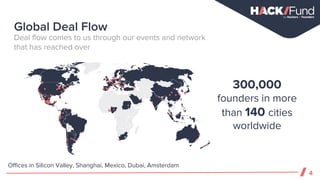

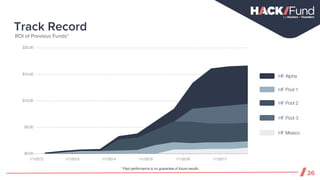

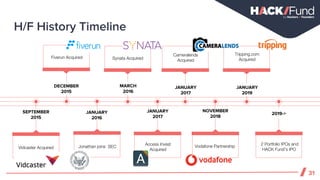

The document summarizes a venture capital fund that invests globally in technology companies. It has offices in major tech hubs around the world like Silicon Valley, Shanghai, Mexico City, and Dubai. The fund has invested in over 55 companies so far with a total valuation of $600 million generated from 8 exits. It provides services to support portfolio companies, including business consulting, sales and marketing support, and access to mentors. The fund aims to generate returns through investing in cutting-edge technology startups focused on growth.

![Testimonials

33

"Vodafone Tomorrow Street is

delighted that our global

relationship with Hackers and

Founders will provide our growing

portfolio of startups access to the

highly innovative HACK Fund

vehicle for their potential future

funding requirements."

"Hacker [SIC] Fund’s vehicle could

provide more opportunity to invest

in startup companies globally, as

well as more chances for startups

around the world to raise

funding."

“The idea behind Hack Fund is

quite interesting. In most cases

investing in a company leads to up

to ten years of waiting for a liquidity

event... investors can buy shares

that can be bought and sold

instantly while company

performance drives the value up or

down. In short, startups become

liquid in an instant…”](https://image.slidesharecdn.com/hackfundv-pitchdeck-190523015623/85/Hack-Fund-V-Pitch-Deck-33-320.jpg)