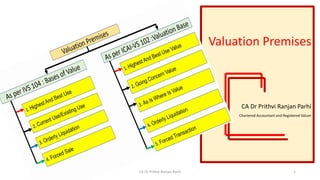

Valuation premises

- 1. Valuation Premises CA Dr Prithvi Ranjan Parhi Chartered Accountant and Registered Valuer CA Dr Prithvi Ranjan Parhi 1

- 2. CA Dr Prithvi Ranjan Parhi 2 What a company is worth depends on who wants to buy it. -Michael Price

- 3. Premise of Value Para 130.1 of IVS 104 Bases of Value • A Premise of Value or Assumed Use describes the circumstances of how an asset or liability is used. • Different bases of value may require a particular Premise of Value or allow the consideration of multiple Premises of Value. • Some common Premises of Value are: 1. Highest And Best Use, 2. Current Use/Existing Use, 3. Orderly Liquidation, and 4. Forced Sale. CA Dr Prithvi Ranjan Parhi 3

- 4. Premise of Value Para 37 & 38 of ICAI-VS 102 Bases of Value • Premise of Value refers to the conditions and circumstances how an asset is deployed. • In a given set of circumstances, a single premise of value may be adopted while in some situations multiple premises of value may be adopted. • Some common premises of value are as follows: 1. Highest And Best Use; 2. Going Concern Value; 3. As Is Where Is Value; 4. Orderly Liquidation; Or 5. Forced Transaction. CA Dr Prithvi Ranjan Parhi 4

- 5. CA Dr Prithvi Ranjan Parhi 5 Valuation Premises 1. Highest And Best Use 2. Current Use/Existing Use 3. Orderly Liquidation 4. Forced Sale As per IVS 104 : Bases of Value As per ICAI-VS 102 :Valuation Base 1. Highest And Best Use Value 2. Going Concern Value 3. As Is Where Is Value 4. Orderly Liquidation 5. Forced Transaction

- 6. Premise of Value #1 – Highest and Best Use Para 140 of IVS 104 Bases of Value • Highest and best use is the use, from a participant perspective, that would produce the highest value for an asset. • Although the concept is most frequently applied to non-financial assets as many financial assets do not have alternative uses, there may be circumstances where the highest and best use of financial assets needs to be considered. • The highest and best use must be physically possible (where applicable), financially feasible, legally allowed and result in the highest value. • If different from the current use, the costs to convert an asset to its highest and best use would impact the value. • The highest and best use for an asset may be its current or existing use when it is being used optimally. • However, highest and best use may differ from current use or even be an orderly liquidation. CA Dr Prithvi Ranjan Parhi 6

- 7. CA Dr Prithvi Ranjan Parhi 7

- 8. Premise of Value – Highest and Best Use Para 140 of IVS 104 Bases of Value • The highest and best use of an asset valued on a stand-alone basis may be different from its highest and best use as part of a group of assets, when its contribution to the overall value of the group must be considered. • The determination of the highest and best use involves consideration of the following: a) To establish whether a use is physically possible, regard will be had to what would be considered reasonable by participants. b) To reflect the requirement to be legally permissible, any legal restrictions on the use of the asset, eg, town planning/zoning designations, need to be taken into account as well as the likelihood that these restrictions will change. c) The requirement that the use be financially feasible takes into account whether an alternative use that is physically possible and legally permissible will generate sufficient return to a typical participant, after taking into account the costs of conversion to that use, over and above the return on the existing use. CA Dr Prithvi Ranjan Parhi 8

- 9. Premise of Value # 2 -Current Use/Existing Use Para 140 of IVS 104 Bases of Value • Current use/existing use is the current way an asset, liability, or group of assets and/or liabilities is used. • The current use may be, but is not necessarily, also the highest and best use. CA Dr Prithvi Ranjan Parhi 9

- 10. Premise of Value # 3 – Orderly Liquidation Para 160 of IVS 104 Bases of Value • An orderly liquidation describes the value of a group of assets that could be realised in a liquidation sale, given a reasonable period of time to find a purchaser (or purchasers), with the seller being compelled to sell on an as-is, where-is basis. • The reasonable period of time to find a purchaser (or purchasers) may vary by asset type and market conditions. CA Dr Prithvi Ranjan Parhi 10

- 11. Premise of Value # 4 – Forced Sale Para 170 of IVS 104 Bases of Value • The term “forced sale” is often used in circumstances where a seller is under compulsion to sell and that, as a consequence, a proper marketing period is not possible and buyers may not be able to undertake adequate due diligence. • The price that could be obtained in these circumstances will depend upon the nature of the pressure on the seller and the reasons why proper marketing cannot be undertaken. • It may also reflect the consequences for the seller of failing to sell within the period available. • Unless the nature of, and the reason for, the constraints on the seller are known, the price obtainable in a forced sale cannot be realistically estimated. • The price that a seller will accept in a forced sale will reflect its particular circumstances, rather than those of the hypothetical willing seller in the Market Value definition. • A “forced sale” is a description of the situation under which the exchange takes place, not a distinct basis of value. • If an indication of the price obtainable under forced sale circumstances is required, it will be necessary to clearly identify the reasons for the constraint on the seller, including the consequences of failing to sell in the specified period by setting out appropriate assumptions. • If these circumstances do not exist at the valuation date, these must be clearly identified as special assumptions. CA Dr Prithvi Ranjan Parhi 11

- 12. Premise of Value # 4 – Forced Sale Para 170 of IVS 104 Bases of Value • A forced sale typically reflects the most probable price that a specified property is likely to bring under all of the following conditions: a) consummation of a sale within a short time period, b) the asset is subjected to market conditions prevailing as of the date of valuation or assumed timescale within which the transaction is to be completed, c) both the buyer and the seller are acting prudently and knowledgeably, d) the seller is under compulsion to sell, e) the buyer is typically motivated, f) both parties are acting in what they consider their best interests, g) a normal marketing effort is not possible due to the brief exposure time, and h) payment will be made in cash. CA Dr Prithvi Ranjan Parhi 12

- 13. Premise of Value # 4 – Forced Sale Para 170 of IVS 104 Bases of Value • General Standards – IVS 104 Bases of Value • Sales in an inactive or falling market are not automatically “forced sales” simply because a seller might hope for a better price if conditions improved. • Unless the seller is compelled to sell by a deadline that prevents proper marketing, the seller will be a willing seller within the definition of Market Value (see paras 30.1-30.7). • While confirmed “forced sale” transactions would generally be excluded from consideration in a valuation where the basis of value is Market Value, it can be difficult to verify that an arm’s length transaction in a market was a forced sale. CA Dr Prithvi Ranjan Parhi 13

- 14. ICAI Valuation Standards 102- Valuation Bases CA Dr Prithvi Ranjan Parhi 14

- 15. Premise #1 Highest and Best Use • 39. The highest and best use of a non-financial asset takes into account the use of the asset that is physically possible, legally permissible and financially feasible. as follows: a) a use that is physically possible takes into account the physical characteristics of the asset that market participants would take into account when pricing the asset (e.g., the location or size of a property); b) a use that is legally permissible takes into account any legal restrictions on the use of the asset that market participants would take into account when pricing the asset (e.g., the zoning regulations applicable to a property); c) a use that is financially feasible takes into account whether a use of the asset that is physically possible and legally permissible generates adequate income or cash flows (taking into account the costs of converting the asset to that use) to produce an investment return that market participants would require from an investment in that asset put to that use. CA Dr Prithvi Ranjan Parhi 15

- 16. Premise #1 Highest and Best Use • 40. Highest and best use is determined from the perspective of market participants, even if the entity intends a different use. • However, an entity's current use of a non-financial asset is presumed to be its highest and best use unless market or other factors suggest that a different use by market participants would maximise the value of the asset. • 41. To protect its competitive position, or for other reasons, an entity may intend not to use an acquired non-financial asset actively or it may intend not to use the asset according to its highest and best use. • Nevertheless, the valuer shall measure the fair value of a nonfinancial asset assuming its highest and best use by market participants. CA Dr Prithvi Ranjan Parhi 16

- 17. • 42. The highest and best use of a non-financial asset establishes the valuation premise used to measure the fair value of the asset, as follows: • (a) the highest and best use of a non-financial asset might provide maximum value to market participants through its use in combination with other assets as a group (as installed or otherwise configured for use) or in combination with other assets and liabilities (e.g., a business). • (i) if the highest and best use of the asset is to use the asset in combination with other assets or with other assets and liabilities, the fair value of the asset is the price that would be received in a current transaction to sell the asset assuming that the asset would be used with other assets or with other assets and liabilities and that those assets and liabilities (i.e. its complementary assets and the associated liabilities) would be available to market participants; • (ii) liabilities associated with the asset and with the complementary assets include liabilities that fund working capital, but do not include liabilities used to fund assets other than those within the group of assets; • (iii) assumptions about the highest and best use of a nonfinancial asset shall be consistent for all the assets (for which highest and best use is relevant) of the group of assets or the group of assets and liabilities within which the asset would be used. • (b) the highest and best use of a non-financial asset might provide maximum value to market participants on a stand-alone basis. If the highest and best use of the asset is to use it on a standalone basis, the fair value of the asset is the price that would be received in a current transaction to sell the asset to market participants that would use the asset on a stand-alone basis. CA Dr Prithvi Ranjan Parhi 17

- 18. Premise #1 Highest and Best Use • 43. Where the highest and best use is different from the existing use, costs, to be incurred, if any for conversion of an asset to its highest and best use need to be considered for determination of value based on highest and best use. • 44. In certain cases, assessment of highest and best use may involve considerable subjectivity/ technical aspects and the valuer may base his assessment considering inter-alia relevant inputs from the client, information available in public domain, etc. CA Dr Prithvi Ranjan Parhi 18

- 19. Premise #2 Going Concern Value • 45. Going concern value is the value of a business enterprise that is expected to continue to operate in the future. • 46. The intangible elements of Going Concern Value result from factors such as having a trained work force, an operational plant, the necessary licenses, marketing systems, and procedures in place etc. CA Dr Prithvi Ranjan Parhi 19

- 20. Premise #3 As-is-where-is Basis • 47. As-is-where-is basis will consider the existing use of the asset which may or may not be its highest and best use. CA Dr Prithvi Ranjan Parhi 20

- 21. Premise #4 Orderly Liquidation • 48. An orderly liquidation refers to the realisable value of an asset in the event of a liquidation after allowing appropriate marketing efforts and a reasonable period of time to market the asset on an as-is, where-is basis. • 49. The reasonable period of time to market the asset would vary based on the market conditions, nature of the asset, etc. CA Dr Prithvi Ranjan Parhi 21

- 22. Premise #5 Forced transaction • 50. Forced transaction is a transaction where a seller is under constraints to sell an asset without appropriate marketing period or effort to market such asset. • 51. Sale in the market that is not active cannot be presumed to be forced transaction without assessing the seller specific circumstances. CA Dr Prithvi Ranjan Parhi 22

- 23. Thank You CA Dr Prithvi Ranjan Parhi 23