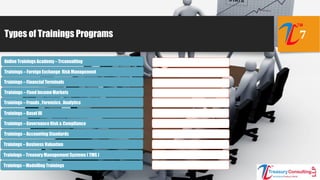

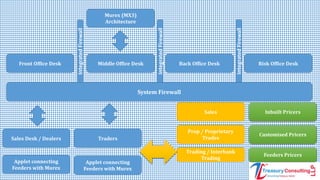

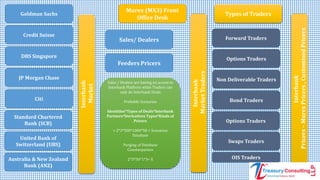

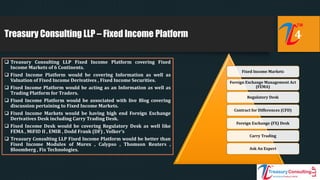

Treasury Consulting LLP is a multidisciplinary consulting firm based in India, offering a range of intellectual services in treasury and financial markets, analytics, governance, risk, and compliance. Founded by Rahul Magan, the firm has a strong global presence across various regions including Asia Pacific, Europe, and the United States, and aims to provide practical knowledge and software-oriented solutions to its clients. The company also focuses on fintech initiatives, educational programs, and provides innovative platforms for trading and analytics in fixed income and foreign exchange markets.