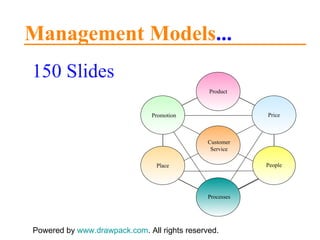

150 Management models and diagrams for your powerful business presentations.

Content:

Powerpoint, presentations, business, slides, diagrams, charts, Break-even, Financing Life Cycle, Economies of Scale, Elasticity, Sales Cycles Market Potential, Portfolio Matrix, Product Model, Four P's, Push/Pull Strategy, Marketing Mix, PDCA Cycle, SWOT, Value Chain, Ansoff Matrix, BCG Matrix, 7-S Modell, Core Competencies, GE Business Screen, Nine Cell Industry Risk/Reward Diagram, Porter's Five Forces, Industry Competition, Generic Strategies, Geobusiness Modell, Porter's Diamond, Matrix Design, PIMS, Leavitt's Diamond, Belbin's Team Roles, Theory X/Y, Maslow's Hierarchy, Herberg's Theory, Cultural Web, Pareto Curve, CIM Concept, Value Drivers

Download these diagrams on

http://www.drawpack.com

(try our free membership offer)

![Drawpack Diagrams Drawpack.com offers premium Business Diagrams for students and professionals around the globe for their personal use. Please enjoy these Business Diagrams. You can send these slides to your personal contacts who might be interested in Business Diagrams. For further information about our service please contact us: [email_address] Please find our membership offer on www.drawpack.com](https://image.slidesharecdn.com/managementmodels-110118035857-phpapp01/85/150-Management-Models-for-business-presentations-153-320.jpg)