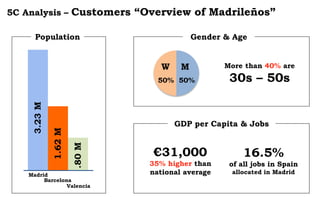

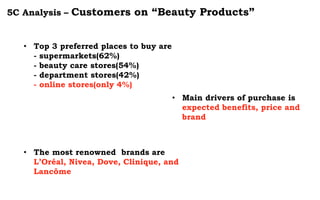

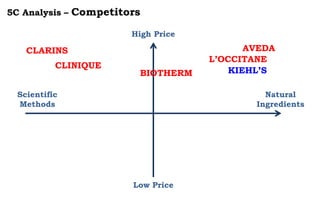

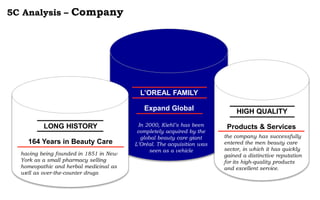

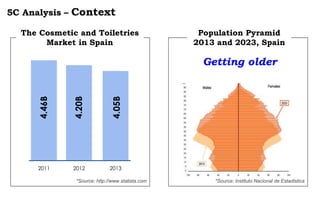

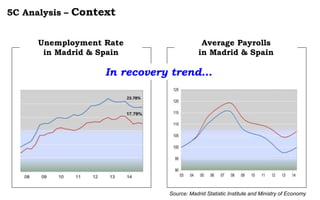

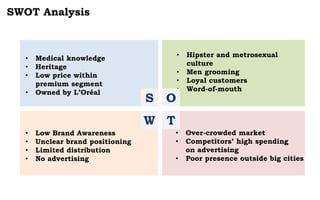

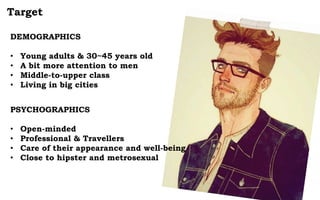

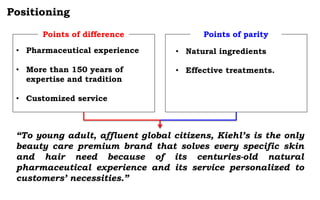

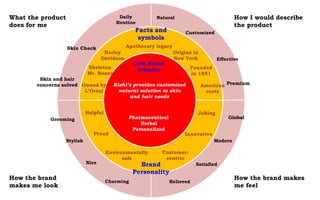

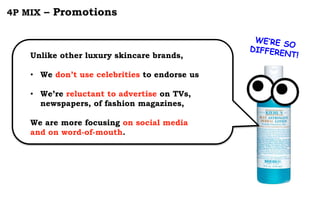

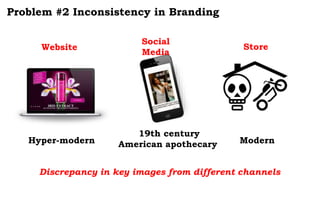

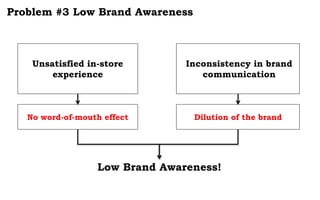

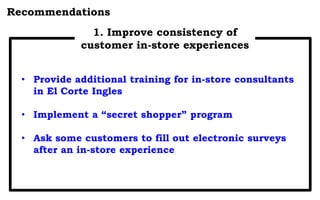

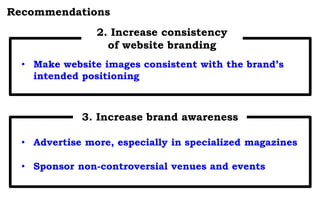

The document analyzes Kiehl’s brand positioning and market presence, detailing its customer demographics, competitors, and product offerings in the beauty sector. It highlights the company's strengths, such as natural ingredients and rich heritage, while addressing weaknesses like low brand awareness and inconsistent customer experiences. Recommendations include improving in-store training, increasing brand consistency, and enhancing marketing efforts to boost awareness and customer satisfaction.