1 souces of funds

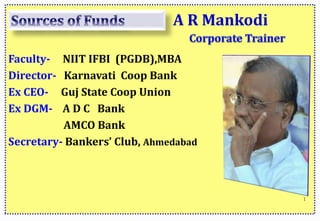

- 1. A R Mankodi Faculty- NIIT IFBI (PGDB),MBA Director- Karnavati Coop Bank Ex CEO- Guj State Coop Union Ex DGM- A D C Bank AMCO Bank Secretary- Bankers’ Club, Ahmedabad 1

- 2. What is Banking? As per BR Act 49 (5b) 49 Bank is an institute collecting money from the public for the purpose of investment and lending, payable on demand by cheque/draft See the word “Money” See the purpose See the term “Demand” See the mode of payment

- 3. Who is customer? Person or entity who is having an account in bank, the dealings in which are of banking nature Relationship changes with dealings type Some relations are Creditor- Debtor Debtor - Creditor Trustee – Beneficiary Bailer -Baillie Duration of account or status of account is immaterial Just Visitor or inquirer is not customer

- 5. Types of Deposits Deposit Services (Liability Products) Residents Demand deposits Savings Current Term deposits Fixed Cumulative Recurring Non residents Demand deposits NRO NRE Term deposits NRO NRE FCNR Other facilities RFC and EEFC (RFC - domestic)

- 6. Savings Deposit Purpose is saving so no business transaction allowed Restriction on number of withdrawals Minimum quarterly average balance requirement in most cases to meet with cost of funds. Basic savings account or PMJDY have liberal terms Combination like 2-in-1 or 3-in-1 offered Combination of other products/services offered on terms Cheque book/debit card/passbook offered. ROI is 4% up to 1 lac QAB as fixed by RBI rest fixed by bank Single/Joint account allowed Nomination allowed KYC/AMLA guidelines/rules/Due diligence codes are applied. High liquidity low yield to customer Part of Low cost(CASA) for bank

- 7. Current Accounts Purpose is convenience of business so unlimited transactions High cost to bank hence no interest paid by bank. High liquidity no yield to customer QAB is required. Non maintenance may attract penalty Verity of product packages offers like 2-in-1,3-in-1,others Cheque book debit card/net banking/fund transfer offered Individual , firm , co. ,association, Society ,HUF, Govt Dept, trusts, AOP, administrator, executor can open More documents like registration, constitution ,resolution, Incorporation certi.bye laws etc. required KYC/AMLA/Due diligence applied. Various charges like cash handling , stationery etc applied. Part of Low Cost (CASA) deposit for bank Nomination allowed Credit facilities can be linked with this.

- 8. Term Deposits Short term or long term offered as time liability Competitive ROI offered on cost and mode of payment Fixed of Floating rate offered Overdraft/loan or premature withdraws on some conditions Nomination allowed Can be offered as security. Interest paid monthly/quarterly/six monthly/yearly TDS applicable Single/joint/legal person can open KYC/AMLA applied. More than 20000/can not be paid in cash PAN required in some cases. CD or RD are variation of term deposits CD are market instruments offered as NI(Usance DP)and in demate form to offered flexibility to market investor

- 9. NRI Accounts Who is NRI? What is condition? Non Resident Ordinary (NRO) account • Current, savings, fixed deposit and recurring deposit in rupees Non Resident External (NRE) account • Current, savings, fixed deposit and recurrent deposit in rupees Foreign Currency Non-Resident (FCNR) account • Fixed deposit account in foreign currency

- 10. NRO account: Is for the local funds and income of the non residents. Is for parking funds from local sources such as rent, interest or profit from business in India. Does not allow repatriation or remittance of balance abroad except an amount not exceeding USD one million per financial year i.e. interest earned on deposits ,bonds ,loans given to local persons , income from business in India dividend, profit from sale of shares, MF or units, rental income subject to TDS Medical treatment abroad of up to USD 100000 per year Proceeds from the sale of property to the extent of funds brought in from abroad for buying the property

- 11. NRE account: Is opened only by non residents. Can be either single or joint accounts. Credits have to be from foreign inward remittances. Funds can be withdrawn freely for local payments. Transfer (from NRE to NRO accounts) is permitted, reverse is not. Transfer (from NRE to local accounts of residents) is permitted, reverse is not allowed. Interest is not taxable. Transfer between NRE accounts and NRE and FCNR accounts are permitted. Local funds cannot be deposited into the NRE account except in the following cases: Sale proceeds of shares or bonds, which are purchased with funds from the NRE account Sale proceeds of real estate property purchased with funds from the NRE account

- 12. FCNR account: Refers to fixed deposits of one to five years maintained in foreign currency. Deposits can be maintained in USD, British Pounds, Euros, Yen, Canadian Dollars and Australian Dollars. Can be either single or joint accounts. Balances: Are freely repatriable. Can be credited to the NRE or NRO accounts. In the NRO accounts cannot be invested in the FCNR accounts. Earns simple interest on deposits of one year.

- 13. RFC (Domestic account): Is for depositing foreign exchange received by residents. Can be utilised for making remittances abroad. Can be maintained only as a current account. Does not have any interest payable. EEFC: Facility is extended to exporters to maintain their export earnings in foreign currency. Can be utilised for making payments abroad. Does not have any interest payable.