More Related Content

More from nadinesullivan (20)

Les 21 1

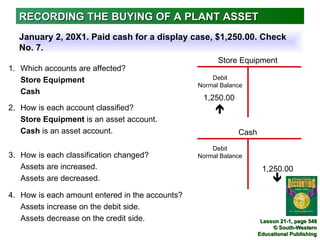

- 1. RECORDING THE BUYING OF A PLANT ASSET

January 2, 20X1. Paid cash for a display case, $1,250.00. Check

No. 7.

Store Equipment

1. Which accounts are affected?

Store Equipment Debit

Normal Balance

Cash

1,250.00

2. How is each account classified?

Store Equipment is an asset account.

Cash is an asset account. Cash

Debit

3. How is each classification changed? Normal Balance

Assets are increased. 1,250.00

Assets are decreased.

4. How is each amount entered in the accounts?

Assets increase on the debit side.

Assets decrease on the credit side. Lesson 21-1, page 548

© South-Western

Educational Publishing

- 2. RECORDING THE BUYING OF A PLANT ASSET

4 3

1

2

1. Account Title

2. Cost of the

Plant Asset

3. Cash Paid

4. Post

Lesson 21-1, page 548

© South-Western

Educational Publishing

- 3. CALCULATING AND PAYING PROPERTY TAX

February 1. Harrison Manufacturing paid cash for property tax,

$840.00. Check No. 187.

+ − Assessed Value × Tax Rate = Annual Property Tax

÷ × $70,000.00 × 1.2% = $840.00

Property Tax Expense Cash

Debit Debit

Normal Balance Normal Balance

840.00 840.00

Lesson 21-1, page 549

© South-Western

Educational Publishing

- 4. TERMS REVIEW

current assets

plant assets

real property

personal property

assessed value

Lesson 21-1, page 550

© South-Western

Educational Publishing