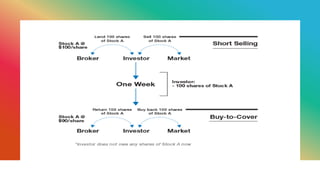

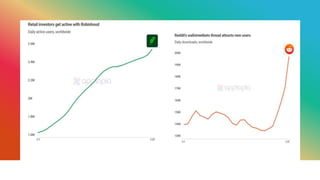

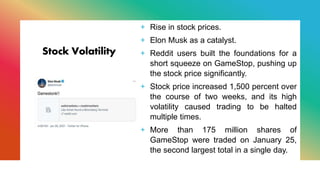

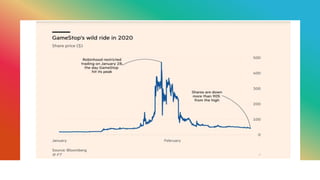

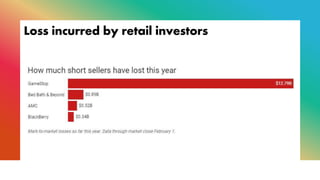

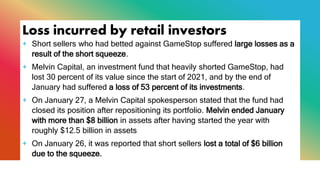

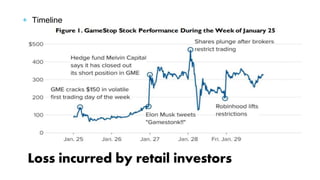

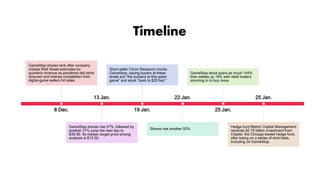

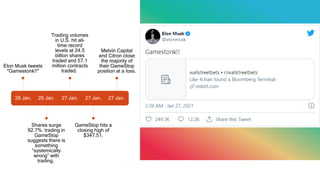

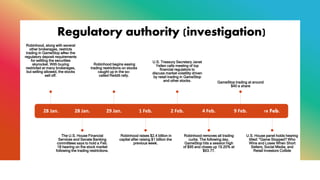

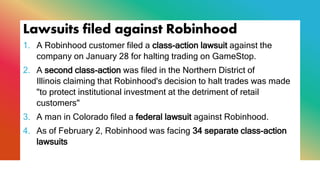

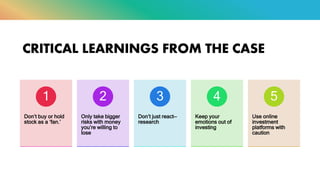

Retail investors on the subreddit r/WallStreetBets coordinated to drive up the price of GameStop stock in January 2021, squeezing hedge funds that had heavily shorted the stock. This led to huge volatility, with GameStop shares rising over 1,500% in two weeks. However, the trading app Robinhood then restricted buying of GameStop and other meme stocks, sparking backlash. Many hedge funds suffered major losses on their GameStop short positions, including Melvin Capital which lost 53% in January. The saga highlighted the power of retail investors to influence markets and sparked regulatory interest.