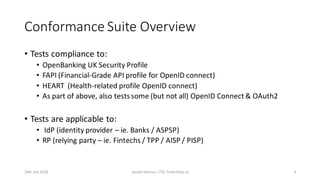

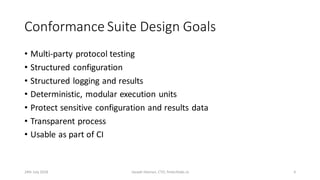

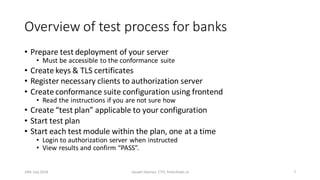

The document discusses FAPI/Open Banking conformance testing. It provides an overview of the conformance suite, including what it tests and its design goals. It then describes the test process for banks, demonstrates the conformance suite, and provides tips for successful FAPI deployment, including common problems banks faced in the UK and advice for running conformance testing early in development.