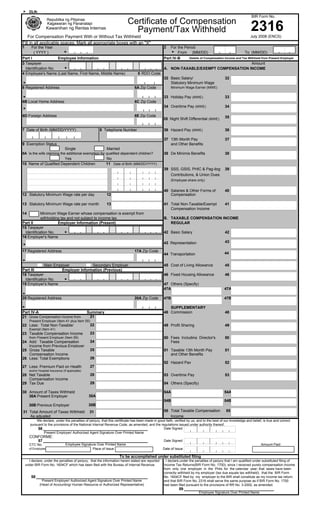

This document is an income tax form that provides details of an employee's compensation and tax withholdings from their employer. It includes sections for employee information, employer information for both present and previous employers, a summary of compensation income and taxes, and signatures from both the employer and employee to certify the accuracy of the reported information. The form captures both taxable and non-taxable components of the employee's compensation, calculates their tax liability and taxes withheld, and is used to file an individual's income tax return or serve as their tax return if under a substituted filing.