Guidelines hss

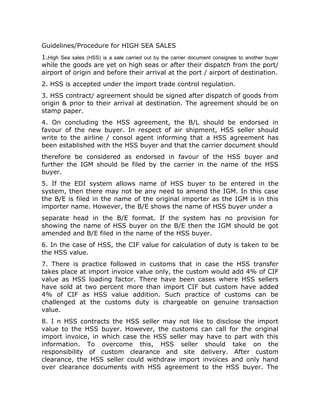

- 1. Guidelines/Procedure for HIGH SEA SALES 1.High Sea sales (HSS) is a sale carried out by the carrier document consignee to another buyer while the goods are yet on high seas or after their dispatch from the port/ airport of origin and before their arrival at the port / airport of destination. 2. HSS is accepted under the import trade control regulation. 3. HSS contract/ agreement should be signed after dispatch of goods from origin & prior to their arrival at destination. The agreement should be on stamp paper. 4. On concluding the HSS agreement, the B/L should be endorsed in favour of the new buyer. In respect of air shipment, HSS seller should write to the airline / consol agent informing that a HSS agreement has been established with the HSS buyer and that the carrier document should therefore be considered as endorsed in favour of the HSS buyer and further the IGM should be filed by the carrier in the name of the HSS buyer. 5. If the EDI system allows name of HSS buyer to be entered in the system, then there may not be any need to amend the IGM. In this case the B/E is filed in the name of the original importer as the IGM is in this importer name. However, the B/E shows the name of HSS buyer under a separate head in the B/E format. If the system has no provision for showing the name of HSS buyer on the B/E then the IGM should be got amended and B/E filed in the name of the HSS buyer. 6. In the case of HSS, the CIF value for calculation of duty is taken to be the HSS value. 7. There is practice followed in customs that in case the HSS transfer takes place at import invoice value only, the custom would add 4% of CIF value as HSS loading factor. There have been cases where HSS sellers have sold at two percent more than import CIF but custom have added 4% of CIF as HSS value addition. Such practice of customs can be challenged at the customs duty is chargeable on genuine transaction value. 8. I n HSS contracts the HSS seller may not like to disclose the import value to the HSS buyer. However, the customs can call for the original import invoice, in which case the HSS seller may have to part with this information. To overcome this, HSS seller should take on the responsibility of custom clearance and site delivery. After custom clearance, the HSS seller could withdraw import invoices and only hand over clearance documents with HSS agreement to the HSS buyer. The

- 2. custom bill of entry does not indicate original import value and is prepared on HSS value. 9. There is no bar on same goods being sold more than once on high seas. In such cases, the last HSS value is taken by customs for purposes of duty levying. The last HSS agreement should give indication of previous title transfers. The last HSS buyer should also obtain copies of previous HSS agreement as such documents may be called upon by the customs. 10. HSS is considered as a sale carried out outside the territorial jurisdiction of India. Accordingly, no sales tax is levied in respect of HSS. The customs documents (B/E) is either filed in the name of HSS buyer or such B/E has an endorsement indicating HSS buyer's name. 11. The title of goods transfers to HSS buyer prior to entry of goods in territorial jurisdiction of India. The delivery from customs is therefore on account of HSS buyer. The CENVAT credit in respect of CVD paid on import is entitled to HSS buyer. 12. HSS goods are entitled to classification, rates of duty and all notification benefits as would be applicable to similar import goods on normal sale. 13. HSS is also applicable to goods imported by air. Sea appearing in HSS should not be constructed by its grammatical meaning. As long as the sale is formalized after dispatch from airport / port of origin and before arrival at the first port of discharge / airport at destination, such sale is considered as HSS. 14. Sometime HSS buyers buy goods after their arrival. Such sale will not be treated as HSS. The stamp paper on which the HSS agreement is executed must not bear the stamp paper purchase date as being post cargo arrival date. Such a case can easily be detected by customs as being a post arrival sale. 15. If the HSS does not mind disclosing original import values to HSS buyer, in such case it is better from custom clearance point of view for the seller to endorse the B/L, invoice , packing list in favour of the HSS buyer. The endorsement should read "Transferred on High Sea Sales basis to M/S -------- for a sales consideration of Rupees --------". Such endorsement should be stamped and signed by the HSS seller. HSS sale is effected through an agreement of sale between the original importer and the HSS buyer , on Rs. 100/- stamp paper, any time after shipment of the goods (B/L date) and the arrival of the goods in India (IGM date). This agreement needs to be produced along with import

- 3. documents at the time of filing of Bill of Entry. Customs, during scrutiny of the documents submitted, can ascertain the date of sale from the date of purchase of the stamp paper.The Bill of entry will be filed in the name of the HSS buyer who will be responsible for clearance of the goods including payment of duty and thereby become the importer for the purpose of passing on the CVD benefit if the HSS buyer decideds to sell these goods after clearance. The benefits of this type of sale is that the original buyer can trade more goods with less investment as they are not to bear the customs duty, clearance, warehousing and transport cost. Further since this sales were completed before its arrival in India, VAT/CST is not applicable. Further the HSS buyer can get the goods immediately if they had missed on the booking of these goods with the overseas supplier. Its a win-win condition. The only requirement is that both original importer as well as the HSS buyer should be eligible to import the goods in question as per the preveiling Export/ Import Policy. Import of goods into theterritoryofIndia, and export of goods outside theterritoryofIndiaare exempt from sales tax under the Karnataka Sales Tax Act, 1957 as well as the Central Sales Tax Act 1956. The issues relating to direct import and direct export do not pose any problem in the field of sales tax levy, since direct import is a single transaction of the goods entering into theterritoryofIndiaand direct export is the sending of goods to other countries outsideIndia. However, transactions of import or export, more often than not take place through import and export agents. It is often the import of goods through another importer or export through another exporter hat pose problems, since the transaction of sale to an exporter and then export by the said exporter are two different transactions, similarly the transaction of import and sale to the ultimate buyer are two different transactions. In order to facilitate the importers as well as exporters who import or export through a third party importer or exporter, Central Sales Tax Act, 1956, has made provisions to exempt second and subsequent imports as well exports with certain conditions attached thereto The transactions of second and subsequent import done through transfer of documents of title to goods before the goods cross the customs station are deemed imports and are exempt.

- 4. Sale preceding an export is deemed export and is exempt. HIGH SEA SALES Imports through transfer of documents of title to goods before the goods cross the customs Frontier of India are popularly known as HighSeasales. The controversy regarding when the goods cross the Customs Frontier of India as been resolved by the amendment to definition Customs Frontier of India – by clarifying that, goods are deemed to be in the import stream until the goods are cleared from the Customs station – the goods are cleared from the Customs station, when the Bill of entry is made – i.e. when the Customs duty is paid. Even after the amendment clarifying and making it easier to decipher when the goods are said to be in the import stream so as to enable the importer to transfer the same by transfer the documents of title to goods – i.e. without taking delivery of the goods-there are disputes regarding this issue. Factors that need to be taken in account to decide whether the goods are still in the import stream and before which the documents of title to goods should be transferred is dealt with by the two high court decisions. The ratio of the said decisions is extracted below, which can be a guide to high sea sales: M & M. T. Corpn of India Ltd. vs. State of A.P 110 STC 394(AP) Under the explanation, the customs station and customs authorities have the same meaning as in the Customs airport, or land customs stations. Customs port means any port appointed Under Section 7 (a) and includes a place appointed under clause (aa) of that section to be an inland container report. Customs airport means any place appointed Under Section 7 (b). A reading of section 2 (ab) makes it clear that if the goods crosses the area of the customs station, viz., the customs port which is noticed Under Section 7 of the Act, where the goods are kept before clearance and if the transfer is effected by transfer of documents of title then if amount to sale in the course of import. In other words if the goods are kept in the port before clearance crossing the limits of that port amounts to sale in the course of import.

- 5. “We have already referred to Section 5 (2), read with Section 2 (ab). The goods will cross the limit of the area of the customs station only on clearance by the customs authorities. Clearance by the customs authorities will be after filing the bill of entry and after the assessment of duty Under Section 28 of the Act. Before the assessment of the duty the goods kept in the customs port cannot cross the limits of the customs port. Therefore irrespective of the fact whether duty is paid or not, when once the bill of entry is filed and the imported duty is assessed, then only the goods can cross the limits of the customs port, therefore, any transfer of documents of title before the clearance of the goods by the customs authorities on making the assessment of goods would amount to a sale in the course of import, as after the assessment is made and on filing of the bill of entry the goods get mingled with the general mass of goods and merchandise of the country, the goods get the eligibility to be declared as local goods after clearance even though they are not physically removed from the harbour premises. They attain the character of local goods and cease to be foreign goods. Therefore, the relevant point of time for determining as to whether the sale of goods is in the courts of import by a transfer of title deeds is the transfer by title deeds before filing the bill of entry and the assessment of duty irrespective of the fact whether the goods are physically cleared from the harbour or not and whether duty is paid or not. As pointed out in the earlier paras after the filing of the bill of entry and the assessment of the duty the import stream dries up and ceases to flow after the Customs Department levies the duty declaring the eligibility of the goods to be cleared and mingles with the general mass of goods and merchandise in the country. Once the duty is levied the import is at an end and the national customs barrier is supposed to have been crossed” S.T. Corporation of India Ltd. vs. State of Tamil Nadu 129 STC 294(Mad)] As held by the Supreme Court in the case of Kiran Spining Mills V. Collector of Customs (1999) 113 ELT 753, which arose under the Additional duty of Excise (Textile and Textile Articles) Ordinance, 1978 the taxable event is the crossing of the customs barrier, and not the date when the goods hand landed in India, or had entered the territorial waters. When goods are imported into India even after the goods are unloaded from the ship and even after the goods are assessed to duty subsequent to the filing of a bill of entry the goods cannot be regarded as having crossed the customs barrier until the duty is paid and the goods are brought out of the limits of the customs station. In the case of Kiran Spinning Mills (1999) 113 ELT 753, the apex Court has observed thus: In other words the taxable event occurs when the customs barrier is crossed.

- 6. In the case of goods which are in the warehouse, the Customs barriers would be crossed when they are sought to be taken out of the customs would be crossed when they are sought to be taken out of the customs and brought to the mass of goods in the country. Until such time as the duty payable on those goods is not paid, the amount of duty payable being determined with determined with reference to the rate at which the duty was levied as on the date of the removal of the goods from the warehouse the goods cannot be regarded as having crossed the customs barrier ofIndia. Section 47 of the Customs Act refers to clearance of goods for home consumption, while section 68 of the Act deals with clearance of warehoused goods for home consumption. In this case, the goods had been warehouse and the clearance for home consumption was made under Section 68, after the title to the goods had been transferred to the buyers. The duty was paid by the buyers. The “clearance” referred to in section 2 (in the interest of Justice and Equity.) of the C.S.T. Act, in the absence of any other compelling factor has to be regarded as having reference to the clearance of goods for home consumption Under Section 47 or the clearance of warehoused goods Under Section 68 of Customs Act. The clearance in this case, clearly was after the transfer of document of title and was not earlier. The crossing of the limits of the customs station tool place after the clearance of the goods from the warehouse for home consumption. The title having assed on to the buyer before such clearance and crossing, the sale effected by the assessee/dealer was clearly one which was in the course of import. The impugned order of the Tribunal upholding the denial of exemption to the dealer in respect of these sales is, therefore, unsustainable and is set aside. The writ petitions are allowed. DEEMED EXPORT The provisions relating to penultimate sales are to be found in Section 5(3) of the Central Sales Tax Act 1956. Importance of exports is well known because of the foreign exchange they generate. We have seen that, direct exports do not attract any sales tax. However, when the goods are sold to an exporter who in turn exports the goods to foreign buyers, the said sale could only qualify to be treated as a sale for export and not in the course of export and prior to 1976, the said sale to

- 7. an exporter were held to be liable for sales tax by the Hon’ble Supreme Court in the case of Mod Sirajuddin v. State of Orissa 36-STC-136(SC) Therefore, in order encourage exports, the penultimate sale or purchase preceding and export are also exempted from sales tax. It may be noted at the outset that, Section 5(3) of the Central Sales Tax Act, 1956, the relevant provision that deals with penultimate sale or purchase preceding an export to be deemed in the course of export. The relevant portion of Section 5 of the Central Sales Tax Act reads as under- (1) A sale or purchase of goods shall be deemed to take place in the course of the export of the goods out of the territory of India only if the sale or purchase either occasions such export or is effected by a transfer of documents of title to the goods after the goods have crossed the customs frontiers of India. ... (3) Notwithstanding anything contained in sub-section (1), the last sale or purchase of any goods preceding the sale or purchase occasioning the export of those goods out of the territory of India shall also be deemed to be in the course of such export, if such last sale or purchase took place after, and was for the purpose of complying with, the agreement or order for or in relation to such export. The scope and ambit of the said Section is no longer res integra. It is well settled by the principles of law laid down by the Hon'ble courts that, in order that, the benefit of Section 5(3) can be taken, the following three conditions have to be fulfilled: (i) The transaction of last sale or purchase takes place after the agreement or order received by the exporter from his foreign buyer. (ii) The last purchase must have taken place after the agreement with the foreign buyer was entered into and (iii) The transaction of such last sale or purchase was entered into for the purpose of complying with the agreement or order received by the exporter from his foreign buyer. In other words, the transaction between the exporter and his foreign buyer must be entered into first and therefore the exporter should enter into the transaction with the penultimate seller or purchaser, as the case may be, with a view of to the full filling his commitment with the foreign buyer.

- 8. (iv) The transaction to be covered by Form H – issued by the buyer to the seller.