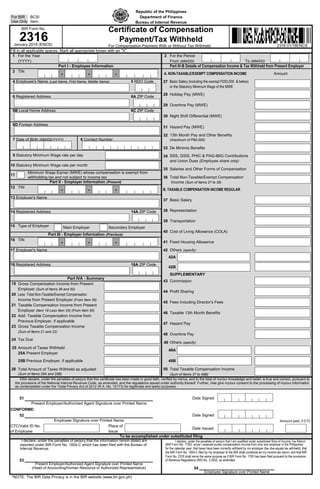

This document is a Certificate of Compensation Payment/Tax Withheld form from the Bureau of Internal Revenue of the Philippines. It collects information about an employee's compensation, including taxable and non-taxable amounts, taxes withheld by the employer, and declarations signed by both the employee and employer. Sections include information about the employee, present and previous employers, a summary of compensation and taxes, and details of compensation income and taxes withheld from the present employer.