QNBFS Daily Market Report April 07, 2019

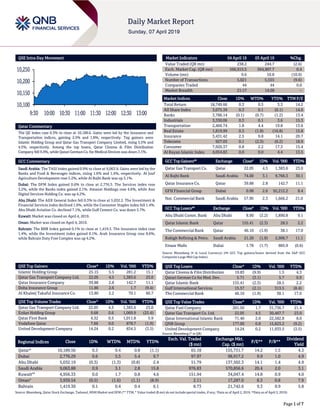

- 1. Page 1 of 7 QSE Intra-Day Movement Qatar Commentary The QE Index rose 0.3% to close at 10,189.6. Gains were led by the Insurance and Transportation indices, gaining 2.5% and 1.8%, respectively. Top gainers were Islamic Holding Group and Qatar Gas Transport Company Limited, rising 5.5% and 4.5%, respectively. Among the top losers, Qatar Cinema & Film Distribution Company fell 9.9%, while Qatari German Co. for Medical Devices was down 3.1%. GCC Commentary Saudi Arabia: The TASI Index gained 0.9% to close at 9,063.9. Gains were led by the Banks and Food & Beverages indices, rising 1.6% and 1.4%, respectively. Al Jouf Agriculture Development rose 5.2%, while Al Rajhi Bank was up 3.1%. Dubai: The DFM Index gained 0.6% to close at 2,776.3. The Services index rose 3.2%, while the Banks index gained 2.1%. Amanat Holdings rose 4.6%, while Aan Digital Services Holding Co. was up 4.2%. Abu Dhabi: The ADX General Index fell 0.3% to close at 5,032.2. The Investment & Financial Services index declined 1.6%, while the Consumer Staples index fell 1.4%. Abu Dhabi Aviation Co. declined 7.1%, while Gulf Cement Co. was down 5.7%. Kuwait: Market was closed on April 4, 2019. Oman: Market was closed on April 4, 2019. Bahrain: The BHB Index gained 0.1% to close at 1,419.3. The Insurance index rose 1.4%, while the Investment index gained 0.1%. Arab Insurance Group rose 8.6%, while Bahrain Duty Free Complex was up 4.2%. QSE Top Gainers Close* 1D% Vol. ‘000 YTD% Islamic Holding Group 25.15 5.5 281.2 15.1 Qatar Gas Transport Company Ltd. 22.05 4.5 1,383.6 23.0 Qatar Insurance Company 39.88 2.8 142.7 11.1 Doha Insurance Group 11.86 2.6 1.7 (9.4) Al Khaleej Takaful Insurance Co. 13.80 2.2 70.1 60.7 QSE Top Volume Trades Close* 1D% Vol. ‘000 YTD% Qatar Gas Transport Company Ltd. 22.05 4.5 1,383.6 23.0 Ezdan Holding Group 9.68 0.6 1,069.9 (25.4) Qatar First Bank 4.32 0.5 1,011.8 5.9 Vodafone Qatar 7.66 0.0 878.7 (1.9) United Development Company 14.24 0.2 834.5 (3.5) Market Indicators 04 April 19 03 April 19 %Chg. Value Traded (QR mn) 238.2 244.7 (2.6) Exch. Market Cap. (QR mn) 566,915.5 564,907.7 0.4 Volume (mn) 9.6 10.8 (10.9) Number of Transactions 5,021 5,555 (9.6) Companies Traded 44 44 0.0 Market Breadth 21:17 14:28 – Market Indices Close 1D% WTD% YTD% TTM P/E Total Return 18,749.66 0.3 0.5 3.3 14.2 All Share Index 3,075.39 0.3 0.1 (0.1) 14.6 Banks 3,786.14 (0.1) (0.7) (1.2) 13.4 Industrials 3,330.06 0.3 0.1 3.6 15.3 Transportation 2,466.74 1.8 4.4 19.8 13.6 Real Estate 1,819.99 0.3 (1.8) (16.8) 15.8 Insurance 3,431.42 2.5 9.8 14.1 20.7 Telecoms 927.03 0.1 (2.3) (6.2) 18.9 Consumer 7,920.37 0.8 2.2 17.3 15.4 Al Rayan Islamic Index 4,054.83 0.0 0.0 4.4 13.5 GCC Top Gainers## Exchange Close# 1D% Vol. ‘000 YTD% Qatar Gas Transport Co. Qatar 22.05 4.5 1,383.6 23.0 Al Rajhi Bank Saudi Arabia 74.00 3.1 9,766.3 30.1 Qatar Insurance Co. Qatar 39.88 2.8 142.7 11.1 GFH Financial Group Dubai 0.98 2.6 92,212.2 8.4 Nat. Commercial Bank Saudi Arabia 57.90 2.3 1,666.2 21.0 GCC Top Losers## Exchange Close# 1D% Vol. ‘000 YTD% Abu Dhabi Comm. Bank Abu Dhabi 8.90 (3.2) 1,890.8 9.1 Qatar Islamic Bank Qatar 155.41 (2.3) 28.5 2.2 The Commercial Bank Qatar 46.10 (1.9) 38.1 17.0 Rabigh Refining & Petro. Saudi Arabia 21.20 (1.9) 2,906.7 11.1 Emaar Malls Dubai 1.78 (1.7) 885.9 (0.6) Source: Bloomberg (# in Local Currency) (## GCC Top gainers/losers derived from the S&P GCC Composite Large Mid Cap Index) QSE Top Losers Close* 1D% Vol. ‘000 YTD% Qatar Cinema & Film Distribution 19.83 (9.9) 1.5 4.3 Qatari German Co for Med. Dev. 5.71 (3.1) 5.7 0.9 Qatar Islamic Bank 155.41 (2.3) 28.5 2.2 Gulf International Services 15.57 (2.1) 313.5 (8.4) The Commercial Bank 46.10 (1.9) 38.1 17.0 QSE Top Value Trades Close* 1D% Val. ‘000 YTD% Qatar Fuel Company 201.50 1.7 31,736.7 21.4 Qatar Gas Transport Co. Ltd. 22.05 4.5 30,467.7 23.0 Qatar International Islamic Bank 71.40 2.0 22,582.8 8.0 QNB Group 177.00 0.8 15,823.2 (9.2) United Development Company 14.24 0.2 11,933.5 (3.5) Source: Bloomberg (* in QR) Regional Indices Close 1D% WTD% MTD% YTD% Exch. Val. Traded ($ mn) Exchange Mkt. Cap. ($ mn) P/E** P/B** Dividend Yield Qatar* 10,189.56 0.3 0.4 0.8 (1.1) 65.18 155,731.7 14.2 1.5 4.3 Dubai 2,776.29 0.6 5.5 5.4 9.7 97.97 98,917.2 9.9 1.0 4.9 Abu Dhabi 5,032.19 (0.3) (1.3) (0.8) 2.4 51.79 137,502.3 14.1 1.4 4.9 Saudi Arabia 9,063.88 0.9 3.1 2.8 15.8 976.83 570,856.6 20.4 2.0 3.1 Kuwait## 4,956.33 0.0 1.7 0.8 4.6 151.94 34,047.4 14.8 0.9 4.0 Oman# 3,939.54 (0.5) (1.6) (1.1) (8.9) 2.11 17,287.0 8.3 0.8 7.9 Bahrain 1,419.30 0.1 0.4 0.4 6.1 8.73 21,742.6 9.3 0.9 5.8 Source: Bloomberg, Qatar Stock Exchange, Tadawul, MSM Market and DFM (** TTM; * Value traded ($ mn) do not include special trades, if any; #Data as of April 2, 2019, ##Data as of April 3, 2019) 10,100 10,150 10,200 10,250 9:30 10:00 10:30 11:00 11:30 12:00 12:30 13:00

- 2. Page 2 of 7 Qatar Market Commentary The QE Index rose 0.3% to close at 10,189.6. The Insurance and Transportation indices led the gains. The index rose on the back of buying support from Qatari shareholders despite selling pressure from GCC and non-Qatari shareholders. Islamic Holding Group and Qatar Gas Transport Company Limited were the top gainers, rising 5.5% and 4.5%, respectively. Among the top losers, Qatar Cinema & Film Distribution Company fell 9.9%, while Qatari German Company for Medical Devices was down 3.1%. Volume of shares traded on Thursday fell by 10.9% to 9.6mn from 10.8mn on Wednesday. Further, as compared to the 30-day moving average of 11.4mn, volume for the day was 15.7% lower. Qatar Gas Transport Company Limited and Ezdan Holding Group were the most active stocks, contributing 14.3% and 11.1% to the total volume, respectively. Source: Qatar Stock Exchange (* as a % of traded value) Global Economic Data and Earnings Calendar Global Economic Data Date Market Source Indicator Period Actual Consensus Previous 04/04 US Department of Labor Initial Jobless Claims 30-March 202k 215k 212k 04/04 US Department of Labor Continuing Claims 23-March 1,717k 1,752k 1,755k 04/04 US Bloomberg Bloomberg Consumer Comfort 31-March 58.9 – 60.0 04/05 US Bureau of Labor Statistics Unemployment Rate March 3.8% 3.8% 3.8% 04/05 Germany Deutsche Bundesbank Industrial Production SA MoM February 0.7% 0.5% 0.0% 04/05 Germany Bundesministerium fur Wirtscha Industrial Production WDA YoY February -0.4% -1.4% -2.7% 04/04 India Markit Nikkei India PMI Services March 52.0 – 52.5 04/04 India Markit Nikkei India PMI Composite March 52.7 – 53.8 04/04 India Reserve Bank of India RBI Repurchase Rate 4-April 6.0% 6.0% 6.3% 04/04 India Reserve Bank of India RBI Reverse Repo Rate 4-April 5.8% 5.8% 6.0% 04/04 India Reserve Bank of India RBI Cash Reserve Ratio 4-April 4.0% 4.0% 4.0% Source: Bloomberg (s.a. = seasonally adjusted; n.s.a. = non-seasonally adjusted; w.d.a. = working day adjusted) Earnings Calendar Tickers Company Name Date of reporting 4Q2018 results No. of days remaining Status QNBK QNB Group 9-Apr-19 2 Due ERES Ezdan Holding Group 11-Apr-19 4 Due QEWS Qatar Electricity & Water Company 14-Apr-19 7 Due IHGS Islamic Holding Group 15-Apr-19 8 Due MARK Masraf Al Rayan 17-Apr-19 10 Due QIBK Qatar Islamic Bank 17-Apr-19 10 Due CBQK The Commercial Bank 17-Apr-19 10 Due ABQK Ahli Bank 18-Apr-19 11 Due NLCS Alijarah Holding 18-Apr-19 11 Due GWCS Gulf Warehousing Company 21-Apr-19 14 Due QGTS Qatar Gas Transport Company Limited (Nakilat) 21-Apr-19 14 Due QIGD Qatari Investors Group 23-Apr-19 16 Due UDCD United Development Company 24-Apr-19 17 Due MERS Al Meera Consumer Goods Company 28-Apr-19 21 Due KCBK Al Khalij Commercial Bank 29-Apr-19 22 Due DHBK Doha Bank 30-Apr-19 23 Due Source: QSE Overall Activity Buy %* Sell %* Net (QR) Qatari Individuals 38.38% 45.16% (16,174,663.60) Qatari Institutions 31.87% 21.60% 24,457,732.94 Qatari 70.25% 66.76% 8,283,069.34 GCC Individuals 1.07% 1.05% 36,818.03 GCC Institutions 0.21% 1.57% (3,217,621.63) GCC 1.28% 2.62% (3,180,803.60) Non-Qatari Individuals 11.11% 13.54% (5,776,322.18) Non-Qatari Institutions 17.36% 17.08% 674,056.44 Non-Qatari 28.47% 30.62% (5,102,265.74)

- 3. Page 3 of 7 News Qatar ABQK to disclose 1Q2019 financial statements on April 18 – Ahli Bank (ABQK) announced its intent to disclose 1Q2019 financial statements for the period ending March 31, 2019, on April 18, 2019. (QSE) GWCS to disclose 1Q2019 financial statements on April 21 – Gulf Warehousing Company (GWCS) announced its intent to disclose 1Q2019 financial statements for the period ending March 31, 2019, on April 21, 2019. (QSE) MERS to disclose 1Q2019 financial statements on April 28 – Al Meera Consumer Goods Company (MERS) announced its intent to disclose 1Q2019 financial statements for the period ending March 31, 2019, on April 28, 2019. (QSE) QGTS to disclose 1Q2019 financial statements on April 21 – Qatar Gas Transport Company Ltd. (QGTS) announced its intent to disclose 1Q2019 financial statements for the period ending March 31, 2019, on April 21, 2019. (QSE) KCBK to disclose 1Q2019 financial statements on April 29 – Al Khalij Commercial Bank (KCBK) announced its intent to disclose 1Q2019 financial statements for the period ending March 31, 2019, on April 29, 2019. (QSE) QCFS’ AGM and EGM endorses items on its agenda and approves the distribution of 15% cash dividend – Qatar Cinema & Film Distribution Company (QCFS) announced that Annual General Meeting (AGM) and Extraordinary General Assembly Meeting (EGM) were held on April 3, 2019. AGM approved the board’s recommendation for a dividend payment of QR1.50 per share, representing 15% of the nominal share value. Following resolutions are passed in the EGM: (i) Approved the amendment of article No (5) of the memorandum of association of the company, by dividing the share value, to become the nominal share value QR1, instead of QR10, (ii) Approved to add a new article to the memorandum of association, by increasing the maximum cap of the non-Qatari possession of the company shares, to be 49%, and (iii) Approved the amendment of article No (9) of the memorandum of association of the company, by increasing the shareholder possession of the company shares, to be 10% instead of 5%. (QSE) Ooredoo highlights tech, innovations from around the world at roadshow – Ooredoo stated it elevated Qatar’s standing as a burgeoning global hub for innovation, technology and entrepreneurship after the recent success of its second Ooredoo Innovation roadshow in Doha. The event attracted hundreds of innovators from around the world, including department heads from the Government of Qatar, entrepreneurs, business leaders, technology experts and futurists, the company stated. Global companies such as Ericsson, Google, Microsoft and many others also took part in the event to showcase their innovations. Ooredoo’s ecosystem of startup incubators, accelerators, channel partners and customers exchanged best practices and shared knowledge with their global counterparts. (Gulf- Times.com) UDCD launches final sales phase of Al Mutahidah Towers – United Development Company (UDCD) has launched the fourth and final phase of sales at Al Mutahidah Towers – Viva Bahriya 28, its luxurious project in the relaxed beachfront precinct of Viva Bahriya. The development, which consists of high-end connected towers offering 480 accommodation units of various dimensions including studios, lofts, and townhouses, as well as high-level penthouses, features panoramic sea views and direct access to the beach. Comprising 480 apartments, the project has attracted strong interest from visitors and investors as evidenced by the successful conclusion of the third sales phase in record time following the completion of the construction of Al Mutahidah Towers’ connecting bridge. The most complex structure of the project, the connecting bridge is a unique feature among towers at The Pearl-Qatar. (Gulf-Times.com) Nakilat participates in LNG2019 Conference and Exhibition – Nakilat participated in the LNG2019 Conference and Exhibition that took place in Shanghai from April 1 to 5. In its 19th edition, the international conference and exhibition on liquefied natural gas (LNG) is among the largest LNG-centric events globally, attracting more than 11,000 professionals from the energy industry. Being hosted in China, one of the leading importers of LNG worldwide, the event provides a strategic platform to discuss current industry topics and display the latest technological innovations. As the world’s leading transporter of clean energy, Nakilat was proud to be participating at LNG2019 and to showcase its shipping and maritime expertise at the event. In addition to its shipping services, Nakilat also provides integrated maritime solutions through its local joint ventures, offering ship repair, offshore repair and fabrication, as well as ship building at its world-class Erhama Bin Jaber Al Jalahma Shipyard located at Ras Laffan Industrial City, as well as towage, shipping agency, logistics and other maritime services. (Gulf-Times.com) GECF chief: Natural gas key to achieving lower carbon energy system – Natural gas will be the only hydrocarbon resource to increase its share in the global energy mix, from the current 22% to 26% in 2040, Dr Yury Sentyurin, Gas Exporting Countries Forum (GECF) secretary general Dr Yury Sentyurin, said at the African Petroleum Producers Organisation congress and expo in Equatorial Guinea. “Natural gas is a destination fuel that will prove to be key to achieving a lower carbon energy system,” Sentyurin said in his opening address at the African Petroleum Producers Organisation (APPO) CAPE VII Congress and Exhibition in Malabo, Equatorial Guinea yesterday. Africa’s progress in natural gas development will be a triumph against energy poverty, where approximately 80% of people still rely on biomass and waste to meet their energy needs, he said. Given the numerous health and air quality concerns associated with biomass burning, improving energy accessibility on the continent is not only a necessity for fighting energy poverty, but for fulfilling climate change objectives, and UN Sustainable Development Goal 7: access to affordable, reliable, sustainable and modern energy for all, Sentyurin noted. (Gulf-Times.com) QTerminals handles its heaviest cargo at Hamad Port – QTerminals, which is jointly established by Mwani Qatar (51%) and Milaha (49%), handled the heaviest cargo since start of its operations at Hamad Port. The cargo unit was handled with two mobile harbor cranes discharging the unit in a synchronized tandem move. QTerminals provides container, general cargo, RORO, livestock and off shore supply services in Phase 1 of Hamad Port, Qatar’s gateway to world trade. (Gulf-Times.com)

- 4. Page 4 of 7 US import from Qatar surges by 153% – The Qatar-US trade balance in goods, which is often in favor of the US, was skewed towards Qatar in January 2019. The world’s largest economy reported a rare trade deficit of $143.2mn (QR521.46mn) against Qatar for the first month of this year, latest official data show. Before January 2019, the US, over a period of the last five years, witnessed a monthly trade deficit (against Qatar) only on two occasions—once in July 2018 (with a small deficit of $3.2mn) and other in January 2015 ($11.7mn). This was due to an unprecedented change in the usual trade pattern between the two countries. There was a significant increase in US import from Qatar and a sharp decline in US export to the Gulf nation in January 2019 as compared to the previous month (December) as well as the corresponding month last year. The bilateral trade volume (in goods) between Qatar and the US reached $435.4mn (QR1.58bn) in January 2019, up nearly 27% (year-on- year) as compared to $343.1mn (QR1.24bn) registered in January last year, according to online data released by the US Census Bureau. The US exported goods worth $146.1m to Qatar in January 2019, while its import from Qatar surged to $289.3m, registering a triple digit growth of about 103% compared to $142.6mn in January 2018. When compared with the previous month ($114mn in December 2018) it increased by over 153%. (Peninsula Qatar) Project Qatar 2019 to begin on April 29 – Project Qatar 2019, the nation’s biggest and longest-established construction event, will take place between April 29 and May 1. The event’s impact and contribution to the construction industry in Qatar has grown consistently since its launch in 2004, and it is now a mainstay of the international construction industry calendar. The 2019 edition has been carefully tailored to be aligned with the journey towards the realization of the Qatar National Vision 2030. It will provide a unique platform for global industry players to learn how best to tap into the nations array of construction-related opportunities, as Qatar’s infrastructural upgrades gain pace. (Peninsula Qatar) Four new Monoprix stores to open this year – Four new Monoprix stores will open in various locations across Qatar, including a ‘digitally smart store’ at Msheireb Downtown Doha (MDD), by the end of this year, its regional general manager Sebastien Farhat has said. The French retail chain was introduced by Ali Bin Ali Group in Qatar in 2013 and now has two stores – in West Bay (Palm Tower) and the largest one at Doha Festival City. Ali Bin Ali Group owns the franchise of Monoprix in the region. (Gulf-Times.com) Kuwari attends WEF on MENA in Jordan – Minister of Commerce and Industry HE Ali bin Ahmed al Kuwari is leading Qatar’s delegation to the World Economic Forum (WEF) on the Middle East and North Africa (MENA), which is taking place at the Dead Sea, Jordan, on April 6-7. This year’s edition of the forum, which is being held under the theme “Globalisation 4.0,” will convene over 1,000 key leaders from government, business and civil society from over 50 countries, the Ministry of Commerce and Industry (MoCI) said in a statement. The forum focuses on providing support for the development of institutions in the MENA amid efforts to promote intra-trade and commerce with the GCC, the US, Europe and Asia, in addition to addressing the ongoing geopolitical transformations and humanitarian challenges through multi-stakeholder dialogue. The forum will discuss the women entrepreneurship, and key intergenerational issues such as transparency, accountability, sustainability and environmental. (Qatar Tribune) International US employment report points to growing economy – US employment growth accelerated from a 17-month low in March, assuaging fears of an abrupt slowdown in economic activity, but a moderation in wage gains supported the Federal Reserve’s decision to suspend further interest rate increases this year. Milder weather boosted hiring in sectors like construction, but worsening worker shortages and lingering effects of tighter financial market conditions at the turn of the year left job growth below 2018’s brisk pace. The Labor Department’s closely watched employment report on Friday also showed a small upward revision to February’s meager job gains. “This was a Goldilocks report, with a rebound in job growth to calm fears of an imminent recession, and wage growth that was solid enough without triggering inflationary concerns,” said Curt Long, chief economist at the National Association of Federally- Insured Credit Unions. “The Fed will be pleased, as it supports their present stance of holding firm on rates.” Nonfarm payrolls rose by 196,000 jobs in March. Data for February was revised modestly up to show 33,000 jobs created instead of the previously reported 20,000. February job gains were the smallest since September 2017. Economists polled by Reuters had forecast payrolls increasing by 180,000 jobs last month. Average hourly earnings increased by 0.1 percent in March after jumping 0.4 percent in February. That lowered the annual increase in wages to 3.2 percent from 3.4 percent in February, which was the biggest gain since April 2009. (Reuters) US jobless claims hit 49-year low; labor market resilient – The number of Americans filing applications for unemployment benefits fell to a nearly half-century low last week, pointing to sustained labor market strength despite slowing economic growth. Initial claims for state unemployment benefits declined 10,000 to a seasonally adjusted 202,000 for the week ended March 30, the lowest level since early December 1969, the Labor Department said. Economists polled by Reuters had forecast claims rising to 216,000 in the latest week. The claims data have shown no significant pickup in layoffs and there have been reports of companies reluctant to let go of workers amid a growing shortage of skilled labor. The scarcity of workers contributed to a recent slowdown in hiring. (Reuters) UK loses GBP 6.6bn a quarter since referendum: S&P –The United Kingdom has lost GBP 6.6bn in economic activity every quarter since it voted to leave the European Union, according to S&P Global Ratings, the latest company to estimate the damage from Brexit. In a report published on Thursday, the ratings agency’s senior economist, Boris Glass, said the world’s fifth- biggest economy would have been about 3 percent larger by the end of 2018 if the country had not voted in a June 2016 referendum to leave the EU. Quarterly growth rates would have averaged about 0.7 percent, rather than 0.43 percent, he said. “Immediately after the referendum, the pound fell by about 18 percent. This was the single most pertinent indicator of the impact of the vote and the drag it created, via inflation, has

- 5. Page 5 of 7 been spreading through the economy,” he said. As imports became more expensive, inflation started to rise, curbing household spending. S&P estimated inflation was 1.8 percent higher than it would otherwise have been by the third quarter 2017. The S&P report was based on the Doppelganger approach, an econometric technique that used a synthetic UK economy based on the performance of other economies to estimate how the UK would have performed had it not decided to leave the EU. (Reuters) UK house price growth cools in early 2019, outlook subdued: Halifax – British house price growth cooled in the first three months of 2019 in annual terms and the outlook is likely to remain subdued, given Brexit uncertainty and high property prices, mortgage lender Halifax said. Compared with the same period of last year, prices rose by 2.6%, slower than a rise of 2.8% in the three months to February. A Reuters poll of economists had pointed to an annual rise of 2.3 percent for the first quarter. (Reuters) German industrial output rises on construction surge – German industrial output rose by 0.7% in February as mild weather helped a surge in construction activity but manufacturing production dipped, doing little to boost spirits in Europe’s largest economy after a run of negative news. The rise in output exceeded expectations for a 0.5% increase on the month. January’s reading was revised up to show no change from a previously reported contraction of 0.8%, Statistics Office figures showed. (Reuters) ECB rate hike timing pushed further back again: Reuters poll – The European Central Bank will delay any interest rate hikes further into next year than previously thought as euro zone economic growth and inflation prospects have dimmed, a Reuters poll of economists showed. That change comes only a few months after the central bank shut its monthly asset purchases, known as quantitative easing (QE), and March’s offer of new long-term loans, or TLTROs, to start in September. The ECB is already on its longest break from changing rates and this week’s poll of more than 80 economists showed the central bank will delay any tightening even further. (Reuters) China March new bank loans seen rebounding, further easing expected: Reuters poll – New bank loans in China likely rebounded in March from a drop the previous month, a Reuters poll showed, as policymakers push the country’s banks to keep lending to struggling smaller companies even if it risks more bad loans. Chinese banks likely extended 1.2 trillion yuan ($178.78 billion) in net new loans in March, up about 7 percent from the same period a year earlier, a median estimate in a Reuters survey of 20 economists showed. After a record credit pulse in January into the slowing economy, new lending dropped sharply to 885.8 billion yuan in February, which analysts attributed to seasonal factors and regulators’ concerns about a flare-up in some types of shadow bank financing. But if the March reading is in line with forecasts, total bank lending in the first three months of the year would reach a record quarterly tally of 5.32 trillion yuan ($792.60 billion), suggesting months of policy loosening by the central bank are starting to bear fruit. (Reuters) Japan's coincident index improves, government maintains economic view – Japan’s coincident indicator index improved for the first time in four months in February and the government kept its view to say the economy is at “a turning point”, government data showed. The index of coincident indicators rose a preliminary 0.7 point in February from the previous month, the Cabinet Office said. The government kept its assessment intact to say the economy was at “a turning point towards a downgrade”, meaning the economy may have peaked a few months earlier. (Reuters) Regional IIF: MENA asset accumulation continues – The portfolio debt inflows is expected to increase from $48bn in 2018 to $60bn in 2019 as five GCC states are now in JP Morgan’s EMBI index. During the first quarter of this year, Qatar and Saudi Arabia issued a combined $19.5bn in sovereign Eurobonds, according to Institute of International Finance (IIF). “With an improving EM investment outlook in recent months, we expect healthy equity inflows to continue through the first half of 2019. Resident capital outflows will remain large at $235bn, far exceeding non-resident capital inflows. As a result, the stock of gross foreign assets is projected to increase to $3.1tn by 2020, about 70% of which is managed by SWFs with diversified equity and fixed income portfolios. The other 30% is in official reserves”, the IIF’s ‘capital flows’ report noted. The IIF forecasts Brent oil spot prices to average $65 per barrel in 2019 and $60 per barrel in 2020. With modestly lower oil prices, the aggregate current account surplus of the six GCC oil exporters will narrow from $147bn in 2018 to $91bn in 2019. Non-resident capital inflows are set to rise modestly to $145bn in 2019, equivalent to 9% of GDP. (Peninsula Qatar) Saudi Arabia raises May Arab Light crude OSP to Northwest Europe – Saudi Aramco has raised the May price for its Arab Light grade to Northwest Europe by $1.10 a barrel versus April to a discount of $0.80 a barrel to ICE Brent, it stated. The company raised its Arab Light OSP for Asian customers by 20 cents for May from the previous month to a premium of $1.40 a barrel to the Oman/Dubai average. The Arab Light OSP to the US was raised 10 cents a barrel to a premium of $3.15 a barrel to the Argus Sour Crude Index (ASCI) for May. (Reuters) Dubai realty downturn to get much worse from here, says Mark Mobius – Three years ago, Mark Mobius saw his luxury apartments in Dubai go up in flames. While the suites have by now been restored, the investor has something else to worry about: the frenzy of construction that’s adding to the existing glut in real estate. The downturn will get much worse from here, said Mobius, a pioneer in emerging-market investing, adding he’d hold off on buying more property. “I would probably want to wait until there’s a real slump when all this new building comes in and people are really hurting,” he added. Prices and rents have already dropped by as much as a third in the past five years during what S&P Global Ratings has called the property market’s long decline. The slump will run for another 12 to 18 months because government measures to stimulate the economy - including granting long-term visas which benefit the affluent and people with specialized expertise – will not be enough to revive demand, said Lahlou Meksaoui, a Dubai-based analyst at Moody’s Investors Service. (Gulf- Times.com)

- 6. Page 6 of 7 ADNOC weighs secondary listing overseas for distribution business – Abu Dhabi National Oil Company (ADNOC) is considering a secondary listing for its subsidiary ADNOC Distribution overseas, according to sources. In 2017 ADNOC listed 10% of ADNOC Distribution, the largest operator of petrol stations and convenience stores in the UAE, on the Abu Dhabi Securities Exchange. Reuters reported last June that ADNOC was considering selling another 10% stake in its fuel distribution business. ADNOC Distribution was seeking a minimum free float of 15% to improve its chances of joining the MSCI Emerging Markets Index and attract more international investors, a source told Reuters at the time. (Reuters) First Abu Dhabi Bank, Abu Dhabi Islamic Bank deny merger talks – Abu Dhabi Islamic Bank and First Abu Dhabi Bank denied they were in merger talks after a news report stated the Emirate was considering combining them. Citing sources, Bloomberg reported that Abu Dhabi was considering merging the two lenders to create the Gulf region’s largest lender. First Abu Dhabi Bank, the largest lender in the UAE, in a bourse filing stated it “strongly denies the report issued by Bloomberg on the potential merger”. (Reuters) Fitch revises Kuwait Energy's rating watch to Positive on Acquisition – Fitch Ratings has revised the rating watch on Kuwait Energy’s Long-Term Issuer Default Rating (IDR) of ‘CCC’ to Positive from Evolving following the completion of the acquisition of the company by Hong Kong-listed United Energy Group Ltd (UEG). The rating watch on the company's $250mn bond due in 2019 rated ‘CCC’/Recovery Rating ‘RR4’ has also been revised to Positive from Evolving. The ‘CCC’ rating of Kuwait Energy is primarily driven by its weak liquidity position. The completion of the acquisition is the first milestone towards the redemption of the group's $250mn notes falling due in August 2019. The RWP reflects our view that the enhanced scale and conservative financial profile of the combined entity is likely to support a positive resolution of Kuwait Energy's immediate liquidity issues. (Bloomberg) Kuwait Investment Authority-455 buys 1.1% of Hibernia REIT – Kuwait Investment Authority-455 took a position in Hibernia REIT, buying 1.1% of the company's outstanding stock. Kuwait Investment Authority-455 is a mutual fund under Kuwait Investment Authority, part of Kuwait Investment Authority. (Bloomberg)

- 7. Contacts Saugata Sarkar, CFA, CAIA Shahan Keushgerian Zaid al-Nafoosi, CMT, CFTe Head of Research Senior Research Analyst Senior Research Analyst Tel: (+974) 4476 6534 Tel: (+974) 4476 6509 Tel: (+974) 4476 6535 saugata.sarkar@qnbfs.com.qa shahan.keushgerian@qnbfs.com.qa zaid.alnafoosi@qnbfs.com.qa Mehmet Aksoy, PhD QNB Financial Services Co. W.L.L. Senior Research Analyst Contact Center: (+974) 4476 6666 Tel: (+974) 4476 6589 PO Box 24025 mehmet.aksoy@qnbfs.com.qa Doha, Qatar Disclaimer and Copyright Notice: This publication has been prepared by QNB Financial Services Co. W.L.L. (“QNB FS”) a wholly-owned subsidiary of Qatar National Bank (Q.P.S.C.). QNB FS is regulated by the Qatar Financial Markets Authority and the Qatar Exchange. Qatar National Bank (Q.P.S.C.) is regulated by the Qatar Central Bank. This publication expresses the views and opinions of QNB FS at a given time only. It is not an offer, promotion or recommendation to buy or sell securities or other investments, nor is it intended to constitute legal, tax, accounting, or financial advice. QNB FS accepts no liability whatsoever for any direct or indirect losses arising from use of this report. Any investment decision should depend on the individual circumstances of the investor and be based on specifically engaged investment advice. We therefore strongly advise potential investors to seek independent professional advice before making any investment decision. Although the information in this report has been obtained from sources that QNB FS believes to be reliable, we have not independently verified such information and it may not be accurate or complete. QNB FS does not make any representations or warranties as to the accuracy and completeness of the information it may contain, and declines any liability in that respect. For reports dealing with Technical Analysis, expressed opinions and/or recommendations may be different or contrary to the opinions/recommendations of QNB FS Fundamental Research as a result of depending solely on the historical technical data (price and volume). QNB FS reserves the right to amend the views and opinions expressed in this publication at any time. It may also express viewpoints or make investment decisions that differ significantly from, or even contradict, the views and opinions included in this report. This report may not be reproduced in whole or in part without permission from QNB FS. COPYRIGHT: No part of this document may be reproduced without the explicit written permission of QNB FS. Page 7 of 7 Rebased Performance Daily Index Performance Source: Bloomberg Source: Bloomberg (*Data as of April 3, 2019, **Data as of April 2, 2019) Source: Bloomberg Source: Bloomberg (*$ adjusted returns, # Market was closed on April 5, 2019) 45.0 70.0 95.0 120.0 Mar-15 Mar-16 Mar-17 Mar-18 Mar-19 QSE Index S&P Pan Arab S&P GCC 0.9% 0.3% 0.0% 0.1% (0.5%) (0.3%) 0.6% (1.0%) (0.5%) 0.0% 0.5% 1.0% SaudiArabia Qatar Kuwait* Bahrain Oman** AbuDhabi Dubai Asset/Currency Performance Close ($) 1D% WTD% YTD% Global Indices Performance Close 1D%* WTD%* YTD%* Gold/Ounce 1,291.75 (0.0) (0.0) 0.7 MSCI World Index 2,149.85 0.3 2.0 14.1 Silver/Ounce 15.11 (0.3) (0.1) (2.5) DJ Industrial 26,424.99 0.2 1.9 13.3 Crude Oil (Brent)/Barrel (FM Future) 70.34 1.4 2.9 30.7 S&P 500 2,892.74 0.5 2.1 15.4 Crude Oil (WTI)/Barrel (FM Future) 63.08 1.6 4.9 38.9 NASDAQ 100 7,938.69 0.6 2.7 19.6 Natural Gas (Henry Hub)/MMBtu 2.61 (2.6) (4.4) (18.1) STOXX 600 388.23 0.1 2.4 12.6 LPG Propane (Arab Gulf)/Ton 61.75 (0.4) (9.2) (2.8) DAX 12,009.75 0.1 4.1 11.5 LPG Butane (Arab Gulf)/Ton 60.25 (2.8) (13.0) (13.9) FTSE 100 7,446.87 0.1 2.5 13.0 Euro 1.12 (0.0) (0.0) (2.2) CAC 40 5,476.20 0.2 2.3 13.4 Yen 111.73 0.1 0.8 1.9 Nikkei 21,807.50 0.2 2.0 7.7 GBP 1.30 (0.3) 0.0 2.2 MSCI EM 1,085.14 0.4 2.6 12.4 CHF 1.00 (0.0) (0.5) (1.9) SHANGHAI SE Composite# 3,246.57 0.0 5.0 33.3 AUD 0.71 (0.1) 0.1 0.8 HANG SENG# 29,936.32 0.0 3.1 15.6 USD Index 97.40 0.1 0.1 1.3 BSE SENSEX 38,862.23 0.1 0.7 8.5 RUB 65.36 (0.2) (0.4) (6.3) Bovespa 97,108.17 0.6 2.7 10.7 BRL 0.26 (0.4) 1.2 0.2 RTS 1,225.84 0.5 2.3 14.7 101.5 94.9 81.9