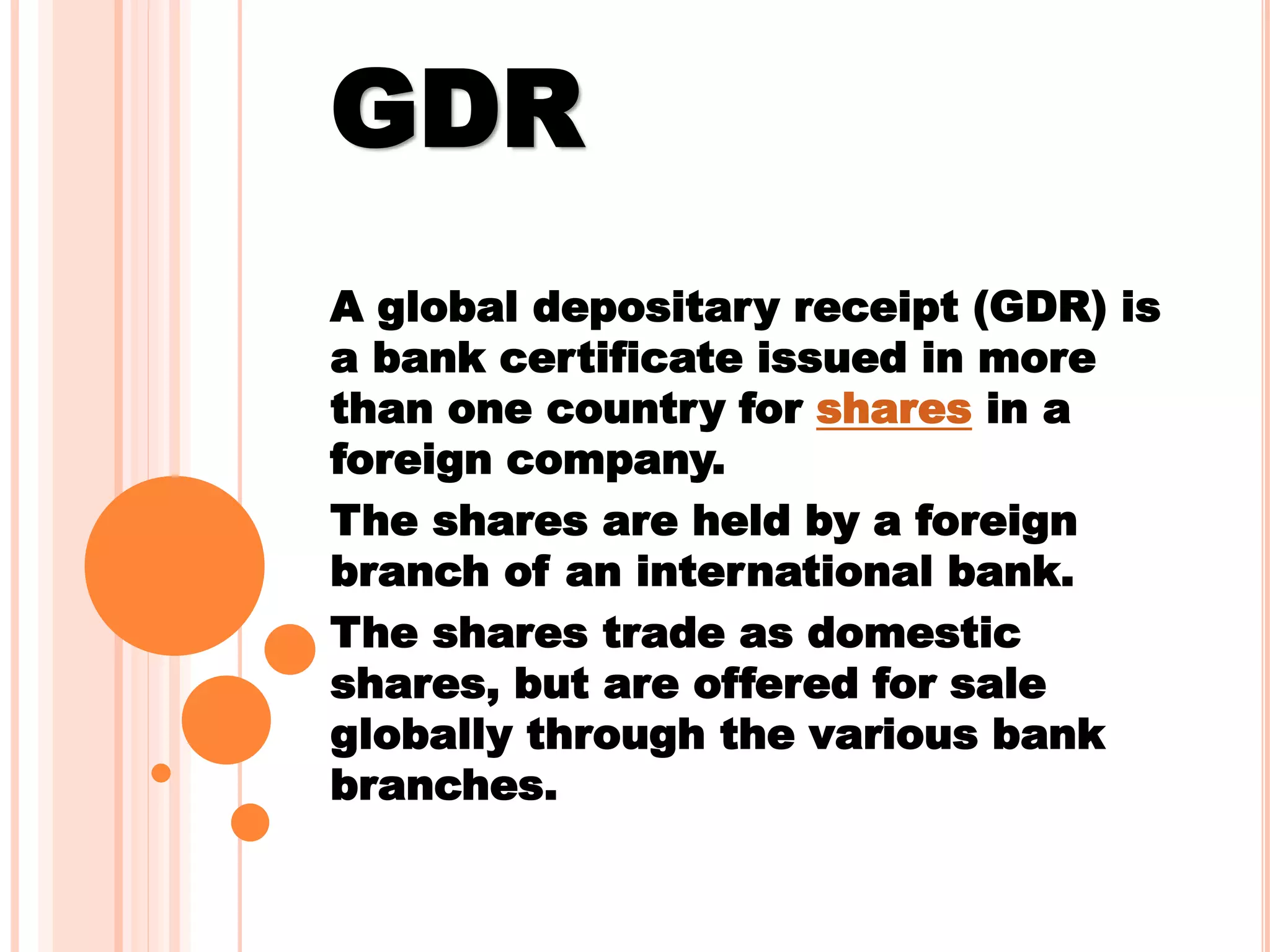

This document discusses various sources of finance for businesses, including both domestic and international options. It covers topics such as leasing, venture capital, factoring, loans from institutions like the Export-Import Bank of India, and forms of debt financing like hire purchase. International sources of finance discussed include foreign direct investment (FDI), investments from foreign institutional investors (FII), and methods of raising capital abroad through vehicles like American depositary receipts (ADR) and global depositary receipts (GDR).