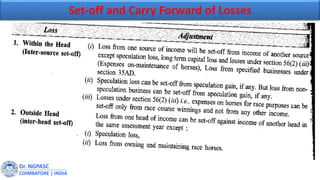

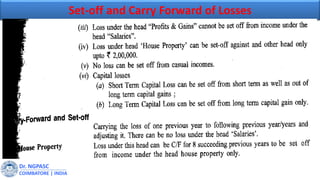

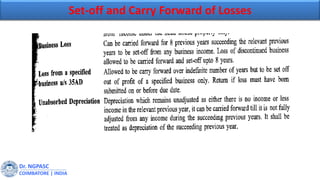

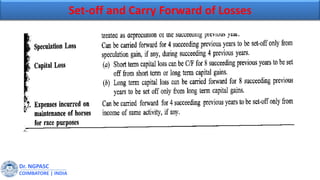

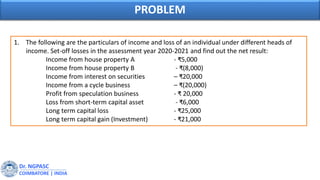

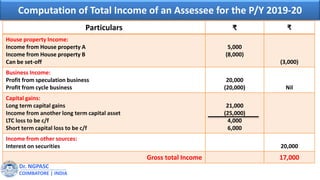

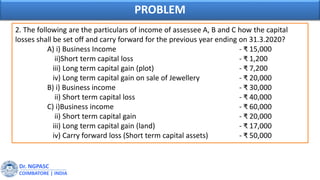

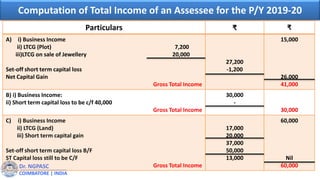

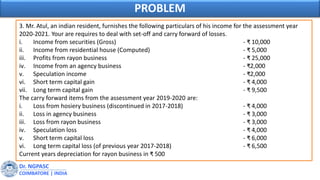

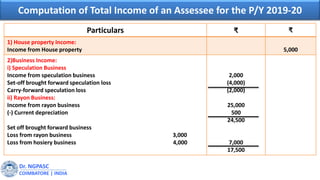

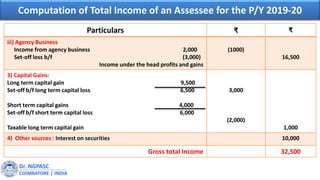

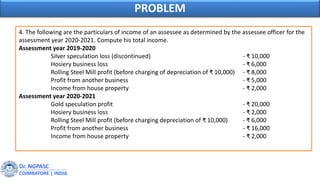

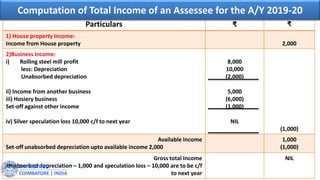

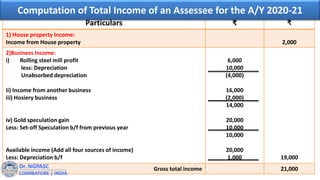

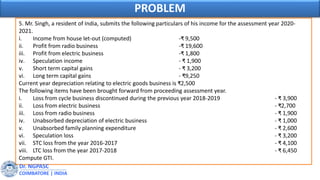

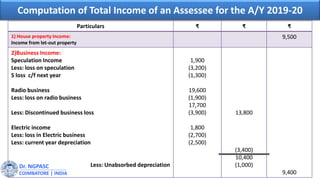

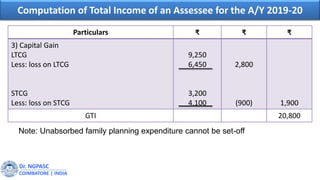

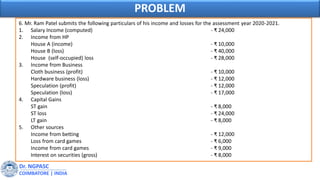

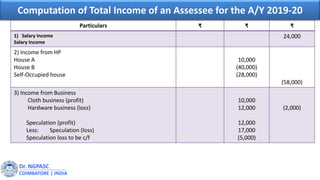

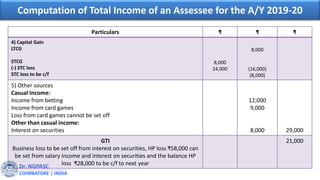

The document discusses set-off and carry forward of losses under the Indian Income Tax Act. It provides examples of computing total income for various assessees by setting off current year losses against income under the same head and carrying forward unabsorbed losses. It also illustrates how to set-off capital losses against capital gains and carry forward the unabsorbed losses. The document contains computational examples showing the set-off of losses from previous years against current year income under the same head and the calculation of gross total income.