Investment pattern v25_jul2012

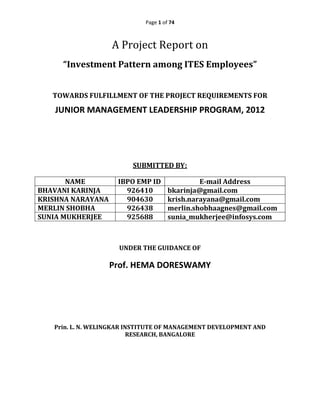

- 1. Page 1 of 74 A Project Report on “Investment Pattern among ITES Employees” TOWARDS FULFILLMENT OF THE PROJECT REQUIREMENTS FOR JUNIOR MANAGEMENT LEADERSHIP PROGRAM, 2012 SUBMITTED BY: NAME IBPO EMP ID E-mail Address BHAVANI KARINJA 926410 bkarinja@gmail.com KRISHNA NARAYANA 904630 krish.narayana@gmail.com MERLIN SHOBHA 926438 merlin.shobhaagnes@gmail.com SUNIA MUKHERJEE 925688 sunia_mukherjee@infosys.com UNDER THE GUIDANCE OF Prof. HEMA DORESWAMY Prin. L. N. WELINGKAR INSTITUTE OF MANAGEMENT DEVELOPMENT AND RESEARCH, BANGALORE

- 2. Page 2 of 74 STUDENT DECLARATION We, Ms. Bhavani Karinja, Mr. Krishna Narayana, Ms. Merlin Shobha, and Ms. Sunia Mukherjee; enrolled for the Junior Management Leadership Program of Welingkar Institute of Management Studies, Electronic City, Bangalore, hereby declare that we have completed the project titled “INVESTMENT PATTERN AMONG ITES EMPLOYEES” as a part of the course requirements for JMLP Programme. We further declare that the information presented in this project is true and original to the best of our knowledge. Team Members Signature BHAVANI KARINJA KRISHNA NARAYANA MERLIN SHOBHA SUNIA MUKHERJEE Date: July 28, 2012 Place: Bangalore, India

- 3. Page 3 of 74 CERTIFICATE FROM THE INTERNAL GUIDE I, Prof. Hema Doreswamy hereby certify that Ms. Bhavani Karinja, Mr. Krishna Narayana, Ms. Merlin Shobha, and Ms. Sunia Mukherjee; enrolled for the Junior Management Leadership Program of Welingkar Institute of Management Studies, Electronic City, Bangalore, have completed a project on “Investment Pattern among ITES employees” under my guidance during the course. Their work has been found to be satisfactory. Date: July 28, 2012 Place: Bangalore, India (Signature of the Guide)

- 4. Page 4 of 74 ACKNOWLEDGEMENTS We would like to thank Infosys BPO Management for having started such a wonderful program – JMLP – Junior Management Leadership Program – wherein we are able to learn while earning. We would like to thank all the WE School Professors for making this program very interesting and putting their passion for teaching in every session which enabled us to increase our knowledge and skill sets. We would like to thank all other JMLP students for making this program more interesting with each other’s interaction and support. We would like to thank our reporting managers and other colleagues at work for providing their support to us to complete this work. We would like to thank to all the sources from where we referred the content and prepared this report. We would like to thank all the respondents for having taken time & providing their inputs. Without their inputs, we would not have been able to proceed further on the data analysis. We would like to thank our project mentor, Prof. Hema Doreswamy, for guiding us in every step of the project.

- 5. Page 5 of 74 Contents & Index Page Chapter One – Research Design 06 to 18 1.1 Introduction to ITES Industry 06 1.2 Importance of the Study 08 1.3 Statement of the problem 09 1.4 Scope of the Study 09 1.5 Review of the Literature 10 1.6 Objectives of the Study 16 1.7 Period of the Study 17 1.8 Limitations 17 1.9 Methodology 17 1.10 Chapter Scheme 18 Chapter Two – Profile 19 to 45 2.1 Profile of Savings and Investments 19 2.2 Profile of ITES Companies 39 Chapter Three – Data Analysis and Interpretation 46 to 67 Chapter Four – Summary of Findings & Suggestions 68 to 74 Findings & Suggestions 68 Conclusion 73 Bibliography (References) 74

- 6. Page 6 of 74 CHAPTER 1: RESEARCH DESIGN 1.1 Introduction to ITES Industry The word ITES stands for Information Technology Enabled Services. What a layman can understand by the term is that any service which is given to the customer by virtue of IT can be classified under ITES. Another name for this industry is BPO (Business Process Outsourcing). Any non-core activity of an organization being done by a different party is termed as ‘Outsourcing’. When the same work is being done at a different location in another country, it is termed as ‘Off-shoring’. Business process outsourcing (BPO) is a subset of outsourcing that involves the contracting of the operations and responsibilities of specific business functions (or processes) to a third-party service provider. Originally, this was associated with manufacturing firms, such as Coca Cola that outsourced large segments of its supply chain. In the contemporary context, it is primarily used to refer to the outsourcing of business processing services to an outside firm, replacing in-house services with labour from an outside firm. BPO is typically categorized into back office outsourcing - which includes internal business functions such as human resources or finance and accounting, and front office outsourcing - which includes customer-related services such as contact centre services. Often the business processes are information technology-based, and are referred to as ITES-BPO, where ITES stands for Information Technology Enabled Service. Knowledge process outsourcing (KPO) and legal process outsourcing (LPO) are some of the sub- segments of business process outsourcing industry. Benefits and limitations: An advantage of BPO is the way in which it helps to increase a company’s flexibility. However, several sources have different ways in which they perceive organizational flexibility. Therefore business process outsourcing enhances the flexibility of an organization in different ways. Outsourcing may provide a firm with increased flexibility in its resource management and may reduce response times to major environmental changes.

- 7. Page 7 of 74 Another way in which BPO contributes to a company’s flexibility is that a company is able to focus on its core competencies, without being burdened by the demands of bureaucratic restraints. Key employees are herewith released from performing non-core or administrative processes and can invest more time and energy in building the firm’s core businesses. The key lies in knowing which of the main value drivers to focus on – customer intimacy, product leadership, or operational excellence. Focusing more on one of these drivers may help a company create a competitive edge. A third way in which BPO increases organizational flexibility is by increasing the speed of business processes. Supply chain management with the effective use of supply chain partners and business process outsourcing increases the speed of several business processes, such as the throughput in the case of a manufacturing company. Finally, flexibility is seen as a stage in the organizational life cycle: A company can maintain growth goals while avoiding standard business bottlenecks. BPO therefore allows firms to retain their entrepreneurial speed and agility, which they would otherwise sacrifice in order to become efficient as they expanded. It avoids a premature internal transition from its informal entrepreneurial phase to a more bureaucratic mode of operation. A company may be able to grow at a faster pace as it will be less constrained by large capital expenditures for people or equipment that may take years to amortize, may become outdated or turn out to be a poor match for the company over time. Although the above-mentioned arguments favour the view that BPO increases the flexibility of organizations, management needs to be careful with the implementation of it as there are issues, which work against these advantages. Among problems, which arise in practice are: A failure to meet service levels, unclear contractual issues, changing requirements and unforeseen charges, and a dependence on the BPO which reduces flexibility. Consequently, these challenges need to be considered before a company decides to engage in business process outsourcing.

- 8. Page 8 of 74 A further issue is that in many cases there is little that differentiates the BPO providers other than size. They often provide similar services, have similar geographic footprints, leverage similar technology stacks, and have similar Quality Improvement approaches. Threats: Risk is the major drawback with Business Process Outsourcing. Outsourcing of an Information System, for example, can cause security risks both from a communication and from a privacy perspective. For example, security of North American or European company data is more difficult to maintain when accessed or controlled in the Sub-Continent. From a knowledge perspective, a changing attitude in employees, underestimation of running costs and the major risk of losing independence, outsourcing leads to a different relationship between an organization and its contractor. Risks and threats of outsourcing must therefore be managed, to achieve any benefits. In order to manage outsourcing in a structured way, maximizing positive outcome, minimizing risks and avoiding any threats, a Business continuity management (BCM) model is set up. BCM consists of a set of steps, to successfully identify, manage and control the business processes that are, or can be outsourced. 1.2 Importance of the Study Savings are the excess of Income over expenditure for any economic unit. Thus: S=Y- E, where S is the savings, Y is the income and E is the expenditure. Excess funds or surplus in profits or capital gains are also available for investment. Savings is abstaining from present consumption for a future use. Savings are something autonomous coming from households as a matter of habit. But bulk of the savings come for specific objectives like interest income, future needs, contingencies, precautionary purposes or growth in future wealth leading to rise in the standard of living etc. Let us learn more about how people earn, how they spend, how they keep money for future needs, and how they use their earnings to get some return.

- 9. Page 9 of 74 1.3 Statement of the Problem Few years ago, people would have hardly heard about BPO industry, or at least, they would have so many notions on the BPO industry as such. BPO is a sunrise industry which started to spread its wings just close to a decade ago. Initially, this industry provided voice support to the customers in English-speaking nations like United States & United Kingdom. One of the major requirements for hiring folks was good communication skills in English & graduation was not considered as one of the criteria. To attract talent, pay package in this Industry was way above the normal expectations. Also, this was considered as an easy route to get into highly-paid jobs for people who couldn’t complete even graduation. Higher pay packages led to a different lifestyle for these employees. As the industry started to mature, pay packages stabilized over a period of time in comparison with other industries. Due to a mismatch between higher expenses due to a different lifestyle versus the income, few people started to get into the debt trap as well. Hence, it was felt appropriate to conduct a study & understand the financial aspects of an employee working in the ITES industry. This study tries to unearth the answers to the questions on whether the employees of this industry invest. If so, what are the options exercised to invest their money. 1.4 Scope of the Study This study covers investment pattern of the employees of some of the major ITES organizations operating from Bangalore. Collection of primary data includes the inputs from the employees of following organizations: Infosys BPO (IBPO) Accenture BPO IBM Hewlett-Packard Fidelity BPO GENPACT

- 10. Page 10 of 74 ANZ BPO Dell BPO & Others Profiles of these organizations have been covered at a later stage of this document. 1.5 Review of Literature Following literature was reviewed and highlights have been provided below: 1. Factors Influencing Investment Decision of Generations in India: An Econometric Study This study was undertaken by Gaurav Kabra, Prashant Kumar Mishra, & Manoj Kumar Dash. This study was conducted to gain knowledge about key factors that influence investment behaviour and ways these factors impact investment risk tolerance and decision making process among men and women among different age groups. Today the field of investment is even more dynamic than it was only a decade ago. There is a rapid change in the events that alter the values of specific assets. Individuals have so many assets to choose from, and the amount of information available to the investors is staggering and continually growing. The turnover rate in investments should exceed the inflation rate and cover taxes as well as allow you to earn an amount that compensates the risks taken. Savings accounts, money at low interest rates and market accounts do not contribute significantly to future rate accumulation. While the highest rate come from stocks, bonds and other types of investments in assets such as real estate. Nevertheless, these investments are not totally safe from risks, so one should try to understand what kind of risks are related to them before taking action. In this paper, researchers focussed their study in trying to find out the factors which affect individual investment decision, difference in perception of investors in the decision of the basis of the age, & difference in perception of the investors in the decision of the basis of the gender. At the end of the study it was concluded that the modern investor is a mature and adequately groomed person. In spite of the phenomenal growth in the security market and

- 11. Page 11 of 74 quality Initial Public Offerings (IPOs) in the market, the individual investors prefer investments according to their risk preference. For e.g. risk-averse people choose life insurance policies, fixed deposits with banks and post office, PPF, and NSC. Occasions of blind investments are scarce, as a majority of investors are found to be using some source and reference groups for taking decisions. Though they are in the trap of some kind of cognitive illusions such as overconfidence and narrow framing, they consider multiple factors and seek diversified information before executing some kind of investment transaction. The purpose of this study was to determine whether the variables such as demographic characteristics (age, gender) and investment patterns could be used individually or in combination to both differentiate among levels of men and women investment decisions and risk tolerance and develop some guidelines to the investment managers to design their investment schemes by considering these views of individuals. 2. Investment Patterns and its Strategic Implications for Fund Managers: An Empirical Study of Indian Mutual Funds Industry This study was conducted by D N Rao & S B Rao and was published in January, 2010. The mutual fund industry in India presents an interesting scenario of 48 million investors at the time of the study, a large variety of product offerings and coexistence of private, public and foreign Asset Managing Companies. The study, adopting the classification of investors and categorization of funds by Association of Mutual Funds in India (AMFI) empirically researches the investment patterns of the five investor groups in the eight fund categories; examines the portfolios of the investor groups to identify their propensity for specific fund categories and identifies the dominant investor groups in terms of quantum of investment and investor folios. The significant findings of the study have been that (a) Corporates are the dominant investor group in the Indian Mutual Fund Industry and they account for almost 48% of the total investment (AUM) in the industry and they are more oriented towards non-equity funds which offer high security & liquidity and hence their propensity towards Liquid/Money Market and Debt-oriented funds; The second dominant group in the industry is the Retail investors’ group which accounts for almost 24% of the total investment (AUM) in the industry, while they account for 98% of the 48 million investors in

- 12. Page 12 of 74 the industry at the time of the study. The portfolio of this group is highly skewed towards equity oriented schemes (almost 80%) which offer high return, capital appreciation coupled with high risk and 18% of the portfolio accounts for Debt-oriented and Balanced funds. 3. Changing Trend of Investment Pattern in India and Emergence of Mutual Fund Industry This study was done by Sheeba Lole. This project is about how the Investor's behaviour is changing and they are now leaving behind the sacred investment options like the fixed deposits, company deposits, gold etc. Investors are now looking towards equity linked investment options. Like most developed and developing countries the mutual fund cult has been catching on in India. There are various reasons for this. Mutual Fund makes it easy and less costly for investors to satisfy their need for capital growth & income preservation. In addition to this, a mutual fund brings the benefit of diversification and money management to the individual investor, providing an opportunity for financial success that was once available only to a select few. In this project the researcher has given a brief about economy, inflation, and equity and debt market. Then it is explained how to cope with the inflation and how mutual fund is one of the best investment options today. A mutual fund is a pool of money, collected from investors, and is invested according to certain investment objectives. The term mutual means that investors contribute to the pool, and also benefit from the pool. There are no other claimants to the funds. The pool of fund mutually invested in by investors is the mutual fund. A mutual fund's business is to invest the funds thus collected, according to the wishes of the investors who created the pool. In many markets these wishes are articulated as ‘investment mandates’. Usually, the investors appoint professional investment managers, to manage their product, and offer it for investment to the investor. A Mutual fund belongs to the investors who have pooled their funds. The ownership of the mutual fund lies in the hands of the investors. Investment

- 13. Page 13 of 74 professional and other service providers, who earn a fee for their services, from the fund, manage the mutual fund. The researcher had done a comparison of different instruments and provides a comparison based on the features of each of the instruments. The researcher has found that Mutual funds are good instruments and provide good returns to the investors. The researcher has provided the detailed benefits of investing in Mutual Funds and the winning features of this instrument over other forms of traditional investment avenues. Finally, it has been concluded that Mutual Funds offers product which combines low-risk of capital loss along with potential to earn reasonable returns in even an uncertain environment. Table from this study has been reproduced below for quick reference: Table 1.1: Comparison of instruments over various factors 4. Working Papers on International Investment – Investment Patterns in a longer- term perspective This study was done by Stephen Thomsen and was published in April 2000 and focuses on the macroeconomic investments. The author has focused on long-term patterns and has demonstrated how FDI (Foreign Direct Investment) has evolved from an activity largely undertaken by large multinational enterprises (MNEs) located in a handful of countries into a global phenomenon. FDs FI Bonds Mutual Fund Accessibility Low Low Low Tenor Fixed (medium) Fixed (Long) No lock in period Tax Benefit None Under Section 80C None Liquidity Low Very Low None Convince Medium Tedious Very High Transparency None None Very High

- 14. Page 14 of 74 Both trade and investment have grown rapidly during the late 90s relative to economic growth more broadly. There have been periods of rapid FDI growth before, such as at the beginning and end of the 1980s, which were subsequently interrupted by economic recessions in major economies. The upward trend in FDI flows can also be interrupted temporarily by a decline in global growth. Like any form of investment, FDI is affected by the business cycle. Slower growth in home countries reduces investor profits at home which could have been used for acquisitions abroad. Economic growth influences both the “supply” and “demand” for FDI. Slower growth in the home country reduces both earnings and equity prices and hence limits the pool of capital available for expansion abroad. Similarly, recession in host countries lowers the short-term profitability of a potential investment. To conclude what we can say is evidence on long-term trends suggests that the 1990s represented not so much a watershed as an acceleration of trends already underway. Many firms from developing countries are now important foreign investors in their own right. Though this study does not focus on individual investors, it makes a good reading to understand the trends of investment patterns of large companies and mid-sized companies in different geographies and different economic status. 5. On Being a Woman: How Our Differences Shape Our Investment Techniques This study was conducted by Nicole Alper and focuses on the difference in the investment pattern based on the gender. According to Ruth Hayden, author of ‘How to Turn Your Life Around: The Money Book For Women’, many of the more appealing ‘female’ characteristics, such as patience, tenacity, and pragmatism make women better investors than men, once they actually get started. "Women have an intuitive sense. They are practical and understand that things work in stages and are therefore comfortable with volatility. And once they're in the market, they'll stay put." If a woman's patience is her virtue, then riding out the peaks and valleys of an ever- changing market should be her pay off. After all, according to most financial planners, it is those investors who stay in it for the long-term who reap the full benefits of the market.

- 15. Page 15 of 74 Women normally do not believe in rapid return philosophy. They do not invest in risky instruments which might yield profits overnight; however sometimes lose out on lucrative opportunities. But according to a survey on women's investment patterns conducted by Merrill Lynch, women are not doing what they need to for total financial independence and retirement. In fact, it is far from it. The statistics are worrying: 48% of women vs. 38% of men do not feel knowledgeable when selecting between investment options; and only 49% of women (vs. 62% of men) say the total amount of their savings and investments are greater than the total amount they own on any consumer debt. Women, because they earn less and live longer, need to be planning for retirement early and aggressively. Ruth says this is more common than people think. "Men jump in fast. Women often just don't jump. There are two things that prevent a woman from getting started: experience and knowledge." Professor Hersh Shefrin, the Mario L Belotti Professor of Finance at Santa Clara University and author of ‘Beyond Greed and Fear: Understanding Behavioural Finance and the Psychology of Investing’, agreed that popular psychology studies depict women as "more collaborative" and "sharing" by nature. Hence women invest much better if they are in a group, and they exchange information. Also if their partners are accommodative, then women invest much better. According to Professor Shefrin, "women should pick a sensible mix of index funds, including bonds and foreign stocks, in order to achieve their goals. They need to invest for the long-term and limit the amount invested in individual stocks to under-10% of their portfolio." Though this paper was based on Ruth Hayden’s book and surveys done by Merrill Lynch and Professor Hersh Shefrin, however, this gives us an insight of the investment patterns of women. 6. Savings and Investment pattern of IT Employees of Bangalore This research study paper was conducted by Hema Doreswamy, who also happens to be our mentor for this study. The study tries to understand the behaviour of people while

- 16. Page 16 of 74 making investment decisions by studying the behaviour of software professionals in Bangalore city. Objectives: In the research paper, objectives of the study have been clearly outlined: To examine history, growth and development of investment avenues in the city To analyze investment pattern of software professionals in Bangalore city. To find out the most accepted investment option in the city. To offer suggestions on the basis of findings with reference to profitability, tax benefits, liquidity and risk. Methodology: This study was conducted by using both the primary data as well as the secondary data. The primary source of data was collected through direct interview with the employees as well as through questionnaires. The random sampling technique was used pertaining to the primary data. Key Findings: Overall growth of the investment options available is very good. There are lots of investment avenues available through which the investors can maximize their returns and minimize their risk. The researcher has found that investing in real estate, life insurance, and Jewellery rank high in respondent’s portfolio. It is evident from the study that the savings of the respondents is less compared to their income level. Factors which predominantly affect respondents while investing are risk, return, and tax exceptions. Conclusion: The researcher has concluded on the basis of analysis done that there are lots of investment options available for all kinds of investors like risk averse, risk takers, moderate investors etc. The investors should rightly select the investments in such a way that the risk is hedged properly and the return is also maximized. The investors should update themselves to properly analyze the investment options before going for investing. 1.6 Objectives of the Study This study has been made with the following objectives: This study focuses on understanding the investment behaviour of employees of ITES Industry – which predominantly employs youngsters To understand how ITES employees manage their ‘Finance’

- 17. Page 17 of 74 To understand investment avenues available based on different type of investors To get an understanding on the preference of investments by ITES employees Take experts’ opinion and suggest the various investment opportunities available 1.7 Period of the Study This study was conducted over a period of six months. 1.8 Limitations The findings of this study are based on sample size, so they can’t be generalized. The research period is very short. So time constraint was a limiting factor. Limited knowledge of respondents about the topic of the study. All are working members, and hence, time & efforts put in this study is very limited. 1.9 Methodology This study was conducted based on both primary data and secondary data. 1.9 (A) Primary Data Primary data was collected based on preparing a ‘questionnaire’ – a popular data collection tool to get the answers to our questions. This questionnaire was floated to ITES employees based at Bangalore on a ‘random sample’ basis. This study covers a sample size of 202 employees working in ITES industry. 1.9 (B) Secondary Data We have made extensive use of resources available in the Internet & other print media to gather the information, do the analysis, and arrive at the conclusion. Information from various sources has been used to understand more about various investment alternatives & to provide suggestions for choosing better investment portfolio. 1.9 (C) Analytical Tools As mentioned earlier, ‘Questionnaire’ (a technique or a method used for obtaining specific information about a defined topic) was used to collect the primary data. This questionnaire contains both close-ended (questions wherein respondent has to select based on the

- 18. Page 18 of 74 options provided) as well as open-ended questions (respondent has to provide his / her personal opinion). Questionnaire that was floated has been attached. 1.10 CHAPTER SCHEME First chapter titled ‘Research Design’ consists of introduction, importance of study, statement of the problem, review of literature, objectives of the study, scope of the study, limitations of the study, methodology, and the chapter scheme. Second chapter titled ‘Profile’ provides details on the research problem and other information pertaining to the topic. Third chapter titled ‘Data Analysis and Interpretation’ provides analysis on the topic of our study. Findings of the answers of the respondents have been provided both in table format and have been put as charts for pictorial representation. Hence, 17 such tables and charts could be found in this chapter. Fourth chapter titled ‘Summary of Findings and Suggestions’ provides the key findings of this study in a nutshell. Suggestions have been made and incorporated in this chapter. We believe everyone would benefit by following some of the simple suggestions. This chapter provides the conclusion drawn from this study. Also, this chapter consists of list of references and finally ends with acknowledgements.

- 19. Page 19 of 74 CHAPTER 2: PROFILE OF THE STUDY 2.1.1: Savings and Investments Savings are the excess of Income over expenditure for any economic unit. Thus: S=Y- E, where S is the savings, Y is the income and E is the expenditure. Excess funds or surplus in profits or capital gains are also available for investment. Savings is abstaining from present consumption for a future use. Savings are something autonomous coming from households as a matter of habit. But bulk of the savings come for specific objectives like interest income, future needs, contingencies, precautionary purposes or growth in future wealth leading to rise in the standard of living etc. When people start saving they search for various investment options to invest their savings. During this process they consider various factors like risk, return, duration, liquidity, tax planning, hedge against inflation, safety etc. In earlier days the investment options available to investors were very limited like insurance, jewellery, fixed deposits, debentures, shares etc. But in the liberalized economy there are many investment options, which promise very high returns. After private players started operating in Insurance, there are many policies available which not only cover the risk, but they also promise high return with good capital appreciation. Individuals engage themselves in such activities to earn money. The money they earn is normally spent on meeting daily needs like buying vegetables, groceries, clothes, giving school fees, telephone bills etc. People also generally try to keep aside a part of their earnings to meet future needs like marriage of their sons and daughters, buying a house, health care, etc. People also use part of their earning to deposit in banks or in buying shares, property or gold. By doing so, these people are also able to generate some extra earnings for themselves. 2.1.2 Income As we know, individuals engage in one or the other occupations to earn their livelihood. For example, a person may be employed in Bank and draw salary, a person may engage in

- 20. Page 20 of 74 selling books and earn a profit, a doctor or a lawyer may do the private practice and get fees for their services. The earning from all these sources is called income. Sometimes we find people earn from more than one source. For example, a teacher can write books for schools and he gets some money from the publishers. If he is a singer, he can sing for All India Radio (AIR) for which AIR gives him some money. Thus, one individual can engage in different occupations to earn money. The earnings from different sources are collectively called as his total income. This total income in a month is called as his monthly income and in a year is annual income. Sources of Income: Some may earn from a single source and others may have multiple sources. Let us learn about the various sources from which people earn their income. Business: Individuals engaged in business earn income by way of profit. Employment: People who are in employment earn their income by way of salary or wages. Profession: You have seen doctors, lawyers and chartered accountants. They provide personal services of special nature and charge fees for their services. This fee is the source of income for professionals. Vocation: As we know vocation is the application of one’s special skill or knowledge to earn money. For example, a good cook can cook food at marriage parties and earn some income. A carpenter can make or repair furniture and earn income. Agriculture: When we cultivate land we produce crops, paddy, vegetables etc. All or a part of it can be sold which gives us a return. This earning is called agricultural income. Property: Normally owning land or a home is considered as owning property. This property can be given on rent or lease to someone for use and we get a return on it. Thus, it becomes a source of income for us. Other Income: People keep a part of their earning either in banks, post office or they can buy shares and debentures, government bonds etc. All these give them some return in the form of interest/dividend. These are also called their income.

- 21. Page 21 of 74 2.1.3 Expenditure When we buy goods or products we pay money for them. Similarly when we avail of some services like consulting a doctor during illness or getting water and electricity for use, we also pay for them. Normally we pay for all these goods and services since we use them. Sometimes we present some gift items to our friends and relatives for their use. Besides this, we also spend money on charity and donation to the poor persons and also to the cyclone or earthquake victims. In these cases, we do not earn any money out of such spending. These are our expenditure. Sometimes we spend money and use it for other purposes to get some additional income. That spending is a type of expenditure through which we generate further income. This is called investment. To clarify the concepts further let us observe the activities of a housewife and a restaurant owner. Both of them buy vegetables. A housewife buys them for consumption of her family and the restaurant owner buys them to prepare different dishes and sells them at a profit. In the first case the housewife does not get any monetary return. Thus, it is expenditure for her. In the second case i.e., in case of restaurant owner, spending on vegetable can be termed as investment, because the spending on vegetables finally generates additional income for him. Thus, the term ‘Expenditure’ refers to spending of money on any item, which does not give any additional monetary income in return to the person who spends that amount. Avenues of Expenditure: Generally, most of us spend a major portion of our income on buying goods and services for daily consumption. Besides spending on goods and services there are also many other areas in which we spend money like expenditure on celebrations, on entertainment, charity and donation, etc. The different areas in which we spent our earnings are called avenues of expenditure. Expenditure on Goods and Commodities: We may spend money on various types of goods and commodities needed for use in our daily living. These may be perishable goods like vegetables, milk, fish, etc. or may be consumer durables like television, radio, furniture etc.

- 22. Page 22 of 74 Expenditure on Services: We also spend money for availing of different types of services. It may be for availing banking services, postal services, transport services, communication services etc. Expenditure on Celebrations: In our daily life we find several occasions for celebration. It may be a birthday, an anniversary, a festival, a marriage ceremony etc. On such occasions we spend a lot of money. Expenditure on Entertainment: In our busy life we often feel like taking a break for some sort of enjoyment through entertainment programs. This may include going to watch a movie or drama or dance or cricket match or even going for a picnic or tour. Expenditure on Charity and Donation: Sometimes people spend money by donating to individuals or institutions engaged in social services or charitable work. These are called expenditure on charity and donation. Expenditure on Health and Education: In a family people usually spend some money on health and education of their children. When individuals go for higher education it requires more money. Thus, money spent on health and education may be termed as expenditure. Other Expenditure: The modern age has paved newer avenues of expenditure for people. For example, now-a-days people go to a gymnasium to keep themselves physically fit, go to beauticians to take care of their body and beauty, surf the Internet to gather information and also send e-mails, etc. 2.1.4: Savings Savings refer to the amount of money which is kept aside from the current income for future use. We may be able to keep aside this money either by reducing our expenditure or by increasing our income or by doing both. Investors are savers but all savers cannot be good investors as an investment is a science and an art. Savings are sometimes autonomous and sometimes induced by the incentives like fiscal concessions or income or capital appreciation. Savers come from all classes except in the case of the population who are below the poverty line. The growth of urbanization and literacy has activated the cult of investment. More recently, since the eighties the investment activity has become more popular with the change in the govt.

- 23. Page 23 of 74 policies towards liberalization and financial deregulation. The process of liberalization and privatization was accelerated by the govt. policy changes towards a market oriented economy, through economic and financial reforms started in July 1991. Need for Savings: Savings are essential not only for individuals, family or businessmen but it is also very much required for a nation. Growth is practically impossible without savings. Individuals save because of several reasons. Let us discuss why we all require savings. Savings help us to meet future requirements: We need money in future for various purposes like spending money on higher education, on marriages and other celebrations, owning some immovable assets like house, land, farms etc. With savings at hand we, can meet all these expenses. Savings help us to meet expenses during emergencies: There are events which are uncertain and may occur in future. All these events may require some amount of money to be spend, which we can have from our savings. For example, we may require money during emergencies like sudden illness, accidents, etc. Savings help us to raise our standard of living: Savings accumulated over a period of time become a substantial amount, which enables us to buy something, which is better, comfortable or even luxurious. For example, you can buy a vehicle of your own, home, good furniture; you can use generators/inverters at home to avoid power cut, etc. All these improve your standard of living. Savings help us to generate further income: We can use our savings or part of it in buying shares, debentures or bonds, in buying property and renting it out or even in keeping money in a bank for a fixed period. All of these can give us an assured return in terms of dividend, rent or interest. This is an additional income for us. Savings help the nation in its economic development: When we keep our savings in a bank or in a post office, we get interest in return. But have you ever thought what they do with our money? How do they generate more money from our savings? Actually they utilize our money for various productive purposes. For instance, banks may give our money to the business houses as loan and charge more interest from them. Similarly, government may

- 24. Page 24 of 74 use our savings in various industrial activities, by taking it from the post offices or banks. Thus, our savings help in development of business activities, which ultimately contributes to the overall economic development of the country. Impact on Inflation: All the investments lose in value due to inflation or rise in prices leading to depreciation of the rupee. When the rate of inflation or rise in prices leading to depreciation of the rupee. When the rate of inflation is about 10%, the real value of money is lost by 10% every year. The investors have therefore to protect themselves from this loss of real values of their assets by proper investment planning and by securing returns, higher than the inflation rate. Some investments give only income like bank deposits, Post Office certificates, company deposits etc. Some assets show capital appreciation if they are shares in companies or bullion, land and buildings. Some are safe and liquid, like the investments in government securities, bonds of PSU, etc. A few investments like Indira Vikas Patra are easily transferable and marketable. So also the shares and securities listed and traded on the stock exchanges. But all the above investments do not satisfy all the needs and objectives of investors, referred to later, including securing a hedge against inflation. All objectives of income, capital appreciation, safety, marketability, liquidity, & hedge against inflation can be secured only by proper investment in corporate securities. Tips on Saving: We have learnt that savings are required for every individual. Let us learn some tips so that we will be able to save. Keep a record of your total income and its sources: This is essential as you get to know when and how much you earn and to plan your expenditure accordingly. Keep a record of your current expenditure: As you know there are certain expenses which you have to incur regularly and the amount you spend is almost certain. For example, expenditure on food, tuition fee for children, electricity and water bill, expenses on newspaper, house rent, etc. These are your current expenditure. Once you know about these expenditures which you cannot avoid, you can plan for other expenses keeping current expenditure in mind.

- 25. Page 25 of 74 Plan your expenditure: There are certain expenses which do not occur regularly. For example, buying a TV, refrigerator, washing machine, computer, etc… To spend on these you have to make a priority list and then you can defer the expenditure, which is least important. For example, suppose you plan your expenditure on 25th December and fix your requirements as a refrigerator, a computer and a washing machine. You prioritized your requirements in the following order – washing machine, refrigerator, and computer. This is so because you find that a computer shall be most useful during the next academic session, a refrigerator shall be most useful during summer (next March) and washing machine is urgent as it is becoming difficult to wash cloth manually in winters. So naturally you will spend on the washing machine and defer your expenditure on the refrigerator for three months and the computer for six months. Here, we would like to highlight on one of the aspects that we have recently noticed. Most of the youngsters working in the ITES industry spend on having latest expensive mobile phones by changing their mobile phones quite often. Thanks to the rapid changes happening in the technology front, we have new versions of mobile phones every now and then. Many of the youngsters grab the new phones for snobbish appeal, sometimes, going to the extent of buying it on debt. If they could resist the temptation of going for the latest expensive gadgets, they could use that amount of money to invest for the future. Cut down on expenditure: There are certain expenses which one may incur in an unplanned way. For example, suppose you have gone to Shimla on a tour in the month of March and got some winter clothes. You may use them at Shimla but coming back from Shimla you may not be requiring all those winter clothes. This sort of expenditure may be cut short. Try to generate additional income and don’t spend it. This is a very good way of savings. Whatever we earn from a regular source we can spend it on our livelihood. But the extra earnings that we make from other sources can be kept aside for future use. For example, suppose one of your articles is published in the newspaper or magazine and you are paid some money for that. You can keep aside this money for future use.

- 26. Page 26 of 74 2.1.5: Investment We have already learnt that sometimes people spend some money on buying shares, bonds, properties, etc… which gives them some monetary return. Sometimes people also keep their savings or a part of it as a recurring or fixed deposit in the banks or post offices and earn interest on it. Similarly some people deposit their money in Mutual Funds, Public Provident Fund Account etc. some buy National Savings Certificates from the post office and some take Life Insurance Policies etc. All these give them some additional income. These types of expenditures are called investment. Thus, the term ‘investment’ refers to depositing or spending money on some items that generate additional income either immediately or in the future. For example, if you deposit money in Public Provident Fund Account it will give you some amount of return in the form of interest. So, this is your investment. Objectives of Investor: Income Appreciation of capital Safety Liquidity Hedge against inflation A method of tax planning The mix of these objectives may also depend on the time frame of the investment. Short-term/day to day trading gains Short term capital gain up to one year Long term appreciation of more than 1 to 3 years Investment preferences of public may be set out in terms of their savings for: Transaction purpose (for daily needs or regular payment) Precautionary purpose (for contingencies or special needs) Speculation or asset purposes (for capital gain or building of assets) Let us learn about avenues available for investment.

- 27. Page 27 of 74 Deposits in Banks and Post Offices: These are the most common, popular, risk-free, and trustworthy investments. In banks and post offices, individuals deposit their money in savings account, where they can withdraw the money whenever required. They can also deposit money for a fixed period on one-time basis or a recurring basis. All these investments are safe and give an assured return. There is something known as recurring deposits. That means in Banks we can open recurring deposit accounts, and every month/quarter, we can deposit the fixed amount and the bank will give a fixed interest on that money which is usually higher than the regular interest rates in the banks. Other Schemes/Certificates of Bank, Post Office: Apart from deposits, the banks and post offices also offer various other schemes like Monthly Income Scheme, National Savings Scheme, Public Provident Fund, National Savings Certificates, Kissan Vikas Patra etc., which provide assured return and are risk-free. National Savings Certificates (NSC) Ninth (IX) Issue No maximum limit for investment INR 100 grows to INR 234.35 after 10 years Minimum INR 100; No maximum limit available in denominations of INR 100, 500, 1000, 5000, & 10,000 A single holder type certificate can be purchased by an adult for himself or on behalf of a minor or to a minor Rate of interest: 8.90% Maturity value of a certificate of INR 100 purchased on or after 1.4.2012 shall be INR. 238.87 after 10 years Kissan Vikas Patra Minimum Investment of INR 500; No maximum limit Rate of interest 8.40% compounded annually Money doubles in 8 years and 7 months Provident Fund Employee Provident fund scheme came into effect in 1952, and this was done on a mandatory basis so that employees save on a monthly basis through a government scheme.

- 28. Page 28 of 74 The Government gives interest on the money which is deducted in PF. All the employees (including casual, part time, Daily wage contract etc.) other than an excluded employee are required to be enrolled as members of the fund the day, the Act comes into force in such establishment. Ideally when someone attains the age of 55, or over and retires from his duties, then s/he is eligible to withdraw the PF. Public Provident Fund Public Provident Fund (PPF) is a savings-cum-tax-saving instrument. It also serves as a retirement-planning tool for many of those who do not have any structured pension plan covering them. The account can be opened in designated post offices, State Bank of India branches, and branches of some nationalised bank. ICICI Bank is the first private sector bank which has been authorized to open PPF account. Minimum yearly deposit of INR 500 is required Limit of subscription: INR 70,000 in a year Rate of Return on PPF is 8.6 % p.a. (Compounded annually) The minimum tenure of the PPF account is 15 years The subscription, which shall be in multiples of INR 5, for any year, be paid into the account in one lump sum, or instalments not exceeding twelve in a year Government Bonds: Sometimes government and semi-government organizations accept deposits from individuals for a fixed period and promise to pay a fixed amount after the stipulated period. These are in the form of bonds, which are also risk-free and provide assured return. Life Insurance policies: Post offices, Life Insurance Corporation of India, and other private sector life insurance companies insure the life of individuals for a specific amount for a specified period upon payment of a premium amount. The individual who is insured gets a good return on maturity of the policies. This is a very important form of investment. People should look if they are adequately covered. A person’s net worth plays a huge role in determining the amount of policy s/he should have. If a person’s earnings are high, then the lifestyle changes accordingly. Hence individuals should ensure that they buy enough

- 29. Page 29 of 74 coverage so that if case of their unfortunate death, their family can survive well on that insurance money. UTI and other mutual funds schemes: There are some financial institutions (may be government, semi-government or private) which raise money from individuals and invest the collected amount in securities and deposits and thereby earn a good return. This return is then distributed among the investors as dividend. These types of investments are risky. It may give you very good return or it may also lead to losses. Here, to avoid some of the disadvantages associated with Mutual Funds, Systematic Investment Plan (SIP) has been introduced. A systematic investment plan or SIP (as it is more commonly known) is a way to invest in mutual funds regularly. The idea is to set apart a sum every month or quarter, and use that to buy units of a particular mutual fund, regardless of its price. People like such a system because it helps them save regularly and build up an investment. Benefits of SIP: Regular saving habit: Perhaps the best benefit of setting up a SIP is that it forces us to set apart some money every month and enforces saving discipline. Protects from timing the market: If we commit an amount of money to a SIP, we would most likely continue to invest, regardless of a big fall or huge gains in the market. This in turn will enable us to invest regularly rather than try to time the market, which not many small investors can do successfully. Corporate securities and deposits: There are companies which accept deposits from public for a fixed period. People can invest their savings in these companies. This is bit risky as your money goes into private hands. But if the company is good and a reputed one, you can get assured return. Similarly people sometime invest in buying shares of the company. If the company is performing well the shareholders get good return otherwise the shareholders may not get anything. These investments are again risky.

- 30. Page 30 of 74 Real estate: Sometimes people spend money on buying a plot of land, an apartment or a house etc., the value of which appreciates over a period of time. By giving it on rent, they can earn money. These types of investments are less risky. Business activities: You must have observed that some people invest money to carry on various business activities. They may start the business individually i.e., in the form of sole proprietorship, or by inviting others to invest money with them i.e., they can start partnership form of business. By investing their money and putting their best effort then can get return in the form of profit. Investment in the share market: A person can invest his money in the share market by purchasing shares. A share market is a public institution and it serves the growth of the capital market. In a stock market, purchase and sale of shares are made in conditions of free competition. It is organized as voluntarily, non-profit making association of brokers to regulate and protect their interests. Whenever a company raises capital through public issue of securities, its securities are required to be listed on the stock exchange within ten weeks of the closing of the subscription list mainly to provide liquidity to the investors. Gold, Silver, Precious Metals, and Precious Stones: All these items vary as per the market rates. And in the past few years, the rates of them have only increased. Now if we see the gold price per 10 gram on Jan 2009, it was INR 13,664. And it was INR 27,322 on Jan 1, 2012. So in 3 years it went up by INR 13,658, which is almost 100%. So if someone had invested in gold at the right time, then it brings in good results. The same goes for silver too. Silver price on Jan 1, 2009 was INR 13,753 per kilogram and it went up to INR 51,043 per kilogram on Jan 1, 2011. So the increase was INR 37,290 per kilogram that means the increase was 271%. Hence, people who had invested in silver had reaped a better return than investing in gold. In fact on May 1, 2011 it went up to INR 71,576 per kilogram. Venture Capital: Venture capital (VC) is financial capital provided to early-stage, high- potential, high risk, growth start-up companies. The venture capital fund makes money by owning equity in the companies it invests in, which and usually have a novel technology or business model in high technology industries, such as biotechnology, IT, software, etc. The

- 31. Page 31 of 74 typical venture capital investment occurs after the seed funding round as growth funding round (also referred to as Series A round) in the interest of generating a return through an eventual realization event, such as an IPO or trade sale of the company. Venture capital is a subset of private equity. Therefore, all venture capital is private equity, but not all private equity is venture capital. In addition to angel investing and other seed funding options, venture capital is attractive for new companies with limited operating history that are too small to raise capital in the public markets and have not reached the point where they are able to secure a bank loan or complete a debt offering. In exchange for the high risk that venture capitalists assume by investing in smaller and less mature companies, venture capitalists usually get significant control over company decisions, in addition to a significant portion of the company's ownership (and consequently value). This option is usually applicable for High Net-worth Individuals (HNIs) to consider who have a huge risk-appetite. New developments in Investment avenues: Exchange traded funds: (ETFs) are a new variety of mutual funds that first became available in 1993. ETFs have grown rapidly and now hold nearly $80 billion in assets. ETFs are sometimes described as more 'tax efficient' than traditional equity mutual funds, since in recent years, some large ETFs have made smaller distributions of realized and taxable capital gains than most mutual funds. REIT (Real estate investment trust): REITs are companies which own properties such as office buildings, shopping complexes, and hotels etc, which are giving continuous income. As these companies pass most part of their income to the shareholders, they get tax benefits from their income. Like other stocks that are traded in the stock exchanges, REIT can also be traded in the stock exchange. REITs give a new opportunity to the retail and institutional investors to diversify their portfolio. Classification of Investments: There are different methods of classifying the investment avenues.

- 32. Page 32 of 74 A major classification is: Physical investment: Example of physical investments is land, property, flats, house, gold, precious metals and stones, paintings, etc… Financial investment: Examples are Fixed Deposits, Bonds, Shares, and Mutual Funds etc. Most of the financial assets, barring cash are used for production or consumption, or further creation of assets, useful for production of goods and services. Among different types of investments, some are marketable and transferable and others are not. Examples of marketable assets are shares and debentures of public limited companies, particularly the listed companies on stock exchanges, bonds of P.S.Us, Government securities, etc. Non-marketable securities or investments are bank deposits, provident fund and pension funds, insurance certificates, post office deposits, NSC bonds, company deposits, private limited companies shares etc. Difference between Savings and Investments: Savings are money or other assets kept over a long period of time, usually in a bank without any risk of loss or making profit. Investments are money or other assets purchased with the hope that it will generate income, reduce costs, or appreciate in the future. In an economic sense, an investment is the purchase of goods that are not consumed today but are used in the future to create wealth. In finance, an investment is a monetary asset purchased with the idea that the asset will provide income in the future or appreciate and be sold at a higher price. And usually it has also a risk of some loss. As far as we are talking about investment then it is certain amount of money which is saved or used in some projects where we can take profit more than the money we have saved or invested. In general terms investment means the use of money to make more money. Features of investment avenues: The investor has various alternative avenues of investment for his / her savings to flow in accordance with his / her preferences. All investments involve some risk or uncertainty. The objective of the investor is to minimize the risk involved in investment and maximize the return.

- 33. Page 33 of 74 1. Risk: The risk depends on the following factors: The longer the maturity period, the larger is the risk. The more the creditworthiness of the borrower or agency issuing securities, the less is the risk. The nature of instrument, namely, the debt instrument or fixed deposit or ownership instrument like equity or preference share, also determines risk. The risk of variability of returns is more in the case of ownership capital as the return varies with the net profits after all commitments are met. The nature of tax liability on the instrument 2. Return: A major factor influencing the pattern of investment is its return, which is its return and capital appreciation, if any. The difference between the purchase price and the sale price is capital appreciation and the yield is the interest or dividend divided by its purchase price. 3. Safety: The safety of the capital is the certainty of return on capital without loss of money or time involved. In all cases of money lent, some transaction costs and time are involved in getting the funds back. 4. Liquidity: If a capital asset is easily realizable, saleable or marketable, then it is said to be liquid. An investor generally prefers liquidity for his /her investments, safety of his /her funds, a good return with a minimum risk or minimization of risk and maximization of return (dividend and capital appreciation). 5. Marketability: This refers to transferability or saleability of an asset. Those listed in stock market are more easily marketable than those that are not listed. 6. Tax benefits: Some instruments enjoy good tax benefits; hence their net return is higher. Risk-return Relationships: Risk and return are directly correlated with each other, when the risk is high; return is also high, and vice versa. The relationship between risk and return is a fundamental financial relationship that affects expected rates of return on every existing asset investment. The Risk-Return

- 34. Page 34 of 74 relationship is characterized as being a ‘positive’ or ‘direct’ relationship meaning that if there are expectations of higher levels of risk associated with a particular investment, then greater returns are required as compensation for that higher expected risk. Alternatively, if an investment has relatively lower levels of expected risk then investors are satisfied with relatively lower returns. This risk-return relationship holds for individual investors and business managers. Greater degrees of risk must be compensated for with greater returns on investment. Since investment returns reflects the degree of risk involved with the investment, investors need to be able to determine how much of a return is appropriate for a given level of risk. This process is referred to as ‘pricing the risk’. In order to price the risk, we must first be able to measure the risk (or quantify the risk) and then we must be able to decide an appropriate price for the risk we are being asked to bear. Think Before Making an Investment: When we are investing money, we must look into some factors to reduce the risk involved in investment. Following factors determine where to invest the money: Ability to save: Some of the investments require regular contributions of certain amount of money like payment of LIC premium or instalments in a recurring deposit. We need to assess our ability to save before taking such decision. Safety: We must look into the various risks or drawbacks of the instruments where we are going to invest to ensure safety of our investments. Easy Liquidity: Any investment we make must be capable of being converted into cash, whenever necessary. Rate of Interest: Rate of interest is more important than the amount of return we get. Savings and Investment normally, for larger deposits, higher rates of interest are fixed. Tax relief: One must take into consideration the various tax benefits we can avail of through our investments. Personal Tax planning for an Individual

- 35. Page 35 of 74 Some people have a wrong notion that tax planning is useful only once we are well settled in life. Rather, the best time to start tax planning is right from the day we start earning any income in our name. For any individual, tax planning occupies a prominent position in the investment planning process. Tax Planning: Everyone is entitled to arrange his / her affairs to reduce his / her tax liability, but the arrangement must be real and genuine, and not a sham. Thus tax planning ensures not only the accrual of tax benefits within the four corners of law but also that the tax obligations are properly discharged to avoid penal provisions. It should not be mixed with tax evasion and tax avoidance. Tax planning at different stages of life through various Investments: When a person starts earning by default the company s/he works for deducts the PF which is exempted from tax. Also, Insurance policy (life Insurance, medical insurance u/s 80D and retirement plans) can be planned as deduction can be availed u/s 80C. Next stage is to own a house. The biggest advantage of putting your money in residential house property is tax haven in one hand while on the other hand; you get a secure place of your own to live in. The repayment of principal is deductible up to one lakh in a year u/s 80C. Usually, a person has to spend a lot on the education of children. Tax planning can be used as effective tool in this respect as it may ensure that the capital base is not eroded or adversely affected. Sec 10(14) and rule 2BB provides for certain allowances that are exempt according to the limit specified in respect of each such allowances. Senior citizens can invest special Senior Citizens schemes launched by govt. of India. Tax planning brings fiscal discipline in the functioning of a taxpayer and reduces the transfer of money, from the person who has earned it by hard labor, to the govt. for waste and ostentation. Thus the amount invested enhances the capacity of the taxpayers for expansion and growth, which in turn increases the tax revenue of the govt. Wealthy Investors

- 36. Page 36 of 74 According to a study undertaken jointly by Merrill Lynch, CapGemini, Ernst and Young, High Net worth Individuals [HNIs] or wealthy investors are proactive in portfolio management, risk management, consolidation of financial assets and use of diversification strategies as actively as large institutions. HNIs are proactive in identifying new investment options and take inputs from professional advisors in volatile market conditions. HNIs are dynamic in modifying their asset allocation and were among the first investors to move from equities to fixed income during 2001-2002 period of downturn in equity markets. They shifted back to equities when they identified favourable market trends. Needs of wealthy investors Wealthy investors being aware of the emerging investment opportunities use sophisticated investment strategies such as:- Leveraging on the professional advisors' capability to analyse market trends and make appropriate investments Searching for innovative products to enhance value Diversifying across various types of assets Investing across emerging geographies Consolidating financial information and assets Investment products and avenues Managed products: Managed product service is the most popular investment strategy adopted by wealthy investors globally. Real Estate: Wealthy investors have found this asset class very attractive and have invested directly in real estate and indirectly through real estate investment trusts. Art and passion: Wealthy investors also have their investment in art, wine, antiques, and collectibles. Precious Metals: Gold and other precious metals are attractive investment options to balance the asset allocation. Commodities: Wealthy investors have turned to commodities to offset the lower returns from fixed income securities.

- 37. Page 37 of 74 Alternative investments: Hedge funds and Private equity investments such as venture funds are becoming increasingly popular with wealthy investors to reduce the investment risks related to stock market fluctuations. This is because these alternative instruments have low correlation with equity asset class performance. Investment in non correlated assets, such as commodities helps to improve diversification of the portfolio amidst volatile market conditions. Characteristics of wealthy investor The wealthy investor of today is:- Young, educated and knowledgeable Well informed about global trends Willing to take risks Demanding and quality conscious Performance oriented in taking decisions and less loyal Techno savvy and seeks information from various sources Smart in looking for the best deal Not attracted by traditional status symbols that do not add value Hands on in checking investments, making deals and getting personally involved Special needs of wealthy investors The strategies and characteristics of wealthy investors have led to financial institutions innovating and expanding their product range to meet the growing demands of such investors. A financial advisor should keep in mind the following special needs and expectations of the wealthy clients: Demand broader range of services and skills: Wealthy clients not only are on the lookout for multiple investment avenues, unlike other clients, but are also ready to face the risks associated with newer products. Net worth and goals need to be matched and assets need to be planned tax effectively: Since wealthy investors have surplus funds that can be passed on to the next generations

- 38. Page 38 of 74 and also come into the high tax-paying category, investors need to advise them on the best methods to transfer their assets after death as well as on the best tax saving investments. Estate planning and tax planning: In-depth knowledge about tools of estate planning such as wills, trusts, and power of attorney is necessary. It is also important to know the succession rules and tax rules to do effective tax planning resulting in minimal/no tax on transfer of assets. Educate the client: Educating the client on various and different types of investment avenues that will suit him the best will prove very beneficial for the financial advisor. Wealthy clients, especially those who are self made, may assume that if they can make wealth in one industry they can manage their own portfolio as well. In such cases it is best to educate the client about the best investment options rather than trying to push a product; because if one is trying to push a product, the client is unlikely to get interested since he/she will be having enough people chasing him/her for investments.

- 39. Page 39 of 74 PROFILE 2: Profile of ITES Industry The Indian information technology (IT) / IT enabled Services (ITeS) industry has played a key role in putting India on the global map. Over the past decade, the Indian IT-BPO sector has become the country’s premier growth engine, crossing significant milestones in terms of revenue growth, employment generation and value creation, in addition to becoming the global brand ambassador for India. The Indian IT-BPO sector including the domestic and exports segments continue to gain strength, experiencing high levels of activity both onshore as well as offshore. The companies continue to move up the value-chain to offer higher end research and analytics services to their clients. The Indian IT-BPO industry has grown by 6.1 percent in 2010, and is expected to grow by 19 percent in 2011 as companies coming out of recession harness the need for information technology to create competitive advantage. India’s fundamental advantages—abundant talent and cost—are sustainable over the long term. With a young demographic profile and over 3.5 million graduates and postgraduates that are added annually to the talent base, no other country offers a similar mix and scale of human resources. Realizing the wealth of potential in the IT-ITES sector, the central and state governments are also working towards creating a sound infrastructure for the IT-ITES sector. CII aims to make the Indian IT and ITES industry world class by continuously providing a platform for understanding and adoption of the new developments & best practices worldwide in this sector, taking up issues and concerns of the Indian industry with the relevant ministries at National and State level, coming up with studies, reports and surveys to help understand the potential of Indian IT and ITES market and the issues faced. As one of the key growth engines of the economy, the Indian IT/ITES industry has been contributing notably to the economic growth accounting for around 5.6% of the country’s GDP and providing direct employment to about 2.3 million people and indirect employment to many more.

- 40. Page 40 of 74 Profile of ITES Companies (in alphabetic order) Before we proceed with the profiles of the companies, we need to understand and differentiate between two types of BPO: Captive BPO: This is a type of BPO wherein work would be off-shored to its wholly-owned subsidiary instead of a third-party vendor. The benefit of doing such an arrangement would be to leverage the cost savings of using offshore resources, while maintaining complete control over process and delivery. The costs of such an arrangement are generally higher than using a vendor. Third-party BPO: This is a type of BPO wherein work is outsourced to a third-party vendor who would run the operations. It is interesting to note that the captive business model was the pioneer of BPO services but many of the captives are reconsidering the decision by preferring third-party vendors. Third-party vendors are usually preferred over captive outfits because of substantially lower costs, flexibility, and the ability to enforce price and quality competition. From this project point of view, getting further information from official sources is a challenge as it is not usually disclosed. Accenture BPO: Accenture is a global management consulting, technology services and outsourcing company, with more than 249,000 people serving clients in more than 120 countries. Initially called Andersen Consulting, Accenture was formally established in 1989 when a group of partners from the Consulting division of the various Arthur Andersen firms around the world formed a new organization focused on consulting and technology services related to managing large-scale systems integration and enhancing business processes. In April 2001, Accenture’s partners voted overwhelmingly to pursue an initial public offering, and Accenture became a public company on July 19, 2001, when it listed on the New York Stock Exchange under the symbol ACN.

- 41. Page 41 of 74 The majority of Accenture employees are organized in one of four ‘workforces’ (Consulting, Services, Solutions and enterprise) and they chose to open their BPO Wing in Bangalore in April 2003. The company generated net revenues of US$25.5 billion for the fiscal year ended Aug. 31, 2011. ANZ BPO: Captive BPO Unit of ANZ is known by the name ‘ANZ Support Services India Pvt. Ltd.’ and is located in Bangalore. ANZ stands for Australia and New Zealand – one of the premier banking institutions. In Bangalore, ANZ currently employs close to 5000 people in technology development, operations and shared services roles. The group has been servicing ANZ’s technology needs for more than 21 years and has in recent years extended its capabilities to include operations and support functions. Dell BPO: Dell BPO is a captive BPO unit of Dell. Dell Inc. (NASDAQ: DELL) is an American multinational computer technology corporation based in Texas. Dell is listed as one of the top 50 companies in the Fortune 500 list. Revenues of the Dell Group stand at US $ 63.07 billion. It was founded by Michael Dell, and bears the surname of the founder. It is the third-largest PC vendor in the world after HP and Lenovo. Dell started its operations in India by incorporating as Dell Computer India Private Ltd. in Bangalore in 1996, Dell has been among the fastest growing technology companies in India and continues to be among the top three today. Dell employs more than 110,000 employees. Dell’s first India-based contact centres opened in Bangalore and Hyderabad in 2003; Chandigarh was added in 2005 and Gurgaon contact centre opened in 2006. Dell India accounts for the company's largest employee base outside of the United States. Fidelity: FMR LLC (Fidelity Management and Research) or Fidelity Investments is an American multinational financial services corporation. It is one of the largest mutual fund and financial services groups in the world. It was founded in 1946 and serves North American investors. Fidelity Ventures is its venture capital arm. Fidelity International

- 42. Page 42 of 74 Limited (FIL) was an international affiliate founded in 1969, serving most countries in the rest of the world. In September 2011, FIL was rebranded as 'Fidelity Worldwide Investment'. Fidelity Investments manages a large family of mutual funds, provides fund distribution and investment advice services, as well as providing discount brokerage services, retirement services, wealth management, securities execution and clearance, life insurance and a number of other services. Fidelity is a privately held company founded by Edward C. Johnson II in 1946, which is owned by employees and the Johnson family. Fidelity Management & Research Company, the US investment management division of Fidelity Investments, acts as the investment adviser to Fidelity's family of mutual funds. FMR Co has three fund divisions: Equity (headquartered in Boston, Massachusetts), High-Income (Boston) and Fixed-Income (Merrimack, New Hampshire). The company's subsidiaries serve as distributors and transfer agents to the entire Fidelity fund family. Fidelity has headquarters in Boston, Massachusetts, U.S. Genpact: Genpact Limited (NYSE: G) is a global provider of business process and technology management services, offering a portfolio of enterprise and industry-specific services. It was formerly a GE owned company called GE Capital International Services or GECIS. It operates from India, China, Guatemala, Hungary, México, Morocco, the Philippines, Poland, the Netherlands, Romania, Spain, South Africa, Australia, UAE, Brazil and the United States. Genpact went public on NYSE on August 2, 2007 under the symbol "G". It currently employs around 55,000-plus employees and has revenues of $1.6 Billion. The NYSE symbol "G" was initially allocated to the Gillette Company. After the Gillette Company was acquired by Procter and Gamble, the symbol became free and Genpact and Google booked it. It was Genpact in the end that got to keep G as its stock symbol. Foundation of GENPACT: