Clarification for Foreign ExchangeForeign Currency Transla.docx

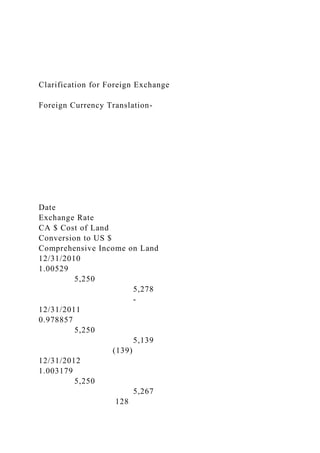

Clarification for Foreign Exchange Foreign Currency Translation- Date Exchange Rate CA $ Cost of Land Conversion to US $ Comprehensive Income on Land 12/31/2010 1.00529 5,250 5,278 - 12/31/2011 0.978857 5,250 5,139 (139) 12/31/2012 1.003179 5,250 5,267 128 12/31/2013 0.940531 5,250 4,938 (329) ABC Company acquired a Canadian Subsidiary whose only asset was land. ABC Company purchased the subsidiary on 12/31/10 for CA $5,250 and retaines 100% interest in the subsidiary. Go to www.x-rates.com and use the historic lookup feature to determine the exact exchange rates on 12/31/10, 12/31/11, 12/31/12 and 12/31/13. Clarification for Comprehensive Income For the Year Ended December 31, 2013 Net Earnings 5,385.00 Other Comprehensive (Loss) Income: Foreign Currency Translation Adjustments (329.00) Cash Flow Hedges, net of tax (12.00) Other Comprehensive Income (10.00) Total Other Comprehensive (Loss) Income (351.00) COMPREHENSIVE INCOME 5,034.00 Clarification for statement of OE ABC Company Statement of Owners Equity For the Year Ended December 31, 2013 Capital Stock: Preferred Stock - Common Stock 88.00 88.00 Additional Paid in Capital 8,402.00 Retained Earnings 23,048.00 31,538.00 Accumulated Other Comprehensive Income 46.00 Treasury Stock (19,194.00) Total Shareholder's Equity 12,390.00 Clarification for Statement of Earnings ABC Company Statement of Retained Earnings For the Year Ended December 31, 2013 January 1, as Reported 20,038.00 Correction of depreciation error (903.00) Cumulative increase in income from inventory method change 771.00 January 1, as adjusted 19,906.00 Net Income 5,385.00 25,291.00 Dividends (2,243.00) Balance, December 31 23,048.00 Title ABC/123 Version X 1 ABC Company History ACC/545 Version 6 1 University of Phoenix Material ABC Company History The ABC Company is a mid-sized company that manufact.

Recommended

Recommended

More Related Content

Similar to Clarification for Foreign ExchangeForeign Currency Transla.docx

Similar to Clarification for Foreign ExchangeForeign Currency Transla.docx (20)

More from monicafrancis71118

More from monicafrancis71118 (20)

Recently uploaded

Recently uploaded (20)

Clarification for Foreign ExchangeForeign Currency Transla.docx

- 1. Clarification for Foreign Exchange Foreign Currency Translation- Date Exchange Rate CA $ Cost of Land Conversion to US $ Comprehensive Income on Land 12/31/2010 1.00529 5,250 5,278 - 12/31/2011 0.978857 5,250 5,139 (139) 12/31/2012 1.003179 5,250 5,267 128

- 2. 12/31/2013 0.940531 5,250 4,938 (329) ABC Company acquired a Canadian Subsidiary whose only asset was land. ABC Company purchased the subsidiary on 12/31/10 for CA $5,250 and retaines 100% interest in the subsidiary. Go to www.x-rates.com and use the historic lookup feature to determine the exact exchange rates on 12/31/10, 12/31/11, 12/31/12 and 12/31/13. Clarification for Comprehensive Income For the Year Ended December 31, 2013 Net Earnings 5,385.00 Other Comprehensive (Loss) Income: Foreign Currency Translation Adjustments (329.00) Cash Flow Hedges, net of tax (12.00) Other Comprehensive Income

- 3. (10.00) Total Other Comprehensive (Loss) Income (351.00) COMPREHENSIVE INCOME 5,034.00 Clarification for statement of OE ABC Company Statement of Owners Equity For the Year Ended December 31, 2013 Capital Stock: Preferred Stock - Common Stock 88.00 88.00 Additional Paid in Capital 8,402.00 Retained Earnings

- 4. 23,048.00 31,538.00 Accumulated Other Comprehensive Income 46.00 Treasury Stock (19,194.00) Total Shareholder's Equity 12,390.00 Clarification for Statement of Earnings ABC Company Statement of Retained Earnings For the Year Ended December 31, 2013

- 5. January 1, as Reported 20,038.00 Correction of depreciation error (903.00) Cumulative increase in income from inventory method change 771.00 January 1, as adjusted 19,906.00 Net Income 5,385.00 25,291.00 Dividends (2,243.00) Balance, December 31 23,048.00 Title ABC/123 Version X 1 ABC Company History ACC/545 Version 6 1

- 6. University of Phoenix Material ABC Company History The ABC Company is a mid-sized company that manufactures goods in the United States and has begun to expand the operation overseas. The company maintains a healthy balance sheet and has reported positive net income since inception. Currently, the organization utilizes the average cost inventory method and is exploring a change in accounting principle to maximize net income and attract new stockholders. Also, the company utilizes the straight-line method of depreciating fixed assets, which are primarily machinery/equipment and several large production facilities. The organization is a publically–traded company that sells its stock on the open market. Demand for the stock has caused an increase in the price per share, and if the trend continues, the organization is considering splitting the stock to encourage investment. The company is having success selling preferred stock on the open market as well. ABC Company offers its employees a generous pension plan, but it is currently investigating pension plan changes that will benefit both the employees and the stockholders. Also, the company offers a 401k and an employee stock purchase plan to encourage employees to be owners of their company. Finally, the company finances some of the major investments it has made, including warehouses and land. To accomplish company goals, it has issued bonds in which the company is now considering restructuring. 2013 2012

- 7. Cash $ 35,000 $ 32,000 Accounts receivable 33,000 30,000 Allowance for doubtful accounts (1,300) (1,100) Inventory 31,000 47,000 Property, plant, & equipment 100,000 95,000 Accumulated depreciation (16,500) (15,000) Trade accounts payable (25,000) (15,500) Income taxes payable (21,000) (29,100) Deferred income taxes (5,300) (4,600) 8% callable bonds payable (45,000) (20,000) Unamortized bond discount 4,500 5,000 Common stock (50,000) (40,000)

- 8. Additional paid-in capital (9,100) (7,500) Retained earnings (25,200) (64,600) Sales (558,300) (778,700) Cost of goods sold 250,000 380,000 Selling expenses 141,500 172,000 General and administrative expenses 137,000 151,300 Interest expense 4,300 2,600 Income tax expense 20,400 61,200 Additional information: 1. Los Lobos purchased $5,000 in equipment during 2007. 2. Los Lobos allocated one-third of its depreciation expense to selling expenses and the remainder to general and administrative expenses. 3. Bad debt expense for 2007 was $5,000, and write-offs of uncollectible accounts totaled $4,800. 4. $12,000 of the debt is current portion.

- 9. Cash Sales $72,600 Collections on Receivables 477,900 Purchases (219,500) Purchase of Equipment (5,000) Wages (150,700) Payments to Suppliers (126,300) Tax Payments (27,800) Borrowing 30,000 Repayment of Debt (5,000) Interest Payments (3,800) Sale of Stock 11,600 Dividends (51,000) On January 1, 2006, Jamona Corp. purchased 12% bonds, having a maturity value of $300,000, for $322,744.44. The bonds provide the bondholders with a 10% yield. They are dated January 1, 2006, and mature January 1, 2011, with interest receivable December 31 of each year. The company uses the effective-interest method to allocate unamortized discount or premium. The bonds are classified as available-for-sale. The fair value of the bonds at December 31 of each year is as follows:

- 10. · 2006 – $320,500 · 2007 – $309,000 · 2008 – $308,000 · 2009 – $310,000 · 2010 – $300,000 The following information is available from Jamona’s inventory records: Units Unit Cost January 1, 2007 (beginning inventory) 600 $ 8.00 Purchases: January 5, 2007 1,200 9.00 January 25, 2007 1,300 10.00 February 16, 2007 800 11.00 March 26, 2007 600 12.00 A physical inventory on March 31, 2007, shows 1,600 units on hand. Select any one of the inventory methods (LIFO, FIFO,

- 11. Average Cost, or others). On July 6, Jamona Corp. acquired the plant assets of Berry Company, which had discontinued operations. The appraised value of the property is: Land $ 400,000 Building 1,200,000 Machinery and equipment 800,000 Total $2,400,000 Jamona Corp. gave 12,500 shares of its $100 per value common stock in exchange. The stock had a market value of $168 per share on the date of the purchase of the property. Jamona Corp. expended the following amounts in cash between July 6 and December 15, the date when it first occupied the building. Repairs to building $105,000 Construction of bases for machinery to be installed later 135,000 Driveways and parking lots 122,000 Remodeling of office space in building 161,000 Special assessment by city on land 18,000

- 12. On December 20, the company paid cash for machinery, $260,000, subject to a 2% cash discount, and freight on machinery of $10,500. On January 1, 2007, Jamona Corp. signed a 5-year, noncancelable lease for a machine. The terms of the lease called for Jamona to make annual payments of $8,668 at the beginning of each year, starting January 1, 2007. The machine has an estimated useful life of 6 years and a $5,000 unguaranteed residual value. The machine reverts to the lessor at the end of the lease term. Jamona uses the straight-line method of depreciation for all of its plant assets. Jamona’s incremental borrowing rate is 10%, and the lessor’s implicit rate is unknown. Restructuring Debt Data Your company is in financial trouble and is in the process of reorganizing. Your manager wants to know how you will report on restructuring the debt. Use the following information to help with this assignment. Part A ASSETS CURRENT ASSETS Cash and cash equivalents $ 108,340 Trade accounts receivable, net of allowances 2,866,260 Other receivables 62,150 Operating supplies, at lower of average

- 13. cost or market 58,630 Prepaid expenses 446,050 Total Current Assets 3,541,430 PROPERTY, PLANT, AND EQUIPMENT (at cost) Land 1,950,000 Buildings and improvements 2,327,410 Equipment 5,015,660 Other equipment and leasehold improvements 1,645,580 total

- 14. 10,938,650 Accumulated depreciation and amortization (7,644,430) Net Property, Plant, and Equipment 3,294,220 OTHER ASSETS Deposits and other assets 1,000,080 TOTAL ASSETS $ 7,835,730 LIABILITIES AND SHAREHOLDERS’ EQUITY (DEFICIT)

- 15. CURRENT LIABILITIES Accounts payable $ 972,160 Accrued liabilities 2,071,270 Accrued claims costs 793,620 Federal and other income taxes 19,710 Deferred income taxes 500 Current maturities of long-term debt and capital lease obligations 50,610 Short-term borrowings 249,250 Total Current Liabilities 4,157,120 LONG-TERM LIABILITIES

- 16. Capital lease obligation 54,580 Note outstanding 3,000,000 Mortgage outstanding 608,030 Other liabilities 95,860 Total long-term liabilities 3,758,470 Total Liabilities 7,915,590 SHAREHOLDERS’ EQUITY (DEFICIT) Common stock, $.01 par value; authorized 500,000 shares; issued 231,000 shares 2,310 Additional paid-in capital

- 17. 731,090 Accumulated other comprehensive loss (113,500) Retained earnings (deficit) (639,180) Treasury stock (60,580) Total Shareholders’ Equity (Deficit) (79,860) TOTAL LIABILITIES AND SHAREHOLDERS’ EQUITY $ 7,835,730 Part B As stipulated, your company is having financial difficulty and has asked the bank to restructure its $3 million note outstanding. The present note has 3 years remaining and pays a current interest rate of 10%. The present market rate for a loan of this nature is 12%. The note was issued at its face value. The bank agrees to accept land in exchange for relinquishing its claim on this note. The land has a book value of $1,950,000 and a fair value of $2,400,000. The company provides the following information related to its postemployment benefits for the year 2007: · Accumulated postretirement benefit obligation at January 1,

- 18. 2007: $810,000 · Actual and expected return on plan assets: $34,000 · Unrecognized prior service cost amortization: $21,000 · Discount rate: 10% · Service cost: $88,000 Lee Corporation Equity Scenario Lee Corporation is an American company that began operations on January 1, 2004. It has just completed its fourth full year of operations on December 31, 2007. Ending Year Balances for the prior year that ended on December 2006 were as follows: Retained Earnings: $225,000 Common Stock at par: $500,000 Additional Paid-in Capital: $1,000,000 Treasury Stock: $200,000 Income before taxes for 2007 totaled $240,000. Effective Tax Rate was 40% for all years of operation including 2007. The following information relates to 2007: 1. An error was discovered during 2007. Specifically, depreciation expense was understated in 2005, resulting in the need for a Prior Period Adjustment of $25,000 before taxes. 2. Lee Corporation changed its method of valuing inventory during 2007. The cumulative decrease in income from the change in inventory methods was $35,000 before taxes. 3. Lee Corporation declared cash dividends of $100,000 in late 2007 to be paid out in 2008. 4. Lee acquired a Canadian subsidiary whose sole asset is a piece of land. Lee acquired the subsidiary on 12/31/04 for the exact value of the land, CA $100,000. Lee owns 100% of the

- 19. subsidiary. Go to www.x-rates.com and use the historic lookup feature to determine the exact exchange rates on 12/31/04, 12/31/05, and 12/31/06. Requirements: 1. Prepare journal entries for items 1 to 3 above. 2. Calculate and journalize the foreign exchange adjustments for 2005, 2006, and 2007 for the Canadian subsidiary. 3. Prepare a Retained Earnings Statement for the year ended December 31, 2007. 4. Prepare a Statement of Changes in Stockholders’ Equity for the year ended December 31, 2007. Copyright © XXXX by University of Phoenix. All rights reserved. Copyright © 2014 by University of Phoenix. All rights reserved. Week #2 Supplemental Material(A) Depreciation Expense Using Straight-Line Method-ABC Company has the following assets acquired on January 1, 2013 requiring depreciation calculation:AssetCostLifeAnnual Dep. ExpensePlant with 30 year life at a cost of $660,00066030Land at a cost of $2,250,0002,250Machinery and Equipment with 20 year life at a costof 79,000.7920Truck with a life of 7 years at a cost of

- 20. $42,0004273,031-(B) Inventory Calculation-A physical inventory on December 31, 2013, shows 810 units on hand.Calculate Cost of Goods Sold (COGS) using average cost.PurchasesUnitsCostTotalBeginning Inventory80014.3911,512January 5, 201395013.4612,787PurchaseMarch 25, 201395012.8112,170PurchaseJune 8, 201374513.6510,169PurchaseSeptember 15, 201362513.258,281PurchaseDecember 15, 201350514.977,560Purchase4,57550,967Total Purchases(C ) Error Corrections-(1) An error was discovered during 2013 relating to the understatement of depreciation expense in 2011resulting in a Prior Period Adjustment of $1,505 before taxes.(2) ABC Company changed its method of valuing inventory during 2013. The cumulative increase in incomefrom the change in inventory methods was $1,285 before taxes.