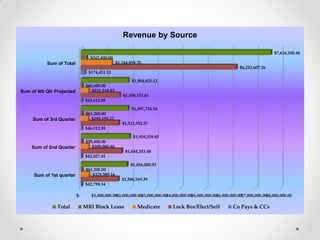

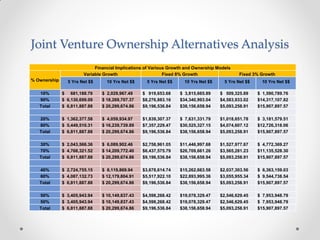

The document provides an analysis of a radiology practice including initial observations, recommendations for improvement, and procedure volume statistics. Key findings include a lack of formal marketing and financial planning, opportunities to improve operations and billing through automation and analytics, and year-to-date growth in overall procedure volume compared to previous years. Recommendations address enhancing marketing, evaluating strategic partnerships, implementing financial controls, upgrading technology, and monitoring metrics to optimize performance.