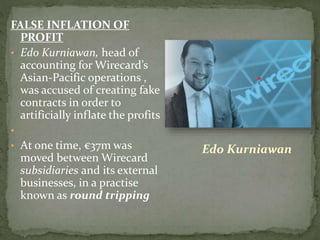

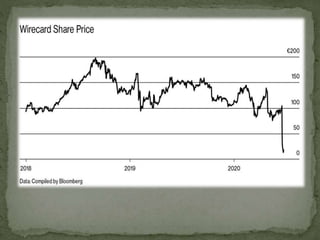

Marcus Braun founded Wirecard in 1999, growing it into a large German payments company. However, in 2020 it collapsed after an accounting scandal where it was revealed that €1.9 billion of cash that was supposed to be held in trust accounts likely did not exist. The company had a history of opaque accounting practices, acquisitions with inflated prices, and accusations of artificially inflating profits. Several red flags were raised over the years but Wirecard's auditor EY and German regulators failed to properly investigate, leading to Germany launching an inquiry into the failures to prevent the large scale fraud.