More Related Content

Similar to Banco Nuevo Mundo - Analisis Financiero Sistema Banca Comerical Peru nov 2000

Similar to Banco Nuevo Mundo - Analisis Financiero Sistema Banca Comerical Peru nov 2000 (20)

More from gonzaloromani (20)

Banco Nuevo Mundo - Analisis Financiero Sistema Banca Comerical Peru nov 2000

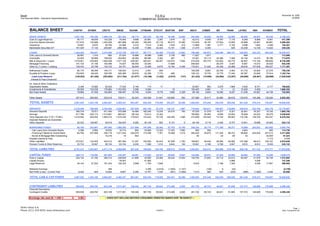

- 1. Souce: PERU November 30, 2000

The Peruvian Bank - Insurance Superintendency US $000

COMMERCIAL BANKING SYSTEM

BALANCE SHEET CONTNT INTBNK CRDTO WIESE SUDAM CITIBANK STDCHT BOSTON BNP BSCH COMER BIF FINAN LATINO NBK NVOMDO TOTAL

QUICK ASSETS 1,037,792 193,340 1,596,216 287,454 89,775 203,225 58,156 76,406 12,005 202,595 54,803 39,092 22,995 90,092 48,847 93,430 4,106,224

Cash & Legal Reserves 95,117 48,839 134,229 75,550 9,696 20,881 2,287 1,678 22 42,512 6,935 8,767 7,170 8,269 8,886 6,561 477,399

Due from Banks-Demand 731,819 120,686 1,203,529 587,686 60,355 156,935 23,118 60,013 10,360 115,035 38,187 27,554 12,805 25,869 23,561 68,891 3,266,403

Clearance 19,827 6,675 28,792 23,566 4,315 7,514 2,348 1,534 615 13,969 1,381 2,771 2,192 2,696 1,652 4,356 124,201

Marketable Securities S/T 191,029 17,140 229,667 (399,348) 15,409 17,895 30,403 13,181 1,008 31,079 8,300 - 829 53,258 14,748 13,622 238,220

LOANS 1,444,043 785,547 2,475,565 2,122,756 436,727 497,711 80,456 173,420 13,664 790,489 165,972 240,490 206,151 229,503 352,323 463,430 10,478,247

Call Loans to Domestic Banks 26,997 1,416 892 27,524 15,966 18,589 3,683 2,100 850 11,827 1,671 - - 989 - - 112,505

Overdrafts 33,252 29,999 159,020 204,664 38,382 99,280 2,352 467 1 23,261 20,113 22,366 7,485 30,155 14,413 28,765 713,976

Bills & Discounts + Loans 1,019,941 578,840 1,825,028 1,577,125 238,367 325,441 66,491 143,974 7,604 219,229 100,770 122,654 92,770 55,507 173,154 188,606 6,735,499

Mortgage Financing 141,133 37,156 183,499 74,527 66,050 32,540 - 17,686 - 206,924 - 28,370 2,457 6,957 14,515 20,532 832,346

Other & LT Loans + Leasing 129,433 52,799 135,722 84,791 56,948 15,269 6,675 10,784 5,346 176,001 31,524 45,308 93,988 29,635 107,938 189,227 1,171,387

Refinanced Credits 90,175 68,348 145,171 136,524 12,413 2,461 908 - - 106,558 8,667 29,709 4,463 91,733 33,924 27,276 758,330

Doubtful & Problem Loans 152,645 98,429 330,036 229,386 29,679 22,299 7,770 480 - 128,122 18,730 16,776 17,244 60,387 33,846 37,914 1,183,744

- Loan Loss Reserve (149,533) (81,440) (303,803) (211,784) (21,077) (18,166) (7,422) (2,073) (137) (81,432) (15,505) (24,694) (12,257) (45,859) (25,467) (28,889) (1,029,540)

-Interest & Fees-Unearned - - - - - - - - - - - - - - - - -

Int. Fees & Other Collections - - - - - - - - - - - - - - - - -

Adjudicated Assets 2,346 12,582 22,433 17,035 5,140 114 17 - - 25,907 893 3,076 1,969 4,202 8,741 4,177 108,632

Investments & Subsidiaries 45,059 103,539 176,882 1,153,593 3,096 5,094 - 10 - 155,405 3,661 11 31 10,520 3,450 - 1,660,352

Net Fixed Assets 79,869 47,459 162,893 199,497 16,706 9,593 8,778 1,680 2,328 68,192 9,603 16,590 8,257 21,256 24,567 44,736 722,003

- - - - - - - - - - - - - - - - -

Other Assets 357,915 260,693 530,818 705,011 52,043 104,508 31,647 100,885 500 157,966 35,517 30,980 69,633 135,676 140,286 139,284 2,853,363

TOTAL ASSETS 2,967,025 1,403,159 4,964,807 4,485,347 603,487 820,246 179,055 352,401 28,496 1,400,554 270,449 330,239 309,036 491,248 578,214 745,057 19,928,820

DEPOSITS 2,318,200 790,090 3,704,484 2,520,261 287,849 402,185 97,276 136,127 1,867 719,834 184,611 100,551 119,805 239,818 233,764 254,176 12,110,897

Demand Deposits 306,318 75,971 671,492 370,298 34,484 160,240 13,235 24,510 792 97,030 21,079 18,377 9,321 32,561 30,327 16,745 1,882,782

Savings 471,766 222,173 1,313,861 682,021 68,102 72,613 12,354 - - 160,683 28,262 6,006 32,824 76,659 44,043 29,279 3,220,645

Time Deposits (Incl. CTS + FCBC) 1,510,083 383,050 1,683,512 1,275,339 179,003 143,223 70,735 105,426 1,069 415,958 125,552 73,742 68,953 116,756 139,705 183,247 6,475,353

Deposits Retained as Guarantee - - - - - - - - - - - - - - - - -

Other Deposits 30,033 108,897 35,619 192,603 6,260 26,109 952 6,191 6 46,164 9,718 2,426 8,707 13,841 19,688 24,905 532,118

BORROWED FUNDS 88,160 343,807 267,965 1,088,264 231,869 197,056 20,084 87,792 14,708 346,334 26,175 171,298 89,377 74,869 203,932 302,062 3,553,754

- Call Loans from Domestic Banks 3,399 5,850 19,632 16,714 850 23,800 12,323 17,323 7,693 850 500 - - 4,943 - 850 114,726

- Financing f/ Banks & Central Bank 84,760 337,958 236,118 1,071,532 230,075 173,256 7,761 70,469 7,015 345,402 25,675 171,245 89,312 69,883 203,932 247,212 3,371,605

- Bonds & Mortgage Bills Outstanding - - 12,216 18 944 - - - - 82 - 54 65 43 - 54,000 67,423

Payable Interest & Fees - - - - - - - - - - - - - - - 7,113 7,113

Other Liabilities 272,221 133,402 445,513 397,382 31,247 100,083 30,433 97,009 1,783 169,851 29,445 28,080 65,092 107,388 66,613 100,107 2,075,649

Pension Funds & Other Reserves 22,733 16,567 59,152 63,154 6,255 7,280 1,915 5,644 192 18,581 2,180 2,769 4,907 4,672 6,812 9,320 232,132

TOTAL LIABILITIES 2,701,313 1,283,867 4,477,114 4,069,060 557,220 706,604 149,708 326,572 18,549 1,254,601 242,412 302,699 279,180 426,746 511,122 672,777 17,979,545

CAPITAL FUNDS 265,712 119,292 487,693 416,287 46,267 113,642 29,347 25,829 9,947 145,954 28,037 27,540 29,856 64,502 67,092 72,280 1,949,275

Paid-in Capital 224,124 91,190 290,312 228,649 41,689 42,990 24,285 28,224 13,502 129,705 27,603 25,715 24,815 65,487 61,578 52,735 1,372,602

Capital Surplus - - - 78,507 - 51,820 - - - - - - 3,966 - 3,056 - 137,349

Legal Reserves 35,144 27,253 181,234 100,323 2,088 1,763 7,648 - - 9,033 - 1,186 1,320 - 4,038 17,061 388,092

- - - - - - - - - - - - - - - - -

Retained Earnings - - 295 - - 4,308 (3,616) (1,805) (1,747) - (149) 9 (24) - - - (2,728)

Net Profit/ (Loss) - Current Year 6,444 849 15,852 8,807 2,490 12,761 1,030 (591) (1,808) 7,215 583 630 (222) (986) (1,580) 2,484 53,959

TOTAL LIAB.& CAP.FUNDS 2,967,025 1,403,159 4,964,807 4,485,347 603,487 820,246 179,055 352,401 28,496 1,400,554 270,449 330,239 309,036 491,248 578,214 745,057 19,928,820

CONTINGENT LIABILITIES 555,638 228,764 623,169 1,017,381 136,348 367,735 95,644 213,408 2,820 481,722 68,743 46,631 91,849 157,372 140,606 170,608 4,398,438

Financial Derivatives - - - - - - - - - - - - - - - - -

Contingent Credits 555,638 228,764 623,169 1,017,381 136,348 367,735 95,644 213,408 2,820 481,722 68,743 46,631 91,849 157,372 140,606 170,608 4,398,438

- - - - - - - - - - - - - - - - -

Exchange rate used (S/. = US$ 1) $ 0.283 ---DOES NOT INCLUDE NEITHER CONSUMER ORIENTED BANKS NOR "MI BANCO"---

Strike Value S.A. Page 1

Phone (511) 919-8252 www.strikevalue.com 1/29/2011 SFN-1100 $SFN1100

- 2. Souce: PERU November 30, 2000

The Peruvian Bank - Insurance Superintendency US $000

COMMERCIAL BANKING SYSTEM

PROFIT & LOSS STAT. CONTNT INTBNK CRDTO WIESE SUDAM CITIBANK STDCHT BOSTON BNP BSCH COMER BIF FINAN LATINO NBK NVOMDO TOTAL

FINANCIAL INCOME 313,384 167,005 586,503 428,200 69,809 82,305 20,829 28,561 1,813 170,847 42,076 38,125 38,049 46,060 69,937 83,506 2,187,010

Ints.& Fees/ Loans 186,871 114,795 328,855 265,103 54,875 58,764 10,180 12,861 824 102,833 34,484 30,916 30,803 30,197 55,053 68,637 1,386,049

Ints.& Fees/ Loans to Banks-Demand 37,382 9,708 64,996 38,237 3,782 6,832 1,840 2,862 551 12,521 2,149 2,273 1,811 2,562 3,433 4,226 195,165

Ints.& Fees/ Due from Banks 2,221 1,187 7,212 1,147 1,113 1,580 732 310 118 935 312 280 354 161 203 261 18,127

Fees from Contingent Liabilities 48,479 16,718 112,482 46,770 4,697 9,931 2,017 4,935 122 21,402 2,767 3,294 3,284 9,479 5,266 6,431 298,074

Trustees & Adm. Fees - 122 434 365 19 - - - - - - - - 35 2 214 1,191

Exchange Gain 16,232 7,955 17,419 15,500 3,106 869 4,046 5,239 94 14,590 1,629 1,157 1,409 1,438 3,122 2,804 96,608

Gain/ (Loss) on Equities Portfolio 21,185 15,187 48,262 60,978 2,095 4,252 2,016 1,652 69 18,297 724 101 287 2,151 2,761 849 180,865

Other Financial Income 1,014 1,334 6,841 100 123 77 - 701 36 269 12 104 103 39 96 85 10,932

FINANCIAL EXPENSES (120,548) (97,699) (203,663) (244,238) (38,635) (29,859) (12,652) (18,301) (803) (77,634) (20,478) (20,407) (22,519) (25,595) (44,433) (50,981) (1,028,446)

Interest on Deposits (107,920) (50,795) (166,751) (154,676) (16,452) (20,025) (10,465) (10,212) (212) (44,787) (16,618) (6,668) (11,808) (12,882) (18,627) (24,070) (672,969)

Ints.& Fees on Borrowed Funds (6,656) (36,948) (22,012) (79,427) (20,275) (9,508) (1,268) (4,785) (510) (29,079) (3,448) (13,676) (10,228) (10,993) (24,126) (25,905) (298,842)

Exchange Losses (160) (3,222) - (398) - - (855) (2,492) (80) - (33) (3) (65) - (1,226) (99) (8,635)

Deposits Indexed to Inflation (108) (1,081) (1,824) (373) (0) - - (737) - - - - (71) - - - (4,195)

Deposits' Insurance + Others (5,704) (5,653) (13,076) (9,364) (1,908) (326) (64) (74) (1) (3,768) (379) (60) (347) (1,720) (455) (907) (43,806)

GROSS FINANCIAL RESULT 192,836 69,306 382,840 183,962 31,173 52,445 8,178 10,259 1,010 93,213 21,599 17,718 15,530 20,465 25,504 32,525 1,158,564

- Loan Loss Provision (105,280) (8,047) (140,135) (43,701) (7,111) (5,356) (3,139) (942) (139) (19,845) (6,861) (7,035) (2,440) (12,349) (5,194) (4,976) (372,552)

- Provision for Loan Losses (105,280) (8,047) (140,135) (43,701) (7,111) (5,356) (3,139) (942) (139) (19,845) (6,861) (7,035) (2,440) (12,349) (5,194) (4,976) (372,552)

NET FINANCIAL RESULT 87,556 61,259 242,705 140,261 24,062 47,090 5,039 9,317 871 73,368 14,737 10,683 13,090 8,116 20,310 27,550 786,012

Other Income 80,877 18,835 42,611 57,939 3,176 8,464 8,762 739 4 29,009 2,047 3,902 1,129 22,986 9,046 20,417 309,942

Other Expenses (157,811) (77,665) (264,057) (192,133) (24,053) (42,318) (11,804) (9,856) (2,523) (90,452) (15,580) (13,702) (13,944) (31,943) (31,111) (45,066) (1,024,019)

Personnel & Board (51,903) (24,245) (108,943) (63,216) (9,561) (17,154) (5,523) (6,361) (1,577) (29,403) (5,648) (4,797) (5,636) (11,342) (10,298) (12,756) (368,365)

General & Administrative Expenses (58,276) (33,151) (117,262) (82,012) (9,884) (18,508) (3,520) (2,905) (705) (38,273) (7,753) (6,339) (6,926) (13,434) (13,354) (16,917) (429,218)

Depreciation & Amortization (16,135) (11,284) (27,325) (32,263) (2,700) (2,859) (1,341) (571) (201) (9,365) (1,049) (1,272) (1,269) (4,688) (4,060) (7,045) (123,427)

Miscellaneous (31,496) (8,984) (10,527) (14,642) (1,908) (3,797) (1,421) (19) (41) (13,412) (1,131) (1,294) (112) (2,478) (3,400) (8,349) (103,010)

E.B.I.Tx. 10,623 2,429 21,259 6,067 3,185 13,235 1,996 200 (1,648) 11,925 1,204 882 275 (841) (1,755) 2,900 71,936

Income Taxes - (671) (451) - (344) (3,580) (358) - 10 (1,868) - - - - - - (7,261)

Result on Inflationary Exposure REI (4,179) (909) (4,956) 2,740 (350) 3,106 (608) (791) (169) (2,842) (622) (252) (497) (145) 175 (416) (10,715)

Extraordinary Income/ (Charge) - - - - - - - - - - - - - - - - -

NET PROFIT/(LOSS) 6,444 849 15,852 8,807 2,490 12,761 1,030 (591) (1,808) 7,215 583 630 (222) (986) (1,580) 2,484 53,959

NET PROFIT/(LOSS) -REI 6,444 849 15,852 6,067 2,490 9,656 1,030 (591) (1,808) 7,215 583 630 (222) (986) (1,755) 2,484 53,959

Strike Value S.A. Page 2

Phone (511) 919-8252 www.strikevalue.com 1/29/2011 SFN-1100 $SFN1100

- 3. Souce: PERU November 30, 2000

The Peruvian Bank - Insurance Superintendency US $000

COMMERCIAL BANKING SYSTEM

FINANCIAL RATIOS CONTNT INTBNK CRDTO WIESE SUDAM CITIBANK STDCHT BOSTON BNP BSCH COMER BIF FINAN LATINO NBK NVOMDO TOTAL

PERCENTUAL STRUCTURE ESTRUCTURA PORCENTUAL

Quick Assets/ Total Assets 35.0% 13.8% 32.2% 6.4% 14.9% 24.8% 32.5% 21.7% 42.1% 14.5% 20.3% 11.8% 7.4% 18.3% 8.4% 12.5% 20.6%

Marketable Securities/ Total Assets 6.4% 1.2% 4.6% (8.9%) 2.6% 2.2% 17.0% 3.7% 3.5% 2.2% 3.1% 0.0% 0.3% 10.8% 2.6% 1.8% 1.2%

Net Loans/ Total Assets 48.7% 56.0% 49.9% 47.3% 72.4% 60.7% 44.9% 49.2% 48.0% 56.4% 61.4% 72.8% 66.7% 46.7% 60.9% 62.2% 52.6%

Gross Loans/ Total Assets 53.7% 61.8% 56.0% 52.0% 75.9% 62.9% 49.1% 49.8% 48.4% 62.3% 67.1% 80.3% 70.7% 56.1% 65.3% 66.1% 57.7%

Overdrafts/ Gross Loans 2.1% 3.5% 5.7% 8.8% 8.4% 19.2% 2.7% 0.3% 0.0% 2.7% 11.1% 8.4% 3.4% 11.0% 3.8% 5.8% 6.2%

Bills, Disc.& Loans/ Gross Loans 64.0% 66.8% 65.7% 67.6% 52.1% 63.1% 75.7% 82.0% 55.1% 25.1% 55.5% 46.3% 42.5% 20.2% 45.8% 38.3% 58.5%

Net Fixed Assets/ Total Assets 2.7% 3.4% 3.3% 4.4% 2.8% 1.2% 4.9% 0.5% 8.2% 4.9% 3.6% 5.0% 2.7% 4.3% 4.2% 6.0% 3.6%

Deposits/ (Liabilities + Capital Funds) 78.1% 56.3% 74.6% 56.2% 47.7% 49.0% 54.3% 38.6% 6.6% 51.4% 68.3% 30.4% 38.8% 48.8% 40.4% 34.1% 60.8%

Savings/ Deposits 20.4% 28.1% 35.5% 27.1% 23.7% 18.1% 12.7% 0.0% 0.0% 22.3% 15.3% 6.0% 27.4% 32.0% 18.8% 11.5% 26.6%

Time Deposits/ Deposits 65.1% 48.5% 45.4% 50.6% 62.2% 35.6% 72.7% 77.4% 57.2% 57.8% 68.0% 73.3% 57.6% 48.7% 59.8% 72.1% 53.5%

Placements/ Deposits 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0%

Borrowed Funds/Liab.+ Capital Funds 3.0% 24.5% 5.4% 24.3% 38.4% 24.0% 11.2% 24.9% 51.6% 24.7% 9.7% 51.9% 28.9% 15.2% 35.3% 40.5% 17.8%

Bonds & Mrtge.Bills/Liab.+ Cap.Funds 0.0% 0.0% 0.2% 0.0% 0.2% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 7.2% 0.3%

Cap.Funds/ Liab.+ Capital Funds 9.0% 8.5% 9.8% 9.3% 7.7% 13.9% 16.4% 7.3% 34.9% 10.4% 10.4% 8.3% 9.7% 13.1% 11.6% 9.7% 9.8%

OPERATIONAL RATIOS COEFICIENTES OPERATIVOS Y DE RENTABILIDAD

Return on Equity (ROE) 2.4% 0.7% 3.3% 1.5% 5.4% 8.5% 3.5% (2.3%) (18.2%) 4.9% 2.1% 2.3% (0.7%) (1.5%) (2.6%) 3.4% 2.8%

Return on Assets (ROA) 0.2% 0.1% 0.3% 0.1% 0.4% 1.2% 0.6% (0.2%) (6.3%) 0.5% 0.2% 0.2% (0.1%) (0.2%) (0.3%) 0.3% 0.3%

Net Profit (Loss)/ Total Deposits 0.3% 0.1% 0.4% 0.2% 0.9% 2.4% 1.1% (0.4%) (96.9%) 1.0% 0.3% 0.6% (0.2%) (0.4%) (0.8%) 1.0% 0.4%

Net Profits/ Earning Assets 13.0% 16.9% 14.5% 12.6% 13.8% 11.9% 15.4% 11.4% 7.2% 17.4% 19.9% 14.9% 17.5% 20.8% 19.4% 16.2% 14.4%

Return on Risk Assets-RORA 0.3% 0.1% 0.5% 0.1% 0.5% 1.6% 0.9% (0.2%) (11.0%) 0.6% 0.3% 0.2% (0.1%) (0.2%) (0.3%) 0.4% 0.3%

Risk Assets (US$MM) $1,929 $1,210 $3,369 $4,198 $514 $617 $121 $276 $16 $1,198 $216 $291 $286 $401 $529 $652 $15,823

Operating Cost/ Net Financial Result 144.3% 112.1% 104.5% 126.5% 92.0% 81.8% 206.1% 105.6% 284.9% 105.0% 98.0% 116.1% 105.7% 363.0% 136.4% 133.3% 117.2%

Operating Cost/ Total Assets 4.3% 4.9% 5.1% 4.0% 3.7% 4.7% 5.8% 2.8% 8.7% 5.5% 5.3% 3.8% 4.5% 6.0% 4.8% 4.9% 4.6%

Personnel/ Total Deposits 2.2% 3.1% 2.9% 2.5% 3.3% 4.3% 5.7% 4.7% 84.5% 4.1% 3.1% 4.8% 4.7% 4.7% 4.4% 5.0% 3.0%

Personnel/ Total Asssets 1.7% 1.7% 2.2% 1.4% 1.6% 2.1% 3.1% 1.8% 5.5% 2.1% 2.1% 1.5% 1.8% 2.3% 1.8% 1.7% 1.8%

Operating Cost/ Earning Assets 5.2% 6.9% 6.3% 5.2% 4.4% 5.6% 7.7% 3.9% 9.9% 7.9% 6.8% 4.9% 6.4% 13.3% 7.7% 7.1% 6.1%

Market Share-Deposits 19.1% 6.5% 30.6% 20.8% 2.4% 3.3% 0.8% 1.1% 0.0% 5.9% 1.5% 0.8% 1.0% 2.0% 1.9% 2.1% 100.0%

Market Share-Loans 13.8% 7.5% 23.6% 20.3% 4.2% 4.7% 0.8% 1.7% 0.1% 7.5% 1.6% 2.3% 2.0% 2.2% 3.4% 4.4% 100.0%

ASSETS QUALITY CALIDAD DE ACTIVOS

Doubtful & PD Loans/ Gross Loans 9.6% 11.4% 11.9% 9.8% 6.5% 4.3% 8.8% 0.3% 0.0% 14.7% 10.3% 6.3% 7.9% 21.9% 9.0% 7.7% 10.3%

Doubt.+ Refinanc Loans/ Gross Loans 15.2% 19.2% 17.1% 15.7% 9.2% 4.8% 9.9% 0.3% 0.0% 26.9% 15.1% 17.5% 9.9% 55.2% 17.9% 13.2% 16.9%

Loan Loss Rsve/Doubt & Refincd.Loans 61.6% 48.8% 63.9% 57.9% 50.1% 73.4% 85.5% 431.4% #DIV/0! 34.7% 56.6% 53.1% 56.5% 30.1% 37.6% 44.3% 53.0%

Loan Loss Reserve/ Gross Loans 9.4% 9.4% 10.9% 9.1% 4.6% 3.5% 8.4% 1.2% 1.0% 9.3% 8.5% 9.3% 5.6% 16.7% 6.7% 5.9% 8.9%

Loan Loss Reserve/ Net Loans 10.4% 10.4% 12.3% 10.0% 4.8% 3.6% 9.2% 1.2% 1.0% 10.3% 9.3% 10.3% 5.9% 20.0% 7.2% 6.2% 9.8%

Earning Assets (-) Expensive Liabilities $7,422 ($143,484) $76,018 ($222,413) ($15,449) $92,682 $17,648 $25,975 $8,616 ($84,895) $376 ($16,818) $8,353 ($93,529) ($77,031) ($40,035) ($456,564)

Net Earning Assets/ Total Assets 0.3% (10.2%) 1.5% (5.0%) (2.6%) 11.3% 9.9% 7.4% 30.2% (6.1%) 0.1% (5.1%) 2.7% (19.0%) (13.3%) (5.4%) (2.3%)

Gross Loans/ Total Deposits 68.7% 109.7% 75.0% 92.6% 159.0% 128.3% 90.3% 128.9% 739.4% 121.1% 98.3% 263.7% 182.3% 114.8% 161.6% 193.7% 95.0%

Fixed Assets/ Capital Funds 30.1% 39.8% 33.4% 47.9% 36.1% 8.4% 29.9% 6.5% 23.4% 46.7% 34.3% 60.2% 27.7% 33.0% 36.6% 61.9% 37.0%

(*) (*) Total Deposits includes: Demand Deposits, Savings, Time Deposits (plus Fgn Cy. CD´s3rd. Parties Severance Indemnities) and Pledged Deposits

Total Deposits includes: Demand Deposits, Savings, Time Deposits (plus Fgn Cy. CD´s & & 3rd. Parties Severance Indemnities) and Pledged Deposits

LIQUIDITY LIQUIDEZ

Quick Assets/ Total Deposits 44.8% 24.5% 43.1% 11.4% 31.2% 50.5% 59.8% 56.1% 643.1% 28.1% 29.7% 38.9% 19.2% 37.6% 20.9% 36.8% 33.9%

Borrowed Funds/ Gross Loans (**) 5.5% 39.7% 9.6% 46.6% 50.6% 38.2% 22.9% 50.0% 106.6% 39.7% 14.4% 64.6% 40.9% 27.2% 54.0% 61.4% 30.9%

Demand Deposits/ Total Deposits 13.2% 9.6% 18.1% 14.7% 12.0% 39.8% 13.6% 18.0% 42.4% 13.5% 11.4% 18.3% 7.8% 13.6% 13.0% 6.6% 15.5%

Call Loans/ Total Deposits 3.8% 43.5% 6.9% 43.2% 80.2% 49.0% 20.6% 64.5% 788.0% 48.1% 14.2% 170.3% 74.5% 31.2% 87.2% 97.6% 28.8%

Call Loans/ Gross Loans 5.5% 39.7% 9.2% 46.6% 50.4% 38.2% 22.9% 50.0% 106.6% 39.7% 14.4% 64.6% 40.9% 27.2% 54.0% 50.4% 30.3%

Due From Banks/ Total Assets 0.9% 0.1% 0.0% 0.6% 2.6% 2.3% 2.1% 0.6% 3.0% 0.8% 0.6% 0.0% 0.0% 0.2% 0.0% 0.0% 0.6%

Financial Cost/ Borrowed Funds 7.5% 10.7% 8.2% 7.3% 8.7% 4.8% 6.3% 5.5% 3.5% 8.4% 13.2% 8.0% 11.4% 14.7% 11.8% 8.6% 8.4%

(**)(**) Borrowed Funds includes: Call Loans owed, Deposits from Banks (placements), Loans and other financing received from domestic/ foreign banksBonds/bills issued to finance loans & WK

Borrowed Funds includes: Call Loans owed, Deposits from Banks (placements), Loans and other financing received from domestic/ foreign banks & & Bonds/bills issued to finance loans & WK

CAPITALIZATION CAPITALIZACION

Capital Funds/ Total Assets 9.0% 8.5% 9.8% 9.3% 7.7% 13.9% 16.4% 7.3% 34.9% 10.4% 10.4% 8.3% 9.7% 13.1% 11.6% 9.7% 9.8%

Capital Funds/ Risk Assets(***) 13.8% 9.9% 14.5% 9.9% 9.0% 18.4% 24.3% 9.4% 60.3% 12.2% 13.0% 9.5% 10.4% 16.1% 12.7% 11.1% 12.3%

Capital Funds/ Gross Loans 16.7% 13.8% 17.5% 17.8% 10.1% 22.0% 33.4% 14.7% 72.1% 16.7% 15.4% 10.4% 13.7% 23.4% 17.8% 14.7% 16.9%

Capital Funds/ Total Deposits 11.5% 15.1% 13.2% 16.5% 16.1% 28.3% 30.2% 19.0% 532.9% 20.3% 15.2% 27.4% 24.9% 26.9% 28.7% 28.4% 16.1%

Risk Weighted Ratio 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

(***) Risk Assets = Total Assets less Quick Assets

(***) Risk Assets = Total Assets less Quick Assets

Strike Value S.A. Page 3

Phone (511) 919-8252 www.strikevalue.com 1/29/2011 SFN-1100 $SFN1100