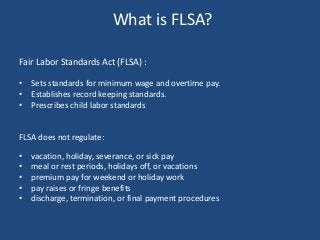

What is FLSA?�

Fair Labor Standards Act (FLSA) :

Sets standards for minimum wage and overtime pay.

Establishes record keeping standards.

Prescribes child labor standards

FLSA does not regulate:�

vacation, holiday, severance, or sick pay

meal or rest periods, holidays off, or vacations

premium pay for weekend or holiday work

pay raises or fringe benefits

discharge, termination, or final payment procedures

FLSA Requirements

Minimum Wage Requirements

Overtime Pay Requirements

Record Keeping Requirements

Child Labor Restrictions

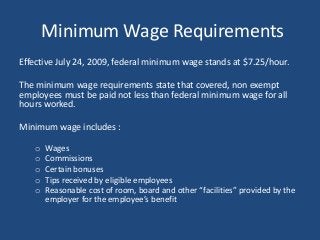

Minimum Wage Requirements

Effective July 24, 2009, federal minimum wage stands at $7.25/hour.

The minimum wage requirements state that covered, non exempt employees must be paid not less than federal minimum wage for all hours worked.

Minimum wage includes :�

Wages

Commissions

Certain bonuses

Tips received by eligible employees

Reasonable cost of room, board and other “facilities” provided by the employer for the employee’s benefit

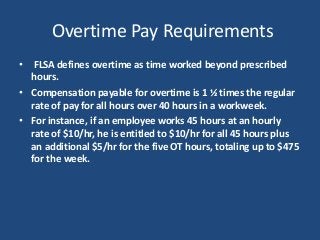

Overtime Pay Requirements

FLSA defines overtime as time worked beyond prescribed hours.

Compensation payable for overtime is 1 ½ times the regular rate of pay for all hours over 40 hours in a workweek.

For instance, if an employee works 45 hours at an hourly rate of $10/hr, he is entitled to $10/hr for all 45 hours plus an additional $5/hr for the five OT hours, totaling up to $475 for the week.

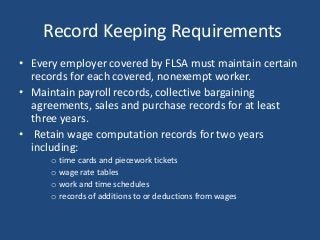

Record Keeping Requirements

Every employer covered by FLSA must maintain certain records for each covered, nonexempt worker.

Maintain payroll records, collective bargaining agreements, sales and purchase records for at least three years.

Retain wage computation records for two years including:

time cards and piecework tickets

wage rate tables

work and time schedules

records of additions to or deductions from wages

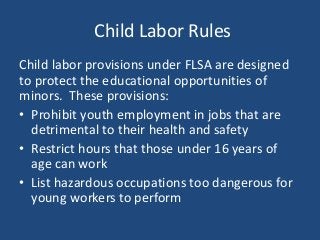

Child Labor Rules

Child labor provisions under FLSA are designed to protect the educational opportunities of minors. These provisions:

Prohibit youth employment in jobs that are detrimental to their health and safety

Restrict hours that those under 16 years of age can work

List hazardous occupations too dangerous for young workers to perform

Want to learn more about FLSA, its requirements and best practices to comply with them? ComplianceOnline webinars and seminars are a great training resource. Check out the following links:

Fair Labor Standards Act: Are Your Employees Classified Correctly?

The In's and Out's of FLSA

How to Conduct FLSA Classification Self-Audit

Avoiding Costly Wage and Hour Problems

How to Pay Overtime Correctly under FLSA

Handling Supplemental Pay Under the FLSA

For More details visit us at:http://www.complianceonline.com/classifying-employees-under-flsa-webinar-training-703602-prdw?channel=flsappt

What is FLSA?�

Fair Labor Standards Act (FLSA) :

Sets standards for minimum wage and overtime pay.

Establishes record keeping standards.

Prescribes child labor standards