TDS Rate for F.Y. 19-20 comparative with F.Y. 18-19 and other regular requirements to be complied by an entity

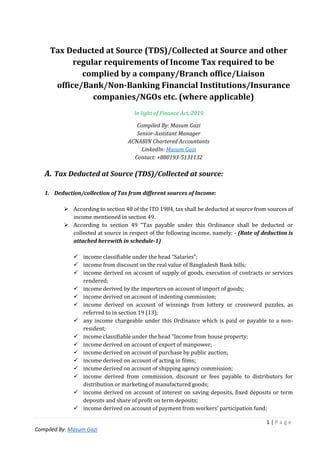

- 1. 1 | P a g e Compiled By: Masum Gazi Tax Deducted at Source (TDS)/Collected at Source and other regular requirements of Income Tax required to be complied by a company/Branch office/Liaison office/Bank/Non-Banking Financial Institutions/Insurance companies/NGOs etc. (where applicable) In light of Finance Act, 2019 Compiled By: Masum Gazi Senior-Assistant Manager ACNABIN Chartered Accountants LinkedIn: Masum Gazi Contact: +880193-5131132 A. Tax Deducted at Source (TDS)/Collected at source: 1. Deduction/collection of Tax from different sources of Income: ➢ According to section 48 of the ITO 1984, tax shall be deducted at source from sources of income mentioned in section 49. ➢ According to section 49 “Tax payable under this Ordinance shall be deducted or collected at source in respect of the following income, namely: - (Rate of deduction is attached herewith in schedule-1) ✓ income classifiable under the head “Salaries”; ✓ income from discount on the real value of Bangladesh Bank bills; ✓ income derived on account of supply of goods, execution of contracts or services rendered; ✓ income derived by the importers on account of import of goods; ✓ income derived on account of indenting commission; ✓ income derived on account of winnings from lottery or crossword puzzles, as referred to in section 19 (13); ✓ any income chargeable under this Ordinance which is paid or payable to a non- resident; ✓ income classifiable under the head “Income from house property; ✓ income derived on account of export of manpower; ✓ income derived on account of purchase by public auction; ✓ income derived on account of acting in films; ✓ income derived on account of shipping agency commission; ✓ income derived from commission, discount or fees payable to distributors for distribution or marketing of manufactured goods; ✓ income derived on account of interest on saving deposits, fixed deposits or term deposits and share of profit on term deposits; ✓ income derived on account of payment from workers’ participation fund;

- 2. 2 | P a g e Compiled By: Masum Gazi ✓ income derived on account of insurance commission; ✓ income classifiable under the head “Capital gains”; ✓ income derived on account of fees for professional or technical services; ✓ income derived on account of manufacture of cigarettes manually without any mechanical aid whatsoever; ✓ income derived from compensation against acquisition of property; ✓ income derived on account of interest on savings instruments; ✓ income derived on account of running of brick field; ✓ income derived on account of services rendered by the doctors; ✓ income derived on account of commission of letter of credit; ✓ income derived on account of survey by a surveyor of general insurance company; ✓ income derived on account of commission, remuneration or charges as a foreign buyer’s agent; ✓ income from dividends. ✓ income derived on account of rendering certain services; ✓ income derived on account of shipping business carried on both inside and outside Bangladesh by a resident assessee. ✓ income derived on account of business of real estate and land developer; ✓ income derived by an exporter on account of export of any commodity; ✓ income derived by a member of a stock exchange on account of transaction of shares, debentures, mutual funds, bonds or securities; ✓ income derived on account of courier business of a non-resident; ✓ income derived on account of export cash subsidy; ✓ on account of renewal of trade license; ✓ income derived on account of freight forward agency commission; ✓ income derived on account of rental power; ✓ income derived on account of interest of Post Office Savings Bank Account; ✓ income derived on account of rental value of vacant land or plant or machinery; ✓ income derived on account of advertisement; ✓ income derived by foreign technician serving in a diamond cutting industry; ✓ income derived from transfer of securities or mutual fund units by sponsor shareholders of a company etc.; ✓ deduction of tax from residents for any income in connection with any service provided to any foreign person; ✓ income derived on account of international gateway service in respect of phone call; ✓ collection of tax from manufacturer of soft drink; ✓ income derived from insurance policy; ✓ deduction of tax from local letter of credit (L/C); ✓ income derived from any fees, revenue sharing, etc. from cellular mobile phone operator; ✓ income from transfer of share of any stock exchange; ✓ income from transfer of share of company listed in any stock exchange; ✓ income derived from lease of property; ✓ deduction of tax from any sum paid by real estate developer to land owner. ✓ 2. Why tax is required to be deducted/collected at source?

- 3. 3 | P a g e Compiled By: Masum Gazi If tax is not deducted at source- ✓ Expense shall not be admissible in respect of which tax thereon has not been deducted in accordance with provision of Chapter VII. [section 30] ✓ Notwithstanding anything contained in section 82C or any loss or profit computed under the head “Income from business or profession”, the amount of disallowances made under section 30 shall be treated separately as “Income from business or profession” and the tax shall be payable thereon at the regular rate. [Section-30B] ✓ For acquiring any asset or constitutes any asset and tax has not been deducted therefrom in accordance with Chapter VII, such payment shall be deemed to be the income of the person responsible for making the payment under this Ordinance and classifiable under the head “Income from other source” in the income year in which the payment was made. [ section-19 (32)] ✓ Where any person fails to deduct or collect tax at source as required, deduct or collect lesser rate or amount or after deducting or collecting fails to pay the same to the credit of the government such person shall be deemed to be an assessee in default. [Section-57 (1)] ✓ The company shall be liable to pay interest @ 2% per month on the amount that was required to deduct including the said amount, calculated for the period from the due date of the deduction or collection to the date of the payment of the amount to the Government Treasury. [Section 57 (2)] ✓ Where an assessee is in default or is deemed to be in default in making payment of tax, the Deputy Commissioner of Taxes may direct that, in addition to the amount of tax in arrears, a sum not exceeding that amount shall be recovered from the assessee by way of penalty. [Section 137] 3. How deducted/collected tax shall be deposited? The person responsible for making deduction or collection of tax under Chapter VII of the Ordinance shall pay the amount of tax so deducted or collected to the credit of the Government- • remitting it through an income tax challan into the Bangladesh Bank or the Sonali Bank; • transferring the amount electronically in the manner as specified by the Board. 4. Which code shall be used to deposit the deducted/collected amount to Government Treasury? Tax deducted by any company defined in section 2 (20) of the Income Tax Ordinance 1984, Co- Operative Society, NGO shall be deposited to the entity’s own tax assessment Zone by using the deposit code against its Taxes Zone name in TR Challan-6. List of treasury deposit code and TR Challan format is attached herewith in Annexure-C & D. 5. When deducted/ collected tax shall be deposited to Government Treasury?

- 4. 4 | P a g e Compiled By: Masum Gazi Income tax deducted/collected at source at the time of making payment to servicer renderer/supplier has to be deposited in the following manner: Sl. Time of deduction or collection Date of payment to the credit of the Government 1. in case of deduction or collection made in any month from July to May of a year within two weeks from the end of the month in which the deduction or collection was made 2. in case of deduction or collection made in any day from the first to the twentieth day of June of a year within seven days from the date in which the deduction or collection was made 3. in case of deduction or collection made in any other dates of the month of June of a year The next following day in which the deduction or collection was made 4. in case of deduction or collection in the last two working days of the month of June of a year on the same day on which the deduction or collection was made B. Other regular requirements: 1. Monthly statement of Tax deduction/collection at source under rule 18 and 21: ➢ Every person who has deducted or collected any tax shall furnish a statement to such income tax authority and in such manner as prescribed in corresponding rule 18 and 21 of the Income Tax Rules, 1984. ➢ A monthly statement, in the proforma as prescribed, of the tax deducted and collected by the entity has to be submitted to the concerned Deputy Commissioner of Taxes of the entity by 20th day of the following month. 2. Requirements for payment of Advance Income Tax: ➢ Advance tax is payable in four equal installments on the 15th day of September, December, March and June of the financial year and an amount computed in the manner as stated in section 65 of the Ordinance. ➢ If any assessee estimates that the tax payable by him is likely to be less than the amount of tax as computed under section 65, he may, after giving the DCT an estimate of the tax payable, pay such estimated amount of advance tax. ➢ If as per the estimation, no advance tax is payable for the said quarter, the assesse need to inform concerned income tax authority accordingly with proper information. 3. Consequences for failure to pay Advance Income Tax:

- 5. 5 | P a g e Compiled By: Masum Gazi ➢ Interest shall be paid under section 73 if the tax so paid (advance tax) falls short from 75% of assessed tax, at the rate of 10% on such shortfall. ➢ Failure to advance tax may involve penalty under section 125 as well depending on will of the concerned Deputy Commissioner of Taxes which is sum not exceeding the amount by which the tax actually paid by him falls short of the amount that should have been paid. 4. Return of Withholding Tax under section 75A: ➢ 1st half-yearly return of withholding tax for the period from 01 July to 31 December is required to be submitted within 31 January of next following and 2nd half yearly return of withholding tax for the period from 01 January to 30 June is required to be submitted within 31 July next following. ➢ However, upon requesting to the concerned Deputy Commissioner of Taxes in proper manner, the last date of submission may be extended up to fifteen days. ➢ Failure to submit the withholding income tax returns may involve penalty under section 124 of the Income Tax Ordinance 1984 which is amounting to 10% of tax imposed on last assessed income or five thousand taka, whichever is higher. 5. Filing of Annual Salary information: ➢ Statements of salary is required to be submitted to the concerned income tax authority under section 108 of the Income Tax Ordinance, 1984 in the format as prescribed within 31 August each year. ➢ Failure to comply may attract penalty under section 124 of the Income Tax Ordinance, 1984 which is amounting to 10% of tax imposed on last assessed income or five thousand taka, whichever is higher. 6. Filing of information of employee’s income tax return submission: ➢ Information regarding filing of return of employees in compliance with section 108A of the Income Tax Ordinance, 1984 in a prescribed form is to be submitted to the concerned income tax authority by 30th day of April of each year. ➢ As per section 30 of ITO, 1984, any payment made by way of salary to an employee for whom the statement under section 108A was not provided shall be disallowed. ➢ Failure to comply may attract penalty under section 124 of the Income Tax Ordinance, 1984 which is amounting to 10% of tax imposed on last assessed income or five thousand taka, whichever is higher. 7. Statement of dividend: ➢ Statements of dividend is required to be submitted to the concerned income tax authority under section 110 of the Income Tax Ordinance, 1984 in the format as prescribed within 31 August each year. ➢ Failure to comply may attract penalty under section 124 of the Income Tax Ordinance, 1984 amounting to five thousand taka, and in the case of a continuing default, a further

- 6. 6 | P a g e Compiled By: Masum Gazi penalty of one thousand taka for every month or fraction thereof during which the default continues. 8. Filing of statement of International Transaction: ➢ As per provision of Section 107EE of the Income Tax Ordinance, 1984, every person who has entered into an international transaction shall furnish, along with the return of income, a statement of international transactions in the form and manner as may be prescribed. This return shall be submitted along with the income tax return. ➢ Where any person fails to comply with the provision of section 107EE of this Ordinance, the Deputy Commissioner of Taxes may impose upon such person a penalty not exceeding two per cent (2%) of the value of each international transaction entered into by such person. 9. Report from an accountant to be furnished for Transfer pricing ➢ As per provision of Section 107F of the Income Tax Ordinance, 1984, every person who has entered into international transactions accumulated value of which exceeds three crore, and if the DCT requires to filing report, it is mandatory to file report from a Chartered Accountant or a Cost Management Accountant. ➢ Where any person fails to furnish a report as required by section 107F of this Ordinance, the Deputy Commissioner of Taxes may impose upon such person a penalty of a sum not exceeding three lakh taka. 10. Filing of Income Tax Return: ➢ "As per provision of Section 75 of Income Tax Ordinance, 1984, person mentioned in there are required to file Income Tax Return for every income year within the Tax Day. ➢ Vide section 75(5) of the Income Tax Ordinance, 1984 every income tax return has to be submitted on or before Tax Day as specified in sub-section 62A of section 2. ➢ In the case of a company, the fifteenth day of the seventh month following the end of the income year or 15th September following the end of the income year where the said fifteenth day falls before 15th September. ➢ However, the DCT may allow an extension of four months (two months by himself and another two-month period with the approval of Inspecting Joint Commissioner) vide section 75(6) of the ITO-1984.

- 7. Schedule-1 In light of F.A. 2019 In light of F.A. 2018 Salaries [section-50(1)] Person responsible for making payment of salary. At the average rate applicable to the estimated total income under the salary head. At the average rate applicable to the estimated total income under the salary head. Salaries (Government) [section 50 (1A)] DDO or who making / signing a bill for Govt Employee. At the average rate applicable to the estimated total income under the salary head. At the average rate applicable to the estimated total income under the salary head. 2 Discount of the real value of Bangladesh Bank Bill (Section-50A) Any person responsible for making such payment. Higher of maximum rate or the rate applicable to such amount Higher of maximum rate or the rate applicable to such amount Deduction shall not be applicable, if it is purchased by an approved superationannuation fund or pension fund or gratuity fund or recognized providend fund or worker's profit perticipation fund 2(b) Payment of remuneration to Member of Parliament (section-50B) Person responsible for making payment. Average of the rates applicable to the estimated total remuneration of the payee. Average of the rates applicable to the estimated total remuneration of the payee. 3 Interest or profit on securities (section- 51) Any person responsible for issuing any security approved by govt. In case of islamic principles @ 5% on upfront basis, in other cases @ 5% of profit at the time of payment or credit whichever is earlier. In case of islamic principles @ 5% on upfront basis, in other cases @ 5% of profit at the time of payment or credit whichever is earlier. This provision shall not apply to the Treasury bond or Treasury bill issued by the Government. Where base amount does not exceed taka 15 lakh-----------2% Where base amount----------does not exceed taka 15 lakh-------2% Where base amount exceeds taka 15 lakh but does not exceed taka 50 lakh-- -------------------------3% exceeds taka 15 lakh but does not exceed taka 25 lakh--------------3% Where base amount exceeds taka 50 lakh but does not exceed taka 1 crore-- -----------------4% exceeds taka 25 lakh but does not exceed taka 1 crore----------4% Where base amount exceeds taka 1 crore------------------5% exceeds taka 1 crore but does not exceed taka 5 crore------------5% exceeds taka 5 crore but does not exceed taka 10 crore--6% exceeds taka 10 crore---7% 1 Changes in light of the Finance Act, 2019 in comparison with the Finance Act, 2018 4 Withholding rate/rates of taxes Remarks Sources of income subject to deduction or collection of tax at source Specified person as mentioned in section 52 (a) execution of a contract, other than a contract for providing or rendering a service mentioned in any other section of Chapter VII; (b) supply of goods; (c) manufacture, process or conversion; (d) printing, packaging or binding; (section-52, rule-16) 82C Provided that – (c) Where any imported goods on which tax has been paid at source u/s 53 is supplied, tax at source on the said supply shall be B-A, where- A= The amount of tax paid u/s 53; B= The amount of tax applicable under this section if no tax were paid u/s 53 d) where any goods on which tax has been paid at source under section 53E is supplied, tax at source on the said supply shall be B-A, where- A = the amount of tax paid under section 53E, B = the amount of tax applicable under this section if no tax were paid under section 53E. Sl. # Head of withholding with section Withholding authority Compiled By: Masum Gazi 7

- 8. Schedule-1 In light of F.A. 2019 In light of F.A. 2018 Withholding rate/rates of taxes RemarksSl. # Head of withholding with section Withholding authority In case of oil supplied by oil marketing companies- (a) Where the payment does not exceed taka 2 lakh-------------- Nil (b) Where the payment exceeds taka 2 lakh--0.60% In case of oil supplied by oil marketing companies- (a) Where the payment does not exceed taka 2 lakh-------------- Nil (b) Where the payment exceeds taka 2 lakh--0.60% In case of oil supplied by dealer or agent (excluding petrol pump station) of oil marketing companies, on any amount-------1% In case of oil supplied by dealer or agent (excluding petrol pump station) of oil marketing companies, on any amount-------1% In case of supply of oil by any company engaged in oil refinery, on any amount- 3% In case of supply of oil by any company engaged in oil refinery, on any amount- 3% In case of company engaged in gas transmission, on any amount--3% In case of company engaged in gas transmission, on any amount------ -- 3% In case of company engaged in gas distribution, on any amount-------- 3% In case of company engaged in gas distribution, on any amount------- - 3% In case of an industrial undertaking engaged in producing cement, iron or iron products except MS Billets---------- ------3% In case of an industrial undertaking engaged in the production of MS Billets--------------0.05% 5 Royalties, franchise, or the fee for using license, brand name, patent, invention, formula, process, method, design, pattern, know-how, copyright, trademark, trade name, literary or musical or artistic composition, survey, study, forecast, estimate, customer list or any other intangibles [section-52A] 82C Any person responsible for making such payment where base amount does not exceed taka 25 lakh-------------------------10% Where base amount exceed taka 25 lakh--------------12% where base amount does not exceed taka 25 lakh----------10% Where base amount exceed taka 25 lakh--------------12% the rate of tax shall be fifty percent (50%) higher if the payee does not have a twelve-digit Taxpayer’s Identification Number. 6 Deduction from the payment of certain services.- (section- 52AA) Advisory or consultancy services are 82C items Specified person as mentioned in section 52 Annexure-A Annexure-A 7 C&F Agency Commission (Section 52AAA) 82C Commissioner of Customs. 10% on commission amount 10% on commission amount 4 Specified person as mentioned in section 52 The rate of deduction from the classes of person shall be Compiled By: Masum Gazi 8

- 9. Schedule-1 In light of F.A. 2019 In light of F.A. 2018 Withholding rate/rates of taxes RemarksSl. # Head of withholding with section Withholding authority 8 Manufacturer of non mechanical Cigarettes (bidi)(section-52B)-82C Any person responsible for selling banderols to any manufacturer of cigarettes. 10% of the value of banderols 10% of the value of banderols 9 Compensation against acquisition of property (Section-52C) 82C Any person responsible for payment of such compensation. (a) 2% at City Corporation Area, Paurashava or Cantonment board; (b) 1% at outside City Corporation Area, Paurashava or Cantonment board; (a) 2% at City Corporation Area, Paurashava or Cantonment board; (b) 1% at outside City Corporation Area, Paurashava or Cantonment board; 10 Interest on saving instruments (section- 52D)-82C Any person responsible for making such payment. 10% 5% 11 Deduction at source from payment to a beneficiary of workers’ participation fund.- (section-52DD) Any person responsible for making such payment. 5% 5% 12 Collection of tax from Brick manufacturers (section-52F) Any person responsible at the of permission or renewal a. Tk. 45,000 for 1 section of brick field b. Tk. 70,000 for 1.5 section c. Tk. 90,000 for 2 section d. Tk. 150,000 for automatic machine of brick field a. Tk. 45,000 for 1 section of brick field b. Tk. 70,000 for 1.5 section c. Tk. 90,000 for 2 section d. Tk. 150,000 for automatic machine of brick field 13 Commission of letter of credit (section 52I) Any person responsible for opening letter of credit. 5% on commission 5% on commission 14 Collection of tax from travel Agent.- (Section-52JJ)-82C Any person responsible for paying on behalf of airlines as commission or discount or incentive bonus or any other benefits for selling tickets or caring cargo to a resident See section 52JJ See section 52JJ Compiled By: Masum Gazi 9

- 10. Schedule-1 In light of F.A. 2019 In light of F.A. 2018 Withholding rate/rates of taxes RemarksSl. # Head of withholding with section Withholding authority 15 Collection of tax by City Corporation or Paurashava at the time of renewal of trade license.- (Sec.-52K) Any person responsible for renewal of trade license (a) Tk. 3000 in Dhaka North & South City Corporation or Chittagong City Corporation; (b) Tk. 2000 in any city corporation, other than Dhaka and Chittagong city corporation; (c) Tk. 1000 in any paurashava at any district headquarter; (d)Tk. 500 in any other paurashava. (a) Tk. 500 in Dhaka North & South City Corporation or Chittagong City Corporation; (b) Tk. 300 in any city corporation, other than Dhaka and Chittagong city corporation; (c) Tk. 300 in any paurashava at any district headquarter; (d)Tk. 100 in any other paurashava. 16 Freight forward agency commission (section-52M) Any person responsible for making such payment. 15% 15% 17 Collection of tax on account of rental power.(Sec 52N)-82C BPDB 6% 6% 18 Foreign technician serving in diamond cutting industries (section-52O) 82C Employer 5% 5% 19 Services from convention hall, conference centre etc. (section-52P) Specified person mentioned in section 52 (2) 5% 5% No deduction shall be made by a company when such amount is paid directly to the government. 20 Any income in connection with any service provided to any foreign person (section-52Q) Bank/financial institution 10% 10% No deduction on remittance from abroad for sales of software & services of a resident under paragraph 33 of Part - A of 6th Schedule. 21 International gateway service in respect of Phone call (section-52R) -82C See section 52R See section 52R See section 52R 22 Deduction of tax from any payment in excess of premium paid on life insurance policy(section-52T) Insurance company 5% on excess amount of premium 5% on excess amount of premium Provided that no deduction of tax shall be made in case of death of such policy holder. 23 Deduction from payment on account of local L/C (section-52U) Bank/ Financial institution 3% at the time of extending any credit facility for the purpose of trading, or of reselling after process or conversion 1% At the time of extending any credit facility to a distributor under a financing arrangement against the invoice or sale of goods. 3% at the time of extending any credit facility for the purpose of trading, or of reselling after process or conversion 1% At the time of extending any credit facility to a distributor under a financing arrangement against the invoice or sale of goods. Nothing in this section shall limit the applicability of section 52: payment to contractor. Compiled By: Masum Gazi 10

- 11. Schedule-1 In light of F.A. 2019 In light of F.A. 2018 Withholding rate/rates of taxes RemarksSl. # Head of withholding with section Withholding authority 24 Deduction from payment by cellular mobile phone operator (section-52V) Principal Officer of cellular mobile phone operator company 10% at the time of credit or payment whichever is earlier. 10% at the time of credit or payment whichever is earlier. On account of any revenue sharing or any license fees or any other fees or charges to the regulatory. 25 Import (section-53)-82C The Commissioner of Customs (a) 5% (general rate) (b) 2% on certain imported goods (c) Tk. 800 per ton in case of import of certain items (a) 5% (general rate) (b) 2% on certain imported goods (c) Tk. 800 per ton in case of import of certain items Please see Rule 17 for product list 26 House property (section-53A, rule-17B) Specified person under section 52 (2) 5% on gross rent 5% on gross rent Explanation.- For the purpose of this section, " rent" means any payment, by whatever name called, under any lease, tenancy or any other agreement or arrangement for the use of any house property or hotel accomodation including any furniture, fittings and the land appurtenant thereto. 27 Shipping business of a resident (section- 53AA) 82C Commissioner of Customs or any other authority duly authorized. 5% of total freight received or receivable in or out of Bangladesh. 3% of total freight received or receivable from services rendered between two or more foreign countries. 5% of total freight received or receivable in or out of Bangladesh. 3% of total freight received or receivable from services rendered between two or more foreign countries. Tax will not deduct having a certificate is received in prescribed manner from Deputy Commissioner of Taxes concerned 28 Export of manpower (section-53B, rule- 17C) 82C The Director General, Employment & Training. 10% 10% 29 Export of knit-wear & woven garments, terry towel, jute goods, frozen food, vegetables, leather goods, packed food (section-53BB) 82C Bank 1% of the total export proceeds of all goods Jute goods 1% of the total export proceeds of all goods (other than Jute Goods) 0.60%of the total export proceeds of Jute goods As per SRO. No. 265/AIN/Income Tax/2018 TDS has been @ 0.60% on export proceeds (other than Jute products). This SRO was active till to 30 June 2019. Subsequently, TDS rate 0.60% has been replaced as 0.25% by SRO No. 02/2019. Further, NBR has not issued any SRO in this regard. For Jute products, TDS had been 0.60% till to 30 June 2019 by S.R.O. No. 207/Law/Income Tax/2016. Further, NBR has not issued any SRO in this regard. 30 Member of stock exchanges (section- 53BBB) 82C The Chief Executive Officer of stock exchange. 0.10% 0.10% . 31 Export of any goods except knit-wear & woven garments, terry towel, jute goods, frozen food, vegetables, leather goods, packed food (section-53BBBB)- 82C Bank 1% of the total export proceeds of all goods except goods mentioned in section 52BB 1% of the total export proceeds of all goods except goods mentioned in section 52BB As per SRO. No. 265/AIN/Income Tax/2018 TDS has been @ 0.60% on export proceeds (other than Jute products). This SRO was active till to 30 June 2019. Subsequently, TDS rate 0.60% has been replaced as 0.25% by SRO No. 02/2019. Further, NBR has not issued any SRO in this regard. Compiled By: Masum Gazi 11

- 12. Schedule-1 In light of F.A. 2019 In light of F.A. 2018 Withholding rate/rates of taxes RemarksSl. # Head of withholding with section Withholding authority 32 Goods or property sold by public auction (section-53C, rule-17D)-82C Any person making 5% of sale price 5% of sale price 33 Deduction or collection of tax at source from courier business of a non- resident (Sec. 53CCC.)-82C Any person being a company working as local agent of a non- resident courier company. 15% on the amount of service charge 15% on the amount of service charge 34 (a) Payment to purchase film, drama, radio- TV programed actors- actresses (section- 53D) Person responsible to purchase film, drama, radio-TV programme 10% 10% 34 (b) Payment to actors, actress, singers, directors of film, drama, advertise and any other programme (section-53D) The person producing the film 10% 10% No tax deducted if total payment does not exceed tk. 10,000. 35 Deduction of tax at source from export cash subsidy. (section-53DDD)-82C Bank 10% 3% 36 (a) Commission, discount or fee [section-53E (1) & (2)]-82C Any person being a corporation, body including a company making such payment. (1) 10% on Commission, discount, fees, incentive, performance bonus (2) 1.5% on payment against promotion, distribution or marketing of goods of a company (1) 10% on Commission, discount, fees, incentive, performance bonus (2) 1.5% on payment against promotion, distribution or marketing of goods of a company 36 (b) Commission, discount or fee [section-53E (3)]-82C Any company other than oil marketing company (3) 5%=selling price to Distributor (b) Sales to distributor at a price lower than the retail price shall collect tax from such distributor at the rate of five percent (5%) on the amount equal to B x C where B= the selling price of the company to the distributor or the other person; C = 5%:] (3) 5%=selling price to Distributor (b) Sales to distributor at a price lower than the retail price shall collect tax from such distributor at the rate of five percent (5%) on the amount equal to B x C where B= the selling price of the company to the distributor or the other person; C = 5%:] 37 Commission or remuneration paid to agent of foreign buyer (section-53EE) - 82C Bank 10% 10% 38 (a) Interest on saving deposits & fixed deposits [section-53F(1) -82C ] Any person responsible for making such payment. a. 10% if furnishes e-TIN or balance does not exceed Tk. 100,000 at any time in a year. b. 15% if fail to furnishes e- TIN. c. 10% for some other specified person a. 10% if furnishes e-TIN or balance does not exceed Tk. 100,000 at any time in a year. b. 15% if fail to furnishes e- TIN. c. 10% for some other specified person This shall not apply on the amount of interest of share of profit arising out of any deposit pension scheme sponsored by the government or by a schedule bank with prior approval of the Government. Compiled By: Masum Gazi 12

- 13. Schedule-1 In light of F.A. 2019 In light of F.A. 2018 Withholding rate/rates of taxes RemarksSl. # Head of withholding with section Withholding authority 38 (b) Interest on saving deposits & fixed deposits or any term deposit by or in the name of Fund (section-53F(2)-82C Any person responsible for making such payment. 5% 5% 39 Real state or land development business (section-53FF) -82C Any person responsible for registering any document for transfer or any land or any building or apartment. See section 53FF See section 53FF 40 Deduction at source from insurance commission.- (Sec-53G)-82C Insurance company 5% 5% 41 Deduction at source from fees, etc. of surveyors of general insurance company.- (Sec-53GG)-82C Insurance company 15% 15% 42 Transfer of property (section- 53H) 82C Any person responsible for registering any document of a person.(Registering Office) See section 53H See section 53H 43 Collection of tax from lease of property for at least 10 years (section 53HH) Any Registering Officer responsibel for registering any document in relation to any lease granted by Rajuk, CDA, RDA, KDA, and NHA or any person being an individual, a firm, an association of persons, a Hindu undivided family, a company or any artificial juridical person. 4% 4% Compiled By: Masum Gazi 13

- 14. Schedule-1 In light of F.A. 2019 In light of F.A. 2018 Withholding rate/rates of taxes RemarksSl. # Head of withholding with section Withholding authority 44 Interest on deposit of post office & saving bank account (section-53I) Any person responsible for making such payment. 10% 10% 45 Rental value of vacant land or plant or machinery (section-53J,rule- 17BB) Specified person under section 52 (2) 5% of the rent 5% of the rent 46 Advertisement bill of newspaper or magazine or private television channel, private radio station, or any web site or any person on of advertisement etc (section-53K) The Government or any authority, corporation or body including its units, the activities or any NGO, any university or medical college, dental college, engineering college responsible for making such payment. 4% 4% 47 Collection of tax from transfer of shares or mutual fund units by the sponsor shareholders of a company listed on stock exchange (section-53M) 82C Securities & Exchange Commission 5% 5% 48 Collection of tax from transfer of share of shareholder of stock exchange (53N)- 82C Principal Officer 15% on any gain 15% on any gain 49 Deduction of tax from any sum paid by real estate developer to land owner.-[U/S 53P] 82C Any person engaged in real estate or land development business 15% 15% Any sum to the land owner on account of signing money, subsistence money, house rent or in any other form called by whatever name for the purpose of development of the land of such owner in accordance with any power of attorney or any agreement or any written contract, 50 Dividends (Section 54) The principal officer of the company Resident/ non-rsident Bangladeshi company--------20% Resident/ non resident Bangladeshi person other than company Having 12 digits TIN------------10% Without 12 digits TIN---------15% Resident/ non-rsident Bangladeshi company--------20% Resident/ non resident Bangladeshi person other than company Having 12 digits TIN------------10% Without 12 digits TIN---------15% Provision of this section shall not apply if such dividend is distributed to a company and if such dividend enjoy tax exemption under the provision of paragraph 60 of Part A of the Sixth Schedule. 51 Income from lottery (Section 55) 82C Any person responsible for making such payment 20% 20% 52 Income of non-residents (Section 56) Specified person as mentioned in section 52 (2) Annexure-B Annexure-B Compiled By: Masum Gazi 14

- 15. 15 | P a g e Compiled by: Masum Gazi Annexure-A Deduction from the payment of certain services [Section 52AA] (1) Where any payment is to be made by a specified person to a resident on account of a service as mentioned in this section, the person responsible for making the payment shall, at the time of making such payment, deduct income tax at the rate specified in the Table below: - Sl. No Description of service and payment Rate of deduction of tax Where base amount does not exceed Tk. 25 lakh Where base amount exceeds Tk. 25 lakh 1 Advisory or consultancy service 10% 12% 2 Professional service, technical services fee, or technical assistance fee 10% 12% 3 i. Catering service; ii. Cleaning Service; iii. Collection and recovery service; iv. Private security service; v. Manpower supply service; vi. Creative media service; vii. Public relations service; viii. Event management service; ix. Training, workshop, etc. organization and management service; x. Courier service xi. Packing and shifting service xii. Any other service of similar nature 10% 1.5% 12% 2% 4 Media buying agency service (a) on commission (b) on gross amount 10% 0.5% 12% 0.65% 5 Indenting commission 6% 8% 6 Meeting fees, training fees or honorarium 10% 12% 7 Mobile network operator, technical support service provider or service delivery agents engaged in mobile banking operations 10% 12% 8 Credit rating agency 10% 12%

- 16. 16 | P a g e Compiled by: Masum Gazi Provided that if the amount for services mentioned in SL No. 3 and 4 of the Table shows both commission or fee and gross bill amount tax shall be the higher amount between (i) and (ii) where- (i) tax calculated on commission or fee applying the relevant rate in the table; and (ii) B x C x D, where- B = Gross bill amount C = 10% for Sl. 3 and 2.5% for Sl. 4, and D = rate of tax applicable on commission or fee: Provided further that the rate of tax shall be fifty percent (50%) higher if the payee does not have a twelve-digit Taxpayer’s Identification Number at the time of making the payment: Provided further that where the Board, on an application made in this behalf, gives certificate in writing that the person rendering such service is otherwise exempted from tax under any provision of this Ordinance, the payment referred to in this section shall be made without any deduction or with deduction at a lesser rate for that income year. (2) In this section- (a)“specified person” shall have the same meaning as in clause (a) of sub-section (2) of section 52; (b)“contract” includes a sub-contract, any subsequent contract, an agreement or an arrangement, whether written or not; (c)“base amount” means the higher of the- (i) contract value; or (ii) bill or invoice amount ; or (iii) payment; (d) “payment” includes a transfer, a credit or an adjustment of payment; (e) “professional services” means- (i) services rendered by a doctor; 9 Motor garage or workshop 6% 8% 10 Private container port or dockyard service 6% 8% 11 Shipping agency commission 6% 8% 12 Stevedoring/berth operation commission 10% 12% 13 Transport service, car rental or ride sharing service 3% 4% 13A Wheeling charge for electricity transmission 4% 5% 14 Any other service which is not mentioned in Chapter VII of this Ordinance and is not a service provided by any bank, insurance or financial institutions 10% 12%

- 17. 17 | P a g e Compiled by: Masum Gazi (ii) services rendered by a person carrying on any profession or any other services applying professional knowledge. Annexure-B Deduction from income of non-residents [ Section 56] (1) Subject to the provisions of sub-section (2), the specified person or any other person responsible for making payment to a non-resident of any amount which constitutes the income of such non-resident chargeable to tax under this Ordinance shall, unless such person is himself liable to pay tax thereon as agent, at the time of making such payment, deduct tax on the amount so payable at the rate, specified below: SL. No Description of services or payments Rate of deduction of tax 1 Advisory or consultancy service 20% 2 Pre-shipment inspection service 20% 3 Professional service, technical services, technical know-how or technical assistance 20% 4 Architecture, interior design or landscape design, fashion design or process design 20% 5 Certification, rating etc. 20% 6 Charge or rent for satellite, airtime or frequency, rent for channel broadcast 20% 7 Legal service 20% 8 Management service including even management 20% 9 Commission 20% 10 Royalty, license fee or payments related to intangibles 20% 11 Interest 20% 12 Advertisement broadcasting 20% 13 Advertisement making or Digital marketing 15% 14 Air transport or water transport not being the carrying services mentioned in sections 102 or 103A 7.5% 15 Contractor or sub-contractor of manufacturing, process or conversion 7.5% 16 Supplier 7.5%

- 18. 18 | P a g e Compiled by: Masum Gazi 17 Capital gain 15% 18 Insurance premium 10% 19 Rental of machinery, equipment etc. 15% 20 Dividend- (a) company—- (b) any other person, not being a company— 20% 30% 21 Artist, singer or player 30% 22 Salary or remuneration 30% 23 Exploration or drilling in petroleum operations 5.25% 24 Survey for coal, oil or gas exploration 5.25% 24A Fees, etc. of surveyors of general insurance company 20% 25 Any service for making connectivity between oil or gas field and its export point 5.25% 26 Any payments against any services not mentioned above 20% 27 Any other payments 30% Provided that when any capital gain arises from the transfer of any share of a company, the person or the authority, as the case may be, responsible for effecting the transfer of shares shall not give any effect in respect of such transfer if tax on such capital gain has not been paid. “(2) where, in respect of any payment under this section, the Board, on an application made in this behalf, is satisfied that due to tax treaty or any other reason the non-resident is not be liable to pay any tax in Bangladesh, or is liable to pay tax at a reduced rate in Bangladesh, the Board may issue a certificate within thirty days from the date of receipt of such application accompanied by all the documents as required by the Board to the effect that the payment referred to in sub- section (1) shall be made without any deduction or, in applicable cases, with a deduction at the reduced rate as mentioned in the certificate.’ (2A) Tax deducted under this section shall be deemed to be the minimum tax liability of the payee in respect of the income for which the deduction is made, and shall not be subject of refund or set off or an adjustment against a demand.] Ins by F.A. 2018 (3) In this section,- (i) “specified person” shall have the same meaning as in clause (a) of sub-section (2) of section 52 of this Ordinance; (ii) “payment” includes a transfer, a credit or an adjustment of payment. Annexure-C

- 19. 19 | P a g e Compiled by: Masum Gazi Annexure-C Tax Payment Code Name of the Zone Income tax-Companies Income tax-other than Company Taxes Zone-1, Dhaka 1-1141-0001-0101 1-1141-0001-0111 Taxes Zone-2, Dhaka 1-1141-0005-0101 1-1141-0005-0111 Taxes Zone-3, Dhaka 1-1141-0010-0101 1-1141-0010-0111 Taxes Zone-4, Dhaka 1-1141-0015-0101 1-1141-0015-0111 Taxes Zone-5, Dhaka 1-1141-0020-0101 1-1141-0020-0111 Taxes Zone-6, Dhaka 1-1141-0025-0101 1-1141-0025-0111 Taxes Zone-7, Dhaka 1-1141-0030-0101 1-1141-0030-0111 Taxes Zone-8, Dhaka 1-1141-0035-0101 1-1141-0035-0111 Taxes Zone-9, Dhaka 1-1141-0080-0101 1-1141-0080-0111 Taxes Zone-10, Dhaka 1-1141-0085-0101 1-1141-0085-0111 Taxes Zone-11, Dhaka 1-1141-0090-0101 1-1141-0090-0111 Taxes Zone-12, Dhaka 1-1141-0095-0101 1-1141-0095-0111 Taxes Zone-13, Dhaka 1-1141-0100-0101 1-1141-0100-0111 Taxes Zone-14, Dhaka 1-1141-0105-0101 1-1141-0105-0111 Taxes Zone-15, Dhaka 1-1141-0110-0101 1-1141-0110-0111 Taxes Zone-1, Chattogram 1-1141-0040-0101 1-1141-0040-0111 Taxes Zone-2, Chattogram 1-1141-0045-0101 1-1141-0045-0111 Taxes Zone-3, Chattogram 1-1141-0050-0101 1-1141-0050-0111 Taxes Zone-4, Chattogram 1-1141-0135-0101 1-1141-0135-0111 Taxes Zone-Khulna 1-1141-0055-0101 1-1141-0055-0111 Taxes Zone-Rajshahi 1-1141-0060-0101 1-1141-0060-0111 Taxes Zone-Rangpur 1-1141-0065-0101 1-1141-0065-0111 Taxes Zone-Sylhet 1-1141-0070-0101 1-1141-0070-0111 Taxes Zone-Barishal 1-1141-0075-0101 1-1141-0075-0111 Taxes Zone-Gazipur 1-1141-0120-0101 1-1141-0120-0111 Taxes Zone-Narayanganj 1-1141-0115-0101 1-1141-0115-0111 Taxes Zone-Bogura 1-1141-0140-0101 1-1141-0140-0111 Taxes Zone-Cumilla 1-1141-0130-0101 1-1141-0130-0111 Taxes Zone-Mymensingh 1-1141-0125-0101 1-1141-0125-0111 Large Taxpayer Unit 1-1145-0010-0101 1-1145-0010-0111 Central Survey Zone 1-1145-0005-0101 1-1145-0005-0111

- 20. 2q Kwc 3q Kwc Taxes Circle- Dhaka wU Avi dig bs 6 ( Gm, Avi 37 `ªóe¨) evsjv‡`k e¨vsK/†mvbvjx e¨vs‡Ki ............................... †Rjvi .............................. kvLvq UvKv Rgv †`Iqvi Pvjvb †KvW bs 1 1 1 4 1 0 1 1 0 0 1 1 1 UvKv cqmv Mr. ABC - 00 Company Name 42 Gulshan Avenue, Gulshan-1, Dhaka-1212. ‡gvU UvKv - - UvKv (K_vq) Taka six thousand six hundred and sixty only UvKv cvIqv †Mj ZvwiLt- 01-08-19 †bvU t 1| mswkó `߇ii mwnZ †hvMv‡hvM Kwiqv mwVK †KvW b¤^i Rvwbqv jB‡eb| 2| * †h mKj †¶‡Î Kg©KZ©v KZ©„K c„ôvsKb cª‡qvRb, †m mKj ‡¶‡Î cÖ‡hvR¨ nB‡e| evtmtgy t- 2002/03-10007GdÑ1,00,00,000 Kwc, 2002| evsjv‡`k e¨vsK/†mvbvjx e¨vsK Mr. Kamal Hossain Tax Deducted at Source under section 53A against Office rent Cash 20 g¨v‡bRvi wefv‡Mi bvg Ges Pvjv‡bi c„ôvsKbKvix Kg©KZ©vi bvg, c`ex I `ßi|* hvnvi gvidZ cÖ`Ë nBj Zvnvi bvg I wVKvbv| ‡h e¨w³i/cÖwZôv‡bi c¶ nB‡Z UvKv cÖ`Ë nBj Zvnvi bvg, c`ex I wVKvbv| wK eve` Rgv †`Iqv nBj Zvnvi weeiY gy`ªv I †bv‡Ui weeiY/WªvdU, †c- AW©vi I †P‡Ki weeiY| 1g (g~j) Kwc Taxes Zone - 15 √ Pvjvb bs ------------------- ZvwiL : 01-08-19 Rgv cÖ`vbKvix KZ„©K c~iY Kwi‡Z nB‡e UvKvi AsK Annexure-D The Deputy Commissioner of Taxes

- 21. 21 Direction: • Green color represents provision changes by the Finance Act, 2019 If you have any query relating to tax or have required tax related services you can communicate with me by e-mail at masumgazi613@gmail.com or by mobile at +8801935-131132. Thank You