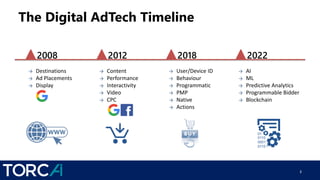

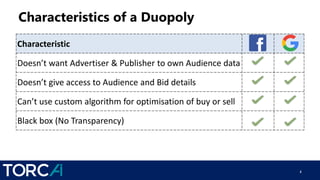

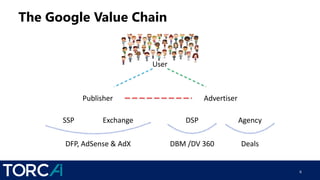

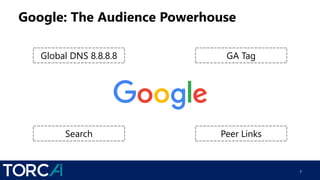

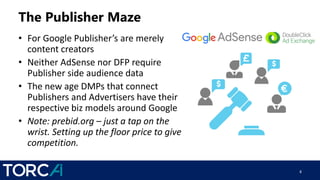

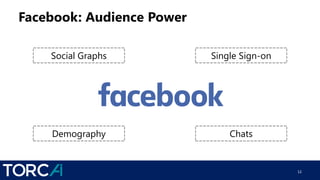

The document presents insights on the evolving digital advertising landscape, focusing on the challenges posed by major platforms like Google and Facebook, which maintain significant control over audience data and ad placements. It emphasizes the importance for publishers and advertisers to build their own audience data and to consider open real-time bidding (RTB) as an alternative to the current duopoly. Key takeaways include viewing audience development as a long-term investment and the need for collaboration between CMOs and CTOs to address the disruptions in the market.