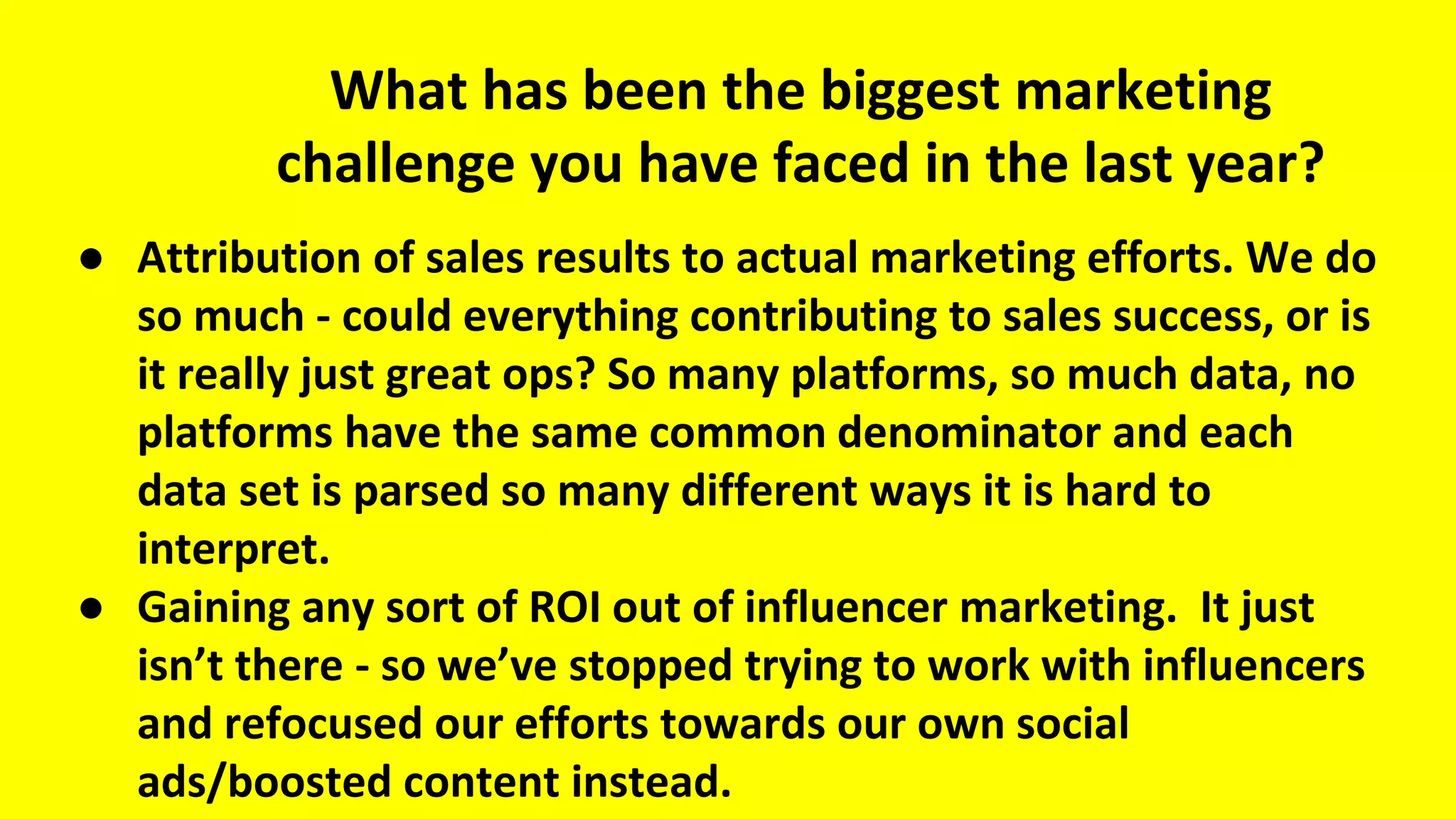

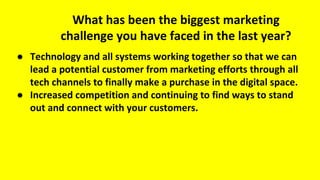

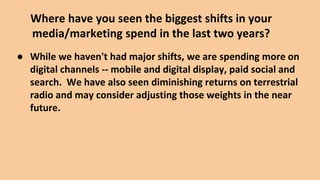

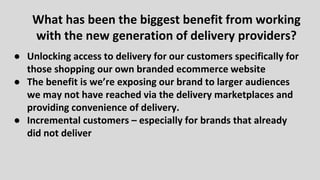

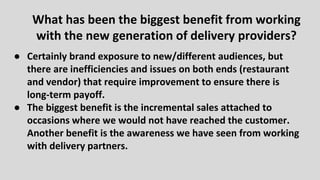

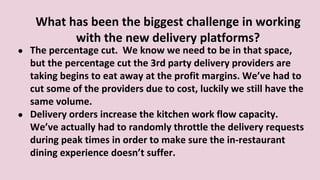

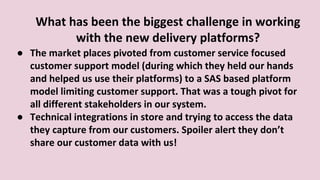

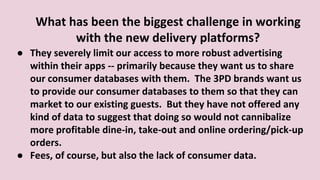

The document discusses marketing challenges and opportunities faced by various companies. The biggest challenges included attributing sales to specific marketing efforts due to lack of common data standards, gaining ROI from influencer marketing, and setting objectives for cross-departmental teams. The biggest opportunities included growth in delivery and online ordering, with delivery providing incremental sales and occasions not otherwise served. However, challenges with delivery platforms included high fees and lack of customer data sharing. Successful marketing approaches driving growth were delivery, online ordering, and loyalty programs leveraging first-party customer data. The most disappointing approaches were influencer marketing and radio due to difficulties tracking results and ROI.