RBC Research Comment: Prudential/GM

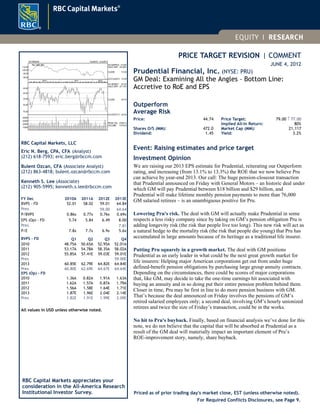

- 1. PRICE TARGET REVISION | COMMENT 125 WEEKS 15JAN10 - 01JUN12 110.00 Rel. S&P 500 HI-23APR10 114.90 HI/LO DIFF -35.26% JUNE 4, 2012 100.00 90.00 CLOSE 74.39 Prudential Financial, Inc. (NYSE: PRU) 80.00 2010 2011 2012 JF M A M J J A S O N D J F M A M J J A S O N D J F M A M J LO-01JUN12 74.39 GM Deal: Examining All the Angles – Bottom Line: HI-18FEB11 67.52 65.00 HI/LO DIFF -37.13% Accretive to RoE and EPS 60.00 55.00 CLOSE 44.74 50.00 Outperform 45.00 LO-07OCT11 42.45 Average Risk 40000 30000 Price: 44.74 Price Target: 79.00 ↑ 77.00 20000 PEAK VOL. 47081.0 VOLUME 17419.8 Implied All-In Return: 80% 10000 Shares O/S (MM): 472.0 Market Cap (MM): 21,117 Dividend: 1.45 Yield: 3.2% RBC Capital Markets, LLC Eric N. Berg, CPA, CFA (Analyst) Event: Raising estimates and price target (212) 618-7593; eric.berg@rbccm.com Investment Opinion Bulent Ozcan, CFA (Associate Analyst) We are raising our 2013 EPS estimate for Prudential, reiterating our Outperform (212) 863-4818; bulent.ozcan@rbccm.com rating, and increasing (from 13.1% to 13.3%) the ROE that we now believe Pru can achieve by year-end 2013. Our call: The huge pension-closeout transaction Kenneth S. Lee (Associate) that Prudential announced on Friday with General Motors – an historic deal under (212) 905-5995; kenneth.s.lee@rbccm.com which GM will pay Prudential between $18 billion and $29 billion, and Prudential will make lifetime monthly pension payments to more than 76,000 FY Dec 2010A 2011A 2012E 2013E GM salaried retirees – is an unambiguous positive for Pru. BVPS - FD 52.01 58.02 59.01 64.84 Prev. 59.00 64.64 P/BVPS 0.86x 0.77x 0.76x 0.69x Lowering Pru's risk. The deal with GM will actually make Prudential in some EPS (Op) - FD 5.74 5.84 6.49 8.00 respects a less risky company since by taking on GM’s pension obligation Pru is Prev. 7.81 adding longevity risk (the risk that people live too long). This new risk will act as P/E 7.8x 7.7x 6.9x 5.6x a natural hedge to the mortality risk (the risk that people die young) that Pru has BVPS - FD Q1 Q2 Q3 Q4 accumulated in large amounts because of its heritage as a traditional life insurer. 2010 48.75A 50.65A 52.95A 52.01A 2011 53.17A 54.78A 58.35A 58.02A Putting Pru squarely in a growth market. The deal with GM positions 2012 55.85A 57.41E 59.03E 59.01E Prudential as an early leader in what could be the next great growth market for Prev. 59.00E 2013 60.85E 62.79E 64.82E 64.84E life insurers: Helping major American corporations get out from under huge Prev. 60.80E 62.69E 64.67E 64.64E defined-benefit pension obligations by purchasing large group annuity contracts. EPS (Op) - FD Depending on the circumstances, there could be scores of major corporations 2010 1.36A 0.82A 1.91A 1.63A that, like GM, may decide to take the one-time earnings hit associated with 2011 1.62A 1.57A 0.87A 1.79A buying an annuity and in so doing put their entire pension problem behind them. 2012 1.56A 1.58E 1.64E 1.71E Closer in time, Pru may be first in line to do more pension business with GM. 2013 1.87E 1.96E 2.04E 2.14E Prev. 1.82E 1.91E 1.99E 2.09E That’s because the deal announced on Friday involves the pensions of GM’s retired salaried employees only; a second deal, involving GM’s hourly unionized All values in USD unless otherwise noted. retirees and twice the size of Friday’s transaction, could be in the works. No hit to Pru's buyback. Finally, based on financial analysis we’ve done for this note, we do not believe that the capital that will be absorbed at Prudential as a result of the GM deal will materially impact an important element of Pru’s ROE-improvement story, namely, share buyback. RBC Capital Markets appreciates your consideration in the All-America Research Institutional Investor Survey. Priced as of prior trading day's market close, EST (unless otherwise noted). For Required Conflicts Disclosures, see Page 9.

- 2. June 4, 2012 Prudential Financial, Inc. Details During its recent investor day, Prudential’s management team emphasized the fact that the 13% to 14% RoE “aspiration” it had set itself had turned into a “goal”, which led many investors to question what the difference was between the aspiration and the goal. Last Friday, Prudential announced a deal that in our view makes the bottom of this range easily achievable and that might have been a reason for management’s confidence boost. More importantly, pricing the deal in a low interest rate environment could make this transaction even more profitable once rates start rising. The deal announced by Pru and GM involves the purchase by the auto maker of what in life insurance is known as a group annuity contract, an arrangement whereby a life insurer gets a big check up front in return for which it agrees to assume the monthly pension obligations of a corporate pension plan sponsor. These contracts are not new; group annuities have been sold by life insurers forever. What makes the Pru/GM deal so noteworthy, however, are two things. First, the transaction is enormous. AON, the insurance and benefits broker, said in a statement posted to its website on Friday that the size of the transaction alone made it unique in the history of pensions. Not since the 1980s has a pension transaction exceeded $1 billion, AON noted, adding that since then the entire pension-closeout market has amounted to only $1 billion over the course of an entire year. The GM transaction involves $29 billion of pension obligations. Second, the transaction was widely regarded by pension experts as something that could not be done. That’s because low interest rates have cut so deeply into life insurers’ investment returns that carriers have had no choice but to raise group-annuity pricing sharply, choking off demand. Those same low rates, by increasing the present value of companies’ pension obligations, have also increased pension plans’ underfundedness. Skeptics, calling that a hole that companies would have to plug before handing off their pension plans to life insurers, have argued that corporate treasurers would be loathe to make such big up-front payments. Nonetheless, despite the obstacles, interest in the type of deal announced by Prudential and GM Friday has been intensifying. And that’s been happening at least two reasons. One is the extraordinary volatility in the stock market and the bond market that has sent the value of pension assets gyrating. Relatively new accounting rules have required U.S. corporations to reflect this volatility in their balance sheets. In a call with analysts on Friday to go over the Pru deal, GM’s CFO, Dan Ammann, specifically cited balance-sheet and earnings volatility as one of the main reasons that the car company chose to rid itself of its pension obligations. The other issue causing companies to at least think of doing deals similar to the one announced by Pru and GM: major improvements in lifespans. Advances in medicine, especially in the areas of cancer and cardiac care, have led to huge improvements in longevity. These improvements, as much as 1 % to 2 % per year, according to experts in the area with whom we spoke over the weekend, have surprised even the most bullish students of the topic and have created additional significant balance sheet and earnings problems for companies, such as GM, that have old-fashioned, traditional defined-benefit plans. That’s because, under the accounting rules, every time it becomes apparent that a group of employees enrolled in a defined-benefit pension plan is going to live materially longer than the plan sponsor imagined—and that these individuals therefore will be receiving pension checks longer than the sponsor forecast— the sponsor has to post an additional pension liability on its balance sheet and record a hit to earnings. It should come as no surprise, then, that for many people involved in this corner of the pension world known as “pension closeouts,” the question is not whether the deal announced by Pru and GM is a harbinger of more deals to come but when these deals will be annnounced. It’s hard to say just how many companies are positioned similarly to GM—willing to take an upfront $3 billion earnings hit in addition to paying as much as $29 billion to Prudential in order to get out from under its pension obligation and the associated balance-sheet and earnings volatility. To us, however, one thing seems certain: The Pru/GM deal will generate many questions in the minds of investors. And that’s why we thought it would be helpful to provide (see below) a list of these questions and our answers to them, along with the specific financial impact that we expect the GM deal will have on Prudential’s financial results. How exactly will the Pru/GM deal work? Under the deal announced jointly by Pru and GM, roughly 42,000 of GM’s 118,000 salaried retirees will be given the choice of receiving a lump-sum pension payment from GM or continuing to receive the same monthly pension check they have been receiving, only the check will no longer be paid by GM but instead will start coming out of Prudential’s pocket on January 1. The remaining 76,000 salaried retirees (118,000 minus 42,000) will have their monthly pension obligation also shifted to Prudential beginning January 1. In return for agreeing to assume these obligations, Prudential will receive a check from GM for somewhere between $18 billion and $29 billion, with the final number being a function of how many of the 42,000 choose the lump sum from GM as opposed to moving over to Prudential. Whatever the final amount, Pru and GM have agreed that it will set equal to 110 % of what the two companies say is the present value of the pension obligations Pru will be assuming. The 10 % premium represents compensation to Prudential for the risk that its projections of future investment returns and U.S. lifespans could prove wrong. 2

- 3. June 4, 2012 Prudential Financial, Inc. Why is the Pru/GM deal happening now? It’s happening now (as opposed to at another time) because more than ever GM wants to be in the car- and truck-building business only, and out of being in what its CFO, Mr. Ammann, called on Friday the “pension business.” That business, as shown in the exhibit below from GM’s conference call with analysts on Friday, has experienced wide swings in the funding status of GM’s pension plan. The plan has gone from being handily overfunded to badly underfunded and back to overfunded again. These swings in “fundedness” have produced significant volatility in GM’s book value, since for several years the funded status of defined-benefit pension plans has appeared on U.S. companies’ balance sheets. GM said on Friday that it expected to record a second-half expense of $3 billion and that it expected its earnings to be lower by $200 million annually as a result of doing the deal with Pru. But it said that it would go forward anyway in order to put the issue pension-related volatility permanently behind the company. Exhibit 1: GM’s Pension Plan “Fundedness” Has Been Volatile Source: Company presentation How will Pru make money off this deal? While the GM transaction is enormous, the economics, i.e., the way in which Pru hopes to make money off of the deal, is no different from any other life insurance transaction. It’s a spread business. Specifically, Pru will immediately put the money it receives from GM to work in the bond market. It fully anticipates earning over the course of time a spread over the rate of interest that was used to discount GM’s pension obligations (we believe that number is 4%). In addition, Pru is hoping to earn longevity-related spread, that is, profit stemming from the fact that GM’s retirees may not live as long as the presumably conservative lifespan assumptions that Pru used in pricing the GM deal. Finally, Pru is probably anticipating generating expense-related spread. This is the profit that a life insurance company earns by being able to administer a block of business at a lower cost than the expenses it built into its pricing proposal. Does the GM deal represent good business for Pru? Probably, although we won’t know for certain for literally decades, when the last retiree in the GM retiree group has died. At that point, Prudential will be able to look back and have a complete picture of how the GM business performed. Still, it’s probable that the GM transaction will end up being a good use of Prudential’s capital and management time. Here’s why: A Natural Hedge to Its Mortality Risk. Prudential has written millions of individual life insurance policies over many decades. The risk to Pru on these policies is mortality risk, i.e., the risk that large numbers of these life insurance policyholders die young. The risk from the GM deal is that retirees live too longexactly the opposite of the risk that Pru is facing in its life business. Therefore, investors can think of the GM deal, as well as further deals like the GM transaction that we expect Pru to do, as a natural hedge of Pru’s flagship mortality business. A Less Risky Business than Life Insurance. The experts we spoke with over the weekend said that longevity deals such as the one Pru struck with GM are on balance also less risky than life insurance since such deals are less likely than life transactions to produce catastrophic losses. 3

- 4. June 4, 2012 Prudential Financial, Inc. If GM’s retirees live longer than Pru contemplated, that development would make the GM business less profitable than Pru imagined. But it probably wouldn’t cause large losses for Pru. It would simply erode returns from the deal slowly and over time. Contrast this to a traditional life insurance business in which events such as global diseasea flu, AIDS, or any pandemiccould bankrupt a life insurer that lets its guard down by not having good medical underwriting. There’s just less volatility in the results of longevity business than in mortality business. Why is Pru able to handle the risk better than GM? Part of the answer is specialization: By doing the deal with Pru, GM is in effect saying that Pru is probably better at managing a portfolio of fixed-income assets to retire a bunch of lifespan-linked liabilities than GM is. GM, in short, is trying to stick to its knitting and let Pru do what it does best: manage money and figure out how long people are going to live. On the other hand, there are important accounting considerations that are also part of the story. GM, like all publicly traded companies, is subject to U.S. Generally Accepted Accounting Principles, or GAAP, for pension obligations. These accounting rules not only have companies record the extent of their pension plans’ underfundedness on their balance sheets, but they also generate big benefits to and hits to earnings depending on swings in plan asset values. Put simply, the resulting balance-sheet and earnings volatility from running a corporate pension plan can be enormous. Prudential, by comparison, doesn’t face this same accounting-driven volatility, at least not when it sells a group annuity contract to take over a company’s pension plan. Pru uses insurance accounting to record that group annuity’s results. And while under this accounting the assets that Pru will receive from its pension-plan customers will get marked to market, most analysts tend to ignore these “marks” in their analysis of Pru. Moreover, the liability that Pru sets up when it sells a group annuity does not move around nearly as much under insurance accounting as that liability moves when it is on an industrial company’s balance sheet as a pension liability. Call it accounting arbitrage. It’s one more reason, in our view, that GM was willing to stomach a huge loss and to pay a 10 % premium to Pru to get part of GM’s retire pension obligation to go away. What is Prudential’s biggest risk? Experts in the pensions area with whom we spoke over the weekend said that by far the No. 1 risk Prudential is taking in the GM deal is longevity risk, i.e., the risk that GM’s salaried retirees will live longer than Prudential contemplated when it priced the deal. That’s because Pru is agreeing to pay these retirees a monthly check for the remainder of the retirees’ lives. If they live longer than Pru forecast, that negative surprise from the company’s perspective will cut into the company’s profit on the GM transaction. The pension experts we spoke with told us that without question Pru assumed in negotiating terms with GM that lifespans of the retirees will continue to improve. So all else being the same, for Pru to achieve its targeted ROE, which we’re estimating is 13%, the improvement in lifespans will need to be equal to or less than what Pru forecast. But if lifespans expand faster than Pru forecast, Pru will take a hit. But if Pru has been such a dominant player in life insurance, doesn’t it naturally follow that Pru understands longevity trends? Not necessarily. For one thing, life insurance companies get the benefit of medically underwritinggetting the medical records of each person who applies for life insurance coverage. With detailed information on that person’s health, life insurers can make an informed judgment as to how much to charge. Not the case for liftetime annuities or for longevity deals like the one Pru entered into with GM: There’s generally no medical underwriting. Pru likely was given some demographic information about the GM retirees whose lifetime income Pru will now be providing. But Pru certainly didn’t get a chance to send out a paramedic to do a physical exam on these individuals, something it would most likely do if it were writing a large life insurance policy on any one of these individual’s lives. Bottom line: Pru certainly is not as familiar with the medical condition and therefore the expected life span of these retirees as would be the case if it were underwriting them for life insurance. What other risks is Prudential taking? In addition to taking longevity risk, Pru is likely taking some interest-rate risk. That’s because it is probable that the duration of some of the liabilities Pru is adding to its balance sheet through the GM deal will exceed the duration of the assets that Pru is able to invest in to retire these liabilities. But Pru will almost assuredly overlay, on top of these investments, a derivative strategy to in effect lock in reinvestment rates on bonds coupons it receives. This will reduce but not eliminate any rate risk that Pru faces. And Pru will face basis riskthe risk that any mortality-related losses on the GM deal won’t be fully offset by mortality-related gains in its life business. The average age of Pru’s life insurance policyholders is probably somewhere between 35 and 45. The average age of the retirees from GM is probably around 65. So it’s quite possible that any errors Pru suffers on the life insurance side of its 4

- 5. June 4, 2012 Prudential Financial, Inc. business will not be fully offset on the longevity side. Errors in predicting death rates in one age cohort don’t necessary appear as offsetting benefits in another cohort. What about credit risk? Won’t there be that, too? Absolutely. The more than $20 billion that Pru will likely be receiving from GM will be invested in the company’s general investment portfolio, known as the general account. That portfolio has a heavy component of corporate bonds, both public and private placement. So, to the extent that Prudential is not hedging these bonds through the use of, say, credit-default swaps, Prudential will face credit risk. As in any other deal of this type, Pru is assuming a certain level of credit losses on the bonds it plans to invest in with proceeds from the GM deal. Any losses in excess of that level would erode Pru’s profit margin on the transaction. Does the Pru/GM deal represent a one-off transaction, or should investors expect more deals like it and for Prudential to be at the center of them? We think more deals are coming. Maybe not immediately. And maybe the next deal won’t be as large as the GM deal announced on Friday. But we wouldn’t be surprised to see big, similarly structured deals reach the market in coming quarters, including at GM, where Mr. Ammann told the analysts Friday, “We see additional opportunities down the road.” That may have been a reference to plans to offload the company’s unionized employee pension plan, which actually would be a bigger deal than the one GM announced on Friday. Prudential executives, meanwhile, have said repeatedly, including at the company’s recent investor day, that the company is homing in on the pension-closeout market as a key growth area for the company in coming years. At a minimum, we would expect that CFOs across America will be looking at the GM/Prudential partnership to see if a similar deal now makes sense for their companies. On the other hand, it’s important to note that there were unusual, if not unique, circumstances in GM’s case that led the auto maker to Prudential. GM had an enormous pension obligation relative to its market capitalization, it is going through a restructuring in which it is trying to focus exclusively on its core auto- and truck-building business, and the plan that GM chose to defease in partnership with Prudential was very well funded (92 %). GM, in short, didn’t have to plug a big pension hole before offloading the white-collar pension obligation to Prudential. Having said that, we still think more deals like the Pru/GM transaction are coming and that Pru will likely be involved with many of them, although such transactions take months to negotiate and therefore might not come immediately. Moreover, to the extent that other global players in the pensions business, such as MetLife, have expressed an interest to move heavily into the pension-closeout area, returns on the business could erode, causing Pru to not be as aggressive in pursuing future business. One thing is for sure: Prudential wants to do more transactions similar to the deal it announced with GM. Pru’s management made this exact point during the company’s investor day the week before last in New York. And by doing the huge GM deal as well as a series of similar but smaller deals in the last 18 months, including reinsuring some longevity risk from a U.K.-based affiliate of Goldman Sachs & Company, Prudential has made it clear to the marketplace its interest in pursuing these types of transactions. With the GM deal notched on its belt, Prudential clearly has a lead in them. Our take on how the GM deal will affect Pru’s financial statements As a result of the transaction that Pru announced with GM, we are raising our 2013 EPS estimate for Pru from $7.81 to $8.00. The new figure is now 25 cents above the $7.75 consensus estimate. At the same time, we are raising our projection for the ROE that we believe Prudential will be able to achieve by the end of next year. Having thought that this number would come in at 13.1 %, we now believe Pru will be able to post a 13.3 % ROE by 2013’s fourth quarter. The changes, simply put, involved our adding additional earnings into our forecast for Pru’s profits for 2013 stemming from the GM deal, without much in the way of reduction in share buyback. Pru said at its investor day the week before last that it expected between dividends, acquisitions, organic growth such as the GM deal, and share buybacksto deploy $3 billion in capital over the four quarters beginning with 3Q12. Our analysis of the GM deal leads us to conclude it will absorb about $1.2 billion in capital, leaving Prudential with the same roughly $250 million a quarter in share repurchase that we had been forecasting. Accordingly, in order to account for the GM deal, all we had to do in order to adjust our earnings model was to add in the expected earnings from the deal, which we peg at roughly $25 million after tax per quarter. 5

- 6. June 4, 2012 Prudential Financial, Inc. Exhibit 2: Assumed Capital Deployment ($ mn) Capital available to deploy over 4 quarters $3,000 Less: Capital used for dividends $884 Less: Capital used for buybacks (3Q12 - 2Q13) 940 Less: Capital used to back GM deal 1,176 Capital surplus/(shortage) $0 Source: PRU 2012 investor day; RBC Capital Markets Research We understand that the ultimate impact of the GM deal on Pru’s earnings and ROE will depend on exactly how much capital the Newark-based company gets to put to work, which in turn is a function of how many of GM’s 118,000 salaried retirees ultimately see their pension payments shifted over to Pru. The impact will also depend on what level of return Pru can ultimately earn on the GM business. We have assumed a 13 % ROE. The table below provides sensitivity analysis that we hope investors will find interesting and helpful. Along the vertical axis, we show different “take” rates: our term for the percentage of the 42,000 GM retirees who are eligible for a lump sum from GM but who instead choose to go with Prudential. Along the horizontal axis, we show different levels of assumed incremental return above the 5 % that we assume Prudential is currently earning on its capital. And in the body of the table we show the various ROE’s that Prudential would post by 2013 year-end under different take- rate/incremental return scenarios. The story is an encouraging one: Under virtually every scenario we looked at, Pru came out posting a 13% ROE. Exhibit 3: 2013 ROE Sensitivity Analysis for Prudential Based on Different Assumptions for the GM Deal Pickup in Returns 5% 6% 7% 8% 9% 10% 11% 12% 20% 13.26% 13.29% 13.32% 13.35% 13.38% 13.42% 13.45% 13.48% 30% 13.24% 13.28% 13.31% 13.34% 13.37% 13.41% 13.44% 13.47% 40% 13.23% 13.26% 13.30% 13.33% 13.37% 13.40% 13.43% 13.47% Take Rate 50% 13.21% 13.25% 13.28% 13.32% 13.36% 13.39% 13.43% 13.46% 60% 13.20% 13.24% 13.27% 13.31% 13.35% 13.38% 13.42% 13.46% 70% 13.18% 13.22% 13.26% 13.30% 13.34% 13.38% 13.41% 13.45% 80% 13.17% 13.21% 13.25% 13.29% 13.33% 13.37% 13.41% 13.45% 90% 13.15% 13.19% 13.24% 13.28% 13.32% 13.36% 13.40% 13.44% 100% 13.14% 13.18% 13.22% 13.27% 13.31% 13.35% 13.40% 13.44% Source: Company reports, RBC Capital Markets analysis 6

- 7. June 4, 2012 Prudential Financial, Inc. Valuation We arrive at our $79 price target by assigning a weight to the price targets based on our approaches to valuation. • Our residual income model yielded an intrinsic value one year from now of $96. For the residual income model, we are calculating a cost of equity using a beta of 1.66, an equity risk premium of 4%, and a 10-year Treasury yield of 2.5%. Our five-year earnings compounded annual earnings growth rate is 16%. We are assuming a long-term payout ratio of 25%. • Our regression-based approach resulted in a price target of $62. Our price target is based on a next 12 months ROE of 12.6%, a book value per share excluding AOCI of $55.85, and the following regression equation: Implied P/BV excluding AOCI = 7.8405 x ROE + 0.0307. We grew the resulting price target by the cost of equity of 9.5% to obtain a one-year price target of $62. Our weighted average price target is $79. We have assigned a weight of 50% to the price target obtained using the residual income model and a weight of 50% to the price target obtained using the regression analysis. Price Target Impediment There are several factors that could impede the company's ability to meet our price target: • Prolonged low interest rates and currency volatility could be a risk to earnings. • Ineffective hedging of variable annuity guarantees. • Potential integration risks associated with recent Star and Edison acquisitions. Company Description Prudential Financial, Inc. and its subsidiaries provide a wide range of insurance, investment management, and other financial products and services to both individual and institutional customers throughout the United States and in many other countries. Principal products and services provided include life insurance, annuities, retirement-related services, mutual funds, investment management, and real estate services. The company has organized its principal operations into the Financial Services Businesses and the Closed Block Business. The Financial Services Businesses operate through three operating divisions: U.S. Retirement Solutions and Investment Management, U.S. Individual Life and Group Insurance, and International Insurance. The company’s real estate and relocation services business as well as businesses that are immaterial to overall earnings are included in Corporate and Other operations within the Financial Services Businesses. The Closed Block Business is managed separately from the Financial Services Businesses and was established on the date of demutualization. It includes Prudential’s in force participating insurance and annuity products and assets that are used for the payment of benefits and policyholders’ dividends on these products, as well as other assets and equity that support these products and related liabilities. 7

- 8. June 4, 2012 Prudential Financial, Inc. ($ in millions) 2012 2013 Earnings Model - Prudential Financial, Inc. 1QA 2QE 3QE 4QE 1QE 2QE 3QE 4QE 2010A 2011A 2012E 2013E Pre-tax adjusted operating income (loss) by division US Retirement Solutions and Investment Mgmt Division $698 $533 $551 $569 $606 $625 $645 $666 $2,002 $1,915 $2,350 $2,542 US Individual Life and Group Insurance Division 74 165 162 168 182 185 181 188 694 687 569 736 International Insurance Division $606 $678 $696 $715 $730 $759 $789 $820 $1,915 $2,383 $2,695 $3,097 Corporate and Other operations ($363) ($341) ($347) ($354) ($358) ($361) ($368) ($375) ($949) ($1,139) ($1,405) ($1,462) Total pre-tax adjusted operating income $1,015 $1,036 $1,061 $1,097 $1,160 $1,207 $1,247 $1,299 $3,662 $3,846 $4,210 $4,914 Income taxes, applicable to adjusted operating income 274 287 294 304 321 334 345 360 961 994 1,159 1,361 Financial Services Businesses after tax adjusted op. inc. $741 $749 $767 $793 $862 $896 $925 $963 $2,701 $2,852 $3,051 $3,647 Effective tax rate 27.0% 27.7% 27.7% 27.7% 27.7% 27.7% 27.7% 27.7% 26.2% 25.8% 27.5% 27.7% Adjustments to operating income $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 Direct equity adjustments for EPS calculation $8 $5 $5 $5 $6 $6 $6 $6 $36 $24 $23 $23 Earnings related to interest, net of tax, on exchangeable surplus notes 4 4 4 4 4 4 4 4 17 17 16 16 Earnings allocated to participating unvested share-based payment awards 8 8 8 8 8 8 8 8 35 38 32 32 Weighted diluted average shares outstanding 477.5 473.3 469.5 465.7 462.0 458.4 454.6 450.9 474.1 488.8 471.5 456.5 Share repurchases as % of weighted diluted avg. shares outstanding 0.00% 0.88% 0.82% 0.81% 0.80% 0.79% 0.83% 0.82% 0.00% 0.00% 2.50% 3.24% Per share information Diluted operating EPS $1.56 $1.58 $1.64 $1.71 $1.87 $1.96 $2.04 $2.14 $5.74 $5.84 $6.49 $8.00 Growth in operating EPS (12.8%) 1.6% 3.3% 4.2% 9.6% 4.8% 4.0% 4.9% 5.2% 1.9% 11.0% 23.4% Dividends per share 0.00 0.00 0.00 1.75 0.00 0.00 0.00 2.15 $1.15 $1.45 $1.75 $2.15 Diluted BV per share, excl. AOCI $55.85 $57.41 $59.03 $59.01 $60.85 $62.79 $64.82 $64.84 $52.01 $58.02 $59.01 $64.84 Operating ROE 11.1% 11.3% 11.4% 11.7% 12.6% 12.8% 12.9% 13.3% 10.9% 10.8% 11.2% 13.1% Share count roll forward Basic weighted avg. common shr - beginning balance - 469.2 465.0 461.2 457.4 453.7 450.1 446.3 348.9 451.9 Treasury stock, net - (4.2) (3.8) (3.8) (3.7) (3.6) (3.8) (3.7) (2.9) (3.7) Newly issued shares - - - - - - - - - - Weighted average common shares outstanding - ending balance 469.2 465.0 461.2 457.4 453.7 450.1 446.3 442.6 466.8 480.3 463.2 448.2 Diluted weighted avg. common shr - beginning balance - 477.5 473.3 469.5 465.7 462.0 458.4 454.6 355.1 460.2 Treasury stock, net - (4.2) (3.8) (3.8) (3.7) (3.6) (3.8) (3.7) (2.9) (3.7) Newly issued shares - - - - - - - - - - Diluted weighted average common shares outstanding - ending balance 477.5 473.3 469.5 465.7 462.0 458.4 454.6 450.9 474.1 488.8 471.5 456.5 Previous period's diluted ending shares - 473.3 469.1 465.3 461.5 457.8 454.2 450.4 351.9 456.0 Treasury stock, net - (4.2) (3.8) (3.8) (3.7) (3.6) (3.8) (3.7) (2.9) (3.7) Newly issued shares - - - - - - - - - - Ending number of diluted shares at the end of period 473.3 469.1 465.3 461.5 457.8 454.2 450.4 446.7 476.4 485.1 467.3 452.3 Assumed dilution - 8.3 8.3 8.3 8.3 8.3 8.3 8.3 7.3 8.4 8.3 8.3 Share buybacks and issuances Assumed share price $0.00 $60.00 $61.20 $62.42 $63.67 $64.95 $66.24 $67.57 - - 61.2 65.6 Sequential increase in Prudential's share price 0% 2% 2% 2% 2% 2% 2% 2% - - 0.0% 7.2% Funds allocated to repurchases ($ in million) $0 $250 $235 $235 $235 $235 $250 $250 - $0 $720 $970 Assumed share price 0.00 60.00 61.20 62.42 63.67 64.95 66.24 67.57 - - 61.21 65.61 Shares repurchased in the period (million shares) - 4.17 3.84 3.77 3.69 3.62 3.77 3.70 - - 11.8 14.8 Number of shares issued (million shares) - - - - - - - - - - - - Assumed Share price $0.00 $60.00 $61.20 $62.42 $63.67 $64.95 $66.24 $67.57 $0.00 $0.00 $61.21 $65.61 Gross proceeds from issuance ($ in million) - - - - - - - - - - - - Attributed equity (for ROE calculation) Including accumulated other comprehensive income $33,509 $34,008 $34,540 $34,305 $34,933 $35,594 $36,269 $36,039 $28,310 $32,817 $34,305 $36,039 Excl. AOCI relating to gains/losses on investment & postretirement benefits n/a n/a n/a n/a n/a n/a n/a n/a n/a n/a n/a n/a Excluding total accumulated other comprehensive income 26,436 26,935 27,467 27,232 27,860 28,521 29,196 28,966 25,571 27,567 27,232 28,966 Other items affecting capital account during the period Operating earnings for the period $741 $749 $767 $793 $862 $896 $925 $963 $2,701 $2,852 $3,051 $3,647 Dividends declared - - - 793 - - - 943 539 691 803 955 Share buybacks during the period ($ in million) - 250 235 235 235 235 250 250 - - 720 970 Share issuance during the period ($ in million) - - - - - - - - - - - - Other metrics Operating ROE as reported per supplement n/a n/a n/a n/a n/a n/a n/a n/a n/m n/m n/m n/m Operating ROE based on attributed equity ex. AOCI 11.10% 11.30% 11.36% 11.68% 12.61% 12.80% 12.90% 13.32% 10.88% 10.82% 11.22% 13.06% Diluted book value per share including AOCI $70.80 $72.49 $74.23 $74.33 $76.30 $78.36 $80.52 $80.67 $57.58 $69.07 $74.33 $80.67 Diluted book value excl. AOCI relating to losses on inv. & postretirement benefits n/a n/a n/a n/a n/a n/a n/a n/a n/a n/a n/a n/a Diluted book value per share excluding AOCI 55.85 57.41 59.03 59.01 60.85 62.79 64.82 64.84 52.01 58.02 59.01 64.84 Leverage ratio calculation Capital debt (see pg. 9/10 of supplement) $10,692 $10,692 $10,692 $10,692 $10,692 $10,692 $10,692 $10,692 $8,763 $11,224 $10,692 $10,692 Junior subordinated debt (hybrid) 1,519 1,519 1,519 1,519 1,519 1,519 1,519 1,519 1,519 1,519 1,519 1,519 Capital debt excluding hybrid 9,173 9,173 9,173 9,173 9,173 9,173 9,173 9,173 7,244 9,705 9,173 9,173 Debt used for calculating leverage 10,312 10,312 10,312 10,312 10,312 10,312 10,312 10,312 7,624 10,844 10,312 10,312 Stockholders' equity 26,436 26,935 27,467 27,232 27,860 28,521 29,196 28,966 25,571 27,567 27,232 28,966 Total capital 37,128 37,627 38,159 37,924 38,552 39,213 39,888 39,658 34,334 38,791 37,924 39,658 Leverage ratio 27.8% 27.4% 27.0% 27.2% 26.7% 26.3% 25.9% 26.0% 22.2% 28.0% 27.2% 26.0% Equity treatment of hybrid 25% 25% 25% 25% 25% 25% 25% 25% 75% 25% 25% 25% RBC score - Prudential Insurance Co of America n/a n/a n/a n/a n/a n/a n/a n/a 533.0% n/a n/a n/a Source: Financial Supplements; RBC Capital Markets 8

- 9. June 4, 2012 Prudential Financial, Inc. Required Disclosures Conflicts Disclosures The analyst(s) responsible for preparing this research report received compensation that is based upon various factors, including total revenues of the member companies of RBC Capital Markets and its affiliates, a portion of which are or have been generated by investment banking activities of the member companies of RBC Capital Markets and its affiliates. RBC Capital Markets, LLC makes a market in the securities of Prudential Financial, Inc. and may act as principal with regard to sales or purchases of this security. A member company of RBC Capital Markets or one of its affiliates received compensation for products or services other than investment banking services from Prudential Financial, Inc. during the past 12 months. During this time, a member company of RBC Capital Markets or one of its affiliates provided non-investment banking securities-related services to Prudential Financial, Inc.. A member company of RBC Capital Markets or one of its affiliates received compensation for products or services other than investment banking services from Prudential Financial, Inc. during the past 12 months. During this time, a member company of RBC Capital Markets or one of its affiliates provided non-securities services to Prudential Financial, Inc.. RBC Capital Markets is currently providing Prudential Financial, Inc. with non-investment banking securities-related services. RBC Capital Markets has provided Prudential Financial, Inc. with non-investment banking securities-related services in the past 12 months. RBC Capital Markets has provided Prudential Financial, Inc. with non-securities services in the past 12 months. The author is employed by RBC Capital Markets, LLC, a securities broker-dealer with principal offices located in New York, USA. Explanation of RBC Capital Markets Equity Rating System An analyst's 'sector' is the universe of companies for which the analyst provides research coverage. Accordingly, the rating assigned to a particular stock represents solely the analyst's view of how that stock will perform over the next 12 months relative to the analyst's sector average. Ratings Top Pick (TP): Represents analyst's best idea in the sector; expected to provide significant absolute total return over 12 months with a favorable risk-reward ratio. Outperform (O): Expected to materially outperform sector average over 12 months. Sector Perform (SP): Returns expected to be in line with sector average over 12 months. Underperform (U): Returns expected to be materially below sector average over 12 months. Risk Qualifiers (any of the following criteria may be present): Average Risk (Avg): Volatility and risk expected to be comparable to sector; average revenue and earnings predictability; no significant cash flow/financing concerns over coming 12-24 months; fairly liquid. Above Average Risk (AA): Volatility and risk expected to be above sector; below average revenue and earnings predictability; may not be suitable for a significant class of individual equity investors; may have negative cash flow; low market cap or float. Speculative (Spec): Risk consistent with venture capital; low public float; potential balance sheet concerns; risk of being delisted. Distribution of Ratings For the purpose of ratings distributions, regulatory rules require member firms to assign ratings to one of three rating categories - Buy, Hold/Neutral, or Sell - regardless of a firm's own rating categories. Although RBC Capital Markets' ratings of Top Pick/Outperform, Sector Perform and Underperform most closely correspond to Buy, Hold/Neutral and Sell, respectively, the meanings are not the same because our ratings are determined on a relative basis (as described above). Distribution of Ratings RBC Capital Markets, Equity Research Investment Banking Serv./Past 12 Mos. Rating Count Percent Count Percent BUY[TP/O] 777 51.94 221 28.44 HOLD[SP] 652 43.58 161 24.69 SELL[U] 67 4.48 2 2.99 9

- 10. June 4, 2012 Prudential Financial, Inc. Rating and Price Target History for: Prudential Financial, Inc. as of 06-01-2012 (in USD) 09/27/11 11/03/11 11/11/11 02/21/12 05/03/12 I:OP:73 OP:78 OP:73 OP:80 OP:77 70 60 50 40 30 20 Q1 Q2 Q3 Q1 Q2 Q3 Q1 Q2 Q3 Q1 Q2 2010 2011 2012 Legend: TP: Top Pick; O: Outperform; SP: Sector Perform; U: Underperform; I: Initiation of Research Coverage; D: Discontinuation of Research Coverage; NR: Not Rated; NA: Not Available; RL: Recommended List - RL: On: Refers to date a security was placed on a recommended list, while RL Off: Refers to date a security was removed from a recommended list. Created by BlueMatrix References to a Recommended List in the recommendation history chart may include one or more recommended lists or model portfolios maintained by a business unit of the Wealth Management Division of RBC Capital Markets, LLC. These Recommended Lists include a former list called the Prime Opportunity List (RL 3), the Guided Portfolio: Prime Income (RL 6), the Guided Portfolio: Large Cap (RL 7), Guided Portfolio: Dividend Growth (RL 8), the Guided Portfolio: Midcap 111 (RL9), and the Guided Portfolio: ADR (RL 10). The abbreviation 'RL On' means the date a security was placed on a Recommended List. The abbreviation 'RL Off' means the date a security was removed from a Recommended List. Conflicts Policy RBC Capital Markets Policy for Managing Conflicts of Interest in Relation to Investment Research is available from us on request. To access our current policy, clients should refer to https://www.rbccm.com/global/file-414164.pdf or send a request to RBC CM Research Publishing, P.O. Box 50, 200 Bay Street, Royal Bank Plaza, 29th Floor, South Tower, Toronto, Ontario M5J 2W7. We reserve the right to amend or supplement this policy at any time. Dissemination of Research and Short-Term Trade Ideas RBC Capital Markets endeavors to make all reasonable efforts to provide research simultaneously to all eligible clients, having regard to local time zones in overseas jurisdictions. RBC Capital Markets' research is posted to our proprietary websites to ensure eligible clients receive coverage initiations and changes in ratings, targets and opinions in a timely manner. Additional distribution may be done by the sales personnel via email, fax or regular mail. Clients may also receive our research via third-party vendors. Please contact your investment advisor or institutional salesperson for more information regarding RBC Capital Markets' research. RBC Capital Markets also provides eligible clients with access to SPARC on its proprietary INSIGHT website. SPARC contains market color and commentary, and may also contain Short-Term Trade Ideas regarding the securities of subject companies discussed in this or other research reports. SPARC may be accessed via the following hyperlink: https://www.rbcinsight.com. A Short-Term Trade Idea reflects the research analyst's directional view regarding the price of the security of a subject company in the coming days or weeks, based on market and trading events. A Short-Term Trade Idea may differ from the price targets and/or recommendations in our published research reports reflecting the research analyst's views of the longer-term (one year) prospects of the subject company, as a result of the differing time horizons, methodologies and/or other factors. Thus, it is possible that the security of a subject company that is considered a long-term 'Sector Perform' or even an 'Underperform' might be a short-term buying opportunity as a result of temporary selling pressure in the market; conversely, the security of a subject company that is rated a long-term 'Outperform' could be considered susceptible to a short-term downward price correction. Short-Term Trade Ideas are not ratings, nor are they part of any ratings system, and RBC Capital Markets generally does not intend, nor undertakes any obligation, to maintain or update Short-Term Trade Ideas. Short-Term Trade Ideas discussed in SPARC may not be suitable for all investors and have not been tailored to individual investor circumstances and objectives, and investors should make their own independent decisions regarding any Short-Term Trade Ideas discussed therein. Analyst Certification All of the views expressed in this report accurately reflect the personal views of the responsible analyst(s) about any and all of the subject securities or issuers. No part of the compensation of the responsible analyst(s) named herein is, or will be, directly or 10

- 11. June 4, 2012 Prudential Financial, Inc. indirectly, related to the specific recommendations or views expressed by the responsible analyst(s) in this report. Disclaimer RBC Capital Markets is the business name used by certain branches and subsidiaries of the Royal Bank of Canada, including RBC Dominion Securities Inc., RBC Capital Markets, LLC, RBC Europe Limited, RBC Capital Markets (Hong Kong) Limited, Royal Bank of Canada, Hong Kong Branch and Royal Bank of Canada, Sydney Branch. The information contained in this report has been compiled by RBC Capital Markets from sources believed to be reliable, but no representation or warranty, express or implied, is made by Royal Bank of Canada, RBC Capital Markets, its affiliates or any other person as to its accuracy, completeness or correctness. All opinions and estimates contained in this report constitute RBC Capital Markets' judgement as of the date of this report, are subject to change without notice and are provided in good faith but without legal responsibility. Nothing in this report constitutes legal, accounting or tax advice or individually tailored investment advice. This material is prepared for general circulation to clients and has been prepared without regard to the individual financial circumstances and objectives of persons who receive it. The investments or services contained in this report may not be suitable for you and it is recommended that you consult an independent investment advisor if you are in doubt about the suitability of such investments or services. This report is not an offer to sell or a solicitation of an offer to buy any securities. Past performance is not a guide to future performance, future returns are not guaranteed, and a loss of original capital may occur. RBC Capital Markets research analyst compensation is based in part on the overall profitability of RBC Capital Markets, which includes profits attributable to investment banking revenues. Every province in Canada, state in the U.S., and most countries throughout the world have their own laws regulating the types of securities and other investment products which may be offered to their residents, as well as the process for doing so. As a result, the securities discussed in this report may not be eligible for sale in some jurisdictions. RBC Capital Markets may be restricted from publishing research reports, from time to time, due to regulatory restrictions and/or internal compliance policies. If this is the case, the latest published research reports available to clients may not reflect recent material changes in the applicable industry and/or applicable subject companies. RBC Capital Markets research reports are current only as of the date set forth on the research reports. This report is not, and under no circumstances should be construed as, a solicitation to act as securities broker or dealer in any jurisdiction by any person or company that is not legally permitted to carry on the business of a securities broker or dealer in that jurisdiction. To the full extent permitted by law neither RBC Capital Markets nor any of its affiliates, nor any other person, accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or the information contained herein. No matter contained in this document may be reproduced or copied by any means without the prior consent of RBC Capital Markets. Additional information is available on request. To U.S. Residents: This publication has been approved by RBC Capital Markets, LLC (member FINRA, NYSE, SIPC), which is a U.S. registered broker-dealer and which accepts responsibility for this report and its dissemination in the United States. Any U.S. recipient of this report that is not a registered broker-dealer or a bank acting in a broker or dealer capacity and that wishes further information regarding, or to effect any transaction in, any of the securities discussed in this report, should contact and place orders with RBC Capital Markets, LLC. To Canadian Residents: This publication has been approved by RBC Dominion Securities Inc.(member IIROC). Any Canadian recipient of this report that is not a Designated Institution in Ontario, an Accredited Investor in British Columbia or Alberta or a Sophisticated Purchaser in Quebec (or similar permitted purchaser in any other province) and that wishes further information regarding, or to effect any transaction in, any of the securities discussed in this report should contact and place orders with RBC Dominion Securities Inc., which, without in any way limiting the foregoing, accepts responsibility for this report and its dissemination in Canada. To U.K. Residents: This publication has been approved by RBC Europe Limited ('RBCEL') which is authorized and regulated by Financial Services Authority ('FSA'), in connection with its distribution in the United Kingdom. This material is not for general distribution in the United Kingdom to retail clients, as defined under the rules of the FSA. However, targeted distribution may be made to selected retail clients of RBC and its affiliates. RBCEL accepts responsibility for this report and its dissemination in the United Kingdom. To Persons Receiving This Advice in Australia: This material has been distributed in Australia by Royal Bank of Canada - Sydney Branch (ABN 86 076 940 880, AFSL No. 246521). This material has been prepared for general circulation and does not take into account the objectives, financial situation or needs of any recipient. Accordingly, any recipient should, before acting on this material, consider the appropriateness of this material having regard to their objectives, financial situation and needs. If this material relates to the acquisition or possible acquisition of a particular financial product, a recipient in Australia should obtain any relevant disclosure document prepared in respect of that product and consider that document before making any decision about whether to acquire the product. To Hong Kong Residents: This publication is distributed in Hong Kong by RBC Investment Services (Asia) Limited, RBC Investment Management (Asia) Limited and RBC Capital Markets (Hong Kong) Limited, licensed corporations under the Securities and Futures Ordinance or, by the Royal Bank of Canada, Hong Kong Branch, a registered institution under the Securities and Futures Ordinance. This material has been prepared for general circulation and does not take into account the objectives, financial situation, or needs of any recipient. Hong Kong persons wishing to obtain further information on any of the securities mentioned in this publication should contact RBC Investment Services (Asia) Limited, RBC Investment Management (Asia) Limited, RBC Capital Markets (Hong Kong) Limited or Royal Bank of Canada, Hong Kong Branch at 17/Floor, Cheung Kong Center, 2 Queen's Road Central, Hong Kong (telephone number is 2848-1388). To Singapore Residents: This publication is distributed in Singapore by the Royal Bank of Canada, Singapore Branch and Royal Bank of Canada (Asia) Limited, registered entities granted offshore bank and merchant bank status by the Monetary Authority of Singapore, respectively. This material has been prepared for general circulation and does not take into account the objectives, financial situation, or needs of any recipient. You are advised to seek independent advice from a financial adviser before purchasing any product. If you do not obtain independent advice, you should consider whether the product is suitable for you. Past performance is not indicative of future performance. If you have any questions related to this publication, please contact the Royal Bank of Canada, Singapore Branch or Royal Bank of Canada (Asia) Limited. To Japanese Residents: Unless otherwise exempted by Japanese law, this publication is distributed in Japan by or through RBC Capital Markets (Japan) Ltd., a registered type one financial instruments firm and/or Royal Bank of Canada, Tokyo Branch, a licensed foreign bank. .® Registered trademark of Royal Bank of Canada. RBC Capital Markets is a trademark of Royal Bank of Canada. Used under license. Copyright © RBC Capital Markets, LLC 2012 - Member SIPC Copyright © RBC Dominion Securities Inc. 2012 - Member CIPF Copyright © RBC Europe Limited 2012 Copyright © Royal Bank of Canada 2012 All rights reserved 11