219389642 qantas-case-study

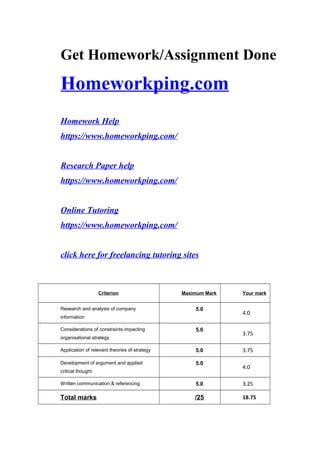

- 1. Get Homework/Assignment Done Homeworkping.com Homework Help https://www.homeworkping.com/ Research Paper help https://www.homeworkping.com/ Online Tutoring https://www.homeworkping.com/ click here for freelancing tutoring sites Criterion Maximum Mark Your mark Research and analysis of company information 5.0 4.0 Considerations of constraints impacting organisational strategy 5.0 3.75 Application of relevant theories of strategy 5.0 3.75 Development of argument and applied critical thought 5.0 4.0 Written communication & referencing 5.0 3.25 Total marks /25 18.75

- 2. MGMT20112 Assignment – 2 T213 Group 2 ii COMMENTS: Good research and lucidly argued. However, language was problematic in parts. See LSU before handing in a report. It could improve your mark. Please see individual comments. Very good work overall.

- 3. MGMT20112 Assignment – 2 T213 EXECUTIVE SUMMARY The report has discussesd and appliesd theoretical concepts and principles of strategic management into analyzing the environment context where to Qantas Airways Limited operates. It shows that, Qantas has a long history and sustainable development but needs to evolve in the global world. ization context, the company has to continue to participate in international activities to grab development opportunities. Besides that, the increasing competitive also challenges the corporation. In order to be successful and take competitive advantages, strategy is the key element for every enterprise including Qantas. By researching and applying strategy analysis theoretical into Qantas case study, its current strategies are outlined and reviewed and some others are suggested. It approves the roles of strategies in create competitive advantages through cost leadership, differentiation and focusing. . Group 2 iii

- 4. MGMT20112 Assignment – 2 T213 Table of contents EXECUTIVE SUMMARY.................................................................................................................iii Table of contents..................................................................................................................................iv Table of Figures....................................................................................................................................v 1.0. INTRODUCTION.........................................................................................................................1 1.1 Background...................................................................................................................................1 1.2 Aims..............................................................................................................................................1 Scope..................................................................................................................................................1 2.0. INTERNAL ANALYSIS...............................................................................................................2 3.0. EXTERNAL AND INDUSTRYIAL ANALYSIS........................................................................8 4.0. STRATEGY TO CREATE COMPETITIVE ADVANTAGE .........................................11 4.2.1. Tangible differentiation:.....................................................................................................13 4.2.2. Intangible differentiation: ...............................................................................................13 5.0. CONCLUSION AND RECOMMENDATION..........................................................................15 6.0. REFERENCES ........................................................................................................................16 7.0. APPENDIX ..............................................................................................................................18 Group 2 iv

- 5. MGMT20112 Assignment – 2 T213 Table of Figures Figure 1: Top 10 international airlines in Australia..........................................................................2 Figure 2: Qantas’s resources from 2008-2012 ................................................................................3 Figure 3: Qantas Airways ratio analysis.............................................................................................4 Figure 4: Qantas Share price from 2008-2012................................................................................5 Figure 5: Qantas strategic priorities ...............................................................................................6 Figure 6: Qantas’s expenditure in 2011-2012 .............................................................................11 Figure 7: Fuel cost of Qantas .......................................................................................................11 Group 2 v

- 6. MGMT20112 Assignment – 2 T213 1.0. INTRODUCTION 1.1 Background In the globalized and integrated world economy, enterprises have spread their operations into other countries and become multinational corporations. Qantas Airways Limited is the Australia's oldest and largest airline also takes part in international activities very early since 1935. The international operations create for the group a great opportunity to expand and grow but also challenge Qantas Airways with inherent risks and competitions in international market. In order to sustainably develop and remain the largest airways not only in Australia but also in the world, the Group should implement strategies to create comparative advantaged. 1.2 Aims - To analyse the company’s information; - To analyse the internal and external context where the corporation operating; - To analyse the resources and capacities of Qantas Airways Limited; - To analyse and discuss strategies the corporation using and recommendation to improve them. Scope Data and information are mainly collected from CQU online module, databases, academic articles, the corporation’s website and textbooks. The report is based on the operations of Qantas Airways in five recently years and focus on two recent years. Group 2 1

- 7. MGMT20112 Assignment – 2 T213 2.0. INTERNAL ANALYSIS 2.1. Qantas Airways Limited Qantas is Australia’s largest airline and the second oldest airline in the world carrying billions passengers in more than 20 countries such as Australia, Asia, North and South America, New Zealand, Africa and Europe. Qantas Group is one of the strongest brands in Australia. The Group's main operation is the transportation of customers in two complementary airline brands - Qantas and Jetstar (low cost carrier). The Group's broad portfolio of subsidiary businesses ranges from Qantas Freight Enterprises to Qantas Frequent Flyer. Qantas has strong network all over the world. Founding member of oneworld alliance, until now Qantas has 27 bilateral partners extending the network and offer passengers a global network. In 2012, Qantas carries a 44.6% shares of the Australian domestic market and 18% of all passengers travelling in and out of Australia while the respective market segments for Jetstar are 20,7% and 8%. The chart below compares the top 10 international airlines. Figure 1: Top 10 international airlines in Australia (Source: ANNA- Airlines Network News and Analysis, 2010) Group 2 2

- 8. MGMT20112 Assignment – 2 T213 2.2. Resources and capabilities - Tangible resources: Establisheding in 1920, Qantas Group has grown gradually and remain one of the largest and strongest in Australian airways industry. During the last 5 recently years, Qantas has steadily expanded its operations by increasing number of aircrafts, passengers, employees and destinations all over the world. Its development can be demonstrated as data below: Figure 2: Qantas’s resources from 2008-2012 Qantas Airways Unit 2008 2009 2010 2011 2012 Number of employees (at year end) 33,670 33,966 32,489 33,169 33,584 Number of destinations (including Jetstar) 146 151 184 201 233 Number of passengers ‘000 38,621 38,438 41,428 44,456 46,708 Number of aircraft (at year end) 224 229 254 283 308 Total asset $M 19,700 20,049 19,910 20,858 21,178 (Adopted from Qantas data book 2012, see Appendix) Qantas’s total asset increased from $19.7 billion in 2008 to $21.1 billion in 2012. More than half of its assets are from property, plant and equipment which book value at $14.13m at the end of FY2012. Intangible assets values at $610,000. At the end of FY2012, the corporation had a cash balance of $3.4 billion, and 308 aircrafts from three main suppliers Airbus, Boeing and Bombardiers. The Group has 12 Airbus A380, 30 Airbus A330, 60 Boeing B737, 36 Boeing B747 and 46 Bombardiers. - Intangible resources: Qantas has a strong reputation for long history with a huge number of customers, larger segment in the Australian market. Qantas is the world’s second oldest airline and since its inception, Qantas has remained one of the largest and strongest brands in Australia. Qantas Frequent Flyer has grown steadily growth, more than 750,000 new members joining the frequent program during 2012. And increase the total member to 8.6 million. (Qantas data book 2012). Many Australians regard Qantas Airways Limited as a national icon and pride of Australia. Another intangible resource of Qantas is its networks with large corporations. Qantas started the Oneworld Alliance with American Airlines, British Airways, Canadian Airlines and Group 2 3

- 9. MGMT20112 Assignment – 2 T213 Cathay Pacific in 1998, and with Finnair and Iberia one year later. Oneworld is an arrangement among airlines to share departure lounges, frequent flyer points and joint booking of flights for travellers to go wherever they want. (Dallas, H 2010). Qantas frequent Flyer has partnerships with many large corporations in and outside Australia, such as Optus, Woolworths, Caltex, Safaris, etc. 2.3. Performance analysis According to Mail Business Staff 2012, Qantas Airways reported $204 million annual loss in FY2012, the first loss since 17 year period. It was impacted from the increasing fuel prices, intense competition, industrial disputes and its struggling international division and a series of strikes that temporarily grounded its fleet. By analyzing data from the corporation’s annual report, profitability index can be calculated as shown bellowed: Figure 3: Qantas Airways ratio analysis Qantas Airways Unit 2008 2009 2010 2011 2012 Turnover $M 15,627 14,552 13,772 14,894 15,724 Profit after tax $M 970 123 116 249 (244) Return on equity (ROE) % 16.9 2.1 1.9 4.0 (4.1) Return on Asset (ROA) % 6.9 1.0 1.3 2.1 (0.8) Debt/Equity 46/54 50/50 51/49 53/47 56/44 Current ratio 0.90 0.96 0.94 0.92 0.77 Quick ratio 0.42 0.58 0.59 0.57 0.48 (Adopted from Qantas data book 2012) As can be seen, the Qantas performs ineffectively in recently. Its turnover, profit and ROA, ROE have reduced considerably particularly a loss of $244 million in 2012. However, the group still has strong financial capability. Its debt/equity ratio slightly increased but can be acceptable and its create leverage to encourage managers improve the corporation’s performance. Qantas has quick ratio around 0.5, that help Group has ability to pay current debt. Besides that, the current ratios were less than 1 and continuously decreased. It faces the Group to risk of liquidity that means Qantas may not have enough resources to pay its debts over the next 12 months in case of liquidity. Group 2 4

- 10. MGMT20112 Assignment – 2 T213 According to Grant, 2013 the goal of a firm is value maximization that means maximizing the shareholders’ wealth. It was measures via the share’s price and profitability. The corporation recorded an decline in share’s price and market capitalization from 2009 to 2012 after a bounce in 2008 to reach the highest price of $6.0 per share. The earnings per share dropped significantly and in 2012 and the shareholders received no dividend due to the loss of $244m. The changing in Qantas’s share price is illustrated as below: Figure 4: Qantas Share price from 2008-2012 Qantas Airways Unit 2008 2009 2010 2011 2012 Market capitalization $M 5,759 4,553 4,983 4,168 2,435 Earnings per share Cents 49 5.6 4.9 11 (11) Share price at 30 June $ 3.04 2.01 2.2 1.84 1.08 (Source: Qantas data book 2012, p.33) Researches show that, loss is result of high fuel price and changing in foreign currency exchanges as well as competition with other low cost airlines in international activities (O'Sullivan, M 2012). The researchers require Qantas implement strategies to hedge fuel cost and manage foreign exchange risks to increase its competitive advantages. 2.3. Genertic strategy and connection to the internal value chain Qantas Airways aim at maintaining its position as the leading Australian domestic carrier and one of the world’s premier sustainable long-haul airlines through two dual airline brands, Group 2 5

- 11. MGMT20112 Assignment – 2 T213 Qantas and Jetstar that endeavour at two different strategies. While Jetstar focus on low cost Airline, Qantas aims to provide safety, highest quality services and more “Ausiee” airline. It seek to deliver sustainable, long term returns to the shareholders. The Qantas Group strategic priorities are illustrated below. Figure 5: Qantas strategic priorities (Source: Qantas data book 2012, p.5) Qantas’s strategies have connection to the firm’s internal value chain. According to Grant 2013, a value chain analysis describes a sequential chain of the main activities that the firm undertakes. Michael Porter’s Value Chain has been used as a tool to analyse competitive advantages. It is divided to two parts, primary activities and support activities. First of all, primary activities include five main activities which are Inbound logistics, Operations, Outbound logistics, Marketing and sales and Customer service (Grant, 2013). Inbound logistics is a part of the ‘supply chain’ and involve distribution. Inbound logistics’ activities describe the receiving and storing of materials (Porter, 1985). Qantas has three major jet suppliers which are Airbus, Boeing and Bombardier. Each supplier has different competitive advantage with others. For example, Airbus has A380 that is larger, longer and can deliver more passengers than others while Boeing has B787 that is lighter, smaller and faster than others. In addition, Qantas also has others suppliers who provide products related to oil, gas and food. Group 2 6

- 12. MGMT20112 Assignment – 2 T213 Operations are activities to transfer inputs into the final product (Porter, 1985). The operation of Qantas group includes airports, catering, engineering, flight operations, operations planning, control and aviation services (Qantas Factfile, 2010). For example, Qantas aviation services are applied through several processes such as customers can book ticket through travel agent or booking online, check-in online, and baggage claim. Outbound logistics is the process related to collect, store and distribute the final products to customers (Porter, 1985). The general activity of airline industry is transportation goods and services from one area to others all over the world. Therefore, most of airlines implement their transactions though travel agent and online and Qantas is not an exception. By using these ways, Qantas achieves the most cost effective, while satisfying customers. Marketing and sales are activities to provide the places which customers can buy the products (Porter, 1985). In order to advertise product, Qantas has created many media advertisements on television, radio, newspapers, posters in travel agents and billboards. Qantas announced $44 million for advertising campaign with Tourism Australia in 2010 (Qantas, annual report 2010). For example, Qantas used Boeing 747 aircraft to paint the words ‘Come play’ in Frequently Flyer program and Sponsorship Football Federation Australia (World football insider, 2010). However, Qantas is trying to use more direct marketing than blanket advertising because blanket advertising is more expensive and less targeted especially to corporations than direct marketing. Moreover, Qantas also uses global marketing strategies which are standardization, customization and global branding. Through these marketing, Qantas has implemented successful strategies to ensure its reputation for high quality goods and services. In addition, Qantas also has sales promotions in particularly periods. An example of this is Qantas launched a two – for one ticket sale, it means that a second passenger is allowed to fly for the cost of taxes and charges. Another is that Qantas first launched to issue 100,000 tickets at $49. Secondly, Support activities consist of Firm infrastructure, Human resources (HR) management, Technology and Procurement (Grant, 2013). Support activities can help primary activities to work more effectively. Firm infrastructure relates to structure of the industry. Qantas’s infrastructure includes functional departments such as accounting department, financial department, marketing department, customer service department or engineering department. Group 2 7

- 13. MGMT20112 Assignment – 2 T213 Qantas’s HR strategy focuses to ensure a flexible, adaptable and safer workforce, improve labour unit costs and productivity, develop management and leadership capabilities as one of the largest employers in Australia, approximately 37,000 people (Qantas, 2012). Qantas’s HR concentrates on four areas: corporate, business segments, shared services, and learning and development. Each area has own responsibilities to help deliver the human resource strategy. Besides that, Qantas group is also known as the Australia’s largest aviation trainer. There are many training courses to help the Qantas employees to improve their knowledge and skills. For example, in 2011/2012, Qantas invested $65 million in training approximately 2,300 pilots (Qantas, annual report 2012). Furthermore, in the past four years, 122 young people graduated through the Qantas program. Their training enables them to experience with various aspects of airline management and they may provide the next generation of aviation executives. Regarding technology development, technology has an important role in supporting Qantas business to deliver enhanced value. Technology development of Qantas focuses on main five areas which are project and program management, business system analysis, testing and quality assurance, services and relationship management, and architecture (Qantas, 2012). Qantas is also investing in new technology for customers; Qantas is the first airline to offer iPads as an option entertainment for passengers to access to the latest entertainment. These activities can support for main purposes to enhance the quality and create reputation for Qantas group. The purpose of Qantas’s procurement is maximizing the shareholders’ value from all supplier relationships (Qantas, annual report 2012). This is implemented through a chain process such as disciplined, systematic and ongoing process. All procurement activities are ensured through Qantas’ procurement policy. One of the important procurement activities is that goods and services meet specification and are transferred on time at competitive prices from stable suppliers. Others procurement activities are also applied such as financial risk, total cost basic must be reduced and supplier relationship management is focused on win-win outcome. 3.0. EXTERNAL AND INDUSTRYIAL ANALYSIS 3.1. Macro economy Qantas as a part in the global airline industry has continued to benefit from globalization where growth trade and tourism increase demands for travelling. According to the World Tourism Organization, throughout 2011, international tourist arrivals went up by 4.4% to 980 Group 2 8

- 14. MGMT20112 Assignment – 2 T213 million, from 939m in 2010. The context also creates corporative opportunities for Qantas. For example, in early 2011, Qantas acquired Network Aviation, a West Australian charter airline that contributed around $19 million in revenue and other income (Marketline 2012). However, globalizations with the participation of many airline industries also threat Qantas in provide good service at reasonable price. Besides that, the increasing and unpredicted fuel price and foreign currency exposure also challenges the Group when participate in international operation. 3.2. Five forces analysis Porter’s Five Forces is a most widely used framework in practice to determine intensity of competition and the level of profitability for companies (Grant 2013). Porter (2008) stated that five forces shape the structure of industries and launch the basement for competition and profitability within industry. These include threats of new entrants and substitutes, bargaining power of substitutes and buyers, and rivalry among existing competitors. According to Dobbs (2012), five forces assessments of threats and opportunities are powerful responses of managers to challenging environment where they must to compete with rivals and increase profits. The first important element is threat of substitutes. Substitute products/services perform a similar function as an industry product by a different means and at times at a cheaper price. This makes the competitions become more violent for all. It corresponds to industry profitability suffers. Therefore, companies have to reinvest themselves such as their services, product and event low price and restructure their organizations in order to survive in challenging environment. They have estimated what threats coming from substitutes whose product are similar to that of a company/brand that is established within the industry and give some strategies for themselves. The aviation business now tries to boost up diverse options and promotions trip with low price to persuade the customers. Under pressure of substitutes like Virgin, Delta, Tiger Airlines, especially coaches or trains, Qantas have to plan some strategies not only in Airline industry but Transportation industry The second of five forces is threats of new entrants. When new entrants have launched in an industry, the proportion of industrial profits has changed. They bring new capacity and desire to share a market with the others, and simultaneously put pressures on old rivals about prices, qualities of services and goods, cost and rate of necessary investment. When threats are high, managers must implement a number of methods into the marketing mix in order to deter new Group 2 9

- 15. MGMT20112 Assignment – 2 T213 entrants. According to Grant (2013), there are some principal sources of barriers to entry: Capital requirements, economies of scale, absolute cost advantages, and product differentiations, access to channels of distribution, governmental and legal barriers, and retaliation. The effectiveness of barriers to entry depends on the resources and capabilities that potential entrants possess. The new entrants, Virgin Airlines or Tiger Airline, become competitors to Qantas with new full service airline and cheap tickets. In order to compete, Qantas is focused on business market which does not have a strong market competitor. The group also try to control the budget airlines through introducing of Jet Star (Reference for business, 2006). In addition, although Emirates airline is a international competitor, Qantas has corporation with Emirates to enhancing their shared network across the Tasman. This hit the competition in Australia and New Zealand (Cornwell 2013). The third is rivalry among existing competitors. According to Grant (2013), in some industries companies compete aggressively, sometimes the prices are under the value of output and leading definitely loss incurred. In the others, they focus on the innovation, advertising and non price dimensions. The intensity of competition of companies base on some factors: concentration, diversity of competitors, product differentiation, excess capacity and exit barriers, cost condition. Simultaneously Qantas operates Jetstart to compete the other companies by cheap tickets, Qantas also cooperate with Woolworths in Frequent Flyer program to maintain loyal customer (Qantas FactFiles, 2010) . The next is bargaining power of suppliers: suppliers are also described as the market of inputs: ability of suppliers to put the buyers under pressure. There are two factor effected on aviation industry including aircraft manufactures and fuel supplier. According to Qantas annual report, 2009, Suppliers of Qantas are Boeing, Airbus, and Bombardier. They have strong power to deal with Qantas because they determine cost and delivery times and can be potential to turn into competitors. Lastly, bargaining power of buyers: Customers are described as the market of outputs and put the firm under pressure of low prices and quality of services. Therefore, Qantas have to cooperate with the other airline such as Emirates, Vietnam airline to rival the others. Qantas also has to impulse its sale with quality product and cheap price in several channels such as travel agency and website to deal with others. What is your conclusion from the 5 Forces Analysis? Group 2 10

- 16. MGMT20112 Assignment – 2 T213 4.0. STRATEGY TO CREATE COMPETITIVE ADVANTAGE In the competitive environment, enterprises have to create competitive advantages or they will be died. Grant (2013) says that a firm can achieve a higher rate of profit over a rival in two ways: supplying an identical product or service at a lower cost, or providing a unique product or service that is differentiated with others in order to persuade customer pay a price premium that exceeds the additional cost of the differentiation. 4.1. Cost leadership In order to take advantages in cost, the corporation has to structure and effectively exploit resources, apply some drivers of cost advantages such as economics of scale, product design, technology and inputs cost (Grant 2013). Figure 6: Qantas’s expenditure in 2011-2012 (Source: Qantas data book 2012, p.18) As can be seen, there are three main parts from Qantas’s expenditure in both 2011 and 2012. They are fuel cost, labour cost and aircraft operating aviation. Figure 7: Fuel cost of Qantas Group 2 11

- 17. MGMT20112 Assignment – 2 T213 (Source: Qantas Data Book 2012, p.19) Fuel cost is the highest expense of Qantas, accounting for more than 25% of total expenses. In 2012, the fuel makes a new record at 27% of total costs at $4.22 billion in compare with $593million in 2011. The Group uses several strategies to reduce the influence of fuel prices. They are hedging; passing fuel surcharges to tickets; shortening the jet fuel supply chain fuel conservation; investment in new fuel-economic aircraft; improvement managing air traffic and enhanced technology in flying techniques and navigation approach. (Qantas data book 2012). Aircraft operating variable spent $3 billion in costs in FY2012. It includes route navigation charges, landing fees are charged by the relevant airport company or authority, maintenance cost and passenger expenses (in-flight consumables and amenities, entertainment). Therefore….? Moving to cost leadership strategy can be applied by Jetstar that focus on low cost airline to gain market share in difference target customer than with the main brand. Due to nowadays, there are many low cost airways emerge worldwide. Thus, the firms that can offer the cheaper price will be gain the customers. Jetstar want to reach the lower price than others fare airlines so the company designs to adapt another strategy such as partnership strategy to deal with the main competitors. In current years, almost aviations industries have considered about how to the firms getting the customer faster than competitors. Also, Jetstar recognizes about low price with fast sale so the firm tries to create new promotion to attract and gain the customers quickly than another firm. The firm can take advantages in cost by increasing passenger load factor (promotion), reduce fuel cost, in-flight consumption and entertainment of customers. 4.2. Differentiation Group 2 12

- 18. MGMT20112 Assignment – 2 T213 According to Grant (2013), differentiation is not just about the product, it embraces the whole relationship between the supplier and customer. Differentiation can be categorised into two types as tangible differentiation and intangible differentiation. 4.2.1. Tangible differentiation: Complementary service: According to Qantas FactFiles (2010), Qantas has provided In-flight entertainment with full-option in all Qantas international flights such as A380, B747 and A330 aircrafts. Simultaneously, Qantas Club lounges with full of necessary facilities are provided to the Qantas’s members at more than 130 lounges worldwide. As Group route network, the Qantas Group have operated numerous flights to cover 173 destinations in 42 countries together with partner airways. According to Qantas annual report (2009), Qantas provides premier price with full service option to serve the customers. For example, Qantas creates unique experiences to Qantas’ members like bringing Chef Heston Blumenthal to meet food and wine (QANTAS 2012). As the result, customers can feel superior when perceive the product or service. This strategy offers unique can enhance value of the product to the customers. The other point is that Qantas designs multi-brand model such as Qantas, Frequent flyers, and Jetstar which give customers the experience they desire. Specifically, Qantas provides the clear choice for business and premium leisure travellers. Frequent flyer builds the world’s best loyalty business while Jetstar brings the clear choice for price sensitive travellers (QANTAS 2011). Grant (2013) states a low-price; no-frills offering is associated with a unique brand image. Hub airports: Qantas has developed Airport terminal consolidation project. This reduces in minimum connection times, underpins Sydney as Qantas’ main hub, and supports the international network alliance strategy, long term price and infrastructure surety. This strategy also increases product differentiation and seamless end-to-end customer experience (QANTAS 2011). 4.2.2. Intangible differentiation: Safety is always the first priority of Qantas aviation firm. Qantas is the leader of safety aviation industry (QANTAS 2008). Qantas is rigorously subjected to the International Air Transport Association’s (IATA) and Operational Safety Audit Certification, which is an internationally recognised safety audit program, once every two years. Moreover, Qantas is regularly scrutinised additional external audits by around 75 external organisations. This Group 2 13

- 19. MGMT20112 Assignment – 2 T213 capability combined with constant prudence and proactive prevention is fundamental to Qantas maintaining its leading safety record and reputation. Group 2 14

- 20. MGMT20112 Assignment – 2 T213 5.0. CONCLUSION AND RECOMMENDATION In conclusion, “strategy is win” (Grant 2013). Enterprises with efficiency strategies and successful implementation will generate advantages in the competitive environment. By applying several strategic analysis methods in analysing the internal and external context of Qantas Airlines Limited, the report has indentified the group’s strategies. Base on the analysis, some strategies has been recommended for the corporation to create competitive advantages by two strategies, cost leadership and differentiation: Expeditionary Marketing: Travel agent can be an important channel to distribute the product and service. Therefore, the Qantas should conduct a plan to consolidate its business activities with the travel agents and sometime the firm has to create a monopoly with those travel agents to decrease competitors. The corporation should also offer promotion to reduce free seat in flight. Unique Service Style: The price of ticket that should included the price of baggage may set up little bit expensive than others low cost airlines without luggage price. It can be attract the customers; especially, women. Due to almost women need space for their clothes and cosmetic that is often liquid may be banned to carry in a passenger area. Fuel hedging: Qantas should continue research for new technology and invest in low-fuel consume aircrafts. Charging fuel surcharges to passengers is better than fuel hedging. Foreign exchange risk hedging: Continue hedging foreign currency to reduce risk by using other derivative financial instruments such as option or forward contracts. Labour cost: Qantas can expand to other countries where labour willing to work for lower payment than in Australia, meanwhile reduces intermediates or agencies, directly or online sell tickets to customers. Group 2 15

- 21. MGMT20112 Assignment – 2 T213 6.0. REFERENCES Airlines network news and Analysis, 2012, ‘Australian international traffic growing strongly but Qantas is losing market share; US and Indonesia see biggest gains’, viewed 15nd August 2013, http://www.anna.aero/2010/04/20/australian-international-traffic-growing-strongly. Allayannis, G, Weston, G 2001, ‘The Use of Foreign Currency Derivatives and Firm Market Value’, The Review of Financial Studies, Vol. 14, No. 1, pp. 243-276. Cornwell, A 2013, Emirates and Qantas to hit competition in Australia and New Zealand, viewed 15th August 2013, http://gulfnews.com/business/aviation/emirates-and-qantas-to-hit- competition-in-australia-and-new-zealand-1.1221392. Dallas, H 2010, ‘Qantas in the global airline industry’, Strategic management: competitiveness and globalisation (4th Asia-Pacific ed), pp. 434-440. Dennis, A 2012, ‘Is Qantas the dying kangaroo?’, Herald Sun, viewed 15rd August 2013, http://www.heraldsun.com.au/travel/australia/is-qantas-the-dying-kangaroo/story-e6frfhbf- 1226392614457 Dobbs M E, 2012, Dobbs, Michael E, 2012, Porter's Five Forces in Practice: Templates for Firm and Case Analysis, Competition Forum 2012, Vol. 10 Issue 1, p22. Grant, R.M 2013, Contemporary Strategy Analysis, 8th edn, John Wiley & Sons, NewYork. Fickling, D&Wang, J 2012, ‘Qantas, China Eastern Plan Cheap Flights for Asia Middle’, Bloomberg, viewed 15rd August, http://www.bloomberg.com/news/2012-03-25/qantas-plans- hong-kong-budget-airline-with-china-eastern.html International Air Transport Association 2013, ‘High cost environment to continue’, Financial Forecast, viewed 15rd August 2013, http://www.iata.org/whatwedo/Documents/economics/industry-outlook-financial-forecast- march-2013.pdf Mail Business Staff 2012, ‘Qantas posts €204m loss as its fuel bill hits €3.6bn’, Daily Mail, p.46. Marketline 2012, ‘Qantas Airways Limited - SWOT Analysis’, viewed 15th August 2013, http://www.marketresearch.com/MarketLine-v3883/Qantas-Airways-Limited-SWOT- 6963059 Morrell, P, Swan, W 2006, ‘Airline Jet Fuel Hedging: Theory and Practice’, Transport Review, Vol. 26, No. 6, pp. 713-730. O'Sullivan, M 2012, ‘Qantas cancels jet orders as it posts first loss’, Brisbanetimes, viewed 15th August 2013, http://www.brisbanetimes.com.au/business/earnings-season/qantas-cancels- jet-orders-as-it-posts-first-loss-20120823-24ngx.html Group 2 16

- 22. MGMT20112 Assignment – 2 T213 Porter, M. E. 2008, The five competitive forces that shape strategy. Harvard Business Review, vol.86, issue 1, p.78-93. Qantas Annual Report 2008, 2009, 2010, 2011 and 2012. Viewed 5th August 2013, http://www.qantas.com.au/travel/airlines/investors-annual-reports/global/en. QANTAS 2008, ‘Qantas sustaining the spirit: Sustainability report 2008’, viewed 15th August 2013, http://www.qantas.com.au/infodetail/about/investors/sustainability2008.pdf QANTAS 2011, ‘Qantas airways limited 2011 strategy day’, viewed 15th August 2013, http://www.qantas.com.au/infodetail/about/investors/qantas-strategy-day-presentation- 2011.pdf QANTAS 2012, ‘Qantas in transformation’, viewed 15th August 2013, http://www.qantas.com.au/travel/airlines/media-releases/aug-2012/1/global/en Qantas 2012, Qantas Data Book 2012, viewed 15th August 2013, http://www.qantas.com.au/infodetail/about/investors/qantas-data-book-2012.pdf. Qantas Factfile 2010, The Qantas group at a glance, viewed 15th August 2013, http://www.qantas.com.au/infodetail/about/FactFiles.pdf. Reference for Business 2006, ‘PORTER'S 5-FORCES MODEL’, viewed 15th August 2013, http://www.referenceforbusiness.com/management/Or-Pr/Porter-s-5-Forces-Model.html. Group 2 17

- 23. MGMT20112 Assignment – 2 T213 7.0. APPENDIX Group 2 18

- 24. MGMT20112 Assignment – 2 T213 Group 2 19

- 25. MGMT20112 Assignment – 2 T213 Group 2 20