Auditols Advertisement Expenses Accowrtant Charges Medical Expenses Discount Allowed Office electricity expenses Donations Ceneral Office Expenses Newspapers & Pedodicals Office Cleaning & Maintainance Postage & Courier Pehol & Diesel Membership and Subscription Printing & Stationery morcSsronal unarges Telephone Expen6es Travelling Expenses Fees & Fines Rent, Raies-& Taxes Renewal Charges loading & Unloading Charges Repairs and Maintenance of Vehicle Miscell,fr reous Expenses Insuftnce Tender Charges WCT paid Round Off Balance Written Off Security Expenses FINANCE COST Interest Expense & Ba.nk Charges Other lnterest 33,474,895.00 5,055.00 7,740,690.00 84,752.00 7,940,430.00 5,418.00 7 ,483,096.00 't75,384.00 1,945,848.00 100,000.00 38,565.00 120,000.00 27,53L.00 73,989.00 63,300.00 106,000.00 5186.00 249,348.00 10,558.00 218,070.00 260,982.00 10,951.00 360,774.00 720,457.00 s2005.00 204,697.00 12,323.00 6,060,164.00 7s,so;.00 L0,499,552.00 1,658,480.00 25.00 6,000.00 78,685,377 .00 3,543,688.58 189,496.00 30,872.00 84,000.00 5,859.00 121,501.00 4,642.00 5,452.00 15,262.00 308,826.00 48,000.00 243,225.00 98,651.00 115,641.00 14,450.00 5,509.00 291,958.00 10,364.00 't,478,785.00 2,395.00 152518.00 94,215.00 212,M5.00 5,000.00 6,794,134.00 3,502831.00 38L,957.00 98.00 6,576,097.00 3,502,929.00 f,*--* ffi

- 11. *.'.',* i) The ComPany has made adequale provision for Curent Tax of Rs .2519937/ - (P.Y, 7 124223 / -) under the provisions ol IrEdme Tax Act, 1961. D The ComPany has Provided for the defened tax based on the tax effect of timing differences, which will rcverse in future. The break up is as uader: Particulars Less: Deferred Tax Ass€ts Net Deferred Tax Liabilify 29 Audito$ Remunelation At 31.03.2017 (<) At 31.03.2016 (r) 't,375,408.42 1,365,513 .57 Particulars '1375408.42 For Statutory Audit For Tax Audit Consultang/ Fees 30 Related Pa*ies Ttansacfions i) Related Partv and thelr relationshlo a) Kgv Manaqement personnel L T M Michael 2. CirilMichael 3. Kuttiyamma Michael 31.03.2017{l) 31.03.2016(t) 100,000.00 189,496.00 '100,000.00 189,496.00 b) Assoclated Conce.n 1. Michael & Michael manufacture and contractors pvt ltd 2. Michael & Michael 3. Shreenath Presstressed Pvt Ltd c) Other Related Parties Di.ector Director Director Nature of Relationship Have a common director Properietorship of Relative of a Director Relative of Director a is a Director pv--si I YY! l r 6 . [ {0(til-t9 ,. e# ti I

- 12. o T ! i 3 i T ; t1 5 a ;3<n !< I5 6{ FP rF {=d :d _3 Iq 3 !q 8 9 a a 3 q 6 _3. I q 3 I a 8 I a t 3 a- a q g 3 F d d d i5 6 I 33 d6a6 t?<d ad <tt 5 -l -sln II I ,if lP g!' d: |f Fi ?; IF 3E Ai l; 6T ^-: |e og :a |o +-* < x +i i&1r !: ::: 9q -ib' E B ;€ : i : P d:4< 6 d' JY ;; E:i: c(' i= E;9;F st! c+aE 6 6 ti { q Eq 9 F 9q cc 6 ::z ? !E' T F9 + :t ! 4e3 ?zc P6. E 3? r -it * 6id X6- 6 4> drz q 1 & z zi ="0 iie; eifiil ii€gIa€5*ri i€tig?Esi' s* ui gt;;; zf +<i n; a2 9T a5 !6! 5 A 9 6' g d 6 6 E 6 { 6 2 -t.? '*F Eo' se, I: N;j:{ lii.bbof r ^q 3r* n 4 q'€l 9 5 Eo; tq_-- roF,'r id s60- a@_ 'ttct =<) - m -F =C) - mf- P! m .D IJ q ct V 3LE tt = I tt. 6

- 13. nz N; - a I ts lz l>F ->:ln : IE n 7 o 2 r H t; !, b F F i B : 9 + 99 s bq sr N J !, b. d (! 9 ! !_ >1 E N F :r i- : J: s' N c F 5 I I N d B a :l H 1., F d - d s : >r B 5 E s ; F F tr i.J 9 :r i') t ; !p : q z ! d .a b. d tr P B u c d i.r :.r 6 nq .TI :'r ? E P P AZ ti< t<j l(/) rn tz: a; (n : ri ll-N ll9 lt: [ ].J il: {llr^ il' [-€. I:J :{ l; -l F o 2 q s s s s : F o : I ry -' :l i3 c O I ; E N v N c E S a E z ! s ffi

- 14. INDIAN INCOME TAX RETURN ACKNOWLEDGEMENT Where the data of the Return of Income in Form ITR-I (SAHAJ), ITR-2, ITR-3, ITR{, ITR{, lTR6,lTR-7 transmitted electronically with digital signaturel Assessment Year 2017-18 F zt <)i >z Yal :!a I aa !.1 i z=' -:--!<El v1 xa Nsme PAN AAECMOS45LMICHAEL d-D YICIIAEL PIPES PRTVATE LII!trTEI) Fhr/Door/Blocl o Name Of Premises/Building/Village Form No, which has been electronically transmitted 3R.D FLOOR CARIX)ZA BLITLDING R..d/Str..ntd Oft. A rer/Loc! lity PATTO Pvt Comoanv STATUS T.rrrcity/Dittri.a State PinZipCode Aadbaar Number/Enrollment ID PANAJI GOA 403001 Designation of AO(ward/Circle) ryI Original or Revised ORIGr|iAL_l E-fi ling Acknowledgement Number 29566420t011117 Date(DD/MM,ryYYY) 0j-tt:2017 9< v= Zt- >^ =zo- I Gross total incooe 1 81231 14 2 Dedudiotrs uadq Chapter-Vl-A 2 0 3 Tota! Income 3 81231r0 JA Cur.ent Ycar loss, ifany ,, 3a 0 4 Net tax peyable iy^>$4tfiK>-/ 4 2426381 5 lnterest payable -td[e !(3?p*V/,/ 5 0 6 Total tax and int€rest payable 6 2426381 1 Taxes Paid a Advance Ta- 7a 0 b TDS 7b 29306s6 c TCS 7a 29500 d SelfAssessment Tax 7d 0 e Totrl Taxes Paid (7 ^+1*1c +1d) 2960156 t Ta Pr5r&le (67e) 8 0 9 Retund (7e-6) 9 533780 l0 Exempt Income Agriculture l0 Others This retum has been digitally signed by T M MTCHA€L in the capacity of DIRECTOR having PAN AE?M3497F from Ip Addrcss 59.95.14.65 on 07-ll-2017 at PANJIM . I l0l9863CN--e-M udhra Sub CA for Class 2 Individual z0l4,Ou=Certifying Authority,O=€Mudhra Consum€r Services Limited,C=tN DSC 5l NO & lssuer

- 15. FORM NO. 3CA lsee ruls 6G(lXa)l Audit report under lectio! 44AB of the locoEFter Act' 196l io a cls€ where the rccouots of thc bEsilcst or pFofe$ioD ofs pcrson h've b€eE 'udited ulder rDJ otler hw l.l rE on dgt rh. sraruoq audir of }ITCHAEL AD }{ICHAEL PIPFS PRfV'ATI LLVITEI) 3RD Flr(X)R- CrRIX)ZI B t'n-Dtlc- TATTO- - TNAJL GOA {3tt A .ECttI45L *&s cooducted by Ur S GAILxDRABABI in p.rsrame of fu For rsiors of rhc c{}vrf,}' AcT Ac1 ard I .nn€x lErE to a cop) of llt audit rEpod d.r.d a5/t2tl7 ehqg $irh ! cs! dh of (.) tu rdn d ft{ d b d fc 6c prrbO bcgr!trDg frorD alirsrr' ro 'odllg 6 lriyl.r? O)rhc rdncdbrbtuc1 .cU[U: d (c) dcrm drrd by 6e 5.i, db b.Frof,.aaqcd rc,6c ftrldbc rdb.b tH- 2- Tbc srrl.rEat of rti(.uhrs rlquittd ro bc firdsh.d rrcrr scsim ,l{AB rs dEGd b.rsrvfuh id F6B No. 3CD. 3. h !g opinion and ro drc best of Ml informrrion and sordiog to examioation ofbooks ofaccount including other relevan! documens ind explanations given to lle the paniculars given in the said Form No, 3CD and the Annexure therelo arc lrue and correct subject to the following observations/qualifications, ifany. Where anv ofthe requirement in the Form is answered in the Negative or with qualification, give reasons therefor FRN (Firm Registratiotr Numb€r) Address I CREDTTORS. LOANS AND ADVANCES NOT PRODUCED BEFORE U . S THESE IFO. ARE SUBJECT TO CONFIRMA

- 16. FORM NO.3CD [See rule 6G(2)] statement ofparticurars required to be furnished under section 44AB of the Income-tax Act. l96r Name of the assessee MICHAEL AND MICHAEL PIP-STRIVATE LMITED 2 Address 3RD FLOOR, CARDOZA BUILDING,, P,{ITo;TTNAJI.IO A, 40300r 3 Permanent Account Number (PAN ) AAECM0845L 4 Whether the assessee is liable to pay indirect tax Iike eyoise duty, service tax, sales tax, customs duty,etc. if yes, please furnish the registration number or any other identification number allotted for the same Yes 5 6 1 B No. SI Type Registration Numbii- Sales VAT/Tax GOA Status Assessment Year I SI No. Relevant clause of section 44AB under which the audit has beenioffi- Lraus€ 44Ar'(A)- | oral sales/nrnover/gross receipts in business exceeding Rs. I crofe 9 a lft.irmorAssociationofPersons,indicatenamesof@ ofAOP, whether shares ofmembers are indete.minate or unknown ? ).NO. Name tPEfriSEr (% Cc R"tio 9 b lf there is any change in the partners or memb preceding year, the particulars ofsuch change. S. No. Date ofchange Name of Partner/ Member 'lype of change Old profit shanng ratio New profit Sharing Ratio Remarks l0 a NatureofbusineSsorprofession(jfmoIethanonebusines ofevery business or profession). S.No. 'eClof Sub Secior Code I Manufdctudng Industry Others 0124 t0 b Ifthere isanychange in thenarure ofbusine@ No S.No. I Business lSector SubSector Code a I wh",h"J_book. of u."oun,. u." pt.r".ib"d un@ Yes S.No. Books prescribed sate and Purchase Register. Cash and Bank book. Ledger. GeneraiTiEEiiiiE-Jin-iiilfi?Eii ll b L|stofbooksofaccountmaintainedandtheaddressatwtr are maintained in a computer system, mention the books ofaccount generated by such computer system. lf the books of accounts are l,lot kept at one location, please furnish the addresses oflocations along with the detaili ofbooks ofaccounts maintained at each location.) Same as I l(a) above S.No. Books maintained Address Line I Address Line 2 City or Town or District State PinCode Sale and Purchrse Re gister, Cash and Ban k book, Ledger, cen eral Ledger and Jour nal Ledger 3RD FLOOR, CARD OZA BUILDING,, PA TTO panaji GOA 403001 ll c Lrst ofbooks ofaccount and nature ofreleuant documents examined. Si66iJ-iT@fi66G JS.No. I Books Examined 12 wnellrer the proht and loss account includes any profits and gains assessable on presurnptive tasGliflesliiiicarc- the amount and the relevant section (44AD,44ADA,'44AE,44AF,448,44BB, 44BBA, 44BBB, chapter xll-G, First Schedule or any other relevant sechon). No S.No. lSection Amount l3 a Merhod of accounting emp@ l3 b whethe.therehasbeenanychangeinthemetlrodofaccounffi the immediately preceding previous year. No

- 17. ans'er lo an adjusrmenl rs ::alir.1e compuuttion and disclosure s|andards nolified under section 3i.srer !o (dlabo!e is in the such lo be maoe !o or ve, gr e provtslons il : lne seclion I :-a.a arLaIi: Lar lOiS. t-umish: a P3.:::.'ihls e '-le lor credits. ofcusloms or or serylce lax, or tal(. * here such credits. drawbacks or refund are admitted as due the authorities concemed property Line 2 as per lhe In! ome-|ax l96l respecl asset or assets, as asser convened inlo which the asset is converted into stock-in trade -o r3r Descriplion ofcapiul asset scope of seclion l8 authority of a State Govemment refered to in section 43CA or 50C, Down Value at the end of the year (A +B-C-D)1+2+3+4 Value (l)

- 18. Amounts le as per the provisions of the Income-tax Act, 196l and also fulfils the conditions, if any specified under the relevant l4provisions of lncome-tax Act, l96l or Income-tax Rules,1962 or any other guidelines, circular, etc., issued in this behalf. sum naid to an emplovee as bonrrs or to him as profits or dividend. [Section 36( lXii)] (i) as ) Details of on which tax is not (B) Details ofpayment on which tax year or in the subsequent year before the expiry of time prescribed under section200(l) sub- section (l) ofsection 139. oI L tame Town District payment lof payment the payee lthe

- 19. rB, D(:Jr.i oip:rmcl.l on hlch le" ha rir.- e.rron r I i of section Ll9. n. PA '1 il:ili" I I : :: : : dLrcred bLLr has not been pald on or Dcr drte sDecitled In .,-. u3ie ol l3 manl -mouru ature ame of ]PAN oi ;:r-.", ::,.-, li-:", Liil".",', avaliable Address Line I Address Line 2 City or Town or Distfrct Pincode AmoLlnt of levy oeouc!ec Amounl oLll of (VI. deposited, il any :n a nnn rl-tllenl T e!c. iii) ffimcln! of Nane oi !l1e IPA ;:ir.i:.: J3)men! Palje 'the PaYe ar aliable Address Line 2 City Pincode ::: !u (rl la (c) Am( .113-r.- {r ) ,.;,r l" 'hnlnvpr f^r nprdrrrsrleq lln( ler sub aiause ( ) @ng.intetest.salar1,bouus.commissionor l0lh)/40f hr') and comnutation thereoi S.No. *-*"1.-l* olurr ci.trireO lemounl Am( /L tuC Admissible Llnad )unl missible Remafks (d) Disalloance deemed lncome undef sec rA' Oa tlle bas,s of the ecmlniltlon o ep.-ndilure coered under section 40A(i ^- "--,r',n' nar>: hrnk dmfi Ifnol nlea accouni te ) .ead lth rule 6DD vere made by account payee e t'umish lhe delails: cheqr lence, whether the re drawn on a bank Yes S.o. Date Oi Pa) menl Nar,rre Oi Amounl in Rs ame ot the payee Payment I Pennanent Account Number oi the payee. if available cuments/evidence' whether lhe paymenl referred to in section 40A(3A) read with rule 6DD were made by accounl payee cheque drawn on a bank or accoLrnt payeebankdraftlfnot,pleasefunrishthedetailsofamountdeemedtobetlreprofitsandgainsofbusinessol nrofe(sion under seclion 40A(lA) YCS S.No. Date OfPayment Nature Ol Payment Amount in Rs Name of the payee Permanent Accounl NLrmber of the payee, if available A Pro"Gton fo-r pa),ment of gralurly llot allowable under seclion 40A 1) d bv the assessee at arl employer nol allowable tlnoel s(clloll quA{qr gl PaflrcLrlars of anv liability of a colltLngent tqt,,re , S.No. Nature Of Liabilit Amount in Rs.ry ffin14AinreSpectof|heexpe[ditureincurredinrelatlonto :._::trr-aaate S . .r:rre Oi Liabiiil Amoun! in Rs. iii)tothe 22 and Medium Entetprises Development Act 2006 2l S.N o. Name of Related Person PAN of Related Pelson I Relatrort Nature ot trasaction Payment Made(Amount) 24 @.!,ion J2ACo'. llAB ot S.No. Section lDescription Amount Nil 25 S.No. Na$e ofPersoD Ifr6iililr in.. 'n" lSe.t'o" lDe'clrptiott oil rrnsaction CompLrtaLron rt alry Nil 26 i)- hirespeaGlarl) srm refened ro rn clarr'c I cr. , b). {j1]!Il9):!]9]4 seciion 43B, the liability for hich:' 26 (')A pre;GGa or1 rl;Trst-dt;fnejrevious year but was not allowed in the assessment oi any precedmg prevrous yea and was:- 26 F;i d d-r, ril glhe tA'6u s ),ea rAXa) S.No. Nature of liabilitySection NiI 26 t(ixAXb) Nor paia drnru tle pret 'or,t )€" Amoul1lS.o. Sectron Nalure of liabrlr!)

- 20. any otlrer indirecl lax. levy. cess. imposl. etc.. is passed the profit and loss account.) o. of Shares lAmount Received lconsiderrtion Fair Market value of the shares market value ofthe shares as refened to in section please fumish the details ofthe same ue Aooeo I a or urrseo ouflrg rne prevrous year ::r ::atli i::d 1c.. account and treatlnent of oLllstandi Centfal Value Added Tax Credits in accounts i:''.1: S.No.rame of PA),I of the ame of the treaimenl whether during the previous year the assessee has received any property, being share of a company not being a company in which the public arc substantially interested, without consideration or for inadequate consideration as refened to in section 56(2Xviia) the person oe6on. from araiiablc $hich shaaes received if c,rmpany from :rich shares i;ael ec CIN ofthe company person, State person '::.: :-. -:::_* :.e :r.t: :1..':igi an aCCOunl ia) ec .:heque.(Seclion 6qD from rvhom consideration aeae: ed ta: issue ofshares a ailable :: . :a :: 3::1r-:l -Ooa:a x3l all h':nd: or anr amount due r,3::le !.i PA of Address .{ddresi City or 'ri :le Line I Line: Town or le-.: ]e-!..- Dist.ict :i,.ir :f n :lan l a::3cle :ti.- -:: :':-i.r al ._::3a::i .-: i-:l' on the amount loan or deposit was taken or accepted cheque or accepted during:-:: t-.::: :ia :=:!ri:s '-5e Iender asah :..3r or deposit in en amounl rerlnan€ Account case loan or depositamount outstanding in the account at any time drLrirlg the Number(if availSble with the assessee) of the lender or the of loan or the loan or or use o electronlc clearing system was taken by cheque or bank draft, whether the same was taken or accepted by an account taken or or bank draft sq during tne l**'''"' or or qePosrror deposiror year

- 21. previorls lthrough a lpayee cheque year I lbank account Jor an account I I ]luY"" bank I I ldraft. 3l b particulan ofeach specified sum ir an amount exceecllng me llmtl specllleo ln sccrturr e!!!Pr!s sq!r!15 tlre nrevious vear:- S.No. Name of lhe person from whom specified received ddress of the person iom whom specified ium is rcceived Permanent Account Number (if available with the assessee) of the person from whom specified sum is received Amount of specified sum laKen or accepted Whether the specified sum was taken or accepted by cheque or bank draft or use of electronic clearing system through a bank accouIIt theln specified sum was taken or accepted by cheque or bank draft, whether the taken accepted Dy an accounl payee cheque account payee bank draft. Nit (Par byu ticul lrstO and-Gt.eed not be given in the case of a Govemment company' a banKlng company or a corpolaLru" *^l cl^r- ^. Dr^t/ih^iol A.r '_"-'-_""_-____ , :: :;ii : ::::::::::; :.:::;:::;i: ii;l;;--.il,.a 31 c Particulars of each repayment of loan or deposll or any speclrreo auvaltuts rrr ax drr!uurrt c^velu'rtE in section 259T made durinq the previous year:- S.N o. Name of the payee Address of the payee Permanentl Accounl Number(if available with the assessee)o the payee Amoun of the repayn Maximum amou[l qrtrstanding in the account at any Dmg during the previous year Whether the repayment was made by cheque or bank draft or use of glectronic system through a bank account. ln case the repayment was made by cheqrLe or bank draft, whether the same was taken or accepted by an account payee cheque or an account payeg bank draft. Nil 3l d ulars ofrepavment ofloan or deposlt or any spealneo aovance m an alltouln E^uEsuxrE rxe rrrrrr! lPwwrr!vs ru oweuv! J."luJ i*,e*ir. thdn by a c'heque or bunk druft or.,or" of electronic clearing system through a bank account 1 the fievious year:-ounnj S.No. Name ofthe payer Address ofthe payer Permandnt Account Number (ll available with the assessee)ofthe payer Amount of loan or deposit or any specified advance recelveo otherwise than bY a cheque or bank draft or use of electronic clearing systemthrough a bank account du ng the previous year 3l e i ceeding the limit specified in sectior Z69T received by a cheque oi bank draft which is llot an account payee cheque or account payee bank draft during the orevious vear:- S.N o Name of the payer Address ofthe payer Permanent Account Number (if available with the assessee)ofthe payer Amount of loan or deposit or any specified advance received bY a cheque or bank draft which is not an account payee cheque or account payee bank draft during the previous yeaf. Note: ( taken ( or Pro Particulars at (c), (d) and (e) nee, rr accepted from Govemment, Go ,incial Act) fioit" giuenin the "".e vemment company, bankil of a repayment of arq, Ioan or de lg company or a corporation esta posit or specified advance blished by a Central, State 32 a n the following manner, to extent available

- 22. S.No. Assessment Year Nature of loss/allowance Amount as returned as Amounl assessed Order U/S and Date Remarks Nil 32 b whether a Aa"g"G;Er"hoiai;E;nhe company has taken place in the pr€vious year due to which the losses incuned prior to the previous year cannot be allowed to be carried forward in terms of section 79. No 32 Whether the 'assessee has irrcurred any specr-rlation Ioss referred to in section 73 during the previous year. No Ifyes, please furnish tbe details below 32 o Whether the assesrsee has incuned any loss refened to in section 73A in respect of any specified business during rhe previous year No Ifyes, please lurnish details of the same 32 e m case ofi co-p".ty-,ph"s" state that wl]ethe. the company is deemed to be carrying on a speculation business as referred in erplanation lo section tl - lfyes, please furnish the details ofspeculation loss ilany incurred during the previous year 33 pter vrA or c!l1E!!41! l€99!!Llq!El!llq!!) No S.No Nfl ffi 34 a W6etffiT;;G;seels required 6 deduct or collect tax as per the provisions of Chapter XVIt-B or Chapter XVll-BB, ifyes please turriish No S.No. axT deduction and collection ACCOUn! Number (TAN) Section Natue ot paymenr Total amount of payment of receipt of the natufe specified in column (3) Total amount on tax was which be requlred to deducted or collected out of (4) Total amount on which tax was deducted or collected at specified rate out of (5) Amount of tax deducted or collected out of (6) Total amount on which tax was deducted or collected at less than specified rate out ol (7) Amount of tax dedrcted or collected on (8) Amount ol tax deducted or collected not deposited credit of the Central Govemmen out of (6) and (8) theto Nil b mffifl}Te-assessee-MifirnishAlie statemenr of tax deducred or tax collected within the prescribed time Ifnot. please fumish the details: Yes S.No. Tax deduction and collection Account Number (TAN) Type ofForm Due date for furnishing Date of furnishing, if tumished Whether the statement of tax deducted or collected contains information about all transactions which are required to be reponed Nil c WGih;r rh-e ass;see is lia-6i; !o pay interest under section 201( lA) or section 206C(7).lf yes, please fumish No S.No Tax deduction and collection Account Number (TAN) Amount of rnterest under section 201(lA)/206C(7) is payable Amount Dates ofpayment Nil 35 a @tative details of prinicipal items ofgoods traded S.No Item Name opening stock Purchas. es during the previour year Sales ouflng the previolls year Closing stock Shortage, excess, ifany Nit 35 b Lllhe case-offi111611;6tudng9 oncem, give quantitative details of the principal items of raw materials, tinished products and by-producrs .- 35 bA Raw materials : S.No. Item Name Unit Openln stock Purchases dLlring the prevrous year LOnSUmpll- on cluflng the previous year Sales during the previoui year Lloslng stocK _ Y lelo of finished prooucr! age of yield excess, ifany

- 23. 3. ::-t--_:s rngP sloai.. drr lng tbe manLr fac tu r prevlous year t:i lou 5 ear ed during rhe rs3iler ltem value anl )es, any, as may be prevlous year Acl. 1 eement on an) by rhe auditor an! cost i res. eire the pro Tuftover )IOIK-ln- Trade rr any, oa disa8:reemenl on any ' as may be ed identified b the cos! auditor Tumover Place Date Panaji 01tr'/20u Name Membership Number FRN (Firm Registratiou NLtmber) the case ofa domeslic company. cletalls ol tax on ;.llitTotal "mounillE; Amount ofltct Amounr ol](d) lolal tax of dist buted lreductioll as lreducliorr as lthereon profits ]referred to in rclerred lo in sectiol] 1 .5- seetion o(lAXi) o{ I -A.xii) of the pin'otrce act, tg94 in relaliotl to valuation of taxable services as may be reported/identified by the auditor yes, give the details, if any, of disqualltlcatlon or dlsagreemenl on any as may be reported./identified by the audltor the previous year under any tax laws other tax Act, l96l and wealth tax Act, 195? alongwith delails ofrelevant

- 24. Address 501 sth floor B Wing Suntek Kanaka. Opp : KTC Bus stand. Panajl. GOA.403001.