Final project of activity ratio by Nigah-e-Nazar

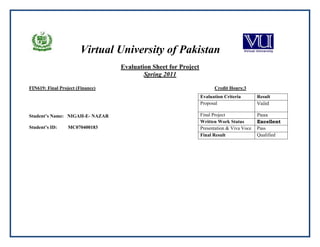

- 1. Virtual University of Pakistan Evaluation Sheet for Project Spring 2011 FIN619: Final Project (Finance) Credit Hours:3 Student’s Name: NIGAH-E- NAZAR Student’s ID: MC070400183 Evaluation Criteria Result Proposal Valid Final Project Pass Written Work Status Excellent Presentation & Viva Voce Pass Final Result Qualified

- 2. IN THE NAME OF ALLAH, THE MOST MERCIFUL AND THE MOST GRACIOUS

- 3. Final Project AACCTTIIVVIITTYY RRAATTIIOOSS’’ AANNAALLYYSSIISS OOFF KKOOHHAATT CCEEMMEENNTT,, LLUUCCKKYY CCEEMMEENNTT AANNDD PPIIOONNEEEERR CCEEMMEENNTT IINN PPAAKKIISSTTAANN IINN SSAAMMEE IINNDDUUSSTTRRYY FFOORR FFYY 22000088--22000099 AANNDD 22001100.. A REPORT SUBMITTED TO THE DEPARTMENT OF MANAGEMENT SCIENCES, VIRTUAL UNIVERSITY OF PAKISTAN IN PARTIAL FULFILLMENT OF THE REQUIREMENTS FOR THE DEGREE OF MASTERS OF BUSINESS ADMINISTRATION Submitted By. MC070400183 NIGAH-E- NAZAR Submitted To Department of Management Sciences, Virtual University of Pakistan

- 5. My effort is dedicated to my parents and my families from whom I learnt the art of sacrifice & who are a continuing source of inspiration for me.

- 6. Acknowledgements In the very beginning, All of praises for Almighty ALLAH who bestowed potentially upon me to accomplish this report successfully. He gave me the power and devotion to make it possible to make the project Secondly, I am also very thankful of my beloved parents who supported me in every way of life including to present the project. They help me and save me from any hurdle of life Then, last but not the least; I am thankful of Dr. Imran Khalid (The project management teacher the institute of cost and management accountant of Pakistan Karachi (ICMAP) for their guidance and the finance manager of lucky cement Karachi for providing the financial statements of last few years. In the last, I am thankful of Virtual University of Pakistan to know my capabilities and assigning me the duty to compile a project report on the financial statement analysis of two companies of the same industry and for inspiring me to learn more and more and to groom me for the future tasks.

- 7. EXECUTIVE SUMMARY First of all We should know about my project topic, how is important this ratio, actually this ratios are measures of how well assets are used, it could be used to evaluate the various benefits produced by specific assets, such as inventory or accounts receivable or we can say it could be use to evaluate the benefits produced by all a company assets together. So according to university task, university has given my various topics to do research on it but I have selected three companies named Kohat, Lucky, and Pioneer cement companies for my activities analysis. Further my study will also measures that how to activity ratio assist companies gauge how effectively the companies are at putting its investment to work. Pakistan. Cement industry is indeed a highly important segment of industrial sector that plays a pivotal role in the socio-economic development. Though the cement industry in Pakistan has witnessed its lows and highs in recent past, it has recovered during the last couple of years and is buoyant once again. Structure: A market is a group of buyers and sellers exchanging goods that are highly substitutable for one another. Markets are defined by demand conditions; they embody the zone of consumer choice for the goods. As above wrote, it is efficiency ratio and good firms would always put their resources to optimum utilization. If any company have better activity ratio, it would be better for the company, it mean the company is utilizing its recourses effectively and properly. This ratio will simply indicate regarding to firms productive efficiency because stronger activities ratio leads to higher profitability, so in study will touch three activities ratio with analysis for the last three years of balance sheet. So need for doing this analysis to find out the real efficiency condition of the three companies who is stronger. This will be finding out through measure the activity ratio of the three firms. Three companies that are write above all competitors each other. My study will show you how to three companies invest their assets like inventory, plant and equipment or other assets to generate revenues. So for this I am going to conduct a research over three company’s activity ratio.

- 8. Page 0 1. Chapter 1…………………………………...………………………..Page # Introduction 1 1.1 Financial Period under Consideration for Analysis 8 1.2 Objectives ………………………………………………8 1.3 Significance ………………………………………………9 2. Chapter 2…………………………………………………………. ….. Data Processing and Analysis …………………………………..13 2.1 Data Processing and Analysis Tools………………………13 2.2 Data Collection Sources……………………………………13 3. Chapter 3 ………………………………………............................ Activity Ratio Analysis……………………………………………20 3.1 Introduction……………………………………………20 3.2 Formula 3.2 Graphical Presentation of Ratio ……………………… … 3.5 Interpretation ……………………………………………. 3.6 Data Processing / Analysis ……………………………… 4. . Chapter 4 ………………………………………........................... Conclusion and Recommendation……………………………….37 4.1 Conclusion…………………………………………………37 4.2 Recommendation…………………………………………..38 Section 2 1. Introduction…………………………………………………………41

- 9. Page 1 2. Appendixes………………………………………………………….41 3. Bibliography …..……………………………………………………42 INTRODUCTION AND BACK GROUND Cement industry is indeed a highly important segment of industrial sector that plays a pivotal role in the socio-economic development. Though the cement industry in Pakistan has witnessed its lows and highs in recent past, it has recovered during the last couple of years and is buoyant once again. Activity ratio analysis to judge the financial performance of different companies whether they belong to the same industry or to the different industries is always different from each other. They vary from each other in many aspects of the recording of the transactions Activity ratio analysis is very important for the industry to know the financial health of the company after some time and it is also very helpful for the investors and the creditors who always seek for the better economic condition The equity investor is primarily interested in the long-term earning power of company, its ability to grow and its ability to pay dividends and increase in value. Short-term creditors such as bank and trade creditors place emphasis on immediate liquidity of the business because they see an early payback of their investment. On the other hand, Long-term investor in bonds, such as insurance companies and pension funds are concerned with the long-term asset position and earning power of the company. They seek assurance of the payment of interest and the capability of retiring or refunding the obligation at maturity. Creditor’s risks are usually smaller than equity risks and may be more easily quantifiable. Financial statements are an approximation of economic reality because of the selective reporting of economic events by the accounting system. Objective of financial statement analysis is the comparative measurement of risk and return to make investment or credit decisions. These decisions require estimates of the future. Financial data are useful to investors only for prediction of a firm’s risk characteristics.

- 10. Page 2 Financial statements are prepared using a monetary unit to quantify the operations of a firm. The fundamental tool used to analyze the financial statement analysis is Ratio Analysis. Financial ratios are used to compare the risk and return of different firms in order to help equity investors and creditors make intelligent and investment decisions. Ratios can be used to compare the risk and return relationships of firms of different sizes. Ratio analysis is used not in financial analysis but also as a tool in internal management analysis and evaluation. Ratios are used to standardize financial statements across firms and over time, facilitating comparative analysis. Ratios also provide insight in to firm performance and economic relationships when evaluated in an integrated analysis. The objective of this project is the presentation of financial statement analysis from the point of view of primary users of financial statements: equity (prospective shareholders) and credit analysts ABOUT PIONEER CEMENT. "Pioneer Cement Limited is committed to make sustained efforts towards optimum utilization of its resources through good corporate governance for serving the interest of all its stakeholders." We at Pioneer Cement Limited are committed to provide our customers quality cement by producing it according to international and Pakistani standards. We have selected ISO 9002 based quality assurance system to ensure that our customers get quality cement according to their expectations. Our Philosophy: The Management of Pioneer Cement Limited is committed to maintaining this quality policy at all levels of the company. For this, as well as to achieve our corporate objectives, we all shall work as a team and pursue continuous improvement. Incorporation: Pioneer Cement Limited (PCL) was incorporated in Pakistan as a public company limited by shares on February 09, 1986. Its shares are quoted on all stock exchanges in Pakistan. The principal activity of the Company is manufacturing and sale of cement.

- 11. Page 3 Paid Up Capital/Equity: Paid up Capital 227.1 million shares of Rs. 10/= each 2,271 Shareholders Equity 2,140 Plant Location The plant is located at Chenki, District Khusshab, in the heart of Punjab Province, 250 km away from Lahore and 120km away from Motorway (M2) Product OPC is one of the most commonly and widely used type of cement in the world. This type of cement is an ideal building material for almost all structural work including all kinds of concrete construction. Pioneer OPC, besides its Exceptional strength, is specially designed for: Ideal Setting Time Low Heat of Hydration Darker Color SRC ABOUT LUCKY CEMENT Lucky Cement Limited was founded in 1996 by Tabba. The company initially started with factories in the Pezu district of the North West Frontier Province (N.W.F.P). It now, also, owns a factory in Karachi. Lucky Cement Limited has been sponsored by one of the largest business groups in Pakistan, the Yunus Brothers Group (YB Group), based in Karachi and has grown remarkably over the last 50 years. The YB Group is engaged in diversified manufacturing activities including textiles, spinning, weaving, processing, finishing, stitching and power generation. The Group consists of a number of industrial establishments other than Lucky Cement Limited, including Lucky Textile Mills, Fazal Textile Mills Limited, Gadoon Textile Mills Limited, Lucky Energy (Private) Limited, Yunus Textile Mills and Lucky Textile Mills - established in 1983. Group. Lucky Cement Limited has been sponsored by Yunus Brothers Group (YB Group) which is one of the largest business groups of the Country based in Karachi and has grown up remarkably over the last 50

- 12. Page 4 years. The YB Group is engaged in diversified manufacturing activities including Textile, Spinning, Weaving, Processing, Finishing, Stitching and Power Generation. The Group consists of a number of industrial establishments other then Lucky Cement Limited, they include: ABOUT KOHAT CEMENT Kohat Cement Company Limited (incorporated in 1980) is an ISO 9001-2000 certified company, listed on Stock Exchanges of Pakistan and engaged in manufacturing of Grey and White Cements. Quality of our products is better than approved British and Pakistan Standards. The plant is located in Kohat about 60 kilometers from Peshawar. Capacity: Grey Cement Tons/Anum White Cement Tons/Anum Line I 594,000 Line II - 148,500 Line III 2,211,000 Total Capacity 2,805,000 148,500 Board of Directors: Mr. Aizaz Mansoor Sheikh Chief Executive Mr. Nadeem Atta Sheikh Director Mrs. Ghazala Amjad Director Mrs. Hafsa Nadeem Director Mr. Omer Aizaz Sheikh Director Mr. Ibrahim Tanseer Sheikh Director Mr. Muhammad Atta Tanseer Sheikh Director Audit Committee: Mr. Ibrahim Tanseer Sheikh Chairman Mr. Omer Aizaz Sheikh Member Mrs. Hafsa Nadeem Member Company Secretary:

- 13. Page 5 Mr. Muhammad Hashim Khan External auditors: KPMG Taseer Hadi & Co. GREY CEMENT KOHAT ORDINARY PORTLAND CEMENT is manufactured under strict quality control on state of the art plant with latest technology. Our Cements comply with following standards: 1. PS 232-1983 (R) 2. ENV 197- 1 & 2 CEM I, CLASS 42.5 N Available in 50 Kg paper or polypropylene bags (20 bags to a metric ton). Bulk cement can be delivered in N.W.F.P areas. WHITE CEMENT A state of the art plant with technology from Babcock-Grenzebach Germany is installed at Kohat. KOHAT SUPER WHITE CEMENT is the product of unique decolourizing process, which prevents oxidation of iron in the clinker and maximizes whiteness. High refractive index and opacity of KOHAT SUPER WHITE CEMENT impart a brilliant luster and smooth finish, even when mixed with pigments. It also mixes easily with inorganic pigments which do not fade in sunshine and alkaline attack. The comprehensive strength of KOHAT SUPER WHITE CEMENT is at par or more than the strength of Ordinary Portland Cement. Therefore it can conveniently be used in place of grey cement in all kinds of concrete and mortar mix. KOHAT SUPER WHITE CEMENT complies with following standards: 1. PS 1630- 1984 2. ENV 1 97-1 &2CEM I, CLASS 42.5 N Financial Period under Consideration for Analysis. The financial period of 2007 2008 2009 and 2010 of M/s Kohat Cement, Lucky Cement and Pioner Cement are selected for consideration and anaylisis.for the activity ratio. See the Attached Annexure A, B, C, D, Objectives

- 14. Page 6 • Which of the selected companies is effectively managing the two specific asset groups-receivables and inventories-and its total assets in general. • The reason(s) that why this company is able to manage its assets effectively. • The reason(s) that why this company is NOT able to manage its assets effectively. The objective of activity ratio analysis is the comparative measurement of financial data to facilitate wise investment, credit and managerial decisions. Some examples of analysis, according to the needs to be satisfied, are: Significance. 1. Get idea how to these companies manage their assets effectively 2. Get clear picture what are various factors that companies not able to manage their assets effectively 3. Data will help for both companies to understand these factors 4. To fulfill my MBA degree requirement The following are the significance of activity ratio. It helps in evaluating the firms’ performance: With the help of ratio analysis conclusion can be drawn regarding several aspects such as financial health, profitability and operational efficiency of the undertaking. Ratio points out the operating efficiency of the firm i.e. whether the management has utilized the firm’s assets correctly, to increase the investor’s wealth. It ensures a fair return to its owners and secures optimum utilization of firms assets It helps in inter-firm comparison: Ratio analysis helps in inter-firm comparison by providing necessary data. An interfirm comparison indicates relative position. It provides the relevant data for the comparison of the performance of different departments. If comparison shows a variance, the possible reasons of variations may be identified and if results are negative, the action may be initiated immediately to bring them in line. It simplifies financial statement: The information given in the basic financial statements serves no useful Purpose unless it s interrupted and analyzed in some comparable terms. The ratio analysis is one of the tools in the hands of those who want to know something more from the financial statements in the simplified manner. It helps in determining the financial position of the concern:

- 15. Page 7 Ratio analysis facilitates the management to know whether the firms financial position is improving or deteriorating or is constant over the years by setting a trend with the help of ratios The analysis with the help of ratio analysis can know the direction of the trend of strategic ratio may help the management in the task of planning, forecasting and controlling. It is helpful in budgeting and forecasting: Accounting ratios provide a reliable data, which can be compared, studied and analyzed. These ratios provide sound footing for future prospectus. The ratios can also serve as a basis for preparing budgeting future line of action. Liquidity position: With help of ratio analysis conclusions can be drawn regarding the Liquidity position of a firm. The liquidity position of a firm would be satisfactory if it is able to meet its current obligation when they become due. The ability to met short term liabilities is reflected in the liquidity ratio of a firm. Long term solvency: Ratio analysis is equally for assessing the long term financial ability of the Firm. The long term solvency s measured by the leverage or capital structure and profitability ratio which shows the earning power and operating efficiency, Solvency ratio shows relationship between total liability and total assets. Operating efficiency: Yet another dimension of usefulness or ratio analysis, relevant from the View point of management is that it throws light on the degree efficiency in the various activity ratios measures this kind of operational efficiency. Help in investment decisions It helps in investment decisions in the case of investors and lending decisions in the case of bankers etc. GENERAL MARKET SCENARIO FY 2008, 09-10:

- 16. Page 8 In FY08, there were extraordinary circumstances for the global economy and all sectors and cement industries was among the worst hit. FY08 witnessed petrol and HSD Price touching the sky substitution of CNG, rising capital and commodity economies of the world. Overall there was a major shift in fuel, labor and operating costs of all business activities. For Cement industries. Matters were further complicated by an unprecedented rise in cotton prices in March and April 2010, with no signs of stability by the year-end. Additional factors were energy crises at domestic level, low yield of cotton in Pakistan and a very weak demand from US and European and credit crunch for general consumers. Although softening of Pak rupee against the US dollar helped to cover a small factor of this accumulated cost pressure, the overall picture for domestic cement industry was that of rising costs and declining consumer demand. Interruption in natural gas supply to manufacturing facilities in winter season continued which led to lower utilization of production facilities operating on gas.

- 17. Page 9 DATA PROCESSING AND RATIOS ANALYSIS: Financial ratio analysis involves the calculation and comparison of ratios which are derived from the information given in the company's financial statements. The historical trends of these ratios can be used to make inferences about a company's financial condition, its operations and its investment attractiveness. Financial ratio analysis groups the ratios into categories that tell us about the different facets of a company's financial state of affairs. Data Collection Source. All data are collected thorough internet with the help of following links Where is the link of the sources Data analysis tools??? Secondary data were collected from three companies website. INTRODUCTION: ACCOUNTS RECEIVABLE TURNOVER Accounts receivable turnover ratio is a measure of the liquidity of a company's AR asset. Typically, the higher the turnover is, the more favorable it is. An interesting counterargument to the preceding statement is that a too high an account receivable turnover ratio may point to an overly restrictive credit policy and that good sales may be lost impacting the overall health and organic growth of the company. The formula for accounts receivable turnover is: Account receivable turnover = total credit sales / average accounts receivable.

- 18. Page 10 Account Receivable Ratio Total Credit Sales Average Account Receivable Company 2010 2009 2008 Kohat Cement 369,203,8418 / ((20010133+ 17792165) / 2) = 195.33 =3395580759/((17792165+15 341081)/2) = 204.96 =1375972754 /((15341081 +21381453)/2) =74.93 Lucky Cement 24,508,793 / ((779305+1267248)/2) = 23.95 =26303404/((1267248+7203 14)/2) = 26.47 =16957879 / ((720314+476667)/2)=28.33 Pioneer Cement = 38,72,834 / ((36851+37802)/2) = 103.75 =5000235/ ((37402+40124)/2) = 128.99 =4853764 /((40124+29717)/2) =138.99 For Diagram Purpose Table Company 2010 2009 2008 Kohat Cement 195.33 204.97 74.9389 Lucky Cement 23.95 26.47 28.3344 Pioneer Cement 103.76 129.00 138.9947 Account Receivable Ratio Interpretation. RECEIVABLES TURNOVER: This ratio measures the effectiveness of firm’s credit policies and also indicates the level of investment in

- 19. Page 11 receivables needed to maintain the firm’s sales level. A high receivables turnover ratio implies either that the company operates on a cash basis or that its extension of credit and collection of accounts receivable are efficient. Also, a high ratio reflects a short lapse of time between sales and the collection of cash, while a low number means collection takes longer. The lower the ratio is the longer receivables are being held and the risk to not be collected increases. A low receivables turnover ratio implies that the company should re-assess its credit policies in order to ensure the timely collection of credit sales that is not earning interest for the firm. A ratio that is low by industry standards will generally indicate that your business needs to improve its credit policies and collection procedures. If the ratio is going up, either collection efforts may be improving, sales may be raising or receivables are being reduced. Kohat Cement and Pioneer cement has the Strong AR turnover ratio than Lucky cement Limited and its trend is during the last three years is positive. AR ratio of both Kohat & Poiner cement is improving from last three years due to increase in sales and better credit policy. And lucky cement AR also strong but they are not health than the two companies General Rule: The longer the collection period, the longer your money is tied up. If your collection period exceeds your terms (e.g., 2/10 net 30), this may be a sign that you have credit risk . . . that you have some receivables that may never be collected. Interpretation update Kohat cement ratio in 201 indicates the debt was quickly received from the consumers as compare to Lucky cement and Pioner cement company. Lucky cement company ratio indicate the quality of consumers are low as firm could not receive debt from customers. Average Collection Period interpretation Average Collection Period represents the average number of days it takes the company to convert receivables into cash. Average Collection Period formula is: Average collection period measures the average number of days that accounts receivable are outstanding. This activity ratio should be the same or lower than the company's credit terms. A rule, outstanding receivables should not exceed credit terms by more than 10-15 days. If you allow various types of credit transactions, then the average collection period MUST be also calculated separately for each category. This ratio takes in consideration ONLY the credit sales. If the cash sales are included, the ratio will be affected and may lose its significance. It is best to use average accounts receivable to avoid seasonality effects. If the company uses discounts, those discounts must be taken into consideration when calculate net accounts receivable. AVERAGE COLLECTION PERIOD.

- 20. Page 12 Company 2010 2009 2008 Kohat Cement =365/195.33 =1.87 Days = 365/204.96=1.78 D ays =365/74.93=4.87 days Lucky Cement =365/ 23.95=15.24 days =365/ 26.47=13.79 days =365/28.33=12.88 days Pioner Cement = 365/ 103.75= 3.52 days =365/128.99=2.83 days =365/138.99=2.63 days For Diagram Purpose Table Company 2010 2009 2008 Kohat Cement 1.87 1.78 4.87 Lucky Cement 15.24 13.79 12.88 Pioner Cement 3.52 2.83 2.63 AVERAGE COLLECTION PERIOD. INTERPRETATION: Average collection period in is equal to year divided by Receivables turnover ratio. Average collection period shows the average length of time it takes affirm to collect credit sales in months. From above analysis it is clear that average collection period is increasing which shows better credit and collection policy of all three Companies. Lucky Cement has strong account receivable outstanding then Kohat Cement and

- 21. Page 13 Pioneer Cement Limited during the last three years. It means LUCKY CEMENT adopt restrict policy of giving credit convenience to its customers. and the second one is the pioneer cement. Both all three companies have improving account receivable days from last three years due to strict & tight control credit policy. ACCOUNTS PAYABLE TURNOVER. A short-term liquidity measure used to quantify the rate at which a company pays off its suppliers. Accounts payable turnover ratio is calculated by taking the total purchases made from suppliers and dividing it by the average accounts payable amount during the same period. Working Company 2010 2009 2008 Kohat Cement 42545/7896 = 5 9253/4578 = 2 85678/45521 =1.8 Lucky Cement 407555/63425=6 1.01 55412/36589=1.5 Pioner Cement 45367/44632 =1 77856/42632 = 1.8 56452/46362 =1 Ratio Company 2010 2009 2008 Kohat Cement 5.0 2.0 1.8 Lucky Cement 6.0 1.0 1.5 Pioner Cement 1.0 1.8 1.0

- 22. Page 14 - 1.0 2.0 3.0 4.0 5.0 6.0 7.0 2010 2009 2008 Kohat Cement Lucky Cement Pioner Cement Interpretation: This ratio shows the portion of credit purchase to the accounts payable. It means that how many times we have paid our creditors in one year. So from the above computation it can be observed that it shows an increasing trend in Three years. Here the all the three companies has better position for short term liquidity measure. AVERAGE PAYMENT PERIOD The average payment period is defined as the number of days a company takes to pay off credit purchases. It is calculated as accounts payable / (total annual purchases / 360). As the average payment period increases, cash should increase as well, but working capital remains the same. Most companies try to decrease the average payment period to keep their larger suppliers happy and possibly take advantage of trade discounts. Formula is : Accounts payable / (total annual purchases / 360) Ratio has been calculated according to formula. Amount has been taken from balance sheet. You should check these figure, weather it is right or wrong

- 23. Page 15 Company 2010 2009 2008 Kohat Cement =(734312487)/(3341872196 +290433057-139293693) *365 = 76.73 =(554458612)/(2591021469+139293693- 174317806)*365 = 79.17 =(244465133)/(12885 70903+174317806- 125147740) *365 =66.70 Lucky Cement =3043320/(16529932+6088 13-1196608)*365 =69.67 =2677356/(16519138+1196608-709372)*365 = 57.46 =3549543/(12595158+ 709372-676256)*365 =102.59 Pioner Cement =903936/(3953814+132072 -146066)*365 = 83.74 =629132/(3667343+146066-68691)*365 =61.32 =863265/(4340151+68 691-150294)*365 =73.99 AVERAGE PAYMENT PERIOD. For Diagram Purpose Table Company 2010 2009 2008 Kohat Cement 76.73 79.18 66.70 Lucky Cement 69.68 57.46 102.59 Pioner Cement 83.74 61.32 73.99 Average payment period Interpretation:

- 24. Page 16 In the above diagram the lucky cement has average payment are flexible change in different time like 102 days to 57 days and kohat cement has increasing from 66 days to 79 days and again down to 76 days while pioneer cement changing the days of payment 73 days to 61day and again goes up to 83 days. Since the average payment period does not affect working capital, this ratio typically has little or no effect on the valuation of a company or on a merger or acquisition. INVENTORY TURNOVER: Inventory Turnover ratio showing how many times a company's inventory is sold and replaced over a period. The Inventory turnover ratio = Cost of Goods sold / Average inventory Inventory Turnover Ratio is equal to Cost of Goods Sold divided by Average Inventory. Inventory Turnover Ratio measures company's efficiency in turning its inventory into sales. Its purpose is to measure the liquidity of the inventory. Inventory Turnover Ratio is figured as "turnover times". Average inventory should be used for inventory level to minimize the effect of seasonality. This ratio should be compared against industry averages. A low inventory turnover ratio is a signal of inefficiency, since inventory usually has a rate of return of zero. It also implies either poor sales or excess inventory. A low turnover rate can indicate poor liquidity, possible overstocking, and obsolescence, but it may also reflect a planned inventory buildup in the case of material shortages or in anticipation of rapidly rising prices. A high inventory turnover ratio implies either strong sales or ineffective buying (the company buys too often in small quantities, therefore the buying price is higher).A high inventory turnover ratio can indicate better liquidity, but it can also indicate a shortage or inadequate inventory levels, which may lead to a loss in business. Formula : recalculate this ratio, store and spares are not the part of inventory Dear Instructor Please read this article click here http://simplestudies.com/accounting-in-merchandising-companies.html Inventory is a current asset on a company's balance sheet. Inventory includes goods for resale, raw materials, spare parts, etc. Inventory turnover Cost of goods sold Average inventory Company 2010 2009 2008

- 25. Page 17 Kohat Cement =3341872196 /((638000427+841844312+ 290433057+139293693)/2) = 3.50 =2591021469/((290433057+139293693+699954 682+174317806)/2)=3.97 =1288570903 /((699954682+174317 806+185856546+1251 47740)/2) =2.17 Lucky Cement =16529932/((4008288+608 813+3411549+1196608)/2) = 3.58 =16519138/((3411549+1196608+4160146+7093 72)/2)= 3.49 =12595158 / ((4160146+709372+19 93572+676256)/2)=3.3 Pioneer Cement =3953814/((932961+13207 2+506050+146066)/2)= 4.60 =3667343/((506050+146066+427193+68691)/2) = 6.38 =4340151 / ((427193+68691+4165 86+150294)/2)= 8.16 Inventory turnover Cost of goods sold For Diagram Purpose Table Average inventory Company 2010 2009 2008 Kohat Cement 3.5 4.0 2.2 Lucky Cement 3.6 3.5 3.3 Pioneer Cement 4.6 6.4 8.2 Inventory turnover INTERPRETATION. High inventory levels are usual unhealthy because they represent an investment with a rate of return of zero. It also opens the company up to trouble if the prices begin to fall. A good rule of thumb is that if inventory turnover ratio multiply by gross profit margin (in percentage) is 100 percent or higher, then the average inventory is not too high. Ratio of Pioneer & Lucky is increasing due to increase in cost of sales year by year. General rule: The greater your inventory turnover, the better. It implies the product is “moving off the shelf”.

- 26. Page 18 Average age of inventory is another way of looking at inventory turnover. This ratio takes inventory turnover ratio and divides it into 365 days. The formula for average age of inventory is: Average age of inventory = 365 days / inventory turnover. Already give you reference above about inventory Company 2010 2009 2008 Kohat Cement =365/ 3.5 =104 =365/3.97 = 91.93 =365/2.17 = 168.20 Lucky Cement =365/ 3.58 = 101.95 =365/ 3.49 = 104.58 =365/3.34 = 109.28 Pioneer Cement =365/ 4.6 = 79.34 =365/6.38 = 57.21 =365/8.16 = 44.73 For Diagram Purpose Table Company 2010 2009 2008 Kohat Cement 104.3 91.9 168.2 Lucky Cement 102.0 104.6 109.3 Pioneer Cement 79.3 57.2 44.7 Average Age of Inventory

- 27. Page 19 INTERPRETATION. this ratio is useful in evaluating the company efforts to maintain an inventory level which is not excessive it can be used to compare entity inventory policy with actual numbers of days inventory was held Management policy for inventory turnover should be used be formulated after a careful of cost of carrying inventory .cost of carrying inventory cost of capital blocked in inventory ,storage cost handling and obsolescence. In the above diagram kohat cement has 168 days in 2008 and in 2009, 2010 91 days and 104 days respectively. and lucky cement has slightly change the number of days in inventory while the pioneer cement has increasingly the inventory age by every year positively If the company can quickly sell its inventory, then the Inventory conversion will be higher. Conversely, if the company cannot sell its inventory very well, then the Inventory Turnover will be low. You will have to watch this figure closely - if the Inventory Ratio climbs too high, then the company may be keeping too little inventory. This could cause lost profits due to customer orders that had to wait until inventory arrived. Lucky and kohat Cement has better ration than pioneer cement. Ratio of all Companies is decreasing due to increase in CGS. Operating Cycle The average time between purchasing or acquiring inventory and receiving cash proceeds from its sale. The Operating cycle definition, also known as cash operating cycle or cash conversion cycle or asset conversion cycle, establishes how many days it takes for a company to turn purchases of inventory into cash receipts from its eventual sale. Operating cycle has three components of payable turnover days, inventory turnover days and accounts receivable turnover days. These come together to form the complete measurement operating cycle days. Operating Cycle Formula Operating cycle calculations are completed simply with this formula: Operating cycle = DIO + DSO - DPO DSO represents day sales outstanding DPO represents days payable outstanding DPO = (Average accounts payables / cost sales) * 365 OPERATING CYCLE CALCULATION Calculating operating cycle may seem daunting but results in extremely valuable information. DIO = (Average inventories / cost of sales) * 365 DSO = (Average accounts receivables / net sales) * 365 Company 2010 2009 2008

- 28. Page 20 Kohat Cement =104+1.87-76.73 = 29.14 =91.93+1.78-79.17 = 14.54 =168.2+4.87-66.7 = 106.37 Lucky Cement =101.95+15.24-69.67 = 47.52 =104.58+13.79-57.46 = 60.91 =109.28+12.88-102.59 = 19.57 Pioner Cement =79.34+3.51-83.74 = -0.89 =57.21+2.82-61.32 = -1.29 =44.73+2.62-73.99 = - 26.64 OPERATING CYCLE CALCULATION For Diagram Purpose Table Company 2010 2009 2008 Kohat Cement 29.14 14.54 106.37 Lucky Cement 47.52 60.91 19.57 Pioner Cement -0.89 -1.29 -26.64 OPERATING CYCLE

- 29. Page 21 Interpretation: this means that on average it takes 29.14 days in 2010 14.54 days in 2009 and 106 days in 2008 for Kohat Cement and it takes 47.52 days in 2010 60.91 days in 2009 and 19.57 days in 2008 for to turn purchasing inventories into cash sales. While the pioneer cement has the safety stock and the cost of goods sold price is higher than its sales value. In regards to accounting, operating cycles are essential to maintaining levels of cash necessary to survive. Maintaining a beneficial net operating cycle ratio is a life or death matter. TOTAL ASSETS TURNOVER: Total Asset turnover is an overall activity measure relating sales to total assets. This relationship provides a measure of overall measure investment efficiency by aggregating the joint impact of both short and long term assets The total asset turnover ratio measures the ability of a company to use its assets to generate sales. The total asset turnover ratio considers all assets including fixed assets, like plant and equipment, as well as inventory and accounts receivable. Formula is Total asset turnover = Total sales / total assets Company 2010 2009 2008 Kohat Cement =3692038418 /((8673379806+8624894242) /2) = 0.42 =3395580759/((8624894242+762392 0500)/2) = 0.41 =1375972754 /((7623920500 +6153376959)/2) = 0.19 Lucky Cement =24508793/((38310244+383 92362)/2) = 0.64 =26303404/((38,392362+34,239074) /2)=0.724 =16957879 / ((34239074+ 25730226)/2)= 0.56 Pioner Cement =3872834/((10325494+1034 7734)/2) = 0.37 =5000235/((10347734+10472589)/2) =0.480 =4853764 /((10472589+8610497)/2) = 0.50 Total Assets turnover Sales Average total assets For Diagram Purpose Table

- 30. Page 22 Company 2010 2009 2008 Kohat Cement 0.427 0.418 0.200 Lucky Cement 0.639 0.724 0.566 Pioner Cement 0.375 0.480 0.509 Assets turnover Interpretation: The lower the total asset turnover ratio, as compared to historical data for the firm and industry data, the more sluggish the firm's sales. This may indicate a problem with one or more of the asset categories composing total assets - inventory, receivables, or fixed assets. The small business owner should analyze the various asset classes to determine where the problem lies.all the three companies has no strong total asset turnover ratio in the given diagram however the lucky cement has better position in this regard. Lucky cement and pioneer cement is better than Kohat Cement limited in generating of sale from current assets. During the last three financial year average Kohat cement and lucky cement has well utilized their t assets for generating of sales. Where the total asset turnover increase, we could image that company as been more effective in the use of the investment On the other hand where the total asset turnover decrease that company as been less effective in the use of the investment. Same look on the above graph, KOHAT cement decreasing in ratio indicate low investment made by the company.

- 31. Page 23 Lucky Cement Company has made effective investment as compare to both companies. FIXED ASSET TURNOVER The fixed asset turnover ratio measures the company's effectiveness in generating sales from its investments in plant, property, and equipment. It is especially important for a manufacturing firm that uses a lot of plant and equipment in its operations to calculate its fixed asset turnover ratio Fixed asset turnover ratio measures sales productivity and plant and equipment utilization. Ratio of all three Companies is increasing due to increase in sales Fixed assets turnover Sales Average fixed assets Company 2010 2009 2008 Kohat Cement =3692038418/((7229393785 +6937818150)/2) = 0.52 =3395580759/((6937818150+6248719954)/2) = 0.51 =1375972754 /((6248719954+55189 05689)/2) = 0.23 Lucky Cement =24508793/((31378255+304 76872)/2) = 0.79 =26303404/((25829520+30476872)/2) = 0.93 =16957879 / ((20318908+25829520 )/2) = 0.73 Pioneer Cement =3872834/((8937904+92546 74)/2) = 0.42 =5000235/((9254674+9570865)/2) = 0.53 =4853764 / ((7510640+9570865)/ 2) = 0.56 Fixed assets turnover Sales Average fixed assets For Diagram Purpose Table Company 2010 2009 2008

- 32. Page 24 Kohat Cement 0.5 0.5 0.2 Lucky Cement 0.8 0.9 0.7 Pioneer Cement 0.4 0.5 0.6 Fixed assets turnover Interpretation: If the fixed asset turnover ratio is low as compared to the industry or past years of data for the firm, it means that sales are low or the investment in plant and equipment is too much. This may not be a serious problem if the company has just made an investment in fixed asset to modernize. In the above diagram Kohat cement has same ratio in 2009 and 2010 while it was low at 2008. While lucky cement has increasing in 2009 and 2010 and lucky cement fixed turn over ratio is greater than kohat and pioneer cement Dear and Respected Instructor You could at the graph, Kohat company ratio indicate the Kohat business is over-invested in plant or other equipment, fixed asset. Lucky cement ratio indicates that business has less revenue or money tied up in fixed asset. So briefly the less above ratio indicate over investment made by the company on fixed asset, the higher the ratio indicate over investment made by the above three companies References

- 34. Page 26 FACTORS LIMITING THE USEFULNESS OF COMPARISON OF RATIOS: It ignores differences between industries, the effect of varying capital structures, and differences in accounting and reporting methods. Competing Strategies Product Life Cycle Industry Economic Factors Trends in ROE ADDITIONAL DATA NECESSARY IN ORDER TO IMPROVE THE COMPARISON OF RATIOS: We can add some more information in published statements like off balance sheet transactions etc. Changes (Trends) in a ratio and variability over time may be more informative than the level of the ratio at any point in time. We can take past data to see the trends in any item related to financial statements. ADDITIONAL INFORMATION TO ENHANCE THE UTILITY OF FINANCIAL STATEMENTS: We can add more information related to short term bank and trade creditors, long term creditors, equity investors, etc so that they can take interest in that specific company on some certain grounds and also the overall financial position of business. COMMENTS ON OVERALL FINANCIAL HEALTH OF BOTH COMPANIES: Both the all three companies have sound financial position because they are on growth stage because of their mission and objectives. Both companies are performing their operations and also doing hard work according to their objectives. According to there four year financial analysis I conclude that kohat cement

- 35. Page 27 and lucky cement Work More efficiently as compared to Pioneer cement Company. I think the main reason behind this that their various financial inputs given by other business run by both company groups.

- 36. Page 28 CONCLUSION & RECOMMENDATIOS: Both three companies are performing well in their respective norms according to their mission and objectives. According to Board of Directors and Chairman’s view in their Statements, both the companies have tendency to move up to meet their objectives. At the end of 2007 2008 and 2010 the Pioneer cement and in the year ended 2008 and 2010 the Kohat Cement both have negative profit. The fact that the company has negative profit could indicate that the company will have problems in expanding. However, negative working profit in and of itself is not necessarily bad, and could indicate that the companies are very efficient at turning over inventory, or that the company has large financial subsidiaries. But in the same both company the pioneer cement 2009 and kohat cement 2007 and 2009 both have gaining profit. The fact that the company has gaining profit could indicate that the company will have no problems in expanding. However, positive working capital in and of itself is good and could indicate that the companies have less financial subsidiaries. Must consider the following point to get maximum profit Maintain proper budget of every accounts like sales production labor material and other expenses. Enhance the quality of the product Select proper time for purchasing the material which can not negative effect on your production due to shortage of inventory Maintain proper collection strategy and cash basis sales can improve the cash flow of the company Improve and rectify the major discrepancies regarding production marketing and sales

- 37. Page 29 RECOMMENDATIONS: Recommendation for three companies 1. Three companies should required to com out from the last years and decrease previous years effect and should improve its PAT through increasing its efficiency by reducing the operating expense down 2. Companies should rely on external financial debt for getting advantage of tax 3. Companies should buy back of all shares so it will help its EPS and it will enhance the firm capability to attract more and more investors 4. According to above way companies could also increase ROE and earning Yield 5. Three company should maintained good level of liquidity for sake of this strategy firms required review the quality of its assets from time to time 6. Three firms should invest its surplus cash because it always leads to lower its opportunity cost 7. Firms should stress more on its current assets then on fixed assets 8. Firms should declare dividend to lure investors because they always look for dividends, especially small investors PRODUCTION: Cement industry is indeed a highly important segment of industrial sector that plays a pivotal role in the socio-economic development. Though the cement industry in Pakistan has witnessed its lows and highs in recent past, it has recovered during the last couple of years and is buoyant once again. Main objective of any business concern is to produce more. But in my humble opinion; certain steps can be taken to increase its production which in reverse will increase the profit. Steps which can be taken are as under: 1. Since further expansion possible, thus managing agents should establish a looming section also produces cloth for the market. 2. To overcome the heavy cost, management should decrease its labor force in production department.

- 38. Page 30 3. While it is necessary for marketing department to capture the international market and it is possible, because the company has also maintained exports to different countries many years ago. 4. Mills will have to minimize its cost of production which in my opinion is very high. 5. Marketing department will have to increase its efficiency for promoting its product both in local and international market. CREDIT POLICY: In most all situations, it means that the the company must gives the buyer a discount of 2% of the invoice if paid within 10 days, but the entire invoice for full payment is 30 days. For better cash flow. And cash collection. INVENTORY MANAGEMENT POLICY: Maintain strong inventory management policy and inventory management software to minimize the inventory storage carrying and ordering cost like Follow the FIFO ,LIFO.WAM,JIT Methods and make budget of every accounts likes sales production material,labour administrative and marketing expense. MARKETING AND SALES PROMOTION: Make strong marketing policy and established a dynamic marketing team to sell the product at right time right place and right price to right people. ADMINISTRATIVE EXPENSES: When we examine the Income Statements we can see that administrative expenses were very high. Thus management will have to control these administrative expenses. By adopting this policy, mills can increase its profit. SECTION 2.

- 39. Page 31 A) INTRODUCTION OF THE STUDENT Last Degree Obtained: MA Economics, ACMA Organization Name: Engineering & Professionals Services Ltd Designation: Chief Accountant Experience (Years): 5 and half years B) Appendix/Appendixes Annexure A Financial Statement KOHAT CEMENT Annexure B Financial Statement of LUCKY CEMENT Annexure C Financial Statement of PIONER CEMENT Annexure D Working for Activity Ratio Analysis Annexure of PDF File of kohat cement of last four years. Annexure of PDF File of lucky cement of last four years Annexure of PDF File of Pioneer cement of last four years. Bibliography General Form hukla and Grewal - Advanced Accounting 2 Jain and Narang - Company Account 3 - Corporate Accounts 4 Chakraborthi - Advanced Account 5 .... . Frank Wood Accounting,Mehr als 70.000 Fachbuecher der Verlage Markt+Technik, Addison-Wesley, CAMPUS Press, Prentice Hall, Allyn Bacon, Longman, Penguin, .. FINANCIAL MANAGEMENT By KHAN, M.Y. JAIN, P.K., ISBN - 007040223X, Price - Rs. 350. Buy BASIC FINANCIAL MANAGEMENT book online and get Free shipping Colin Drury, Management and cost accounting (6th edition), Thomson Learning, London (2004) (xxxii+1280 pp.) Magazine Article

- 40. Page 32 Business Recorder | Reviews | Head Office: Recorder House, 531 Business Recorder Road, Karachi-74550 . The Economist Pakistan - Pakistan News, Politics, Economics, Business & Finance ONLINE JOURNALS, MAGAZINES, NEWSPAPERS http://www.paksearch.com/Annual/Annual00/KC00.htm http://en.wikipedia.org/wiki/Lucky_Cement http://www.pioneercement.com/ Financial Statements of KOHTA,LUCKY AND PIONER CEMENT Data resources from different sites of the relevant companies Misc articles from different sources of ICMAP Library All Excel Working. Financial Statement Analysis of Mr. Javed Zuberi Note: all the statement and ratio analysis is attached as separate annexure of project.