Finding External Funding – What is your money future?

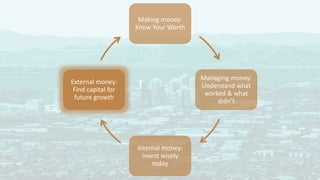

- 1. Making money: Know Your Worth Managing money: Understand what worked & what didn’t Internal money: Invest wisely today External money: Find capital for future growth

- 2. Getting Funded is TOUGH! Success rates are low You don’t get a lot of shots The process is counter-intuitive & time-consuming SO knowing that you’re a good investment is essential!

- 3. Three simple (not easy) steps:

- 4. What kind of money do you want?

- 5. Assess your funding readiness 1) How much money do you need? 2) What exactly will you use it for? 3) Do you review your financials & KPIs regularly? 4) Can you share your story with investors? 5) Do you have an exit strategy?

- 6. Funding is Risky! Talk talk talk Partner $$ out Wait… Wait… Wait… Biz sale Talk talk Underwriter $$ out Payment Payment

- 7. Getting money takes time Attract them •DEBT: Banks / alternate lenders •EQUITY: Friends, Family & Fools/ Angels / VCs •“FREE”: Grants, contests, crowdfunding Get a “Yes” •Convince your banker, then get through underwriting •Get past associates, convince the partners •Impersonal, opaque decisions Prove it •Prove that you can pay back NOW •Prove that you know what you’re talking about & can execute •Included in request Sign & cash in •Sign documents, get your $$ in 10-20 days •Wait until all investors have signed & paid to get your $$ •Arbitrary deadlines Make them happy •Generate enough cash to pay them back starting next month •Sell your biz in 5-7 years •Deliver results (IP issues?)

- 8. What if you don’t get the money?

- 9. Attracting Smart Money Through Strategic Partners Who Shares Your Ideal Customers? B2B? B2C? B2B2C? Do you Represent a Strategic Advantage? Keep risk off their books? Take a load off them? Long term if it works? Who Has The Employees You Want? Existing Connections? Issue You Can Solve? Mutual Strategic Value? Who Cares About Your Credentials or Value? Do you remove a cost? Does this help PR/Story? Does status open doors?

- 10. What did we learn? • Are you ready to raise money? • No one’s waiting to write you a check • Don’t let “No” stop you from moving forward

Editor's Notes

- :08 - :09 Here’s what we’re doing all month & what we’ve already done Transition Today is all about

- :09 - :10 Lots of us think that getting funded will be the solution to all of our problems 1) Success rates are low: Angel / VC funding <1% of applicants, national banks <30%, local banks <50% 2) Not a lot of chances: investors talk to each other, loan applications = credit reports getting pulled, which leaves a record + your credit score is always there for lenders to see… 3) Process is tough: it’s rarely logical or about who you know, you will invest 60 days to 9 months in the process => be sure that you pick the best path for you! Looking for funding as just another marketing campaign – you can’t just try to convince folks to like your product, you need to understand how you can help them. Understanding what kind of investment you are and then talking to funders who want that kind of investment (your “clients”). The best thing you can do for your business is to understand what kind of investment you are and then build your funding plan around that! Transition -> How do you do that? In three simple (but not always easy) steps

- :10-:12 1) Get your hat out of your hand. Stop thinking about what kind of money you think you can get and start thinking about what kind of money you want. Know exactly what YOU want before you ever talk to a “suit”. 2) Understand what your options are and then find the ones that fit with what YOU want for your business. Just because other people are getting loans or VC investment doesn’t mean you need to – what matters is getting the funding that fits your business best, and that may NOT be what you thought. 3) Because you’ve still got a biz to run, it’s important to know how to survive without OPM (other people’s money) – whether just for a while, or for the life of your biz! Give yourself the tools to build a great biz (which you’re already working on if you’ve been to other MM events!) and don’t forget to USE them. Transition -> How do you do that? Step #1, you’ve got to know where you are today

- Step 1 = Finding the right money for you means understanding Where you are now Where you want to go and Whether the path you’re taking to get there makes sense Where you are now = Awareness = how much you need, what it will do for your business, financial reporting, tax situation, where the skeletons are buried. This ties into weeks 1 & 2 (does your biz make money and how do you manage the money you’ve already got?) Where you want to go = Your long term goal = sell / keep / close. This ties into what they learned in week 3 – long-term goal + plan to get from here to there. How you get there = Your story = words & numbers. Make sure that your numbers support what your words are saying, so that your story is coherent & will survive due diligence. In other words, before you ever start looking, you’ve got to be ready for funding! Why is this important? Because you won’t get a lot of chances, and fundraising takes a lot of time, you want to be sure you’re stacking the deck in your favor BEFORE you start your fundraise Transition -> You know where you want to go, but you may not know if you’re ready for funding – so let’s test your funding readiness right now ;-)

- Walk through the questions & help them score themselves. PRINT THIS AS A WORKSHEET FOR PARTICIPANTS (Stephanie will create this) Less than 4 = not funding ready yet How are you feeling right now? Transition -> Why are these elements so important to getting funded? Because funders are worried about risk, and each of these elements increase the risk they see in giving you money.

- Walk through the steps from a lender (like our powered by sponsor National Bank of Arizona) or an investor’s perspective, demonstrating their risk (in red) Two basic types of funding – debt & equity Debt means getting money now that you have to start paying back right away Pros: no ownership of your company, once you pay back, they disappear + fixed cost (interest rate & fees) & term Cons: you have to be able to pay something back right away + personal guarantee + you’re renting money w/out any other benefits (like expertise / operational help / etc.) Equity means getting money now that you pay back with partial ownership of your company, and ultimately the proceeds of sale Pros: no payments right away + access to expertise / introductions / operational help Cons: they are an owner of your company + other restrictions (boards, reporting, etc.) + the venture treadmill (once you start, you can’t stop) Debt has less risk because they start getting paid back sooner…and they know when they will have all their money returned – reminder that loans are only approved 25-50% of the time Equity has more risk because they don’t (usually) get any money back until you sell your business – reminder that less than 1% of applicants receive VC funding Transition -> so what does that mean to you?

- It means you’ve got to understand their process and show how you’re a good bet each step of the way! Resistance is futile ;-) The process is what the process is, and while you may not like it, you can’t change it. Walk through the different phases of getting funded with both debt & equity: Attract them Get them to say “yes” Prove that everything you said before is reality – surviving due diligence Close + fund Keep them happy – repayment and/or regular updates, eventual sale of the biz for equity Walk through each step for both types of $$, including the approximate timeline for each. Attraction can take a very long time if you don’t understand what kind of funding is right for you – BE FOCUSED ON YOUR IDEAL FUNDER Getting yes can also take a very long time if you’re not creating urgency because you’re a good investment – CLEARLY DEFINE YOUR TIMELINE & YOUR DEAL TERMS Prove it = due diligence, which can take from 30-90 days depending on the funder & your readiness – BE PREPARED & DON’T CREATE DELAYS ON YOUR END (respond asap) Close + fund = understand that you won’t get your $$ right away, and that’s not something you can change – PLAN AHEAD SO YOU GET $$ IN TIME Keep them happy = starts as soon as they give you the $$ - CREATE A SYSTEM FOR COMMUNICATING WITH YOUR FUNDERS SO YOU’RE NOT SCRAMBLING EVERY MONTH This can be complicated, so you may not want to do it. Plus, it doesn’t always work! Transition -> So what if you’re not ready or able to convince them?

- Chances are you won’t get funded right away, so what do you do? ID what’s keeping you from getting funded (it’s not just that banks & investors don’t like you or are mean) Prioritize & clean up the biggest areas (run your biz better, get more customers, increase profits, etc.) – you may have already chosen to work on these elements in prior MM2.0 session, and if so, you’re already on the right track! Keep the mindset of continual improvement going! Check your mindset – not getting funded doesn’t equal failure, it just means you’re not ready yet. This can be a great opportunity to practice your relationship building and telling your story better. Keep in touch with funders, stop asking for money and start sharing your progress. Transition -> So what happens if you hear “no” – or choose not to look for outside funding?

- Think about other ways to raise money, including strategic partnerships Even if you aren’t able to get funding, growing your business through strategic partnerships is an invaluable alternative. Start this process of identifying your most ideal strategic partners by looking at your business plan and balance sheet. “SMART MONEY” means money that also brings you strategic and intellectual value…gets you both there faster because you all “get it”. Mention a quick strategic partnership anecdote (30 seconds) Erika’s story generated millions for them, billions for their partner. You’re looking for other businesses who need what you’ve got, so you need to get creative and ask yourself these questions (refer to the different questions on slide) Key elements of making a strategic partnership work: -Be a team player. Think of their needs before yours. What can you bring them? THEN, what can they solve for you and bring you. -EMBRACE AND TOUT YOUR ASSETS! Larger corps ALWAYS have legal obligations to fulfill diversity (SBE, WBE, MBE) requirements…plus, press-worthy. -BE DELIGHTFUL TO WORK WITH! IT’S ABOUT THEM…JUST HAPPENS TO FULFILL YOUR NEEDS. KEEP IT BITE-SIZE, UNCOMPLICATED, SCALABLE. This represents a brilliant growth strategy if you land growth capital or not. GROW EFFICIENTLY. It takes a village to grow a business. Transition -> So we’ve covered a lot of ground regarding funding. But to recap, we’ve learned…

- Speaker concludes :40 - :45 Getting ready means more than asking for $$ - it means connecting the dots between where you are today, the funding you’re looking for, and what that money will do for your business. It also means being credible with your financials as well as your words, by having your financials & taxes in order, etc. Since no one’s looking for you, you’ve got to identify what kind of funding is the best fit for your biz and then create your own marketing campaign for those kinds of funders. Invest the time to learn about their needs & desires and understand how you can help them achieve their objectives. Looking for money means hearing “no” – but you can’t let that discourage you. And if you continue to build your biz while you’re looking for funding, you not only increase your chances of getting funded (because you’ll have better results), but you also build your confidence and your negotiating position when / if you decide to take OPM! Any questions? Transition -> I want to thank you for investing in yourself today, but we’re not done yet. It’s time to apply what you’ve learned in your small groups, and to help us do that, here’s REGIONAL COORDINATOR